The Maverick Protocol (MAV) is a project that is drawing the attention of many investors as it becomes the 33rd Launchpool project on Binance. It is known that this is a relatively new project that was launched not long ago but has already recorded impressive statistics in terms of protocol fee revenue. But what is Maverick? What is MAV coin, and what makes Maverick special? Does Maverick (MAV) have the potential for long-term investment? Let’s take a closer look with a detailed review in the article content below.

Contents

What is MAV coin, should i invest?

What is Maverick – MAV?

The MAV coin is the currency of the Maverick Protocol, an AMM DEX platform that utilizes a Directional LPing solution to provide the best prices for liquidity providers. As a result, liquidity providers can easily manage their liquidity positions while earning more profit from the platform’s transaction fees.

Different from other AMM protocols, Maverick Protocol’s AMM mechanism is a Dynamic Distribution AMM which offers liquidity providers more flexibility in selecting price zones without having to monitor their liquidity positions and incurring fewer fees. This new AMM mechanism also provides support for users to trade smoothly without fear of liquidity shortages during significant price fluctuations.

As of the time , Maverick (MAV) has over 37 million dollars in Total Value Locked (TVL), according to DeFiLlama.

What are the features of Maverick (MAV coin)?

The unique aspect of Maverick Protocol is its ability to enhance capital efficiency and allow Liquidity Providers (LPs) to place directional bets during fee generation. LPs in the Maverick Protocol have to make two critical choices:

- Firstly, they choose the price range they want to provide liquidity for.

- Secondly, they decide how their liquidity will move with price changes.

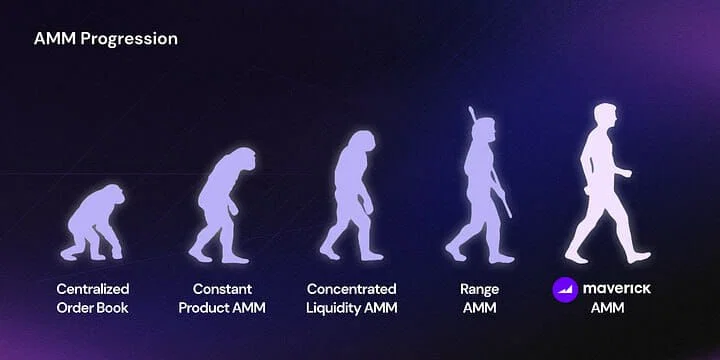

Upon reading this, you might think the mechanism resembles the “Concentrated Liquidity Market Maker (CLMM)” approach. However, a CLMM sets a small range, and once out of range, the provision of liquidity stops. The AMM mechanism provided by Maverick automates following the desired price trend.

=> It can be understood as Maverick providing an upgraded version.

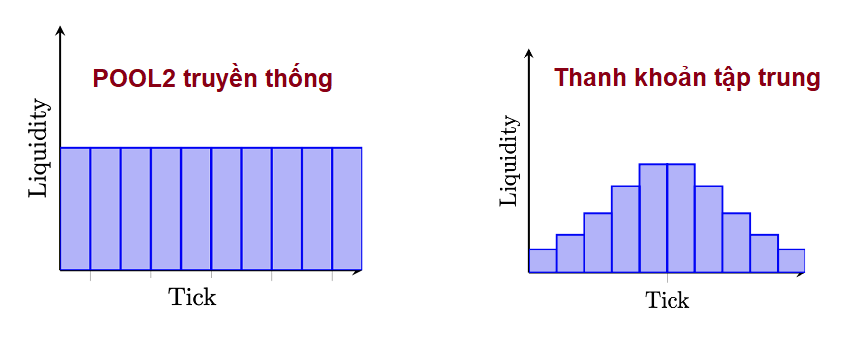

Concentrated Liquidity (CLMM) is a game-changing tool for achieving capital efficiency, but its implementation in current AMMs places a burden on users to shift their own liquidity. This leads to misallocation and reduced efficiency when prices move outside of the concentrated area.

