The narrative surrounding Real World Assets (RWA) is heating up and could be a key factor in widespread cryptocurrency and blockchain adoption. Traditional Finance (TradFi) is plagued by outdated and fragmented technology, leading to inefficient stock and fiat banking systems. RWAs are emerging to address these shortcomings. But what are RWAs? why are they gaining attention, and is the RWA narrative sustainable or just a temporary hype? Let’s explore and evaluate this cryptocurrency trend in the following article

Contents

What are RWAs – Best RWA coins to invest 2025

What are RWAs – Real World Assets?

Real World Assets (RWAs) are assets from the real world that are tokenized as tokens or NFTs, integrating traditional finance (TradFi) and decentralized finance (DeFi) to transform real-world assets into digital assets on the blockchain, facilitating easier transactions.

These assets can vary widely, including money, gold, silver, real estate, stocks, commodities, etc. Tokenization of real assets allows DeFi users to earn sustainable profits and unlock capital flows unaffected by cryptocurrency volatility.

You might not understand what RWA is, but I’m sure we have all used it. Stablecoin is a type of RWA asset.

- USDT and USDC are essentially the US dollar tokenized as assets on the blockchain.

- PAX Gold (PAXG) is gold tokenized as an asset on the blockchain.

However, in this article, we are not only referring to RWA as stablecoin but also RWAs of many other assets. After being tokenized, if these assets are tokens, they can be traded on DEXs like Uniswap. If they are NFTs, they can be traded on marketplaces.

Why could RWA be the “future” of cryptocurrency?

