In the methods of trading coins, forex, Swing Trading is a quite popular method chosen by many traders. However, if you are hearing about Swing Trading for the first time, you might wonder what Swing Trading is? How should you trade? Let’s find out about this trading strategy with invest286.com in the content of the article below.

Contents

What is Swing Trading, Guide and Tips For Beginners

What is Swing Trading?

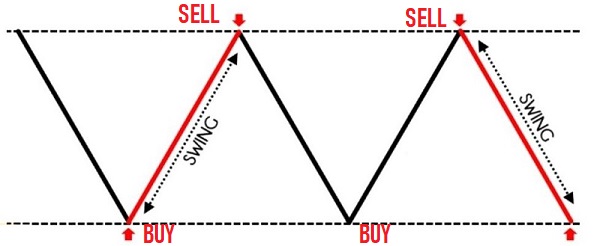

Swing Trading is a trading method aimed at capturing the alternating up and down WAVES of the market. With this type of trading, you can alternately BUY/SELL, without needing to pay too much attention to the main trend. Swing means wave.

Suppose you enter a LONG/BUY order, you will hold the order before selling pressure appears. It means you will take profit before the market reverses to decline.

If you do not understand what Swing Trading is, you can see the illustration below:

Or more realistically, here is Swing Trading with the USD/JPY pair:

How to identify areas for Swing Trading?

Swing Trading is based on the waves of the market. However, you should not participate just because you see a wave, but to increase the win rate, only engage in Swing Trading at the best entry points.

Important:

- You should LONG/BUY at a price you consider ‘cheap’.

- You should SHORT/SELL at a price you consider ‘expensive’.

So how to determine ‘expensive’ and ‘cheap’? You can use the following three methods:

Method 1: Using Support and Resistance

- Support – an area on the chart where, when the price falls to this zone, it tends to bounce back up.

- Resistance – an area on the chart where, when the price rises to this zone, it tends to turn back down.

If you have never learned about support/resistance, you can read through the article:

Example:

Therefore, an area where you can participate in Swing Trading, if you see it has clear Resistance and Support. If you want to “buy low, sell high”… then: BUY at Support and SELL at Resistance.

Method 2: Using Moving Averages (MA)

However, not always will the price chart clearly show you a horizontal support-resistance area as in theory. Such a case only appears when the market is sideways, and the trend of increase/decrease is not clear.

If the market has a clear trend, for example, in an uptrend, it will form higher lows and higher highs.

=> In this case, you can use moving averages (MA).

- In a strong uptrend, the price will touch the MA20 line and bounce up.

- In a moderate uptrend, the price will touch the MA50 line and bounce up.

- In a weak uptrend, the price will touch the MA100 line and bounce up.

Conversely, in a downtrend, the price chart will be below the MA line. When the price touches the MA line, it is likely to turn back down.

Read more: Moving Average: Uses, Formula, Tips and Tricks for Traders

Method 3: Using Trendlines

Or you can also use trendlines.

- An uptrend line: will slope upwards, indicating rising buying pressure.

- A downtrend line: will slope downwards, indicating increasing selling pressure.

Here is an example of an Uptrend Line:

Swing Trading: When should you enter a trade?

You now understand what Swing Trading is, as well as when you should participate in Swing Trading. Now it’s time to delve into your trading – starting with when to enter a trade.

You can trade when the price touches a value area (touches resistance/support, trendline, or MA…) or wait until it shows signs of reversal after touching the value area before entering the trade.

In fact, you can apply both methods, but personally, I prefer waiting until the price reverses. Although you may not earn as much profit, it avoids the situation where the price breaks the current trend.

There are 3 ways to catch signals:

When False Breakout signals appear

This Swing Trading method takes advantage of traders who are ‘trapped’ thinking that a real breakout is occurring. Here’s how it works (example with an uptrend):

- Traders tend to LONG/BUY when the price breaks out of the resistance area.

- But in many cases, after the breakout, the price turns back down. At this point, the Breakout becomes a False Breakout.

But what happens when a False Breakout occurs?