*** Current concentrated liquidity AMMs (i.e., range AMMs) allow liquidity providers (LPs) to focus their liquidity within a specified range. As long as the price remains within this range, their capital efficiency remains high, meaning their capital is at work, generating fees for them – for instance, more fees than they would earn in a constant product AMM. ***

The issue arises when the price moves outside the LP’s range. At this point, their capital efficiency drops to zero, as none of their capital is actively employed in the AMM. If LPs wish to maintain capital efficiency, they have to take on the responsibility of shifting their liquidity to a new range, which costs them time and gas fees. In reality, many LPs struggle to keep up with price movements, and a significant amount of liquidity becomes stagnant in Range AMMs.

=> Maverick is a project that aims to solve this issue. Maverick’s AMM maximizes capital efficiency by automating the re-concentration of liquidity in response to price fluctuations. LPs can choose from various liquidity shifting modes to manage price monitoring and reconcentrate their liquidity for them. Higher capital efficiency leads to greater market liquidity, meaning better prices for traders as well as more fees for liquidity providers. This integrated feature also helps LPs eliminate high gas fees incurred from manually adjusting positions around the price.

It achieves this by supporting Native LST (Liquid Staking Tokens), price following, and protocol support for LSTs.

- Native LST Support: Maverick AMM is the only AMM built to natively support Liquid Staking Tokens (LSTs). AMMs with static ranges and stableswaps are not designed to handle yield-accruing assets like LSTs.

- Price Following: With its dynamic movement modes, Maverick AMM is the ideal solution to maintain liquidity within the yield span of LSTs. This ensures that liquidity is always close to the price throughout the yield cycle of the LST.

- Protocol Support: LST protocols – both large and small – are competing for market share. Maverick is the most efficient platform for this competition to take place: LPs can provide liquidity efficiently and protocols can encourage the distribution of liquidity they desire efficiently.

Overall, the Maverick Protocol is built to natively support LSTs and is the ideal solution for maintaining liquidity within the yield ranges of LSTs. This ensures liquidity stays close to the price throughout the LST’s yield cycle. Currently, many LST protocols are competing for market share, and Maverick is the most efficient platform when this competition occurs.

