Every four years, Bitcoin experiences a highly anticipated event that the entire community looks forward to, known as Bitcoin Halving. When a Bitcoin Halving occurs, the Bitcoin Block Reward is reduced, which significantly impacts the overall cryptocurrency market. But what is Bitcoin Halving? How does Bitcoin Halving affect the price of Bitcoin? And when is the next Bitcoin Halving expected to take place? Join us as we explore these details in the article below.

Contents

Bitcoin Halving: How it works and Why it matters?

What is Bitcoin Halving

Bitcoin Halving is the process by which the reward for mining new Bitcoin blocks is halved. Typically, miners are rewarded with Bitcoin for performing the work of verifying and adding new transactions to the blockchain in new blocks.

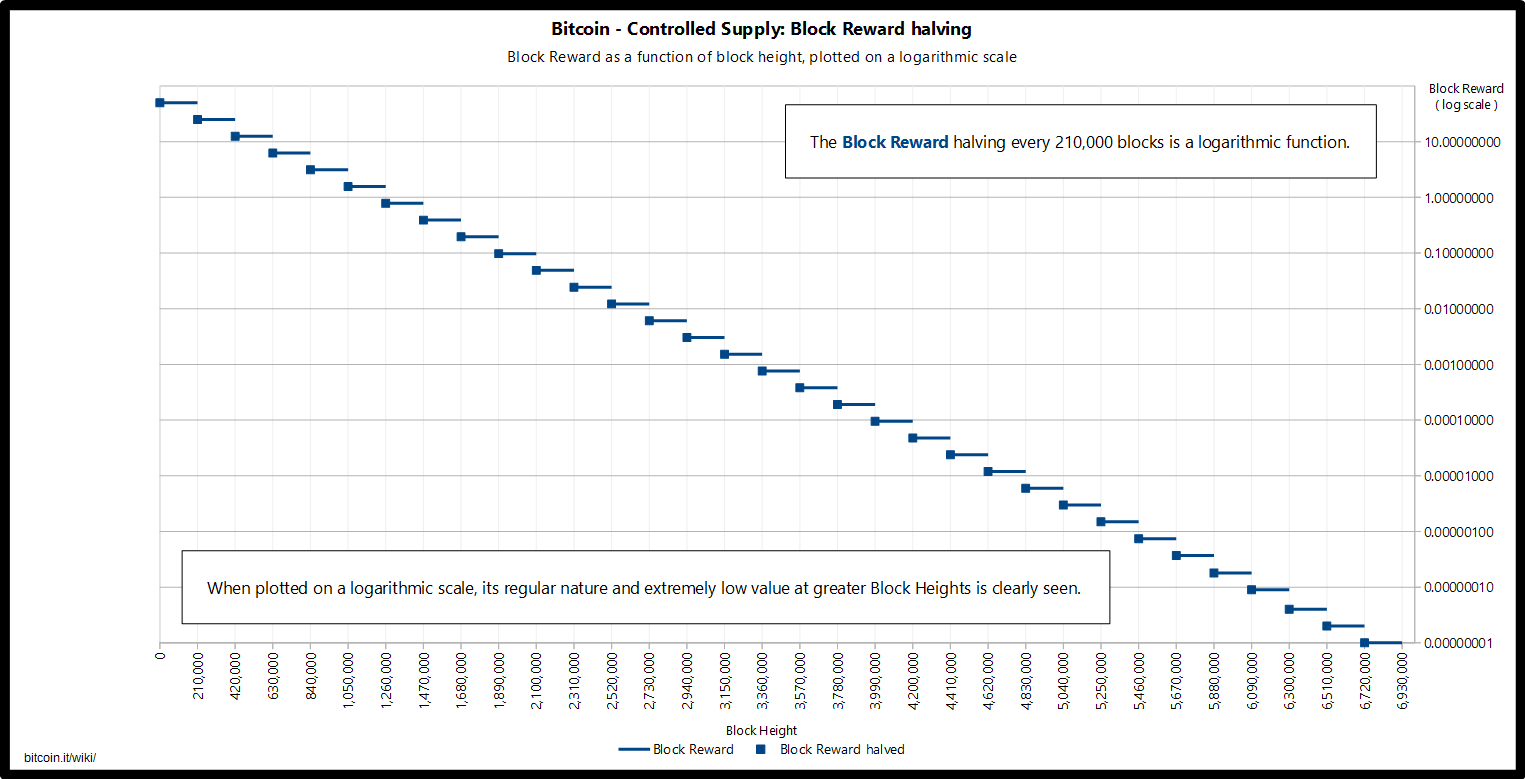

Every 210,000 blocks mined (approximately every four years), the reward for mining new Bitcoin is cut in half. Meanwhile, the total supply of Bitcoin is capped at a maximum of 21 million, which means this halving process slows down the rate at which new Bitcoins are created.