At this point, traders who bought at the breakout are ‘trapped’, and their orders are in the red. If the price continues to fall, it will trigger their stop-loss orders, causing the price to drop even further.

⇒ If you participate in Swing Trading and place an order after a False Breakout signal, you may have a trade with a very high probability of success.

When reversal candlestick patterns appear

Reversal candlestick patterns that show an increase indicate that buyers are gaining control. Some common bullish reversal patterns are: Hammer, Bullish Engulfing, Morning Star, etc.

But for this article, let’s talk about the Hammer:

Hammer is a bullish reversal candlestick pattern (1 candle) formed after a price decline, you will see it appear frequently on the price chart, known as the pullback candle. It looks like this.

– Characteristics: The body of the candle is only about ¼ of the entire candle’s length, with a long wick.

– Meaning of the Hammer candle: The sellers pushed the price down, but strong buying force pushed it higher. In summary, the Hammer indicates that it is difficult for the price to drop further (due to strong buying force below), suggesting an upcoming bullish reversal.

And when the market is in a downtrend, you will look for a candle opposite to the Hammer, which is the Shooting Star. (Additionally, there are other patterns such as Bearish Engulfing, Evening Star, etc.)

But for this article, let’s discuss the Shooting Star, which looks like this:

In general, the Shooting Star is a bearish reversal candlestick pattern, indicating that the price is unlikely to rise further, and a bearish reversal is imminent.

Swing Trading: Where to Place Stop Loss?

What is Swing Trading? The question arises: where to set the stop loss so that you don’t get triggered too early, and if you incur losses, they aren’t too high?

Currently, a common mistake among many traders is applying the principle of placing the Stop Loss very close to the entry point, thinking that doing so will minimize risk.

However, this is not true, because doing so means you will frequently hit your SL, after which the market turns in your favor. => It shows your analysis is correct, but you still lose money because the stop loss is triggered too early.

So, what’s the solution?

Increase the distance of your Stop Loss to a level you can tolerate, then continuously monitor the market. Remember: Only place SL at a point where if it’s triggered, it proves your market judgment was wrong.

Typically, people often set it quite close to resistance/support. But placing it there can easily be triggered, and then the price reverses direction.

Example:

Because some traders see the price drop below the previous low, they think it’s a good price to buy, so they place buy orders, increasing buying pressure.

⇒ That’s why after your STOP LOSS order is executed, the price reverses and starts to rise. Because below the resistance area there is a very strong BUYING pressure.

Therefore, the best way is to set SL a bit farther from resistance and support. You can read more in the following article:

Swing Trading: Where to Place Take Profit?

Where to take profit before the market reverses 180 degrees against you?

Recall that Swing Trading is a trading style where you will close your position when you see buying/selling pressure from the opposite side emerging.

Therefore:

- If you BUY/LONG, you will want to take profit in areas where selling pressure might appear (for example, when the price touches resistance, breaks down below the MA line in an uptrend, etc.).

- If you SELL/SHORT, you will want to take profit in areas where buying pressure might appear (for example, when the price touches support, breaks down below the MA line in a downtrend, etc.).

Example:

However, don’t place Take Profit right at the support/resistance levels, as the market may reverse 180 degrees before reaching your target. Instead, try to take profit a few pips earlier.

- Identify an area to engage in Swing Trading, preferably when the market has clear resistance/support.

- Wait for the price to touch Support.

- Then wait for signals of False Breakout or bullish reversal candlesticks, and then enter a BUY/LONG order.

- Place Stop Loss a little lower than support, and set TP also a bit lower than resistance.

Or:

- Wait for the price to touch Resistance.

- Then wait for signals of False Breakout or bearish reversal candlesticks, and then enter a SELL/SHORT order.

- Place Stop Loss a little higher than resistance, and set TP also a bit higher than support.

Many websites advise using the 4-hour, 1-day time frame. But in my opinion, it’s not like that. You can use any time frame as long as you are familiar with it.

Above are the guidelines on Swing Trading. I hope through this article, you have understood what is Swing Trading, and how to apply it effectively to earn profits in the market. If you have any questions, please leave a comment below for me to answer. Thank you for reading the article and wish you successful trading.