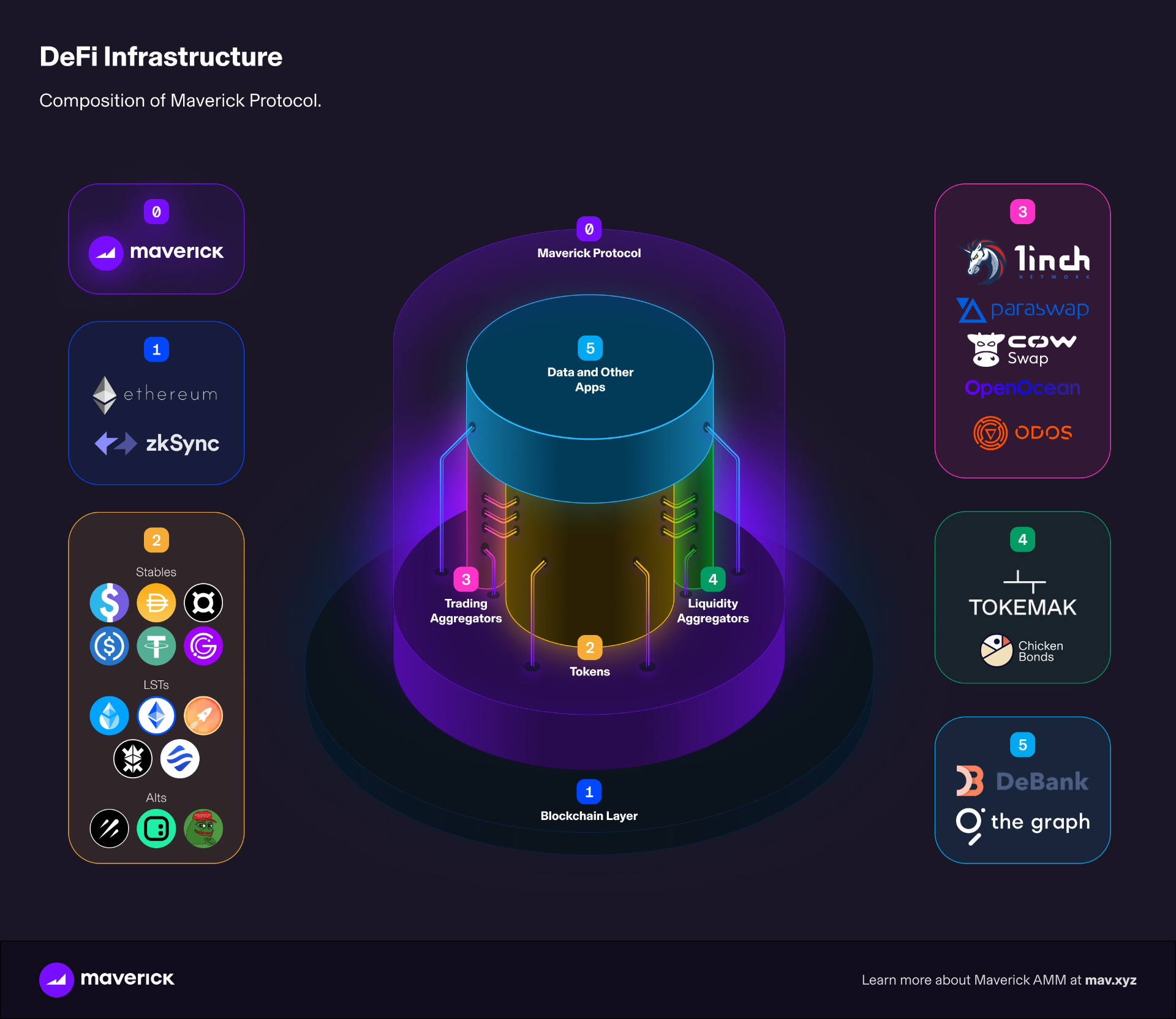

Ecosystem and Mechanism of Maverick (MAV)

The Maverick Protocol is a project anticipated to enhance the efficiency of liquidity usage and construct an ecosystem of interconnected application layers. The ecosystem of Maverick will consist of five main components:

- The foundational blockchain: Ethereum, zkSync

- Trading aggregators: 1inch, Paraswap, etc.

- Tokens: stablecoins, LSTs (Liquid Staking Tokens), etc.

- Liquidity centers (liquidity aggregators): Tokemak, Chicken Bonds Data and other dApps: DeBank, The Graph

Next, to better understand Maverick and MAV coin, let’s delve into its operational mechanism. Maverick AMM has three main features as follows:

