If you have spent some time in the cryptocurrency market, you have surely heard the term “Narrative”. It refers to a certain field that has, is, or has the potential to become a trend, capable of attracting investment in the future. But what exactly is Narrative Crypto in more specific terms? How can one ensure they are always updated and not miss out on these “narratives”? Which are the Narratives that are most worth our attention at the moment? Let’s explore these questions in more detail in the content of the article below.

Contents

What is Narrative Crypto?

Currently, when talking about the “Narratives” of cryptocurrency, many people immediately think of the trends in cryptocurrency. However, the term “Narrative” is much more complex than that. Narratives emerge before trends are formed.

Narrative Crypto refers to the ideas, stories, beliefs, and excitement surrounding an event, project, or specific area of cryptocurrency. These narratives are then marketed, hyped, enthusiastically embraced, and awaited. In short, they are the things that drive a story, making people believe. As a result, they influence the psychology of investors and market trends…

Ví dụ: Layer-2, AI, các công cụ LSD, China Coin… are examples of cryptocurrency Narratives.

Narratives sometimes inform us, predicting which areas might become popular or explode in the near future. However, not every narrative is correct; many are just temporary hype. A narrative can last for days, weeks, or months. But when a “narrative” ends, it ends very quickly, and not everyone benefits from having followed the Narrative. Therefore, seriously evaluating a Narrative is extremely important.

So, where did the term “Narrative” originate? It comes from the book “Narrative Economics,” the work of 2019 Nobel Prize in Economics winner and American economist Robert Shiller. The author believes that “narrative” is an important factor affecting people’s beliefs, values, and behavioral habits… A “Narrative” must meet several criteria such as being novel, easy to understand, emotionally resonant, widely debated, future-oriented, multi-dimensional, and attracting the attention of celebrities…

How to always keep up with Crypto Narratives?

I often see that many people only start paying attention to a particular crypto narrative once it has become mainstream. By that point, it’s no longer as advantageous to get involved. There are those among you who have heard or read about these narratives early on but chose to ignore them when they were just beginning to take shape. Then, when these narratives officially become trends, they look back with regret, thinking “I’ve known about this for a long time,” yet they didn’t participate, which leads to significant frustration.

That’s why being market-savvy and knowing how to capture and stay current with trends is extremely important. However, keeping pace with “Narratives” is not straightforward. To assist you somewhat, I will revisit some key criteria that can help you catch the stories that drive the market.

These will include:

– UNDERSTANDING THE BASIC PRINCIPLES OF CRYPTO: This is essential. You will need to understand what cryptocurrency is, what blockchain is, understand the technology behind it, understand how different types of cryptocurrencies work… Then there are the components that make up the market, such as exchanges (CEXs, DEXs), wallets and wallet classifications, and other services available to facilitate and fulfill the need to transact and exchange. Additionally, you should have some understanding of macroeconomics, regulations to see how they impact the market and each niche area of cryptocurrency…

– STAY AHEAD OF NARRATIVES: This is an important and perhaps the most challenging step. Usually, we are not proactive in finding narratives, only realizing them when a trend has already established. But how do you detect crypto narratives?

- Always read Twitter: Make sure you always follow news channels, KOLs, famous traders. If you don’t know who to follow, you might consult our article ‘50 Twitter Accounts about Cryptocurrency YOU SHOULD FOLLOW,’ then get into the habit of browsing Twitter as often as you do Facebook. In reality, you won’t stumble upon a tweet saying ‘Project ABC is the next narrative, BUY NOW.’ But if you see something interesting on your timeline that some people are talking about, with persuasive analysis and reasoning, you might want to save it and do some research.

- Read the news regularly, be sensitive to news: With just a basic knowledge of crypto, this shouldn’t be too difficult. For example, if you read that the SEC is gradually cracking down on CEXs (hypothetically), you might think who would benefit – the DEXs? Then you could delve deeper, looking at how impactful that news might be. What state are those ‘seemingly’ beneficial subjects in? Which are leading the pack, which are weaker… You know, most narratives are born from significant news that you could read every day.

