DeFi is growing rapidly, leading to increased attention towards decentralized exchanges. This is the moment for DeFi projects to improve their mechanisms in order to attract larger investors and real users. Pendle Finance is a project that possesses these qualities. PENDLE coin is currently a hot topic as it has become the 35th project on Binance Launchpool and is also benefiting from the trending LSDfi trend. So, what is PENDLE coin, what is its potential, and is it worth investing in? Let’s delve into the details in the article below.

What is PENDLE coin, should you invest in it?

What is PENDLE coin?

Pendle Finance is a protocol developed on Ethereum that allows users to tokenize their staking rewards before the maturity date and potentially earn additional profits from these “pre-claimed” interest payments. The objective of Pendle coin is to help users maximize the returns they receive from staking by offering derivative products for those rewards.

For example: You depositing 100k USD in a bank with a 10% annual interest rate. This means you would receive 10k USD in interest after one year. Instead of having to wait for a year to use that 10 million VND, what Pendle provides is an asset representing that 10k, which you can use for savings, trading, or any other suitable purpose, in accordance with the protocol’s requirements.

Pendle was created by an anonymous group of individuals, including TN Lee, GT, YK, and Vu. It is headquartered in South Korea and secured $3.7 million in funding in 2021 from investors such as Hashkey Capital, Bitscale Capital, Crypto.com Capital, Fisher8 Capital, Strategy Round Capital, and others.

In general, Pendle Finance is a DeFi project with the aim of bringing the derivative profit market to the world of decentralized finance, where users can tokenize and trade future profits from various DeFi protocols, bridging the gap between TradFi and DeFi. Thanks to Pendle Finance, the narrative of profit tokenization is being rewritten.

Unlike traditional yield farming, which is limited to betting or providing liquidity for AMMs, yield derivative tools like Pendle offer greater flexibility and stability for DeFi users. This represents a significant advancement for the future DeFi ecosystem.

What is special about Pendle coin?

Combining DeFi and Liquid Staking Derivative (LSD), Pendle offers users an opportunity to increase their income by utilizing their previously staked capital for derivative activities.

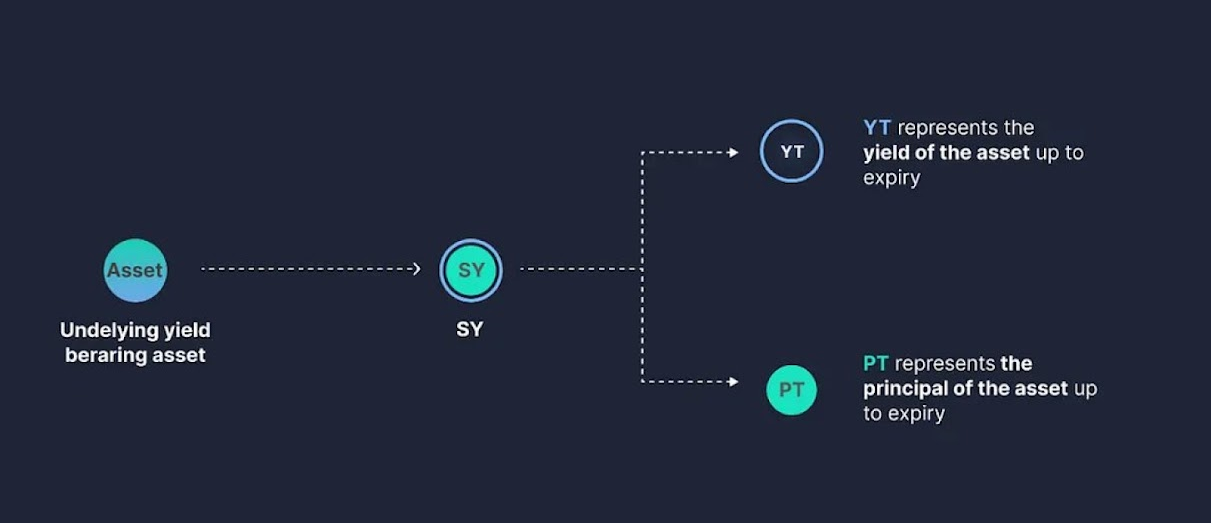

When assets are staked in Pendle’s liquidity pool (with a specific maturity date), they are divided into two types of tokens: Principle Token (PT) and Yield Token (YT), where:

- PT represents the original token’s principal amount, with a convertible value after the maturity period concludes.

