One of the useful Forex tools used by many professional Forex traders is the “currency strength meter”. Suppose you are optimistic about the EURO, but you can choose to trade: EURUSD, EURJPY, EURGBP, EURAUD, EURNZD, EURCAD, etc. Which currency pair should you trade? This is where the currency strength meter comes into play. Let’s explore how it works in the content below.

Contents

Guide to Forex Currency Strength Meter

What is a Forex Currency Strength Meter?

A Currency Strength Meter is a tool that helps you gauge which currency is strong and which is weak, allowing you to choose the most suitable currency pairs for your trades.

*** In some places, it might also be called a currency strength clock or a currency strength indicator ***

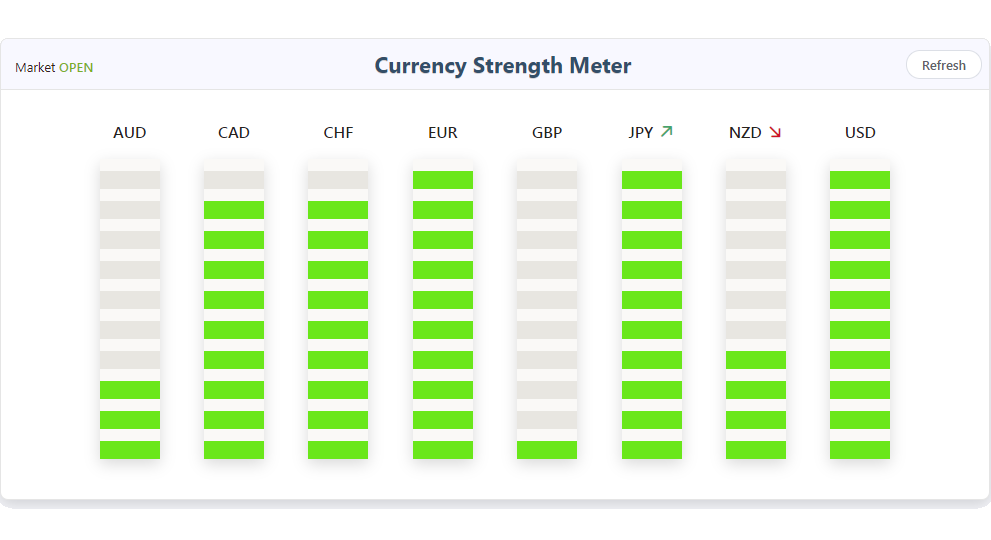

Example: The image above shows the currency strength meter of https://currencystrengthmeter.org/. As seen, EUR is a strong currency, while GBP is weak.

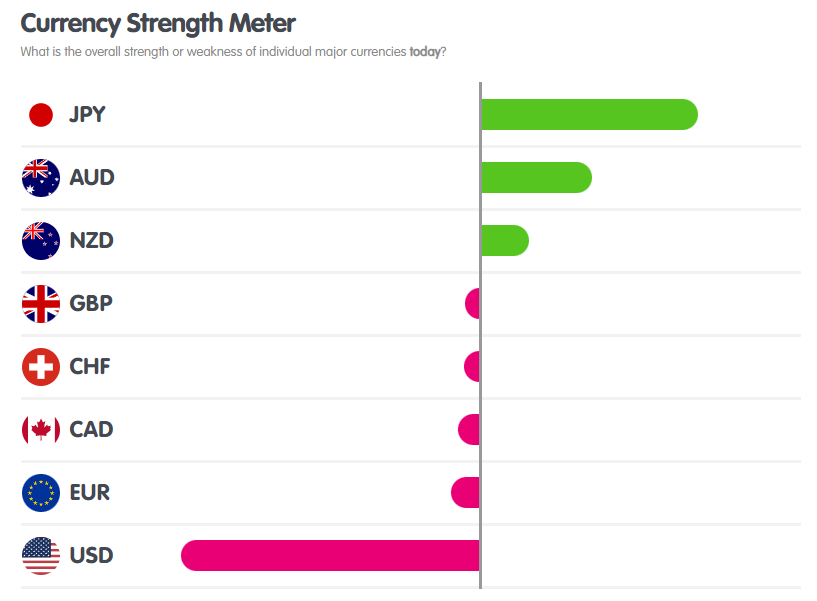

Below is the clock from https://marketmilk.babypips.com/. The data captured shows JPY as strong and USD as weak.

Some websites offer “Currency Strength Clocks” integrated by pairs, allowing you to compare the strength of currencies in a trading pair. For example:

90% of Common Mistakes When Using Currency Strength Meter

Firstly, I want you to avoid common mistakes that traders often make when using a currency strength meter.