- Combine with technical analysis: Sometimes, an event/news appears but in order to become a “narrative,” it also has to align with market trends. If the market is heavy with FUD, would a narrative be strong enough to swim against the current? What is the price action of the projects you are researching like, are they overpriced, or have they already increased sharply because others have discovered the “crypto narrative” before you? Trading volume is also a metric of interest, as when a narrative is formed, it must attract community attention, and that is most clearly reflected in the trading volume.

- Remember the timelines of major events: Many narratives are not difficult to predict, as they are tied to major events in the cryptocurrency market. Ethereum Merge? Bitcoin Halving? These are all typical narratives. Many people are interested, many expectations, many debates, community fomo, leading trends for a while? These events are EASY TO PREDICT. But sometimes, because they are too easy, their price movements are not as expected compared to other “hidden Narratives.”

Additionally: you could also join various Discord, Telegram channels about cryptocurrency. Learn to use market measurement tools such as: Lunarcrush (to measure social activity, keywords); Defillama (to monitor DeFi flows, stablecoins, projects); Moneyprinter (to monitor fees collected & spent for system/project development)…. Or get into the habit of regularly reading in-depth research from: Glassnode, Blockworks Research, Messari, Bankless, … Thus, you can be more sensitive, better at filtering news/events, hence avoiding following narratives that are not strong enough or overly inflated.

Note down any signs you notice, don’t ignore any small signals. Doing this will give us a better understanding of the overall market and filter out keywords to grasp the next direction of the market. Many believe that the big boys often mention new keywords to set trends, which is quite accurate recently. For example, just by relying on the annual summary reports of large Crypto organizations, we can completely catch the trend of “liquid staking” or “AI.”

– FOLLOWING THE NARRATIVE: If you’ve guessed the “Narrative” and decide to BUY into a few positions. I just advise you one thing. DON’T BE GREEDY. When a Narrative has formed and evolved into a trend, it implies that it will trigger a huge FOMO wave. But when the hype, the FOMO sentiment passes, most of us will see prices fall quickly, leaving behind those who “buy at the peak” or those who are “greedy” and do not take profits, getting stuck in liquidity dilemmas. The BigBogs, MMs, they identify the Narratives earlier than us, they will surely always have better positions than us. Therefore, don’t stubbornly HOLD for too long. Sell when you’re in profit, and don’t regret it. Most Narratives follow a pattern: they go up by the stairs, and down by the elevator. But how to avoid “taking profits” too soon? Learn to look up on-chain data, whale behaviors, technical analysis, trading volume, they will definitely help you a lot.

– WHAT TO DO IF YOU MISS THE NARRATIVE: Many of you surely missed the recent price surge trend and therefore carry a sense of regret and discomfort. This leads to a FOMO mentality, fearing the loss of opportunity because it keeps rising non-stop. I advise you not to feel this way. Best to:

- The market does not lack opportunities; there are still many other crypto narratives for the patient. Accept the rise, don’t chase it, only to buy high and sell low.

- Wait for a correction, then enter, because prices can’t keep rising forever; they need to accumulate. At this point, the technical analysis knowledge you’ve learned can be applied to find reasonable buying points according to Fibonacci, support, MA, etc. Remember, when following a trend, always set a Stop Loss according to technical analysis, and importantly, keep updating information to clearly understand the narratives. You must understand, then you will have confidence when making decisions.

Examples of Past Crypto Narratives

In this section, I will recap some past Crypto Narratives. Of course, past events don’t perfectly reflect future events, but they can provide sufficient information for decision-making.

