We have previously introduced an article: A guide to researching and evaluating potential coins through fundamental analysis. In this next article, I will go deeper – more specifically in each “small area” – and first will be how to research basic blockchains, Layer-1 platforms that facilitate smart contracts. Through this, you will learn how to analyze and evaluate a Layer-1 blockchain, for example, BSC, Ethereum, Avalanche… to see what differentiates them from other platforms, and which is the best blockchain currently.

Especially: Evaluating a Layer-1 blockchain is not only about identifying investment potential in this blockchain, but also relates to analyzing the fundamental potential for Layer-2 solutions and dApps running on that blockchain.

Because: Layer-1 is the foundation for the success of Layer-2 solutions.

We can imagine Layer-1 blockchain networks as different countries. They operate independently of each other, differing in data, network, consensus mechanism, having their own ecosystems, etc. They can validate and complete transactions without needing other networks. A “stronger country” will have better conditions for all projects developed on it.

On the contrary, if the Layer-1 blockchain has many flaws or shortcomings, it can collapse. Therefore, promising Layer-2 projects and projects running on that blockchain will also fail. Thus, evaluating a Layer-1 blockchain is extremely important.

Contents

- 1 Criteria for evaluating a Layer-1 blockchain

- 1.1 Criterion 1: Developer-friendliness

- 1.2 Criterion 2: Decentralization/non-centralization

- 1.3 Criterion 3: Blockchain security

- 1.4 Criterion 4: Active users and daily transactions

- 1.5 Criterion 5: Network Transaction Fees

- 1.6 Criterion 6: DApps and Ecosystem

- 1.7 Criterion 7: Developer Activity

- 1.8 Criterion 8: Is the Blockchain Supported by VCs?

- 1.9 Criterion 9: Community & Social Media

- 1.10 IN SUMMARY:

Criteria for evaluating a Layer-1 blockchain

And with basic understanding, let’s delve into evaluating and researching L1 blockchains. We will evaluate based on criteria:

Criterion 1: Developer-friendliness

Developers are the ones who will create projects on blockchains, and the gateway to attract users. So I will place this criterion first.

This criterion refers to the ease or difficulty for others in building solutions, dApps on a particular Layer 1 network. The following points need attention:

- What is the programming language of the blockchain? A programming language that is easy to learn (or a blockchain that supports multiple languages) is more likely to attract developers.

- Are there many available tutorials, and are they of good quality? Are they comprehensive and updated regularly? This helps developers learn how to build on the chain more easily.

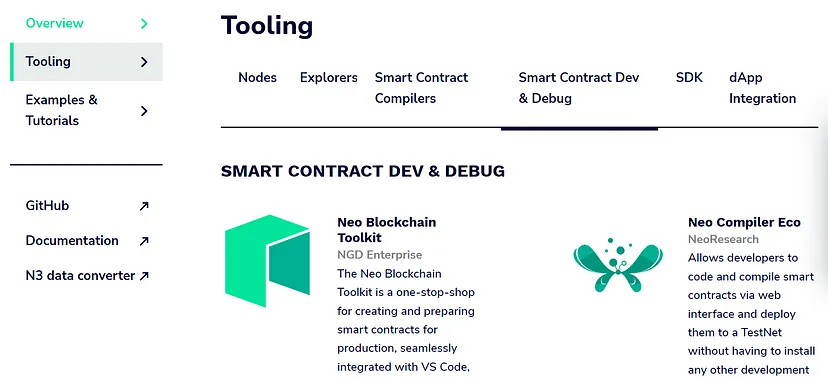

- What tools does the blockchain provide for Layer 2 application developers? Think about software development kits (SDKs), sandboxes, benchmarking tools, block explorers, smart contract compilers, debugging tools, etc.

To find out these, visit the website of the Layer 1 networks, read their whitepapers and official reports.

Criterion 2: Decentralization/non-centralization

Decentralization means that no single entity or just a few entities have control over the system or process. Instead, control is distributed among all participants. Decentralization is very important to ensure the transparency and fairness of blockchain.

In short, the more decentralized the blockchain, the better. However, remember that no project is 100% decentralized.

And here are the aspects you need to research to evaluate a Layer-1 blockchain from a decentralization perspective:

- How many nodes are there? The more, the better.

- Where are they located? The more geographically distributed the nodes, the better.

- What is the hash rate held by individual mining groups in Proof of Work (PoW) networks?

- How large is the percentage of funds held by the top wallets in Proof of Stake (PoS) networks?

