The Liquidity Pool is one of the frequently used terms in DeFi that may be confusing for many. So, what exactly is a Liquidity Pool, how does it work, what are its pros and cons, and which Liquidity Pool should you join? Let’s explore this information in detail below.

Contents

What is a Liquidity Pool?

What is the concept of a Liquidity Pool?

Like traditional stock exchanges, crypto exchange transactions also operate based on the “order book” model, where buyers and sellers place orders at a certain price. While buyers try to buy at the lowest possible price, sellers try to sell as high as possible. For a transaction to be matched, the prices of both the buyer and the seller must coincide.What happens if both buyers and sellers do not match in price? Or, what if there is not enough liquidity for the order to be executed? This is where the concept of Market Makers comes into play. Market Makers facilitate transactions by being ready to buy or sell a specific asset, thereby providing liquidity and allowing transactions to be executed automatically without waiting for another buyer or seller to appear.

In DeFi, relying too much on external Market Makers can lead to relatively slow and expensive transactions. This is where Liquidity Pools come in to solve this problem, which we will discuss in the next section.

How does a Liquidity Pool work?

Liquidity Pools operate based on Smart Contracts, which enable faster transactions with higher liquidity than traditional centralized exchanges.

A key component of Liquidity Pools is the Automated Market Makers (AMM). AMM is a protocol that uses Liquidity Pools to enable automated cryptocurrency trading, determined by a mathematical formula. Each swap transaction supported by a smart contract results in a price adjustment. Liquidity Pools will consist of trading pairs of specific cryptocurrencies.

Liquidity Pools maintain a 50/50 balance ratio for the cryptocurrency pair in terms of USD value. They may use the formula X * Y = K, where X and Y represent the quantity of the cryptocurrency pair in the pool, and K is a constant showing the total or unchanged asset amount in the Pool.

Example: In a Uniswap Pool, there are currently 10 ETH and 1000 USDC in the ETH/USDC pair => K = 10 * 1000 = 10,000.

As the USD value of ETH = USDC (balanced 50/50), Uniswap can calculate the current price of ETH by taking USDC/ETH = 1000/10 => The Ethereum price will be 100 USD on Uniswap’s exchange.

If someone wants to buy 1 ETH from this pool using USDC, following the formula of constant K, we have:

(10 – 1) ETH * (1000 + Y) USDC = 10,000 => (1000 + Y) = 10,000/9 = 1,111.11 => Y = 1,111.11 – 1000 = 111.11

=> If they want to buy 1 ETH from the Pool, they will have to pay an amount of 111.11 USDC, and the price of 1 ETH now increases to 111.11 USD.

The pool now will have 9 ETH and 1,111.11 USDC,

The most important part of a Liquidity Pool is the Liquidity Provider, also known as the liquidity supplier.

What will Liquidity Providers do? Let’s look at a specific example to better understand how Liquidity Pools and Liquidity Providers work.

Example: On Uniswap, there is a USDC/ETH Liquidity Pool, for example. If you own 500 USDC and want to earn from this amount, you can become a Liquidity Provider. You will need to add another 500 USDC and an equivalent amount of ETH to the USDC/ETH Liquidity Pool to maintain a 50/50 balance ratio.

When a transaction occurs on Uniswap with the USDC/ETH pair in your pool, they will have to pay a transaction fee. The transaction fee collected will then be evenly distributed among the Liquidity Providers according to their percentage contribution.

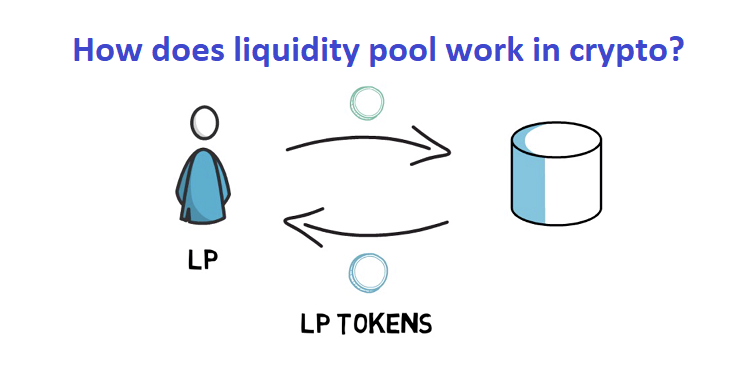

When you add liquidity to the USDC/ETH pair, you will receive LP tokens as a “receipt,” which can be considered as a certificate of your share in the USDC/ETH Pool. When you want to withdraw your funds, you will exchange this receipt to get your money back.