The Ethereum Merge Narrative

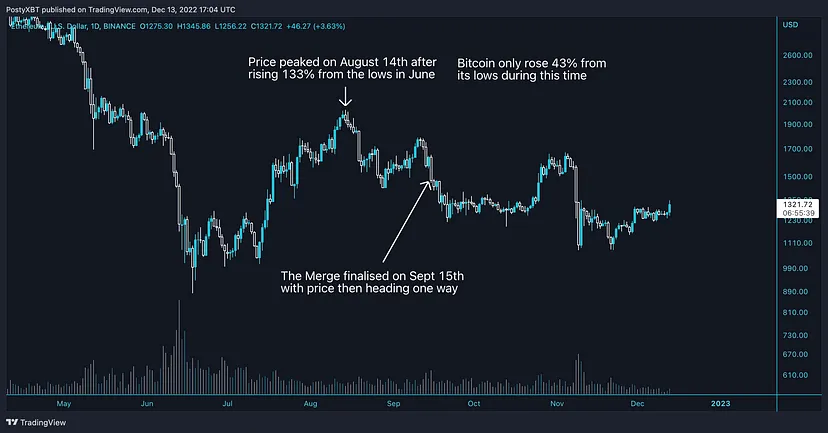

The Ethereum Merge is a great recent example. In September 2022, the much-anticipated Merge finally took place, and the date was set in advance. In the months leading up to the event, $ETH outperformed most of the market (most notably Bitcoin) and peaked locally on August 13. However, the Merge did not take place until September 15. But look at how the price changed in almost a month? A classic example of those who clung to the “narrative” early and took profits early.

The Metaverse Narrative

When the cryptocurrency market peaked in November 2021, there was one story that became incredibly popular, and that was the narrative surrounding the Metaverse. If you were in the market at that time, do you remember how hot the metaverse was and what the expectations were? Metaverse tokens experienced explosive price increases, and the effect was so significant that even Zuckerberg rebranded Facebook to Meta. Metaverse coins like MANA benefited greatly, but when the hype around the Metaverse narrative cooled off, the pain was felt deeply as the market fell.

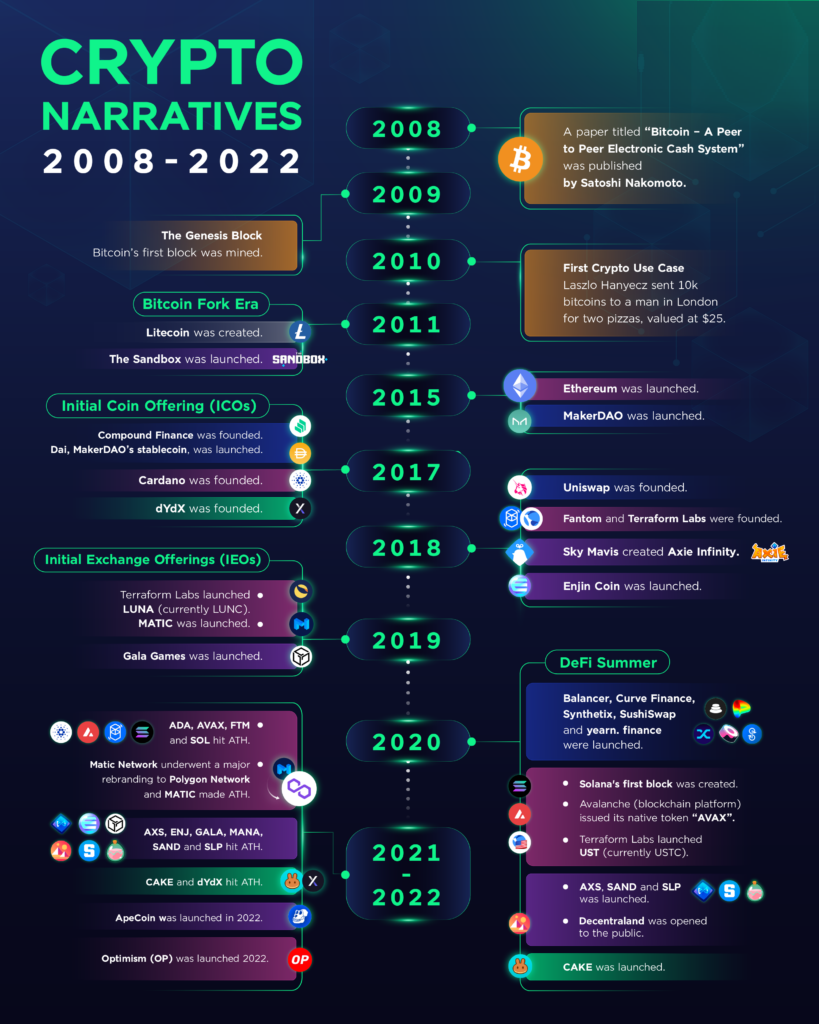

Or looking even further, below is a compilation of some other “Narratives” that have taken place in the past, from 2008 to early 2022. Can you see that these were projects that led the market for a while?