- YT represents all profits generated from the original token, which can be claimed at any time and is fully receivable when the maturity period ends.

Ví dụ:

When someone deposits 2 stETH (ETH staked on Lido) into Pendle with the intention of locking these assets for one year to generate interest, these 2 stETH will be split into two parts: 2 PT stETH and 2 YT stETH.

- 2 PT stETH represents the original principal amount of 2 stETH, with a convertible value after the one-year lockup period ends.

- 2 YT stETH represents all the profits generated from the 2 stETH, which can be claimed at any time and are fully receivable when the one-year lockup period concludes.

To help you better understand what PENDLE coin is and its unique features, let’s delve deeper into each type of token it offers and the project’s key highlights:

Principle token (PT)

Because PT tokens can only be redeemed after their maturity date, purchasing PT tokens on Pendle Finance is cheaper compared to the original token (with a discount equivalent to the staking interest, or even lower). Therefore, investors can take advantage of buying PT tokens at a better price than staking on LSD platforms.

Example:

Someone uses Pendle Finance to buy 1 PT stETH at a price of 0.94 stETH. So after one year, this user would have an stETH profit of ~6.38%.

However, if they were to lock stETH normally on Lido, after one year the assumed APY the user would earn is 5.5%.

=> That investor would benefit from buying PT stETH instead of locking stETH for one year.

It can be seen that holding PT tokens is like holding a zero-coupon bond, which will be redeemed at its face value at maturity. However, the unique thing is that this bond is liquid and can be traded like a regular asset.

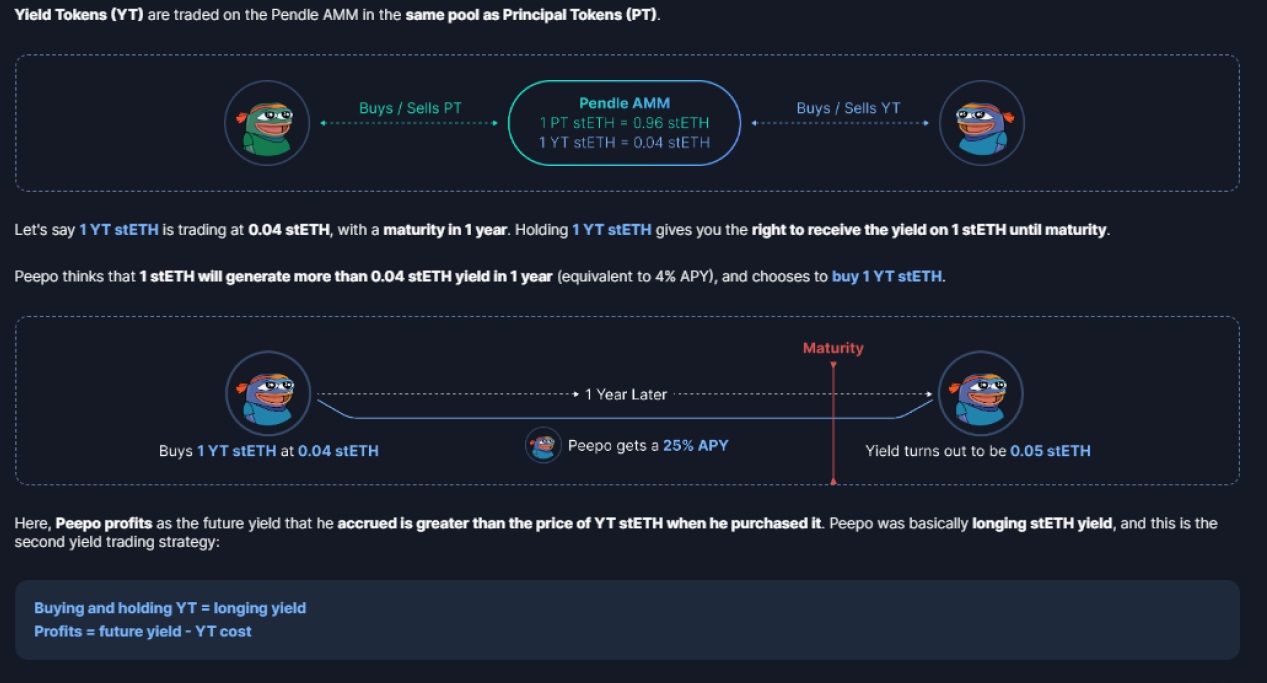

Yield Token (YT)

The YT token represents the interest earned. Selling YT tokens at a fixed price on Pendle Finance equates to preserving the interest rate (APY hedging) instead of risking a significant drop in APY.