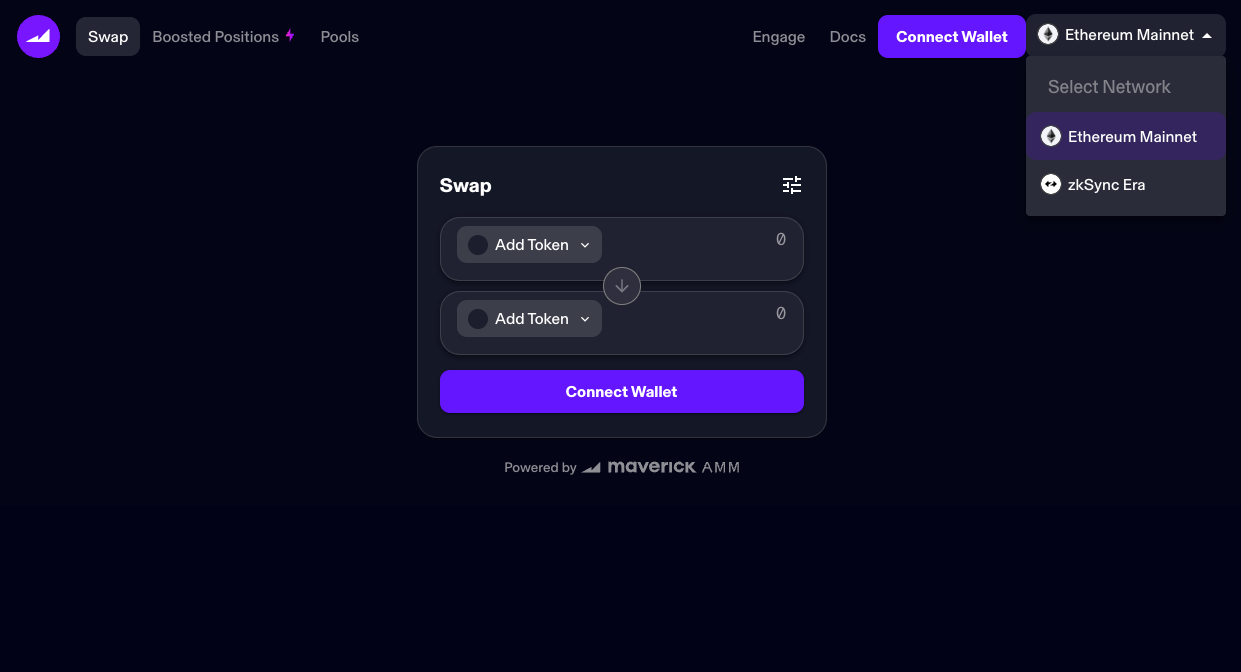

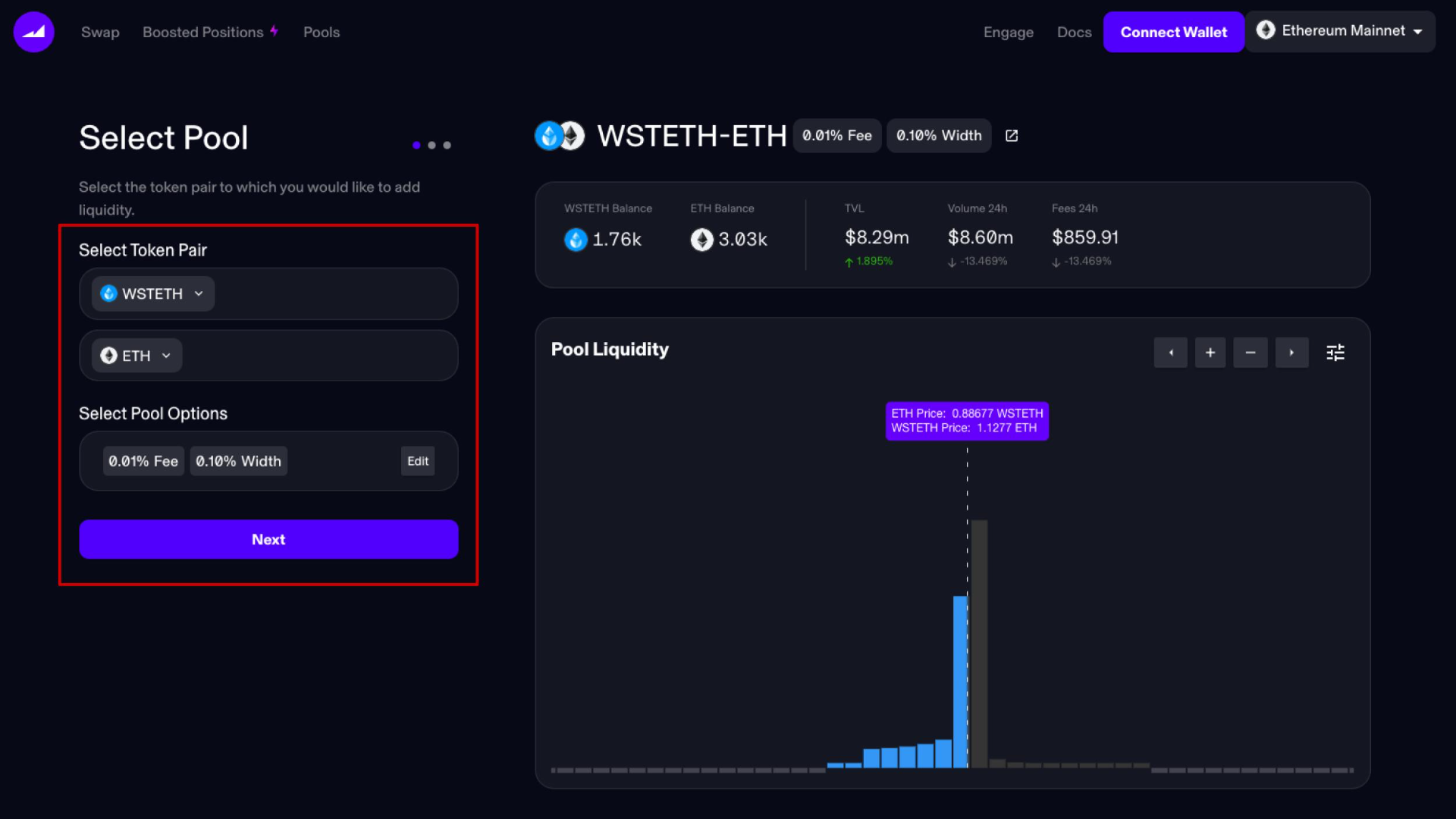

Swaps

This feature allows users to swap between various types of tokens with minimal slippage. Currently, Maverick Protocol supports token swaps on two blockchains: Ethereum and zkSync Era.

Pools

In order to increase the efficiency of the concentrated liquidity AMM model, Maverick AMM allows LPs (liquidity providers) to stake assets within a chosen price range, while also specifying how liquidity moves as prices change. LPs receive transaction fees when the price is within their provided liquidity range.

Each pool in Maverick can select the following parameters:

- (1) Liquidity Pair (Token Pair): This is the two assets that will be traded in the pool.

- (2) Bin Width (Price Range Width): This determines which price range will be activated if the price moves. In a pool with a 2% bin width, if the token price changes by an increase or decrease of 2%, a new bin width is automatically triggered.

- (3) Fee Rate: For highly volatile assets, a suggested bin width is 2%. Meanwhile, for stable assets, a recommended bin width is between 0.02% to 0.05%.

This model is designed to adapt to price changes dynamically, meaning that liquidity can be redistributed automatically to maintain efficiency and continue to generate fees for LPs even when there are significant price movements, without the need for LPs to manually adjust their liquidity positions, which can save on transaction costs and effort.

In addition to these features, the Pools function has four different liquidity modes for users, which are:

-

Mode Right: The bin moves to the right when the price increases and does not move when the price decreases. This means that if the price moves beyond the liquidity range upwards, the bin will shift to the right. However, if the price drops below the active liquidity range, the bin will not move.

-

Mode justify: Contrary to Mode Right, the bin moves to the justify when the price decreases and does not move when the price increases. This means that if the price falls beyond the liquidity range downwards, the bin will shift to the justify. However, if the price rises beyond the active liquidity range, the bin will not move.

-

Mode Both: In this mode, the bin moves in both directions, up or down, as the price moves out of the liquidity range. However, the risk of impermanent loss is very high, and this mode is more suited for stable products like stablecoins.

-

Mode Static: The bin remains fixed and does not move when the price goes beyond the liquidity range.

Each mode is designed to align with a liquidity provision strategy. The first three modes leverage Maverick’s automated liquidity shifting technology to ensure that liquidity remains active according to the user’s setup.