Crypto Narratives to Watch Out For in the Coming Time

So, what Crypto Narratives should we pay attention to in next time? Based on the evaluation of many people and the actual situation of the cryptocurrency market operations, you can refer to the following “Narratives”:

LSD

This narrative has been hot since the beginning of this year, but I think it will continue to be popular afterward. With the successful Ethereum Shanghai upgrade, the native tokens of Liquid Staking Derivatives platforms may benefit from this when a large amount of Ethereum is withdrawn from the Beacon Chain and needs to find a platform to stake, and LSD will be the right destination. LSD will allow ETH owners to stake without locking any tokens. This will maintain liquidity as it means that the staked tokens can be used in other Defi applications.

The future for LSD projects is still great because:

- The staking rate in LSD platforms is quite low at 6.6% compared to others like Sol at 73.1%, Ada at 68.7%, and Avax at 54.64%, so the growth potential of LSD is still very large.

- Only a fraction of ETH IOUs (I owe you) is being used further in Defi activities. IOUs are collateral tokens generated from staking ETH, for example, staking ETH on the Ankr protocol will generate ankrETH as collateral, before only Curve accepted ankrETH for liquidity provision but now Pendle and many other services with higher APYs have accepted it.

Layer-2

Coinbase has just launched Base Layer-2 using the Optimism stack, Shapella Upgrade allocated a part of block space for Layer-02 platforms, this is enough to see that Layer-2 has been, is, and will continue to happen more strongly. After the Shanghai Upgrade, the next Ethereum upgrade named Cancun Upgrade will take place. With this upgrade, Ethereum’s fundamental development direction has two main paths:

- It will promote the development of Layer-2 and focus on Rollups. Note that there are zkRollups and Optimistic Rollups (2 main types).

- Develop Sharding on L1, divided into 3 stages. Pro-Danksharding (EIP-4844), Proposer-builder-separation (PBS), and Danksharding.

If the Shanghai upgrade has benefited LSD tokens, then the upcoming upgrade will definitely make Layer-2 explode. Therefore, you should pay special attention to Layer-2 projects.

ZK-Rollups

ZK stands for Zero-Knowledge Proof (ZKP) – a cryptographic technology that allows one party to prove to another (the verifier) that they know a value x, without revealing any information other than the fact that they know the value x.

ZK technology is quite complex, so even though it has been around for many years, it is still in its infancy. This proves that the ZK trend is not yet strong at this stage, but it is not a hyped trend. ZK has the potential to grow in the future, and just need an opportunity or any positive information, then ZK projects can still increase in price dramatically.

The reason why ZK, despite being shilled by Vitalik before, is only becoming hot again now is because:

- The plan to release tokens from 2 major Layer-2s, zkSync and Starknet, is highly anticipated by the community.

- Polygon’s zkEVM technology has also been successfully deployed

- A post by CZ about applying zk-SNARKs to the Binance PoR verification system in 2/2023 confirms the strength of this technology.

Prominent ZK coins: MINA, LRC, IMX, MATIC, dYdX, DUSK, MUTE, SYS… Projects that have not yet issued tokens (can be researched and hunted for airdrops): zkSync, Starknet, Scroll, Aztec…

China Coin

While the United States is heavily “cracking down” on the crypto industry, China is doing the opposite. Most recently, Hong Kong officially legalized cryptocurrency from 6/2023 and turned it into a Crypto hub of Asia; the largest bank in Southeast Asia, DBS, revealed that in 2022, Bitcoin and Ethereum transactions on their cryptocurrency exchange increased by 80% and 65% respectively, while their customer base also doubled; and most recently according to Cointelegraph, Hong Kong regulators have asked banks to open accounts for cryptocurrency companies.

Moreover, the People’s Bank of China, PBoC, “has injected $92 billion into the market, and this is the largest liquidity infusion by China into its economy to date. Gradually, the United States will no longer dominate, the flow of money from China will become stronger, and China (especially Hong Kong) will become the leader of the cryptocurrency market in the coming time.