Conversely, holding YT tokens is equivalent to taking a long position on the interest rate of the staked asset. Owning a large number of YT tokens also creates leverage when trading interest rates.

- When APY increases, users will earn more profit.

- When APY decreases, users’ assets will suffer greater losses.

Example:

Similar to the PT token, 1 PT stETH is priced at 0.94 stETH. Therefore, 1 YT stETH would be priced at about 0.06 stETH.

After that, an investor could sell 1 YT stETH for 0.06 stETH. The APY at this point is fixed at 6.38%, and liquidity is immediate.

However, if another user expects the APY to rise above 6.38%, they could buy this YT token at 0.06 stETH. After one year, if the APY increases as expected to 7.5%.

=> The investor would gain 0.015 stETH after one year, with an initial investment of 0.06 stETH (this number could be increased if they buy more YT stETH to create leverage).

It can be seen that the YT token operates like bond interest. The difference is that this interest rate is liquid and can be traded like a normal asset.

vePENLE Token Mechanism

Another unique aspect of the PENDLE coin is that it adopts the veToken (vote escrowed token) model from Curve, which is familiar to DEFI users, but also has many differences that are improvements.

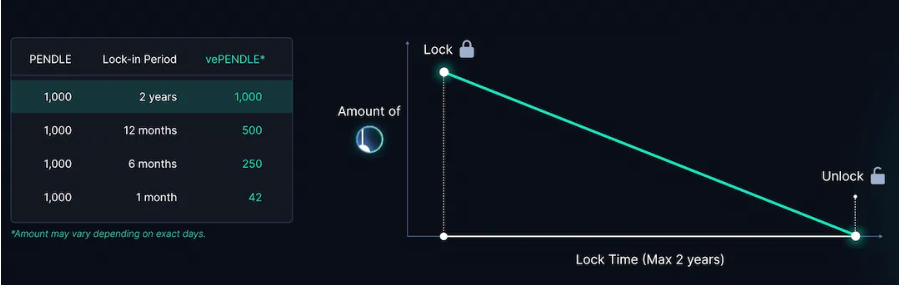

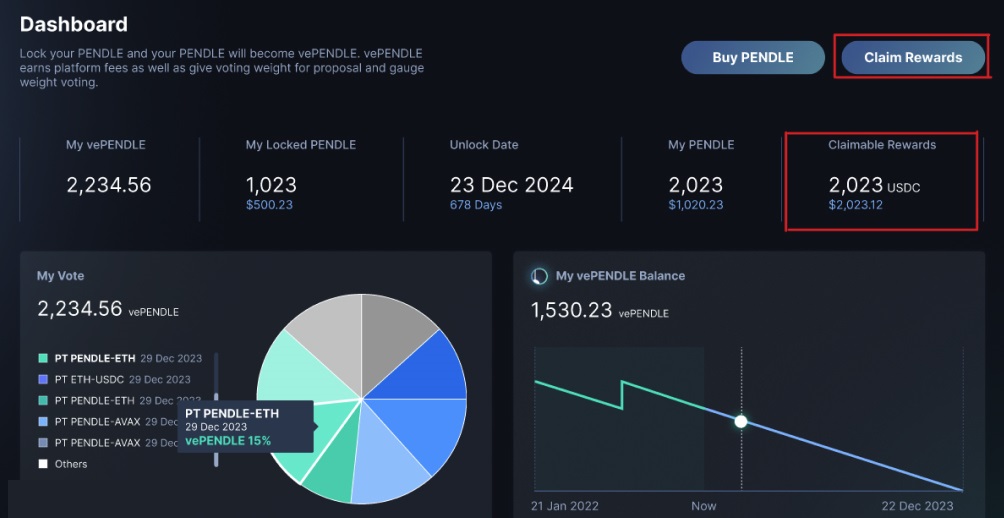

The $PENDLE reward tokens will be locked to receive $vePENDLE, with the usual functions of a veToken such as:

- Using veToken to vote for receiving rewards for asset pairs that get bribe rewards.

- Participating in governance voting for the project.

- Holding $vePENDLE helps increase the amount of $PENDLE rewarded when providing assets to liquidity pools (up to 250% based on the value of $vePENDLE held).

Overall, vePENDLE supports the incentive mechanism on Pendle, meaning that vePENDLE holders can vote and direct rewards to different groups, effectively encouraging liquidity in the groups they vote for.