For instance, if you Google the term “currency strength meter” on Google, you will get over 26 million results:

That means there are many websites offering “forex currency strength meter” tools, and you can easily access and find out which currency is the strongest and weakest.

BUT – none of them tell you the pitfalls to avoid when using a currency strength meter. That’s why many traders lose money even when they have a “GPS” in their hands. So, here are the mistakes to avoid when using a currency strength meter (things no one tells you)…

Mistake #1: You’re Using the Wrong Formula for the Currency Strength Meter

In other words, you’re using it intuitively, thinking it’s easy to understand without knowing how it actually works.

In reality, a currency strength meter is like any other trading indicator. There’s a formula behind it to determine the strength/weakness of a currency. But if you don’t know the formula behind it, how can you trust the results of the currency strength meter?

What happens if you use the wrong formula?

What if the currency strength meter only works on the daily time frame, but you don’t know that and use it on a lower time frame?

That’s why whether you use any tool or indicator, you must always know the formula behind the currency strength meter and how it works. (How to use it, I will explain below).

Mistake #2: You Use the Currency Strength Meter to Time Your Trades

This is the mistake many traders make, trading blindly based on the currency strength meter clock.

Mistake:

You identify the strongest currency pair right now and immediately buy, thinking the price will go higher => a big mistake.

The currency strength meter is not meant to generate buy/sell signals.

The currency strength meter simply tells you which currency is the strongest/weakest at a given moment.

Example JPY is the strongest, and GBP is the weakest.

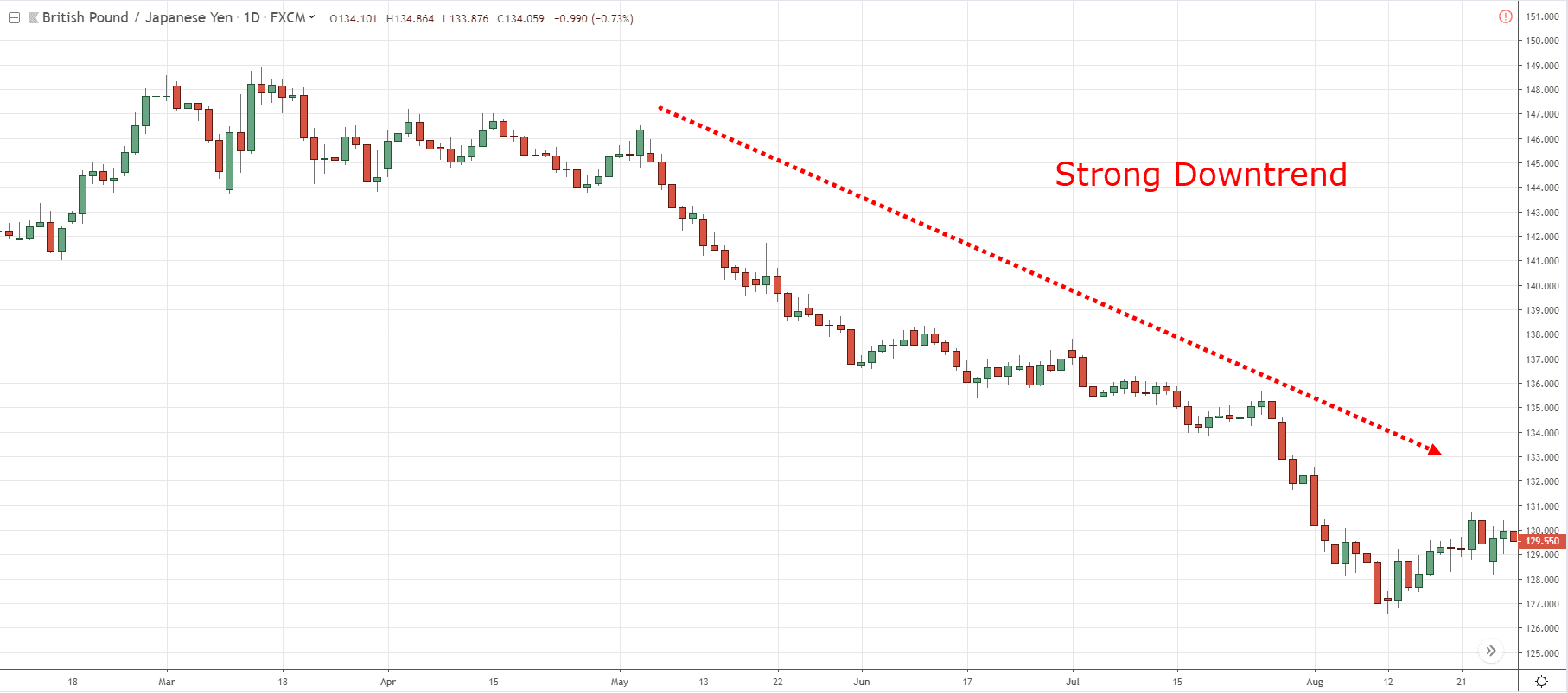

But if you look at the chart below, does it show that this is a bad time to SHORT GBP/JPY?