Although the Crypto Narrative regarding China coin has slowed down at present, we can still look forward to actions from China and if possible, it may boost the growth of Chinese coins once again. This is one of the narratives I am most looking forward to in the near future.

Socialfi

SocialFi is an abbreviation for the term Social + Finance. It represents the combination of decentralized finance with social media platforms. Currently, social networks like Facebook and Twitter are operating as part of Web 2.0. Users have created an immense amount of content on these platforms, generating value worth billions of dollars. However, the profits earned are reaped by the owners of these platforms.

Therefore, SocialFi was born as a way to help content creators, influencers, and even ordinary users control their personal information, data, and creative content on social networks. Additionally, they can earn money by playing games, creating content, and taking quizzes… SocialFi platforms support users in earning money through content creation, gaming, and taking crypto and blockchain educational quizzes.

The reason I’ve chosen SocialFi as a part of the promising crypto narratives set to explode is due to the continuous emergence of projects in the SocialFi sector like HOOK, or the most recent EDU, or the subtle comeback from Coinlist when they announced the listing of CYBER, which also falls under the Social category. Surely, it’s not a coincidence that recently, projects in this area are continuously getting listed on exchanges. Especially since SocialFi is still very new and Web3.0 has much to be explored, we can confidently expect that SocialFi will become one of the prominent trends in the time to come.

Real World Assets (RWA)

Real World Assets (RWAs) are tangible assets that have been tokenized into tokens or NFTs and can be traded like standard tokens. The concept of Real World Assets was established around 2019. However, at that time, the market lacked a solid infrastructure to support this group of projects. Consequently, RWA projects were limited to ideation without tangible products. From 2021 onwards, the DeFi market has matured with the emergence of various infrastructure projects such as custody services, valuation, and legal frameworks. Thus, RWAs have found a foundation for further development.

You may not realize that stablecoins like USDT, USDC, BUSD, etc., which we commonly use, are the first RWA products based on the fiat currency USD. Since their introduction in 2014, stablecoins have grown significantly and have become the backbone of the crypto market. The reason RWAs could become a leading trend in the future is because currently, traditional financial institutions are increasingly applying RWAs. For example, the Central Bank of Singapore experimented with RWAs in Project Guardian to tokenize foreign exchange and government bonds. In February 2023, the technology company Siemens also issued digital bonds worth 60 million Euros on the main Polygon network. Moreover, RWAs still seem to be a relatively new product for crypto investors, implying that there are still many investment opportunities in this field for early investors like us, who are learning about RWAs.

NFTfi

NFTs have been around for several years, but they only truly exploded in popularity in 2021, when NFT games rose to prominence and many famous NFT collections were launched. However, by 2022, things seemed to have slowed down. People realized that NFTs were not as easy to speculate/invest in as standard tokens, and they suffered from a significant drawback: poor LIQUIDITY.

Many people had purchased or owned expensive NFT assets, only to find that they could not sell them, and the prices of these NFTs continued to decline. Generally, the reasons for the poor liquidity of NFTs include:

- Most famous NFT collections are collectibles and owners do not trade them frequently.

- “Blue-chip” NFT collections (like BAYC, Cryptopunks, DeGods, etc.) often carry very high values, making them unaffordable for most people.

- For NFTs related to games, their value depends on the community of that particular game, hence the user base is not large. Moreover, many NFT games have seen a decline in user numbers over time.

Therefore, NFTfi was created to improve this situation. NFTfi is a combination of “NFT” and “Finance,” aiming to “increase liquidity for NFTs and optimize cash flow” for NFT collectors. NFTFi will allow the use of NFTs on decentralized financial platforms, creating liquidity for NFTs with the help of smart contracts.

In particular, Blur has attracted community attention after being listed on exchanges and providing a significant airdrop to users. This attention is not only on this project but also on the broader NFTFi or NFT Marketplace segment. In general, NFT-Fi is an extremely necessary tool to improve the current state of the NFT market. As long as NFTs exist, solutions from NFTfi will be noticed, and the coins in this sector will attract investors.