If you hold vePENDLE and provide liquidity in an LP group, you would certainly want to increase the incentives and PENDLE rewards for all LPs according to the value of vePENDLE you hold, with a maximum boost of up to 250% available.

And this also means there will be a fly-wheel effect of income, which means the more vePENDLE you invest in, the more benefits and rewards you will enjoy. And with the locking of PENDLE tokens, a lot of supply will disappear from the market, and LPs can see up to a 250% increase in income, this is really a user attraction mechanism, and a plus point for PENDLE.

In terms of locking, the amount of vePENDLE that users receive is directly proportional to the amount and duration of the lock, meaning the amount of vePENDLE that users receive decreases over time. When the lock duration expires, it will drop to 0 and the PENDLE locked by the user will be fully released.

*** Side Knowledge: What is the Fly-wheel Effect ***

The Fly-wheel Effect means that to get a stationary flywheel to spin, initially you have to exert a lot of effort, pushing it to turn several times, not in vain, as the flywheel will spin faster and faster. After reaching a certain point, the gravity and momentum of the flywheel become part of the engine’s drive. At this time, you do not need to exert more effort, and the flywheel will continue to spin quickly and consistently.***

In addition, a new improvement of the veToken mechanism in Pendle Finance comes from the implementation of Cross-chain capabilities. It has adopted technology from the Layer Zero protocol, with Pendle’s veTokenomics being the first tokenomics to use a cross-chain mechanism – rewards are accumulated and allocated to all holders in Pendle’s liquidity pool, cross-chain voting, and reward boosting.

Pendle has just received a major power up ????

Thanks to @LayerZero_Labs, Pendle will be the first ever to introduce cross-chain veTokenomics across all of #DeFi!

That means rewards accrual for holders from ALL of the Pendle pools, seamless cross-chain voting, reward boosting. pic.twitter.com/5PynISVIm7

— Pendle (@pendle_fi) March 3, 2023

But you need to be aware that users can only lock $PENDLE to receive $vePENDLE on the Ethereum Blockchain, and then reap the benefits on other chains.

RealYield Mechanism

Pendle charges a 3% fee on all income generated by YT. Currently, 100% of this fee is distributed to vePENDLE holders. Additionally, this protocol does not take any transaction fees (However, this may change in the future).

A portion of the profits from matured PTs that have not been converted will also be distributed proportionally to vePENDLE holders.

PENDLE Coin and the Trend of LSDfi

Liquid Staking Derivatives (LSD) have become one of the biggest stories and a hot trend since the beginning of 2023, especially after the successful Ethereum Shapella upgrade. Simply put, LSDs are instruments that allow for the creation of derivative assets from staked assets. They provide their users with the ability to earn staking rewards and also grant them the flexibility to use these LSD tokens in other decentralized applications (DApps).

Following the Ethereum Shapella upgrade, LSD protocols have continued to see a staggering increase in Total Value Locked (TVL) and are expected to continue this strong growth in the future. This growth has also stimulated the TVL growth of LSDfi protocols.

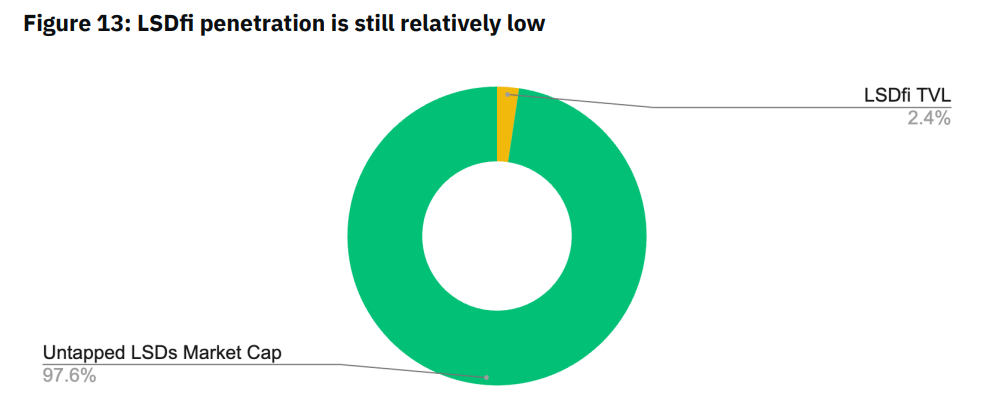

Particularly, Binance Research recently published a research report on LSDfi in 2023. According to the report, we can see that LSD currently has a market value of $18.4 billion, while LSDfi only accounts for 2% of the market. This indicates that there are significant future opportunities in this sector. Evidently, this is the main driving force for projects like Pendle.