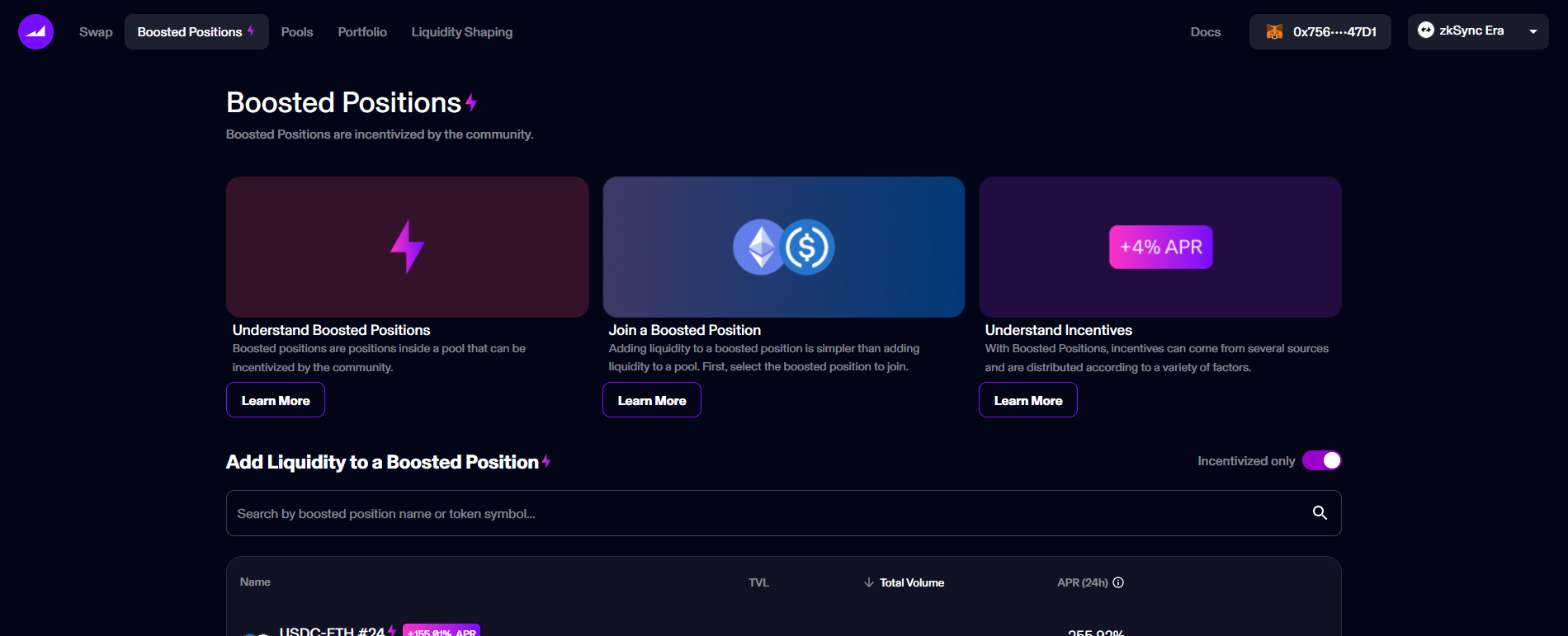

Boosted Positions

The Boosted Position feature of Maverick allows LPs (Liquidity Providers) to earn greater returns. Similar to other LP positions, however, Boosted Position has two distinctive features:

- Other LPs can add liquidity to a Boosted Position and share in the profits from that position.

- A Boosted Position will receive additional bonus tokens.

For each Boosted Position, users can use the bonuses to attract more liquidity to the project.

LPs (Liquidity Providers) who add liquidity to the Boosted Position pool will receive:

- Transaction fees.

- Incentive rewards.

For example:

Project AAA’s Token A needs to become more widely known and attract more liquidity.

This project creates a Boosted Position that only includes ETH (which can be traded for Token A) in the ETH/A pool.

LPs who add their ETH liquidity can receive Token A as a reward.

As a result, Project A gains additional liquidity, and the LPs also benefit from this pool.