Perpetual DEXs

With regulators tightening cryptocurrency and centralized exchanges or incidents like the bankruptcy declaration of CEXs like FTX last year, users are turning to decentralized exchanges (DEX). This year, a new type of DEX is especially a hot topic – Perpetual DEX (A Dex that supports derivative trading).

Perpetual contracts – trading future contracts, opening long and short positions, and using leverage – were previously only available on centralized exchanges under strict regulations. Now, more and more DEXs offer these features. This means you can simply connect your wallet and go LONG, SHORT, and use leverage as you wish.

Stablecoin phi tập trung

Stablecoins are digital currencies whose value is typically pegged or linked to underlying assets such as fiat currencies, commodities, precious metals, or even a basket of other cryptocurrencies. They track the value of the underlying assets to minimize volatility and help make cryptocurrency ideal for everyday use.

Recently, the U.S. Securities and Exchange Commission (SEC) has taken enforcement actions against crypto companies, notably including a lawsuit against Paxos – the company that issues Binance’s BUSD. Therefore, centralized stablecoins like USDT and USDC also face many risks when confronted with legal issues. Hence, the solution for decentralized stablecoins (implying that no company or third party holds the collateral assets) will benefit greatly from this.

Indeed, the “crypto narrative” concerning decentralized stablecoins may not yet be strong at the present moment. Such narratives often require catalysts to gain momentum, such as tighter regulations on stablecoins or fear, uncertainty, and doubt (FUD) related to centralized stablecoins like USDT or USDC. These catalysts could push the crypto community and investors towards decentralized stablecoin options, seeking stability without the risks associated with centralized control.

- Cardano (ADA) – Stablecoin DJED

- Aave (AAVE) – Stablecoin GHO

- Marker (MKR) – Stablecoin DAI

- Frax (FXS) – Stabelcoin FRAX

- Speel Token (SPELL) – Stablecoin MIM

- Sperax (SPA) – Stabelcoin SUSD

- Liquity (LQTY) – Stablecoin LUSD

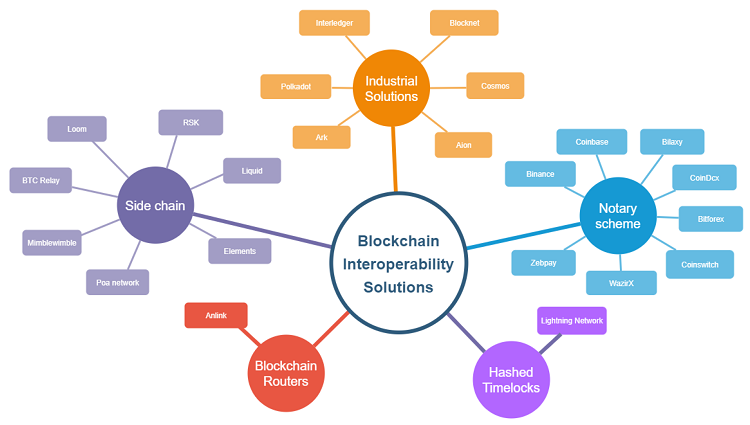

Blockchain interoperability

Blockchain interoperability has become a trend in cryptocurrency over the past few years, although it has not yet exploded strongly, but perhaps it will be a game-changing factor for this industry in the future. Because the interaction between blockchains is extremely necessary, important to promote development and accelerate the adoption of blockchain globally.

Blockchain interoperability is the ability of one blockchain to communicate/share data seamlessly with other blockchains. This has been a major pain point for a long time as cryptocurrency users find it difficult to seamlessly transfer Bitcoin (BTC) to a BNB Smart Chain wallet, or at least not without complicated and insecure bridging processes.

Above are our shares about Crypto Narratives. These narratives can’t predict exactly when they will happen, some have grown positively, some have slowed down, and in the future, perhaps many new narratives will emerge. The content of this article only stops at predicting narratives, not ensuring they will grow, and is not investment advice. Therefore, everyone should only refer to and observe the news, to know when the real money is pouring in, from there to make reasonable investment decisions. We wish everyone successful investing.