With the dominance of LSDs, most holders are likely seeking opportunities to increase their ETH yields, and Pendle offers a way to achieve this. Thanks to Pendle, users can employ enhanced income strategies such as purchasing yield-generating assets at a discount: buying ETH at a 6.31% discount and buying APE at a 19.53% discount.

Moreover, users can also choose to lock their own yield-generating assets, such as staking ETH on Lido, receiving PT stETH and YT stETH tokens upfront, and obtaining the YT stETH income token through the v2 AMM.

In summary, what LSD protocols are doing is helping users commit ETH and seek the highest return rates, and what Pendle is actually doing is realizing the future benefits that LSD protocols bring to users in the present. Currently, Pendle has supported LSD-related assets provided by Lido Finance, Rocket Pool, and Aura Finance.

PENDLE Tokenomics

The native token of Pendle Finance is PENDLE. Its purpose is for governance once participating in the protocol. Specifically, it will support protocol management mechanisms and value accumulation. PENDLE is also an inflationary token with a perpetual inflation rate of 2%.

- Token name: Pendle Finance

- Ticker: PENDLE

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0x808507121b80c02388fad14726482e061b8da827

- Token Type: Utility, Governance

- Total Supply: 231,725,335 PENDLE

- Circulating Supply: 161,331,923 PENDLE

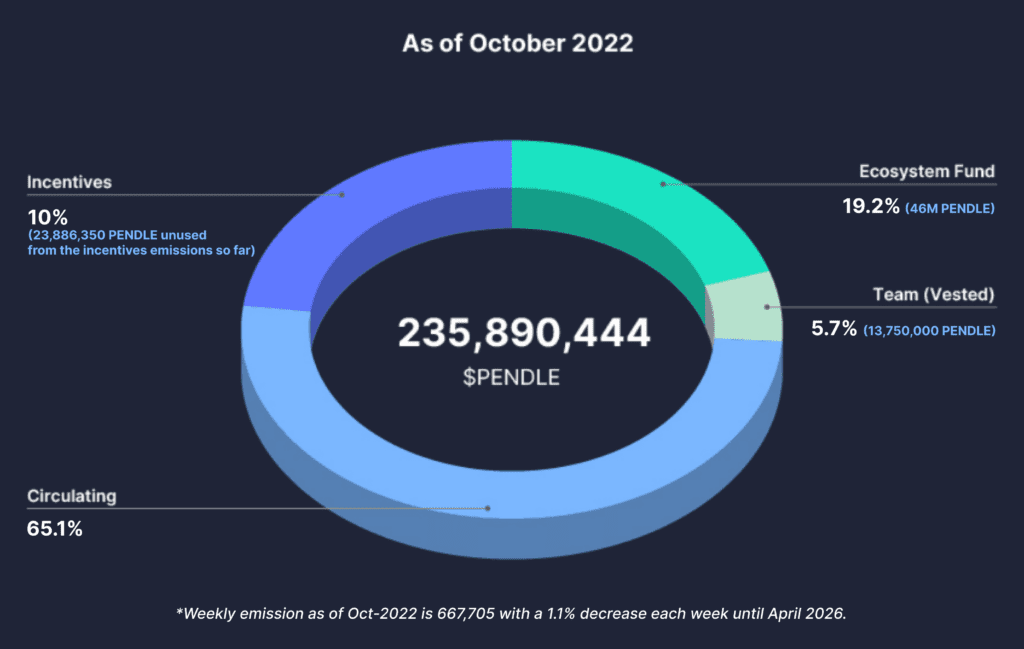

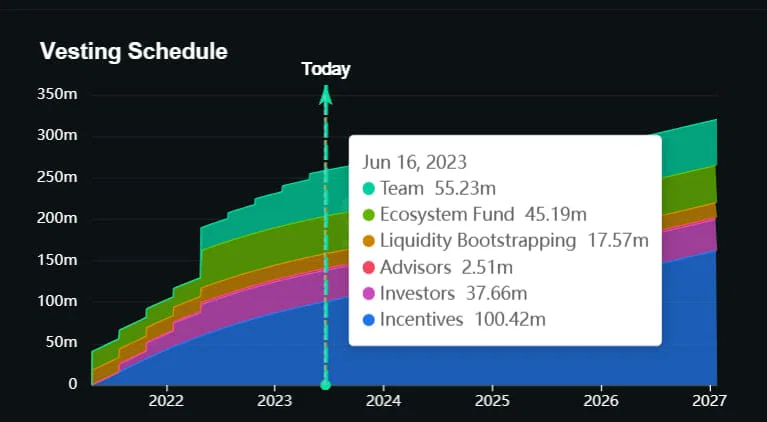

The initial distribution of PENDLE allocated 37% for liquidity incentives, 22% of the supply for the team, and 15% for investors. Additionally, the ecosystem fund received an 18% allocation, and 7% was set aside for liquidity bootstrapping. The remaining 1% of the supply was reserved for advisors.

However, as of October 2022, PENDLE has amended its token distribution strategy. It now has 65.1% allocated to circulation, 19.2% for ecosystem funds, 10% for incentives, and 5.7% for the team.

Users can leverage liquidity incentives to gain additional benefits while holding the PENDLE token. Furthermore, this trading platform allows users to separate their yield tokens from their principal tokens, which enhances flexibility and capital efficiency in the yield market. While there is always the potential for loss in the world of cryptocurrency, Pendle offers various ways for users to earn profits.

The PENDLE token has a weekly emission rate of 667,705, with a decrease of 1.1% per week until April 2026. Overall, the end-of-term inflation rate is set at 2% per annum.

Should you invest in PENDLE coin?

Have you gained some understanding of what is PENDLE coin? As mentioned above, Pendle Finance provides a tool that enables deeper liquidity mining for LSD projects, while also opening up a new market that allows users to create leverage for the APY of their staking assets.