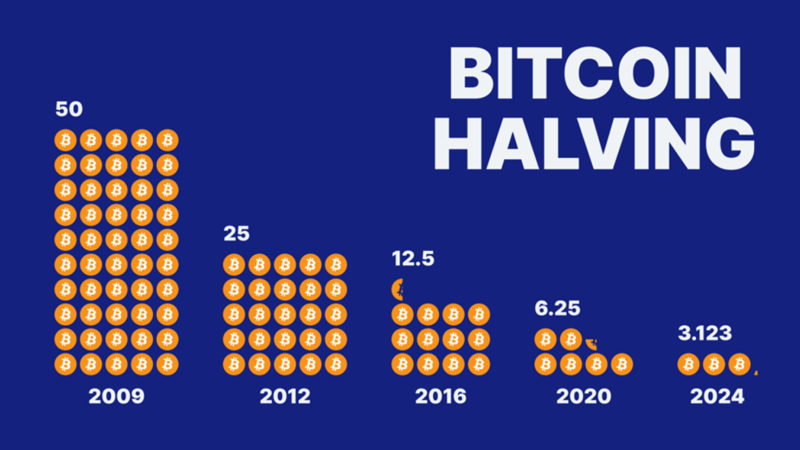

New Bitcoins are released by the Bitcoin network approximately every 10 minutes. In the first four years of Bitcoin’s existence, the number of new Bitcoins issued every 10 minutes was 50. Every four years, this amount is halved. This halving event is referred to as “Halving” or “Bitcoin Halving.”

Specifically:

- The first Bitcoin Halving on November 28, 2012: Every 10 minutes, 25 new BTC were produced.

- The second Bitcoin Halving on July 9, 2016: Every 10 minutes, approximately 12.5 new BTC were created.

- The third Bitcoin Halving on May 14, 2020: Every 10 minutes, 6.25 new BTC were produced.

=> In the next Bitcoin Halving event scheduled for 2024, the reward will decrease from 6.25 BTC per block to 3.125 BTC.

What is the significance of Bitcoin Halving?

Bitcoin Halving is the event where the number of new bitcoins generated per block is halved.

=> With fewer new bitcoins being created, Bitcoin becomes scarcer.

In traditional markets, low supply combined with stable demand usually leads to higher prices. Since the demand for Bitcoin is increasing due to the growing popularity of cryptocurrencies, Bitcoin Halving is an important factor in driving up the price of Bitcoin. Historically, the price of Bitcoin has significantly increased after each Halving.

As Bitcoin is known as the number one cryptocurrency at present, it influences many other altcoins. => When Bitcoin’s price rises, other altcoins often increase in price as well.