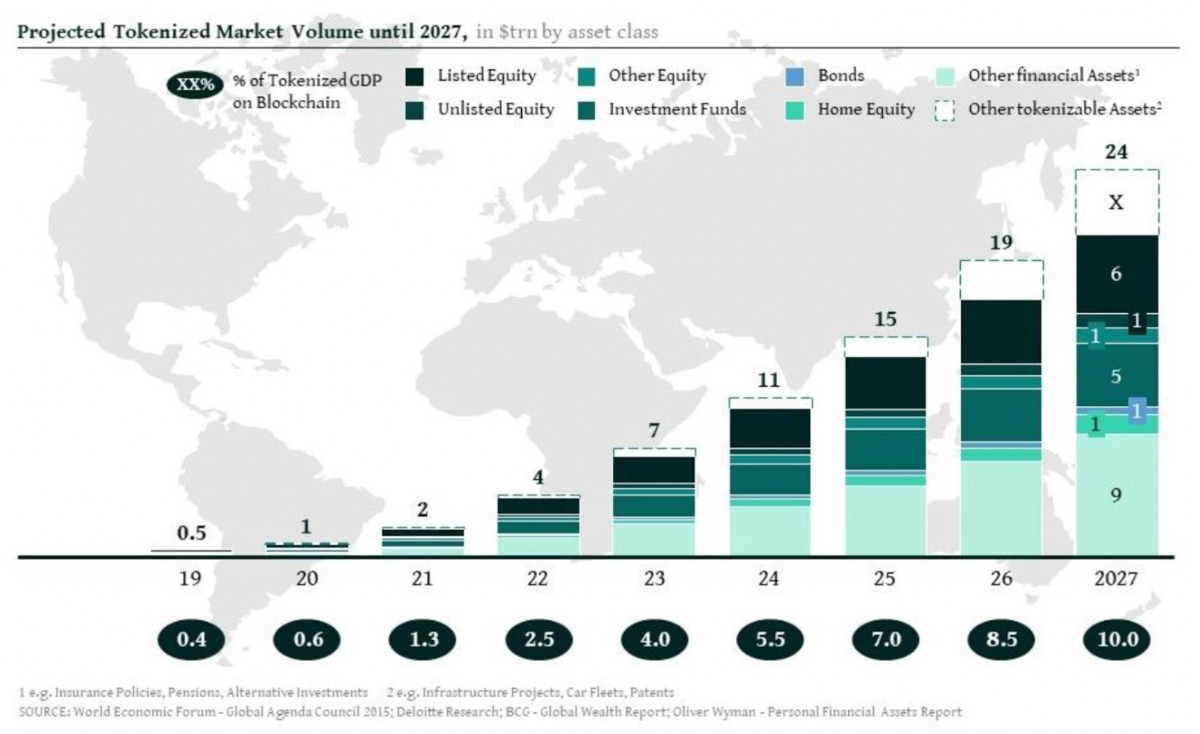

According to a study by the Boston Consulting Group, tokenizing globally illiquid assets is estimated to unlock business opportunities worth 16 trillion USD by 2030. Moreover, research organizations like Blockworks, Messari, and Binance Research have listed RWA as one of the main topics for 2023.

The World Economic Forum predicts that 10% of the global Gross Domestic Product (GDP) will be stored on blockchain technology by 2027. A large part of this will likely be home equity loans, suggesting that real estate could dominate the RWA ecosystem in the future.

But why is RWA gaining attention? Because RWA tokens can bring many benefits:

- Low management fees.

- Enables the DeFi market to have more practical applications, adding value to the real world.

- Optimizes capital flow in the global market.

- Allows investment anywhere, eliminating geographical barriers, making assets globally usable.

- Fragmentation of assets (e.g., dividing real estate), allowing many people to invest, regardless of capital size.

- Most importantly, it enables immediate liquidity.

Example: For example, suppose investor A owns a condominium worth $1,000,000 in their investment portfolio, expecting it to double in value over 10 years. During this time, A identifies another investment opportunity but lacks the capital to pursue it.

Traditionally, A would have to sell their condo to free up capital for the new investment opportunity. A would face complicated procedures, high fees, and a lengthy transaction time. However, with RWA, since the condo has been tokenized as an asset that can easily be traded on the blockchain, A can sell it immediately.

A promising sign for RWA is the rapidly growing interest from major institutions. Some recent examples of RWA development from traditional finance include:

- The Central Bank of Singapore was one of the first financial institutions to experiment with RWAs in Project Guardian in 2022.

- In February 2023, tech company Siemens also issued digital bonds worth 60 million Euros on the Polygon mainnet.