What are the Advantages & Disadvantages of Liquidity Pools?

The biggest drawback Liquidity Pools face is Impermanent Loss, known in English as Impermanent Loss.

What is Impermanent Loss in Liquidity Pools?

Impermanent Loss (IL) is a term used to describe a situation where the price of a token in a Liquidity Pool suddenly increases or decreases, causing the investor to incur a temporary loss instead of higher profits.

To understand this better, let’s look at the following example:

Suppose you have 10 ETH and you want to become a Liquidity Provider for the ETH/USDT liquidity pool (this pair will have a 50/50 ratio in terms of USD value conversion). Assuming ETH is currently priced at 1000 USDT, you will need to deposit 10 ETH + 10,000 USDT into the Pool. Let’s say the total locked asset value of the Pool is hypothetically 100,000 USDT (50 ETH + 50,000 USDT) => Your stake percentage in the Pool will be: (20,000 USDT/100,000 USDT) * 100 = 20%.

Then you will receive an LP token similar to a receipt recording your stake percentage in the pool, which you can exchange to retrieve your added tokens/coins at any time.

However: when the price of ETH suddenly doubles to 2000 USDT while the Liquidity Pool’s algorithm cannot adjust immediately, the investor faces a potential loss of funds compared to if they had not put their money in the Liquidity Pool.

The formula used is called the Constant Product Formula = number of ETH * number of tokens (Constant Product remains constant).

In this case, the Constant Product is calculated as 50 ETH * 50,000 USDT = 2,500,000.

When the price of ETH doubles while the Constant Product remains the same, the amount of ETH and USDT in the Pool is recalculated as follows:

ETH = √(2,500,000/2000) = 35.35 ETH

USDT = √(2,500,000*2000) = 70,710.6 USDT

If you want to withdraw the assets you added to the pool when the ETH price rises, you need to exchange your LP token according to the 20% stake you own. From your holdings, you will be able to withdraw 20% of 35.35 ETH = 7.07 ETH and 20% of 70,710.6 USDT = 14,142.12 USDT.

=> Your total withdrawn assets would be: 7.07 2000 + 14,142 = 28,282 USD, whereas previously you added 10 ETH + 10,000 USDT, which at the current price would be 102,000 + 10,000 = 30,000 USD.

Popular Liquidity Pools today

-

Uniswap: A leading decentralized exchange (DEX), allowing users to trade ETH for any other ERC-20 token without going through a centralized exchange. Uniswap enables people to freely create a trading pair on the network for free.

-

Curve: A decentralized Liquidity Pool that allows swapping of cryptocurrencies and various stablecoins based on the Ethereum network such as USDT, DAI, USDC, USDD,…

-

Balancer: A DeFi platform that offers a range of pooling options, such as Private Liquidity Pools (private liquidity pools) or shared ones to provide benefits for its Liquidity Providers.

-

Bancor: One of the best Liquidity Pools of 2025 based on Ethereum. This platform uses algorithmic market making with smart tokens, providing liquidity along with accurate pricing. Bancor maintains a constant ratio between different connected tokens, along with implementing modifications in token supply.

Which Liquidity Pool Should You Join?

Currently, there are quite a few DeFi projects related to Liquidity Pools for people to choose from. However, each Liquidity Pool has different advantages and disadvantages with different trading pairs.

What you should do is choose Liquidity Pools with high Total Value Locked (TVL) along with popular stablecoins like USDC, USDT, DAI and top coins like ETH, BTC to earn higher passive income with lower risk.

Of course, participating in Liquidity Pools means you can hardly avoid the risk of impermanent loss, so it’s best to avoid pairs with large fluctuations. Regularly monitor the price movements of coin/token pairs in the Pool so you can sell your shareholding before the price deviates too far from the starting level.

Top Liquidity Pools currently for you to consider include: Uniswap, Curve, Bancor, Balancer, Sushiswap.

See more:

- Understanding the Bitcoin Fear and Greed Index more accurately

- Top 10 best Copy Trading Platforms in the World 2025

Through this, we hope you now understand what a Liquidity Pool is, how Liquidity Pools operate, their risks, and advantages. If you have any further questions, please leave a comment for a response within 24 hours. We wish you a wise and successful investment decision.