Criterion 3: Blockchain security

Another very important aspect is the immutability of the blockchain. Most of us are not IT security experts. That’s why we have to rely on developers, collaborators, white hat hackers, and others to ensure the code of the blockchain is error-free and risk-free. However, there are some questions we can try to answer:

Can the blockchain withstand various attacks such as 51% attacks, Sybil attacks, Distributed Denial of Service (DDoS) attacks, etc.?

It’s important when analyzing this criterion, it requires you to have some knowledge, a basic understanding of how different consensus algorithms work in theory and their pros and cons. Understanding it can help you understand what type of threats or attacks the blockchain may face.

Criterion 4: Active users and daily transactions

You can build the best software ever. But if no one uses it, it’s nothing. That’s why it’s important to understand user activity. Here are the statistics you should focus on:

- What is the long-term trend of the number of users? A steady increase in the number of active users is a good sign.

- What can you see from the number of daily transactions? Again, what you want to see here is an increase in daily transactions.

- How many hodlers are there? But keep in mind, while a certain percentage of people just holding the native currency of the blockchain is good, it’s best not to have too many people hoarding money without ever using it.

To get this information, on-chain data websites, Blockchain Explorer tools will help you. I’ll share the link at the end of the article.

Criterion 5: Network Transaction Fees

Ideally, transaction fees should be user-friendly. Exorbitant fees can negatively impact the growth of the chain. However, it can also reflect how much users are willing to pay for block space. Higher fees = more security.

Criterion 6: DApps and Ecosystem

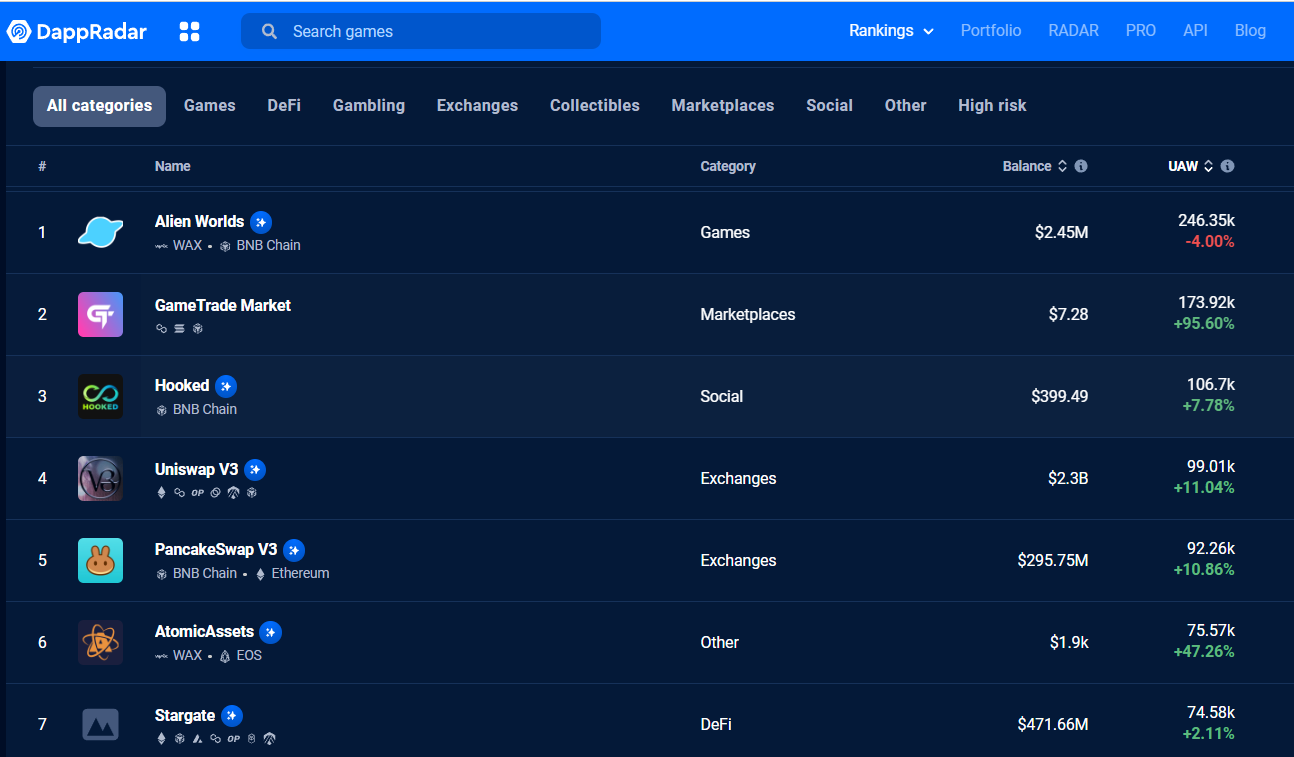

This is an excellent criterion because if we evaluate Layer-1 blockchains, seeing them as countries, then the DApps built on them are like the economic sectors in a country. For a country to be strong, diverse industries and economic activities are necessary. Moreover, a large and diverse ecosystem attracts investments and new solutions.