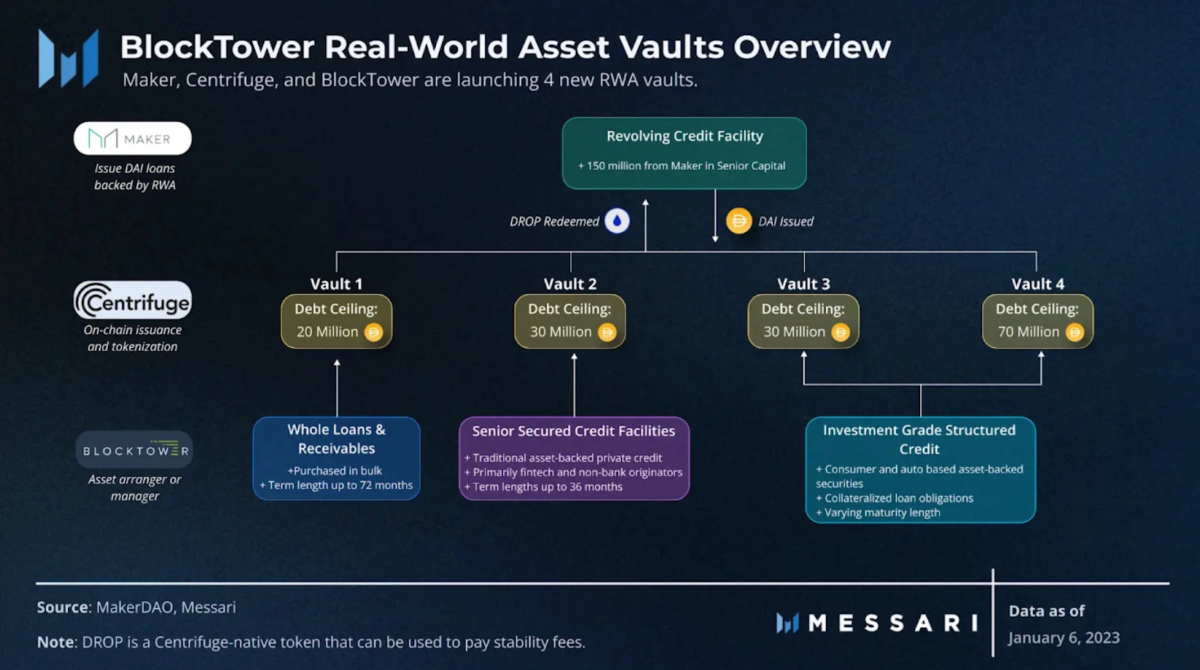

- BlockTower, a traditional financial institution specializing in venture capital, credit issuance, and portfolio management, also joined the RWA ecosystem. In January 2023, they partnered with MakerDAO and Centrifuge, bringing an additional 220 million USD into the DeFi market.

- On February 16, 2023, Hong Kong issued its first tokenized green bond worth 101 million dollars.

- On April 3, 2023, Credit Agricole CIB and Sweden’s SEB began developing a blockchain-based platform for digital bonds.

- On April 14, 2023, Bank of America detailed the tokenization of RWAs like commodities, currencies, and stocks as a key driver of digital asset adoption.

- On April 20, 2023, Societe Generale introduced a European stablecoin, CoinVvertable on Ethereum – the first institutional stablecoin deployed on a public blockchain.

- On April 26, 2023, Mitsubishi UFG Trust and Banking Corporation developed a digital securities platform using IBC (Cosmos) as the communication protocol and Corda blockchain infrastructure.

- …

=> It’s evident that financial institutions are increasingly delving into the DeFi market through RWAs. The most tokenized assets could be real estate, bonds, luxury cars, etc. This signals a positive trend, indicating that RWAs are worth paying attention to and likely to become a trend in cryptocurrency in the near future.

Best RWA coins to Invest 2025

Currently, the RWA narrative is heating up, and many exciting projects have emerged in this field. If you are interested in RWA and looking for notable projects to follow and consider investing in, don’t miss these names:

MakerDAO (MKR)

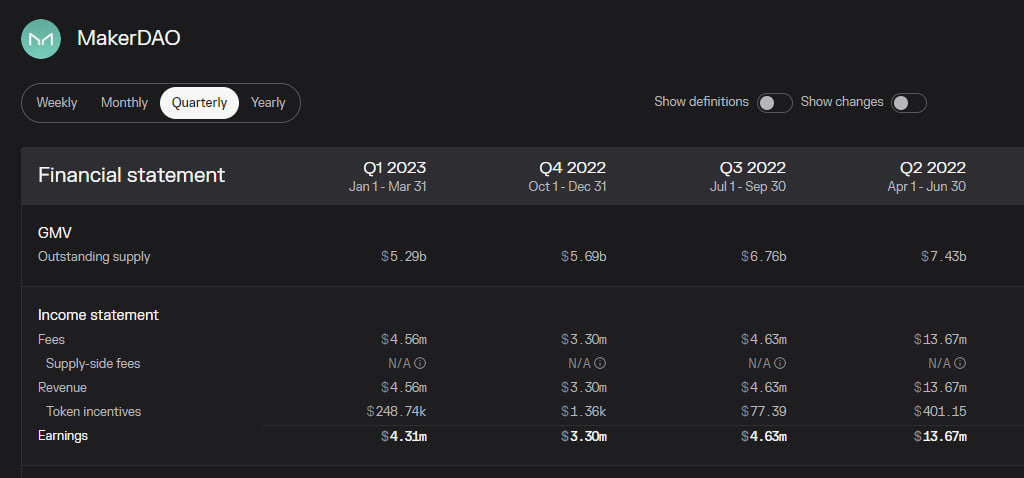

MakerDAO is a blue-chip DeFi project that hardly needs further introduction. Over the past year, MakerDAO has been actively working to diversify its reserves and establish other revenue streams. RWAs account for 75% of their revenue and have accumulated over $600 million in RWA collateral.