Because you are chasing the market down after it has already dropped significantly. There’s no proper place to set your Stop Loss, and you may end up cutting your losses during the pullback.

Mistake #3: Low Timeframes Lead to False Signals

Most currency strength meters calculate price changes within a timeframe to determine which currency is strong or weak.

But this can lead to false signals if the timeframe is too low.

Why? Because major news events can cause price “spikes,” skewing the strength/weakness of a currency pair. That’s why you should create your own currency strength meter to calculate price changes from a higher timeframe to avoid volatility.

And here’s how you do it…

How to Create a Forex Currency Strength Meter That Suits You

All currency strength meters work in a similar way.

However, they will differ in how they calculate price changes in each timeframe that we choose. So, you need to determine the appropriate timeframe before identifying the strongest/weakest currency pairs.

Here’s how to create a (free) currency strength meter for yourself:

#1. Create a List of Major Currency Pairs

The list includes EUR/USD, GBP/USD, AUD/USD, NZD/USD, JPY/USD, CAD/USD, CHF/USD.

Now you might be wondering:

“Why do you use JPYUSD instead of USDJPY?”

Simple. We are standardizing USD as our base currency unit to make comparisons easier.

#2: Calculate the Percentage Change Over the Past 15 Weeks

- Insert the Rate of Change (ROC) indicator on a weekly timeframe

- Change the settings to 15 periods

- Do this for all major currency pairs

Đây là cách thực hiện trên TradingView:

Here’s how to do it on TradingView:

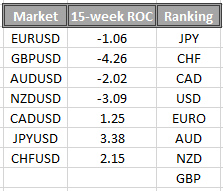

#2: Rank them from strongest to weakest

Now that you have the values, you’ll need to rank them from strongest to weakest.

The currency pair with the highest value should be at the top, followed by the second highest, third highest, and so on.

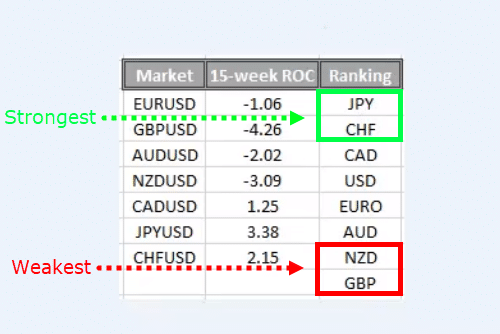

Here’s what it looks like in Excel:

Note: If you wish, you can add exotic currency pairs like USDZAR, USDTRY, USDRUB, etc., to have more markets to trade.

Furthermore, you’re not obliged to use a 15-week ROC, as it might be too long for short-term traders. You can adjust the currency strength meter accordingly:

- If you trade below the 4-hour timeframe, use a 4-week ROC.

- If you trade between the 4-hour and weekly timeframe, use a 15-week ROC.

- If you trade on the weekly timeframe, use a 30-week ROC.

How to use the currency strength meter correctly

So, how should you use the currency strength meter?

Objective: Use the currency strength meter and pair the strongest currency with the weakest currency to catch a strong trending market.

Example: Look at the currency strength meter below… You can see that GBP is the weakest, and JPY is the strongest.

And when combined, you’ll get GBP/JPY in a strong downtrend…

Remember:

- The currency strength meter doesn’t tell you when to enter your trades. It only helps you filter out the best currency pairs to trade.

- When trading, you’ll need to look for other suitable signals, such as breakouts, pullbacks, candlestick patterns, etc.

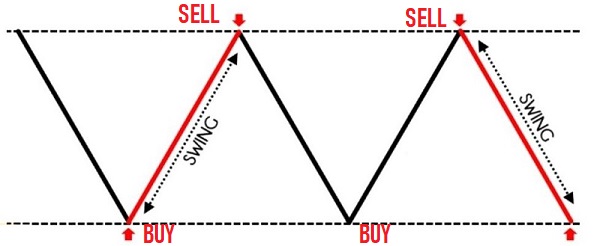

In case you don’t like trend trading and prefer swing trading, which means trading within a clearly defined support/resistance area, and you enter trades at Swing High and Swing Low price levels of the trend.

At this point, use the currency strength meter, and here’s how: Look for currency pairs with similar strength or weakness.