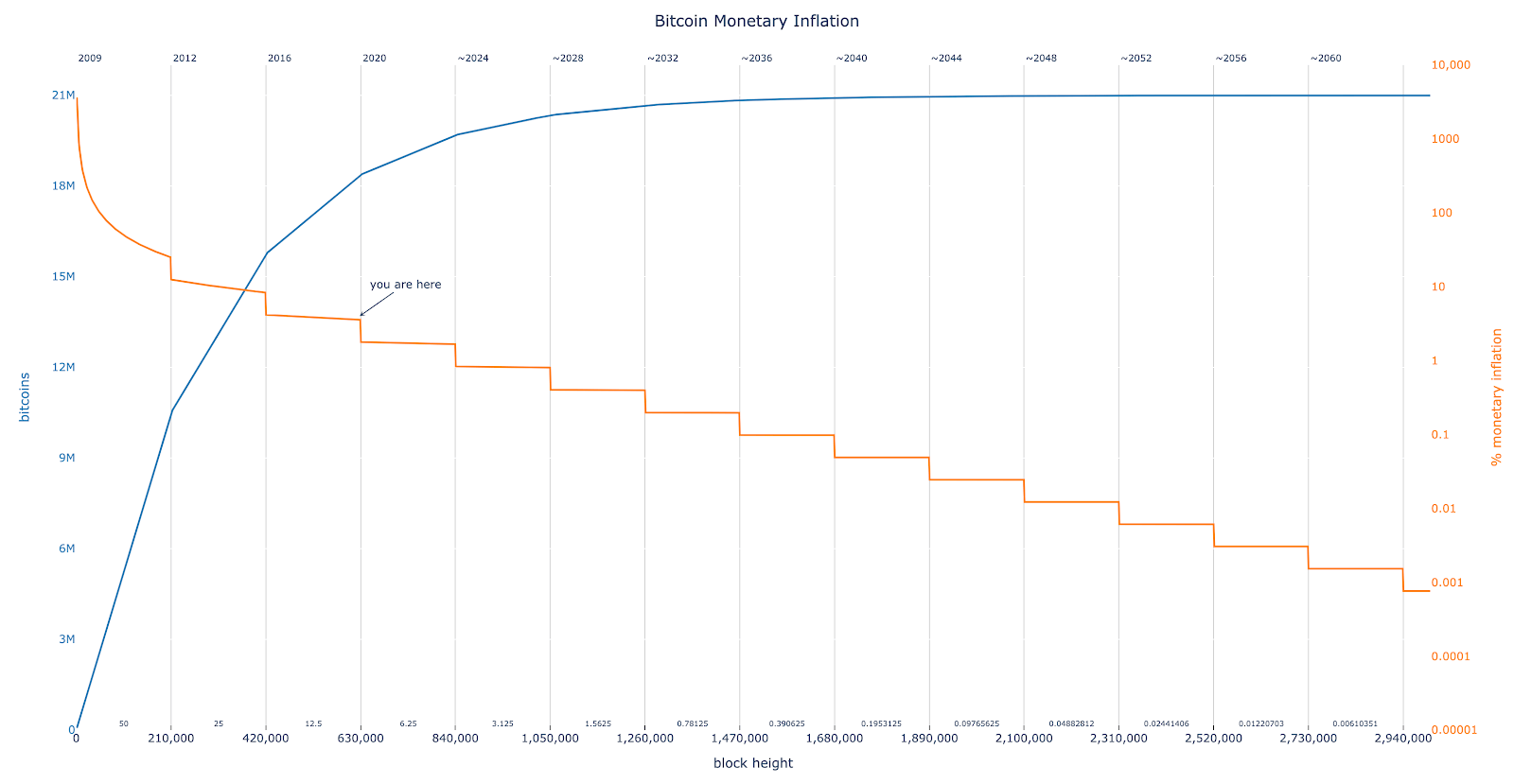

Below is a chart describing the inflation rate of Bitcoin over various periods:

As can be seen, after each Halving, the inflation rate of Bitcoin also decreases. In the figure above, the orange line represents the inflation rate of Bitcoin over a certain period, while the blue line represents the total number of bitcoins issued. These two lines are inversely related.

The theory about Bitcoin Halving and its impact can be summarized as follows:

Bitcoin Halving → halving of inflation → lower available supply → higher demand → higher prices → Because of the higher price, Bitcoin miners still have the incentive to mine, regardless of the reduced reward.

So, what if the price of Bitcoin doesn’t increase after Halving??

Specifically, if the Halving of Bitcoin does not increase demand and prices, miners will not be motivated because the rewards are less while the value of Bitcoin is not high enough.

To prevent this, Bitcoin has a process to change the difficulty level to receive mining rewards, or in other words, the difficulty of mining a transaction. If the reward is halved and the value of Bitcoin does not increase, the mining difficulty will decrease to encourage miners. This means that the number of new bitcoins issued as rewards is still smaller, but the difficulty of processing transactions is reduced.