Visit dappradar to view popular DApps for every Layer blockchain. This site also lists the number of users for each DApp.

But DApps are just a part of the whole ecosystem. Other aspects include exchanges (centralized and decentralized), infrastructure like bridges, oracles, APIs, etc., are also very important. You can find this information on the websites of the L1 blockchains themselves, or search on Google with the keyword “xxx Ecosystem” – with xxx being the blockchain name.

Criterion 7: Developer Activity

This information can be found on the project’s Github page. It is an excellent source of detailed information, even if you do not have programming knowledge. Here you can find out about the following:

- How many active developers are contributing to the chain?

- How many commits are made each day?

- Developers are crucial for blockchain adoption as they create DApps for users. The number of developers actively working on a blockchain provides insight into its future potential and overall strength. Developers are responsible for creating decentralized applications (DApps), fixing bugs, building smart contracts, and adding new features for beta testing before launch.

- If a blockchain lacks developers, it cannot progress. Therefore, the more developers (Developers), the better.

- There’s a Twitter account that specializes in compiling and summarizing this data for you. You can refer to @ProofofGitHub

GitHub Daily Development Activity:

#1: 835 Polkadot / Kusama

#2: 702 Internet Computer

#3: 609 Cardano

#4: 587 Hedera

#5: 488 Ethereum

#6: 465 Status

#7: 460 ChainLink

#8: 427 MultiversX

#9: 405 Decentraland

#10: 389 Cosmos pic.twitter.com/DYv3Ve5Irz— ProofofGitHub (@ProofofGitHub) April 26, 2023

Criterion 8: Is the Blockchain Supported by VCs?

Big institution money (VC) is one of the easiest verifiable indicators to let you know if a project is good or not. This is because VCs typically conduct in-depth research before investing. However, being backed by a VC does not guarantee a project will succeed. The recent failure of Terra is a reminder of this.

Criterion 9: Community & Social Media

To wrap things up, always take some time to check the social media accounts of the network. You can learn a lot by looking at Twitter, Telegram, Discord, etc.

- What are they talking about? Discussing issues and improvements?

- Do they provide detailed information about roadmaps, development progress, etc.?

A sustainable Layer-1 blockchain requires a strong community, and its team must be active, up-to-date, and informative about the platform.

It’s not a good sign if the official social media accounts of a Layer-1 blockchain haven’t been updated for weeks. This could be a sign that the team is encountering problems or has abandoned the project.

IN SUMMARY:

It’s tough to find all the information I’ve listed in this guide. No website lists all the information you need to know. But don’t worry too much if you can’t find some data to mine. It requires experience and time. Just try to gather as much as possible, and gradually if you really like and want to understand this market, you’ll learn how to research easily.

Below are some “resources” you can refer to:

- Ethereum:

https://etherscan.io/charts

https://messari.io/asset/ethereum/charts

https://www.ethernodes.org/countries

- Solana:

https://solscan.io/

https://analytics.solscan.io/public/dashboard/8d888828-baae-47b9-948b-d087e5de1411

https://solanabeach.io/

https://explorer.solana.com/

- BSC:

https://www.bscscan.com/charts

- Avalanche:

https://stats.avax.network/dashboard/overview/

https://explorer-xp.avax.network/validators

- Cardano:

https://messari.io/charts/cardano/act-addr-cnt

https://messari.io/charts/cardano/fees

- Polkadot

https://messari.io/asset/polkadot/chart/act-addr-cnt

- Fantom

https://ftmscan.com/charts

- Algorand:

https://algoexplorer.io/top-statistic

https://metrics.algorand.org/#/

Or don’t miss some articles:

We hope you find this guide helpful and can learn how to evaluate a Layer-1 blockchain to see which is the most promising. If you have any questions or additions, please leave a comment to share with us. Thank you for reading the article and wish you successful investment.