By offering many such “investment doors,” Pendle will be able to attract users, and also help to promote many potential projects within the LSD narrative. Pendle is currently in possession of an improved model that brings numerous applications to products of the LSD trend, and is currently collaborating with many major projects such as: GMX, LayerZero, Balancer, AuraFinance, RocketPool, etc. And Pendle interacts not only with stETH, but its liquidity pool also includes many names like rETH from RocketPool, LOOKS from Looksrare, sAPE from ApeCoin, and notably the recent addition of GLP from GMX.

#RealYield just got more real on Pendle!

Starting today, our new home in #Arbitrum will house everyone’s favourite jam – $GLP by @GMX_IO ????

With just a little Pendle magic, you can harness the full potential of this powerful asset ???? pic.twitter.com/bGHf3Z2cgk

— Pendle (@pendle_fi) March 2, 2023

Pendle has launched support for our @AuraFinance / @Balancer rETH-WETH pool!@pendle_fi is a #DeFi yield-trading protocol that has created some exciting opportunities & functionality for $rETH, and we're stoked to see our ecosystem expanding.

Read on to find out more! pic.twitter.com/8QnbllGdcs

— Rocket Pool (@Rocket_Pool) January 12, 2023

The above information shows that Pendle coin fully demonstrates the potential for strong future growth, as it is being supported in its development by “big” projects and has a “desirable” customer base within the vast DeFi ecosystem.

And speaking of Pendle Finance, we must remember it as one of the leading names in the LSDfi trend thanks to its promising market-making mechanism using specialized tokens. Since the beginning of 2023, Pendle’s TVL (Total Value Locked) on DeFiLlama has increased by over 600%, while the total token market capitalization remains relatively stable, which indicates a very high potential for a “pump” in the future.

However, PENDLE’s scale remains relatively small in the market, ranking 5th among yield dApps, and its market share is still lagging behind some of the big names in the industry like Lybra Finance, Instadapp… In terms of competition, it faces models operating quite similarly, such as Yearn (YFI) or Aura Finance (AURA).

Overall, I still highly value PENDLE coin and see it as a project worth paying attention to in the long term. There is a risk associated with PENDLE, which is the instability inherent in the DeFi space itself. As an emerging industry still in its developmental phase, the DeFi space may experience sudden and significant price changes, which could affect the value of investments in Pendle. Moreover, as new DeFi projects continue to emerge, there is always a possibility that Pendle will face increased competition, which could impact its market share and growth potential.

BUT, despite these inherent risks, the innovative approach that PENDLE coin brings and its ability to bridge the gap between TradFi and DeFi make it a promising investment opportunity for those who want to engage with the DeFi space. As always, it is crucial that you conduct your research and due diligence before making any investment decisions. I wish you discernment and successful investment decisions.

Invest286.com