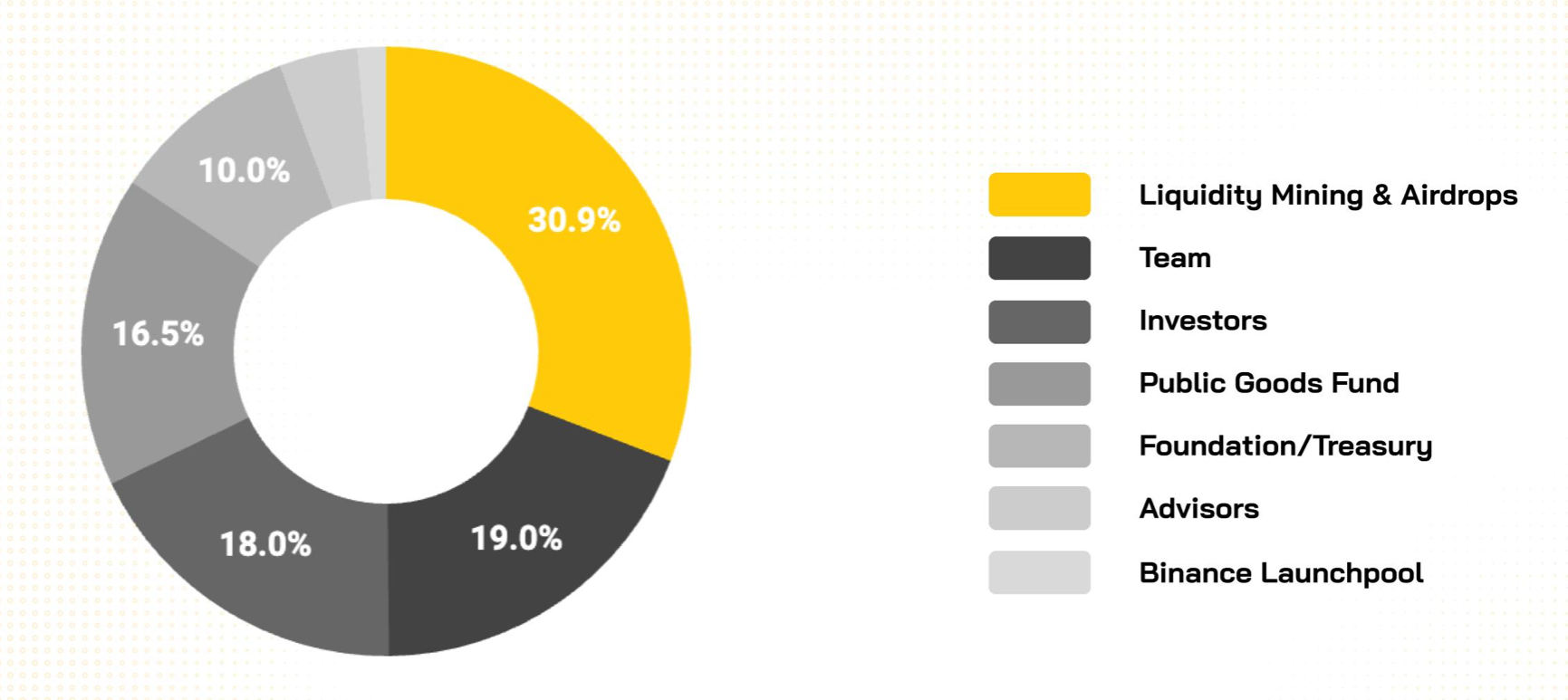

Maverick (MAV) Tokenomics

MAV is the utility token that plays a crucial role in the Maverick Protocol ecosystem. Owners of MAV can stake their MAV tokens to receive veMAV – the governance token of the project, which confers voting rights in governance decisions. Notably, the longer users choose to stake their MAV, the more veMAV they receive, and consequently, the greater their governance rights become.

- Token Name: Maverick Protocol

- Ticker: MAV

- Blockchain: Ethereum

- Token Standard: ERC-20 T

- oken Type: Utility and Governance

- Total Supply: 2,000,000,000 MAV

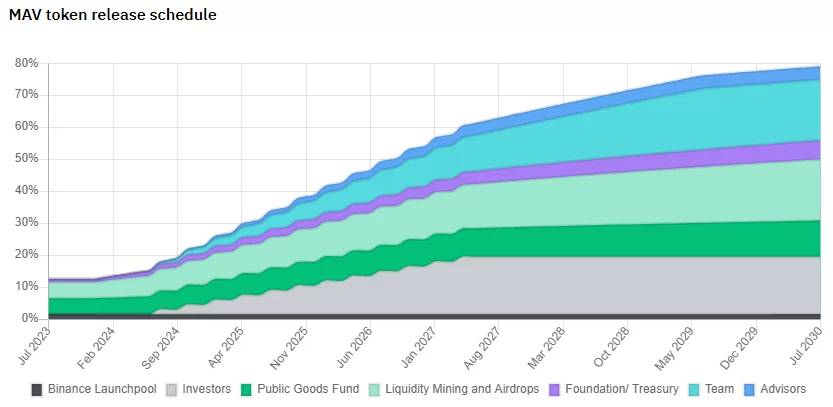

MAV token release schedule:

The Maverick Protocol Team, Investors, and Partners

Maverick Project Team:: Comprising members who have worked together across various segments of the DeFi market. They have served as advisors for MetaMask, BitTorrent, Abra, TrueFi, Paxful, and LedgerPrime. Notable team members include:

- Alvin Xu: Currently a Contributor at Maverick Protocol, Alvin has several years of experience in the crypto field, having built ecosystems at TRON Foundation, managed products at BitTorrent, and developed products at Metamask.

- Bob Baxley: Ông hiện là Contributor tại Maverick Protocol. Ông đã có hơn 10 năm kinh nghiệm trong lĩnh vực công nghệ khi đang là Co-Founder và CTO Bastille, thành viên của Ubiquity Ventures – một quỹ đầu tư hướng đến các công ty công nghệ phần mềm trong giai đoạn Seed round.

Investors: Maverick Protocol (MAV) has raised 9 million dollars from a group of leading investment funds in the cryptocurrency sector. It has been backed by prominent names such as Pantera, Jump, Altonomy, Circle, Gemini, Spartan,…

Partners: Some of the notable partners of MAV coin include:

- Liquid Staking Tokens (LST) Protocols: Maverick currently supports liquidity for Liquid Staking Tokens (LST) such as wstETH, frxETH, swETH, rETH, and cbETH.

- Stablecoins: Some stablecoins available on Maverick include LUSD, FRAX, GRAI, USDC, USDT, and DAI.

- Trading Aggregators: Maverick AMM integrates with trading aggregator tools on both Ethereum Mainnet and zkSync Era such as 1inch, Paraswap, Odos, Cowswap, and OpenOcean.

- Additionally, Maverick collaborates with other partners like Tokemak, Galxe, etc., to optimize the user experience.

Roadmap Maverick Protocol:

– Q3/2023

- Deployment on BNB Chain.

- Launch of Voting Escrow and Governance contracts.

– Q4 2023 (based on DAO voting)

- Launch of Boosted Pool Voting.

- Launch AMM on various other blockchain systems.

– Q1/2024 (based on DAO voting)

- Launch AMM on various other blockchain systems.

- Support for MAV LayerZero on multiple blockchain systems.

Maverick (MAV coin) – Is it a potential investment?

Maverick Protocol is an AMM DEX platform utilizing the Directional LPing solution to provide the best pricing for liquidity providers. With support for LST assets from various protocols, an expansion roadmap across multiple blockchains, and being the 34th Binance Launchpool project, it is evident that Maverick Protocol is a thoroughly invested and serious project, set to be one of the key initiatives in DeFi’s future.

Following the successful Ethereum Shanghai upgrade, LSD projects have gained increasing attention, making protocols like Maverick Protocol more effective. If CLMMs represent a beneficial step for liquidity providers, Maverick goes even further, improving almost all of the current shortcomings of CLMMs. Therefore, I hold this project in high regard and believe it has the potential to grow even stronger in the future.

Maverick’s ultimate goal is to become a community-owned decentralized platform. A decentralization roadmap is being developed to gradually transfer control to the community. In general, Maverick is a relatively new project and will need time to develop. However, with its achievements and future direction, we can certainly have high expectations for Maverick (MAV).

You can keep up to date with more content related to Maverick Protocol on their media channels:

The above are our shares about Maverick Protocol. We hope that through this article, you have understood what MAV coin is and assessed its potential. However, please note that this article is not an investment recommendation, as all trading decisions need to be combined with many other factors such as macro factors, cash flow, market trends, appropriate buying and selling areas, etc., and to limit impulsive FOMO, especially after it has been officially listed on Binance. We hope you make wise decisions and invest successfully.