Key milestones for them include a $10 million partnership with Huntingdon Valley Bank, where RWAs are connected and used as collateral for lending DAI. Additionally, there is a recent partnership in December 2022 with Block Tower to fund $220 million in real-world assets through Centrifuge.

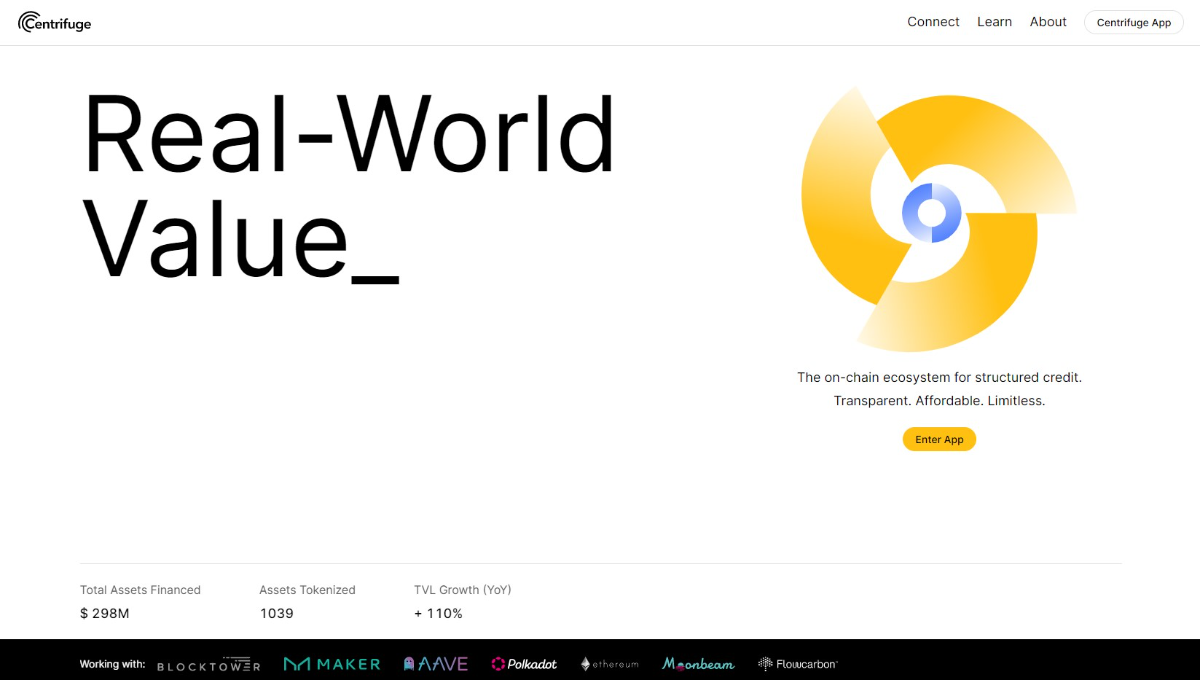

Centrifuge (CFG)

Meanwhile, Centrifuge is actively involved in RWA-related activities, deploying two main products: Centrifuge Chain and Tinlake. Centrifuge chain plays a role in tokenization, allowing assets to be authenticated and brought to the On-chain market.

Tinlake operates like lending protocols, but the collateral is not Cryptocurrencies but RWAs. In this model, traditional companies are the borrowers, while DeFi users deposit Stablecoins to earn interest.

Currently, Centrifuge’s services cater not only to Tinlake but also to other projects like Aave, MakerDAO, RealT Platform, etc. Thus, Centrifuge is considered to have the widest range of activities, involving both tokenization and the application of tokenized assets.