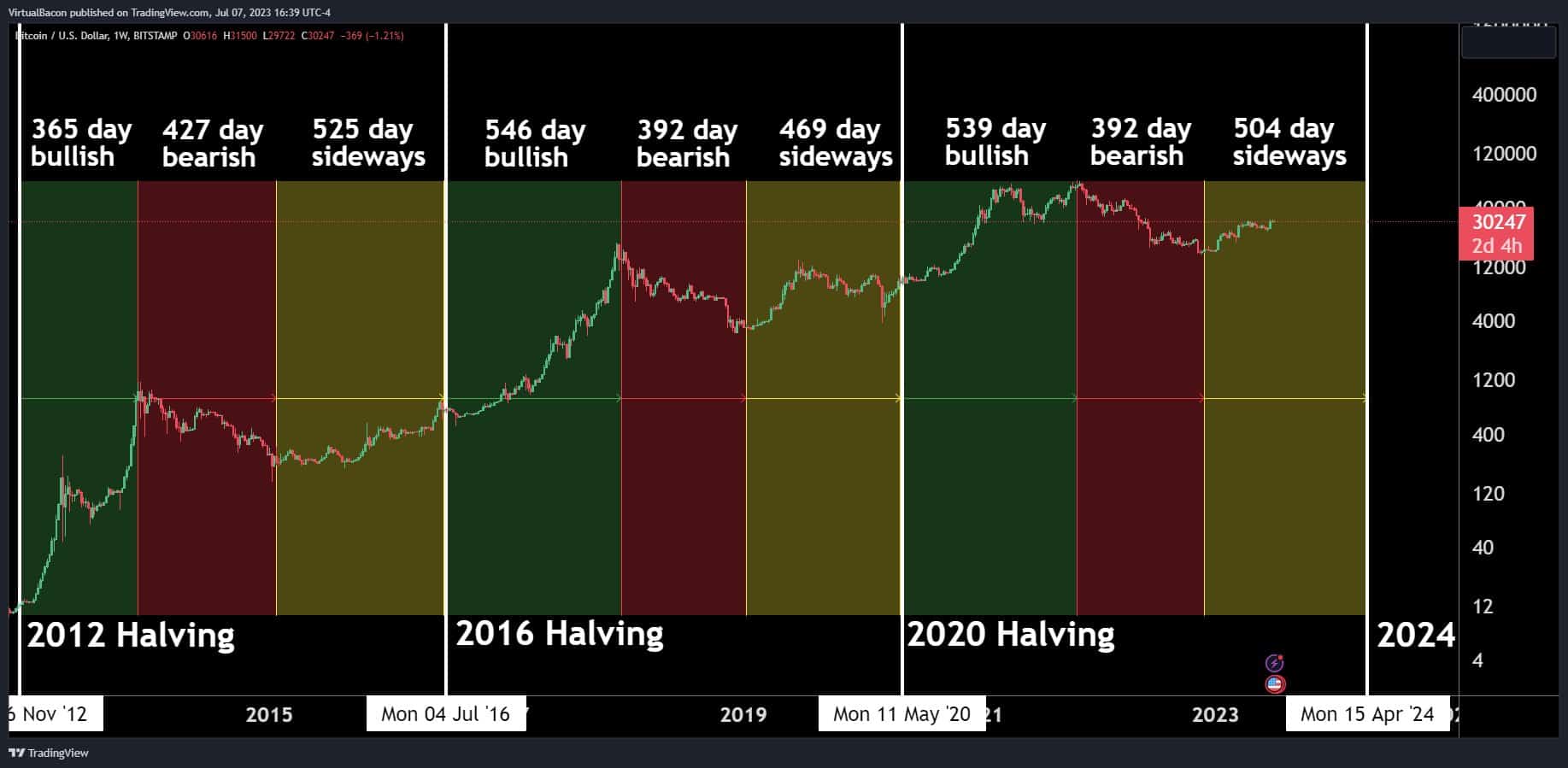

=> This process has been proven successful twice. Therefore, after each Bitcoin Halving, you will see a sharp price increase, often creating new higher peaks than the previous ones. Although Bitcoin may subsequently drop sharply, the price after the crash is still higher than before the Halving.

For example: The 2017 to 2018 bubble saw the value of BTC rise to about $20,000, but then it dropped to about $3,200. This is a significant drop, but the price after the drop remains very high because the BTC price before the Halving was only $650.

But please note:

- Although the Bitcoin price model before and after Halving has always been correct so far, be cautious as it often comes with speculation, hype, and exaggeration. So nothing is certain in the future; the market may not respond in the same way as it did with previous Bitcoin Halvings.

- The third Bitcoin Halving took place in the context of a global pandemic, accompanied by a more liberal public perception of cryptocurrencies. These factors also partly promoted the increase in Bitcoin prices, not necessarily that the BTC price increase is entirely dependent on Halving.

How does Bitcoin Halving affect investors and miners?

Since Bitcoin Halving is a significant event, it has a major impact on various parties involved in the Bitcoin network. Below is a brief description of how Bitcoin Halving affects the main actors:

-

Investors: Generally, the occurrence of Bitcoin Halving leads to an increase in the price of BTC due to a reduced supply and increased demand, which means it is good news for investors. Typically, the demand for purchasing BTC increases before each Bitcoin Halving event. However, the rate of price increase varies, as it also depends on macroeconomic factors at the time.

-

Miners: The impact of Bitcoin Halving on miners is quite complex. On one hand, the reduced Bitcoin supply increases demand and price. But fewer rewards can also make it difficult for individual miners or small-scale mining operations to survive in Bitcoin’s ecosystem as they may struggle to compete with larger mining organizations.

