In the world of Forex trading, success is often determined by the ability to make informed decisions and adapt to dynamic market conditions. Traders face the challenges of analyzing data, managing risk, and navigating the complex realm of currency exchange. Amidst this complexity, the Forex journal emerges as an invaluable tool, offering traders a structured approach to record, analyze, and improve their trading performance. This article delves into the significance of a Forex journal, explaining what it Forex Trading Journal and providing insights into how to create an effective one. Whether you’re a novice trader looking to refine your strategies or an experienced professional aiming for consistent profitability, understanding the power of a Forex journal can be a game-changer in your trading journey.

Contents

What is a Forex Trading Journal? How to create an Effective Forex Journal?

What is a Forex Trading Journal?

In general, maintaining a Forex journal is highly essential for traders as it can help them avoid repeating past mistakes. Additionally, a Forex journal serves as the initial documentation upon which traders can build a suitable trading plan.

A Forex journal becomes the personal performance database, giving you the opportunity to rewind time and determine the frequency of your trades, the success rate of each trade, which currency pairs perform better, or even which timeframes yield the highest percentage of profit.

Benefits of keeping an Effective Forex Trading Journal

Keeping a trading journal offers numerous benefits for traders of all experience levels. Here are some of the key advantages:

- Improved Self-Awareness: Maintaining a trading journal forces traders to reflect on their trading decisions, strategies, and emotional states. It enhances self-awareness by helping traders understand their strengths and weaknesses.

- Error Identification and Avoidance: A trading journal helps traders identify recurring mistakes or patterns in their trading behavior. By recognizing these errors, traders can take steps to avoid making the same mistakes in the future.

- Objective Decision-Making: Recording trades and strategies in a journal encourages traders to make more objective decisions. It prevents impulsive or emotional trading, leading to more rational choices.

- Strategy Refinement: Traders can use their journal to evaluate the effectiveness of their trading strategies. By analyzing past trades, they can refine and fine-tune their approaches for better results.

- Risk Management: A trading journal allows traders to track their risk management practices, including stop-loss and take-profit levels. This helps maintain proper risk-reward ratios and protect trading capital.

- Goal Setting and Tracking: Traders can set specific trading goals and objectives in their journal. Regularly reviewing these goals and tracking progress keeps traders motivated and focused.

- Performance Evaluation: Over time, a trading journal becomes a performance database. Traders can assess their overall trading performance, identifying which strategies and currency pairs yield the best results.

- Confidence Building: Analyzing past successful trades in the journal can boost a trader’s confidence. It reinforces the belief in their strategies and decisions.

- Adaptation to Changing Markets: Markets are dynamic, and what works in one market condition may not work in another. A journal helps traders adapt to changing market environments by documenting what strategies are most effective in various conditions.

- Documentation for Tax and Compliance: A trading journal serves as a record for tax reporting and compliance purposes. It provides documentation of trading activity, profits, and losses.

- Educational Tool: For traders who are constantly learning, a journal is an invaluable educational tool. It helps them understand the dynamics of the Forex market and refine their trading skills.

- Accountability: Knowing that every trade will be recorded in the journal can make traders more accountable for their decisions. This can deter impulsive or reckless trading behavior.

In conclusion, keeping a trading journal is an essential practice for traders looking to enhance their skills, minimize mistakes, and achieve consistent profitability. It provides a structured framework for self-improvement and better decision-making, making it a valuable tool in the trader’s toolbox.

How to write an Effective Forex Trading Journal?

Writing a Forex trading journal involves a systematic and organized approach to record-keeping. Here are the steps to create and maintain an effective Forex trading journal:

Step 1: Choose a Recording Method: Decide whether you want to keep a physical journal or use digital tools. Many traders prefer digital solutions like spreadsheets or specialized trading journal software because they offer easy organization and data analysis capabilities.

Step 2: Define Journal Sections: Set up dedicated sections in your journal for different types of information you plan to record. Common sections include:

-

- Trade Details: Date, time, currency pair, entry and exit prices, trade size, and direction.

- Trading Strategy: Describe the rationale behind each trade, including technical or fundamental analysis.

- Emotional State: Document your emotional state before, during, and after the trade.

- Risk Management: Record stop-loss and take-profit levels, as well as position size relative to your account balance.

- Trade Outcome: Note whether the trade resulted in a profit, loss, or break-even, along with any lessons learned.

Step 3:Record Every Trade: For each trade you make, diligently enter the relevant details into your journal. Be consistent, regardless of whether the trade is a winning or losing one.

Step 4: Include Charts and Screenshots: Consider attaching charts or screenshots to your journal entries. Visual representations can provide additional context and help with analysis.

Step 5:Analyze Your Journal Regularly: Periodically review your trading journal to assess your performance. Look for patterns, recurring mistakes, and areas for improvement.

Step 6: Learn from Your Entries: Take time to reflect on your journal entries and extract lessons from your trading experiences. Identify what worked well and what didn’t.

Step 7: Set Goals and Milestones: Use your journal to set specific trading goals and track your progress toward achieving them. This can help keep you motivated and focused on your objectives.

Step 8:Evaluate Your Emotional State: Pay attention to the emotional states you’ve recorded. Recognizing how emotions influence your decisions can lead to better emotional control in future trades.

Step 9: Adapt Your Strategies: Based on the insights gained from your journal, make adjustments to your trading strategies and risk management techniques.

Step 10:Regularly Update Your Journal: Maintain the habit of recording every trade and relevant information consistently. Avoid gaps in your journal, as this ensures comprehensive data for analysis.

Step 11:Seek Feedback: Consider sharing your trading journal with a mentor, coach, or trading community for constructive feedback and insights.

Step 12: Review Periodically: Besides reviewing individual trades, periodically evaluate your overall trading performance over weeks, months, or quarters to identify long-term trends and areas of improvement.

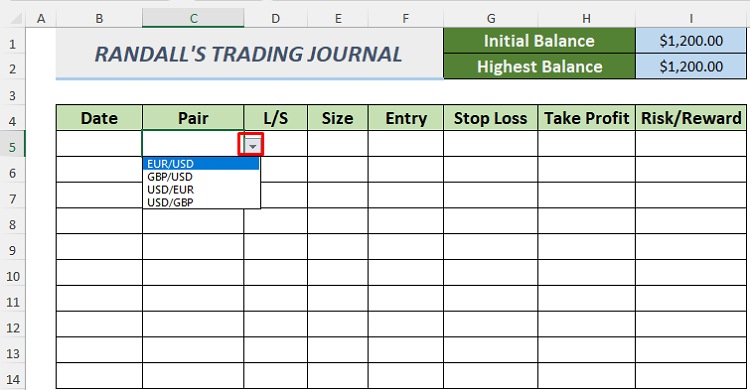

Forex trading journal Template by Excel

If you want to find a template in excel for Forex trading journal, you can refer to some of templates below:

+ Template 1: HERE

+ Template 2: HERE

+ Template 3: HERE

Related post:

In summary, a Forex trading journal is a vital tool for traders, serving as a compass in the world of currency trading. It helps traders navigate the complexities of the Forex market by providing structure, discipline, and insights into their trading activities. By documenting trades, analyzing strategies, and managing emotions, traders can build a solid foundation for consistent success and continuous improvement in their trading endeavors.