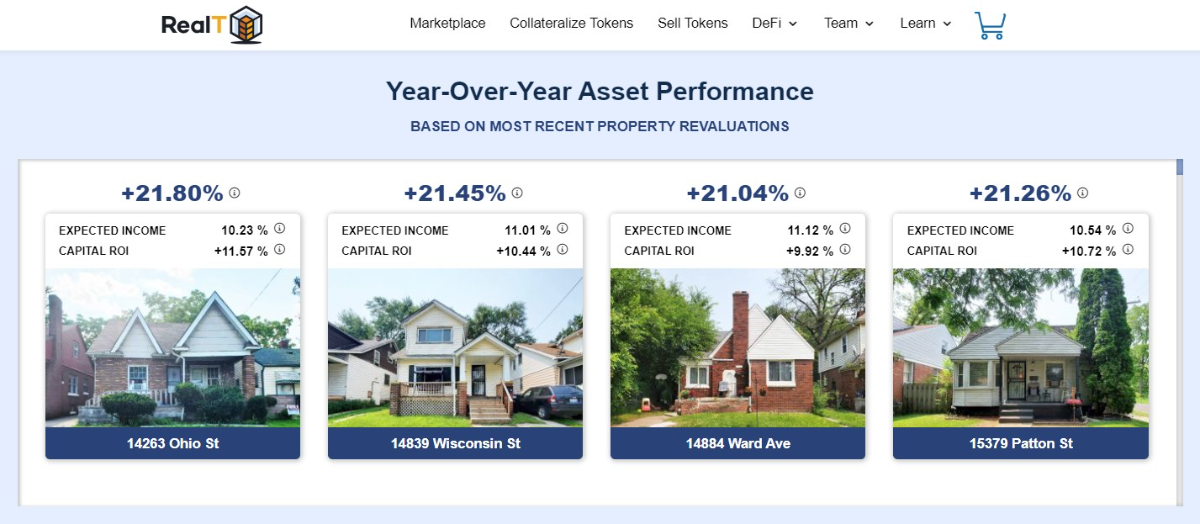

RealT Platform (Chưa ra token)

RealT Platform is a project for tokenizing and fractionalizing real estate into Real World Asset tokens. RealT’s model benefits multiple parties, for example:

- Property owners can tokenize assets and then use them as collateral for loans.

- DeFi users can deposit xDAI (Stablecoin) to earn interest or invest in a portion of the real estate to profit from rental activities.

As mentioned, RealT is also connected with Aave and Centrifuge in its real estate tokenization and lending activities.