*** According to many studies, the mining capacity of Bitcoin miners fluctuates in cycles relative to its price. Therefore, as the price of Bitcoin rises, the number of miners in its ecosystem decreases, and vice versa. The Bitcoin Halving event is characterized by price increases and may raise the probability of a 51% attack on the Bitcoin network as miners gradually move out of its network, and control becomes more concentrated among “large miners,” thereby making it less secure. ***

BTC price history before and after Halving

Bitcoin Halving 2012, which occurred on November 28, 2012:

- New BTC per block before: 50 BTC per block

- New BTC per block after: 25 BTC per block

- Price on Halving day: $12.35

- Price 150 days after: $127.00

Bitcoin Halving 2016, which occurred on July 9, 2016:

- New BTC per block before: 25 BTC per block

- New BTC per block after: 12.5 BTC per block

- Price on Halving day: $650.63

- Price 150 days after: $758.81

Bitcoin Halving 2020, which occurred on May 12, 2020:

- New BTC per block before: 12.5 BTC per block

- New BTC per block after: 6.25 BTC per block

- Price on Halving day: $8,821.42

- Price 150 days after: $10,943.00

Some questions about Bitcoin Halving

When will the Bitcoin Halving in 2024 take place?

The schedule for Bitcoin Halving does not occur on a specific date but is planned according to the number of blocks mined. The Halving occurs after every 210,000 blocks.

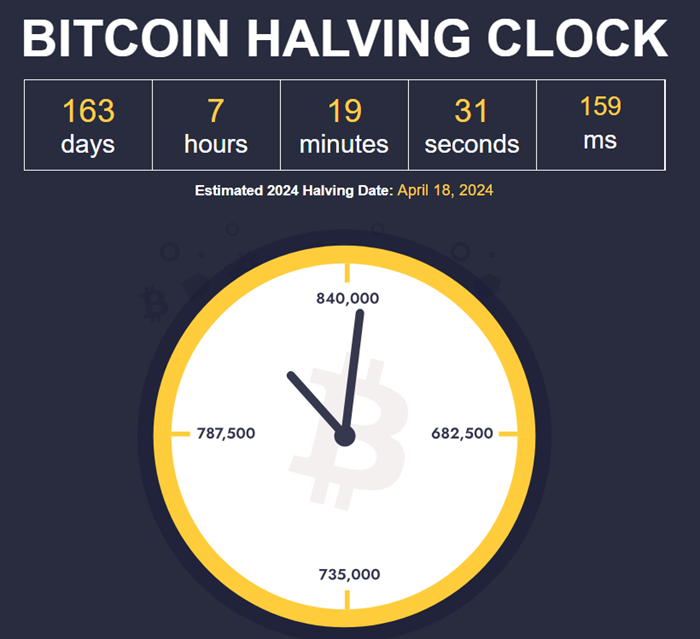

Thus, the next Bitcoin Halving will take place when the 840,000th block is mined.

If a new block is created every 10 minutes, then it is expected to occur from April 2024 to June 2024. There are various tools available to count down to this date, which you can find by searching for “Bitcoin halving countdown.“

When will all 21 million Bitcoins be mined out?

If all Bitcoin is mined, then there will be no more Bitcoin Halvings. All 21 million bitcoins (BTC) are expected to be mined by the year 2140. However, over 98% will have been mined by 2030.

Nevertheless, miners will still be encouraged to continue validating and confirming new transactions on the blockchain because the transaction fees paid to miners are expected to increase in the future.

Is Bitcoin Halving really necessary?

The occurrence of Halving is extremely necessary. This is how Bitcoin controls its supply, prevents inflation, and keeps its value consistently at the top as it is currently.

Why does Bitcoin Halving happen every four years?

This is due to the mining algorithm of Bitcoin, which aims to discover new blocks every 10 minutes. However, if more miners join the network and add more hashing power, the time to find blocks would decrease.

This is counteracted by resetting the mining difficulty (or the computational difficulty to solve the mining algorithm) every two weeks or so to restore the 10-minute target. Therefore, over the past decade, the Bitcoin network has always maintained an average time of less than 10 minutes (about 9.5 minutes) to find a block. And according to the algorithm that Halving occurs every 210,000 blocks, multiplying the time results in approximately every 4 years.

Above are our shares about what Bitcoin Halving is, hoping that through this article, you can grasp some understanding of this most important event in the world of cryptocurrency. Although historically, after each Bitcoin Halving, the price of Bitcoin has increased significantly, it does not mean that the same will happen in the future. Therefore, consider investing wisely, avoid investing too much, and always stay updated with the news as well as maintain the most realistic perspective to make the right decisions. We wish you successful investing.