Example:

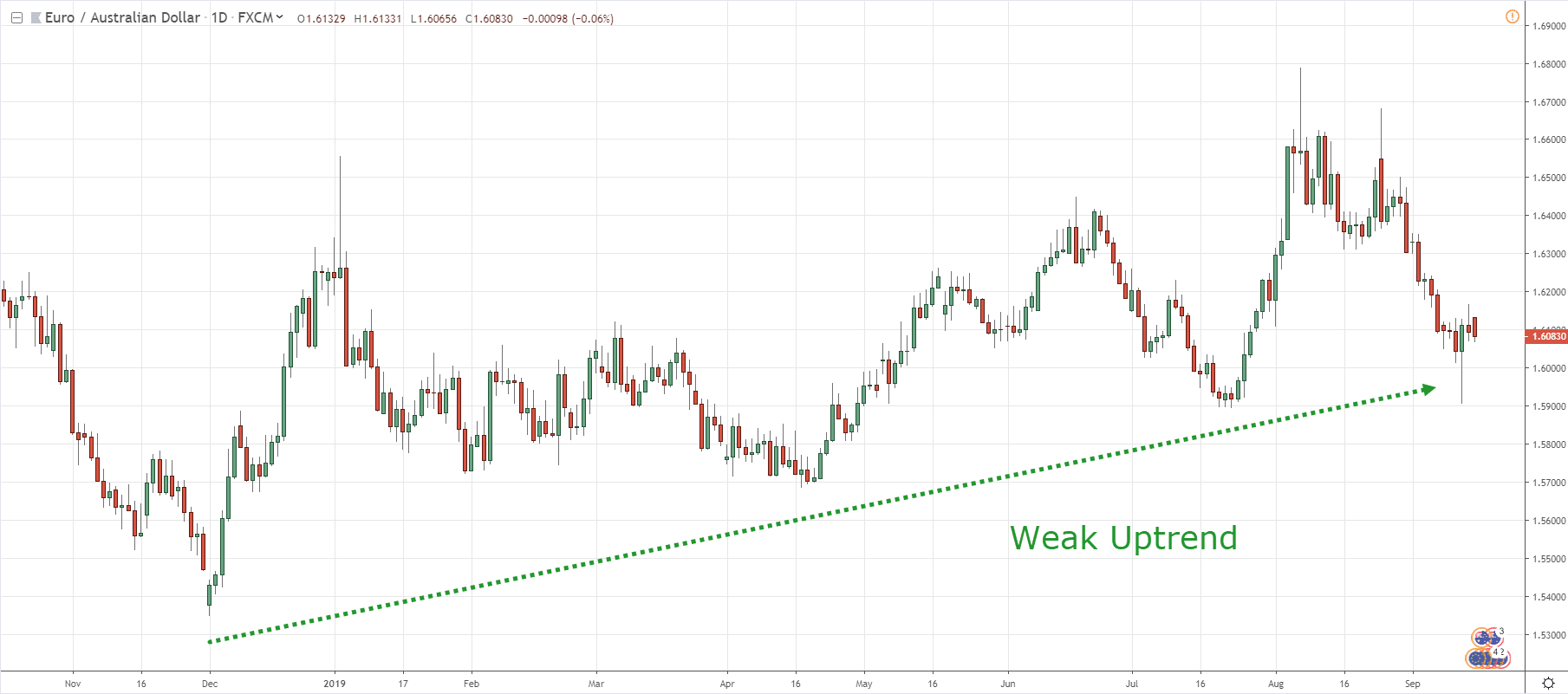

If you look at the currency strength meter above, EURO and AUD are ranked closely (both are relatively weak).

And if you pair them together, you’ll find EUR/AUD is currently in a weak trend…

Based on this signal, as a swing trader, you can look for buying opportunities around the 1.6000 – 1.5900 area.

IN SUMMARY:

Here’s what you need to remember from this article:

-

The Currency Strength Meter will calculate % price changes to rank currency pairs from strongest to weakest.

-

The Currency Strength Meter doesn’t tell you when to enter your trades; it only helps you filter potential currency pairs for trading.

-

You can adjust your Currency Strength Meter to suit different trading timeframes.

-

If you want to trade in strong trending markets, choose pairs with one strong currency against one weak currency.

-

If you prefer swing trading, select currency pairs that have similar strength or weakness.

These are the fundamental principles of using the Currency Strength Meter. By the end of this article, you should have a better understanding of this tool and how to apply it. If you have any questions, feel free to leave a comment below the article, and I’ll be happy to answer. Thanks for reading, and I wish you become an expert with the best Forex trading tools.