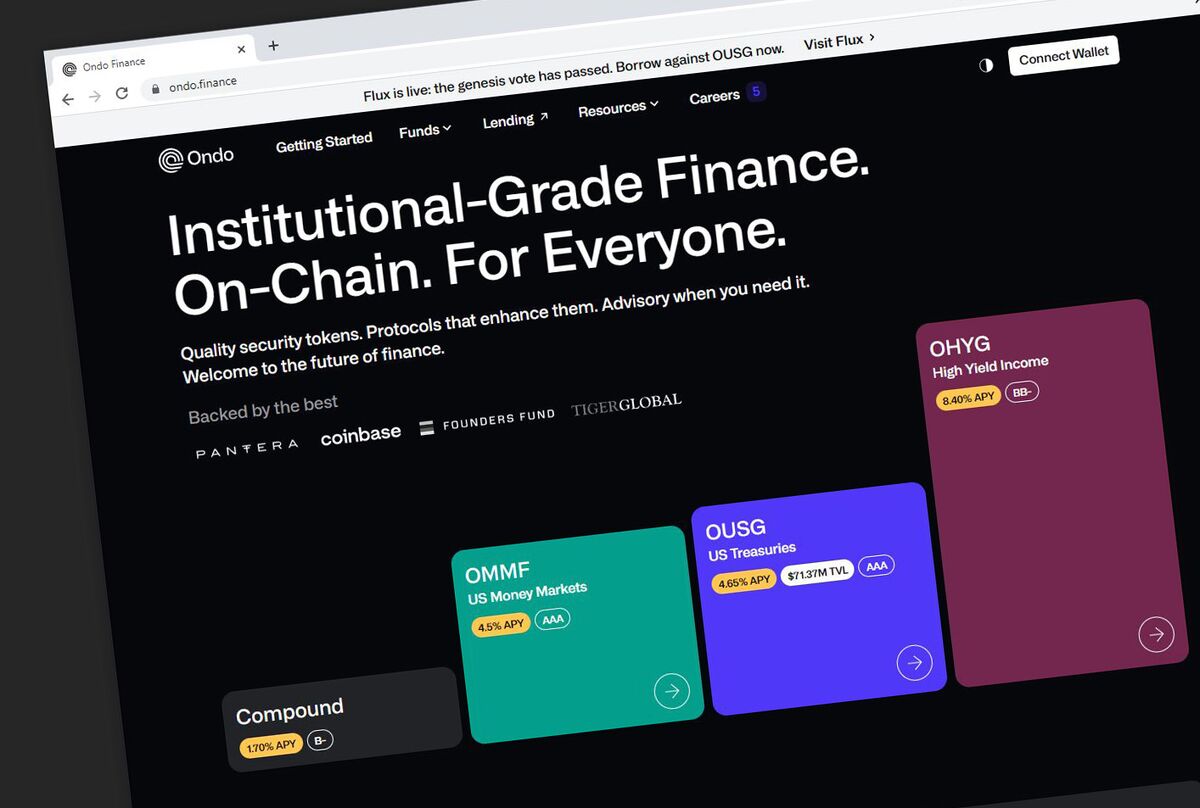

Ondo Finance (ONDO)

Ondo Finance has introduced tokenized funds that shield users from cryptocurrency volatility while offering sustainable returns. These funds enable stablecoin owners to directly invest in traditional finance instruments through three separate RWA funds, each charging a 0.15% fee. These include:

- Ondo Short-Term US Government Bond Fund (OUSG) investing in short-term U.S. Treasuries via Blackrock’s US Treasuries ETF (SHV).

- Ondo Short-Term Investment Grade Bond Fund (OSTB) investing in corporate bonds through PIMCO’s Enhanced Short Maturity Active ETF (MINT).

- Ondo High Yield Corporate Bond Funds (OHYG) investing in high-yield corporate bonds via Blackrock’s iBoxx $ High Yield Corporate Bond ETF (HYG).

TrueFi (TRU)

TrueFi is a leading DeFi lending platform that allows borrowing of both cryptocurrency and real-world assets without collateral. Its efficiency for both borrowers and lenders is significant, establishing it as the first and leading uncollateralized lending protocol in DeFi.

TrueFi offers competitive returns, flexibility, and high liquidity. Importantly, it has the TrueFi SAFU Fund for TRU investors, providing millions in comprehensive insurance to protect your lending assets. It raised $12.5 million from BlockTower Capital in an ICO in 2021.

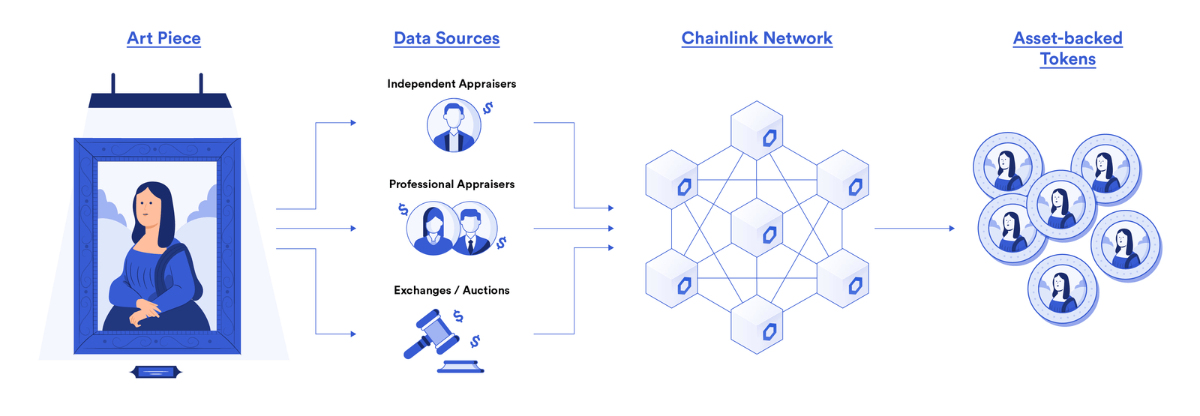

Chainlink (LINK)

Chainlink is best known as an Oracle project providing prices for numerous Dapps in the Crypto market. However, they offer more than that. As an infrastructure for the DeFi market, Chainlink also develops solutions to encode Real World Assets.

The simulation image below shows how Chainlink would encode the Mona Lisa painting into tokens. Firstly, the painting will be appraised and valued, with the value estimated either by experts or based on the average price of art exchange platforms. Then, this data will be entered into the Chainlink Network to be encoded into tokens/NFTs representing the painting.

Chainlink Real World Assets

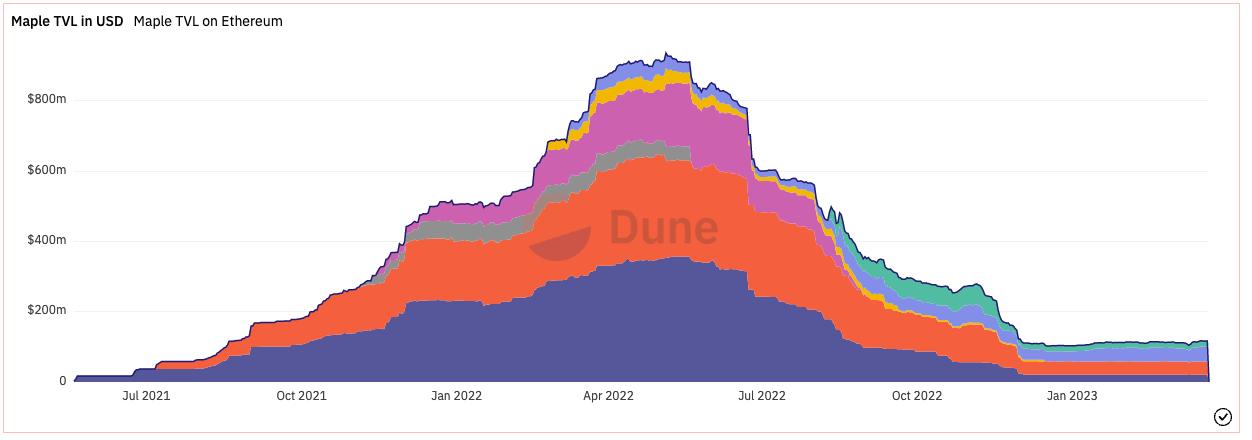

Maple Finance (MPL)

Maple Finance is also a notable project, invested in by major funds like Framework Capital, Bitscale, Alameda Research, One Block Capital, Polychain, etc. After experiencing defaults and a thorough overhaul, Maple Finance shifted from uncollateralized lending activities towards RWA. They have eliminated the excessive collateral thresholds of traditional DeFi for borrowers as long as they have RWA to repay. Maple partnered with London-based AQRU to create new groups investing in U.S. Treasury bonds and insurance refinancing using strategies derived from TradFi.

Their idea originated from the need of institutions and investment funds to use capital during project investment phases (as projects often have a long token payment schedule and only pay in parts, making rapid capital recovery unfeasible for funds). Therefore, Maple Finance will build a protocol allowing funds to borrow under collateral from Liquidity Pools (contributed by users).

Currently, Maple has several collaborations with major names – such as TRM Labs, Trail of Bits, Meta Mask, Anchorage Digital, ImmuneFi, Fireblocks, meow, Coinbase, Circle, Gnosis Safe, Gemini, and Code4arena. Overall, it could be considered one of the most potential RWA projects at present.

Phuture Finance (PHTR)

Phuture Finance is building one of the largest decentralized crypto index funds, leveraging traditional index funds to create one of the largest decentralized crypto index funds. Phuture Finance has three core products: Phuture DeFi Index (PDI), Colony Avalanche Index (CAI), and USDC Savings Vault (USV).

Like traditional index funds structured to provide investors access to a financial market index rather than a single stock for risk diversification, PDI and CAI are market capitalization-weighted indices providing access to top DeFi protocols in the Ethereum and Avalanche ecosystems.

USV is a vault that generates interest for the idle USDC of depositors. $PHTR is primarily used for governance and incentivizing users.

Synthetix (SNX)

A decentralized exchange (DEX) where users can trade “synths” – derivative versions of assets, similar to CFDs. Synths include not only cryptocurrencies but also a range of other RWA such as gold, commodities, stocks…

Launched in 2017 and developed on the Ethereum blockchain, Synthetix’s trading volume of synthetic assets reaches hundreds of millions of dollars daily. Synthetix also serves as infrastructure, providing liquidity to projects like Kwenta, Lyra, and Thales, pioneering the field of Synthetic Assets.

Synthetix has raised a total of 66 million USD from investment funds like Coinbase Ventures, IOSG Ventures, Paradigm, Framework Ventures, DWF Labs.

Goldfinch (GFI)

GoldFinch aims to build a credit market for emerging markets, offering credit to businesses in Africa, Southeast Asia, and Latin America with active loans valued at 103 million dollars to date. Therefore, it can be considered a noteworthy RWA project.

GoldFinch, in essence, is a lending protocol on the Ethereum blockchain. It functions on a consensus-based trust system, requiring users to establish their reliability through their track record in past transactions.

This evaluation by Goldfinch is employed to autonomously distribute funds to borrowers. By removing the need for collateral and introducing a passive income feature, Goldfinch is swiftly growing its pool of borrowers and exploring the opportunities presented by Liquidity Providers.

Risks associated with Real World Assets – RWA

Understanding what are RWAs and some of the prominent RWA projects is essential. However, investing in RWAs involves certain risks due to several barriers, such as:

- Custodial service barriers: Custody companies only operate in specific countries and specialize in certain areas, like real estate, art, vehicles, etc. Although this issue can be addressed as the market isn’t short of these services, it requires time to integrate them.

- Legal barriers: Legal frameworks for assets differ by country. To operate RWAs in the DeFi market encoding various assets, they face many obstacles, making it challenging to bring RWAs to the blockchain market:

- Geographical barriers: Many Real World Assets are geographically bound, like real estate with fixed locations. This makes assets, though encoded On-chain, less practically applicable. For example, a Vietnamese individual investing in U.S. real estate through a DeFi Marketplace, but might not have the legal rights to own the property under U.S. laws.

Overall, RWAs are significant for attracting traditional market capital to DeFi. However, not all assets are suitable for On-chain encoding.

Additionally, two major risks related to RWA are:

- First, what would you do if your RWA asset gets hacked? If a wallet is hacked, does ownership of real estate, stocks, documents get swiftly transferred to the hacker? This is a genuine concern for many. With the ongoing CeDeFi crisis and over 3 billion USD hacked last year, the risks associated with asset encoding must be considered.

- Second, the liquidity crisis issue. The detrimental impact of low liquidity on algorithmically-pegged assets in volatile market conditions has been observed. When prices start to fall, users rush to sell their positions, exacerbating the effect and causing further decline. If unsure, consider the mechanism behind Terra’s native stablecoin (USDT).

In conclusion – Are RWAs promising?

What are RWAs? RWA, or the tokenization of real-world assets, still largely depends on traditional financial institutions. Therefore, RWAs might be complex and different from the traditional DeFi market we know, which only deals with cryptocurrencies. However, RWAs remain an exciting prospect with evolving custodial solutions and advanced data.

Consider “digital assets,” which we are increasingly encountering in our lives, like bank card transactions. If we continue to develop in this direction and gradually adapt it to the cryptocurrency market, we can envision a world where most things are integrated through RWA transactions. The opportunity is vast, and the potential for encoding assets worldwide is immense, making a market capitalization goal of 1 billion USD attainable.

However, upon deeper exploration, Real World Assets face significant barriers. Assets in the real world have yet to be deeply applied, remaining limited to collateral for loans. Nevertheless, Real World Asset remains a hugely significant and long-term narrative worth following for the next 2-3 years. The trend of combining and circulating assets between TradFi and DeFi will likely gain popularity soon.

What are your thoughts on RWA? Could it become a trend in cryptocurrencies? Feel free to comment and discuss with us.

Readmore: What is Narrative Crypto? The Top Current ‘Narratives’ to Watch