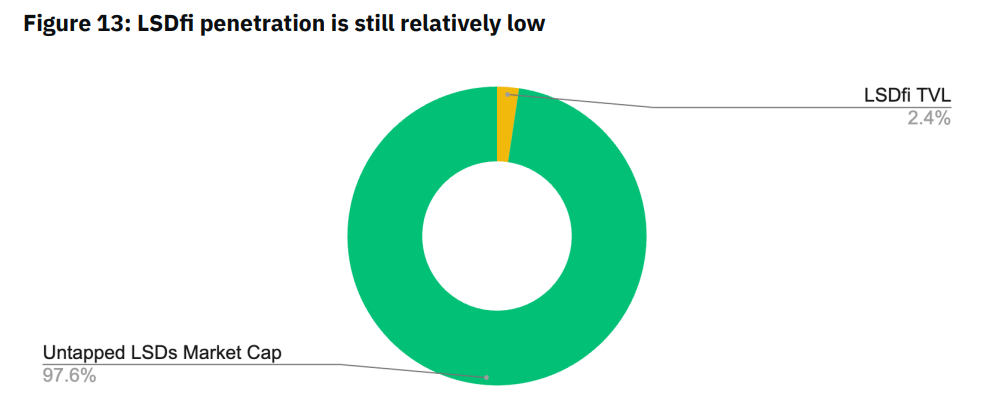

Binance Research recently published a research report on LSDfi. According to the report, we can see that LSD currently has a market value of 18.4 billion US dollars, while LSDfi accounts for only 2% of the market, hence the future opportunities in this field are enormous. In yesterday’s article, let’s explore what LSDfi is, how it differs from LSD, and quickly analyze the most promising LSDfi projects at present.

You can read the entire report:

What is LSDfi – Understanding the LSD-fi Trend

What is LSDfi?

Liquid Staking Derivatives, also known as LSD, have been one of the biggest stories and a craze since early 2023, especially after the successful Shapella upgrade of Ethereum. Simply put, LSD is a tool that allows for the creation of derivative assets of staked assets. It enables users to retain flexibility in using these LSD tokens in other decentralized applications (DApps).

So, what is LSDfi and how does it differ from LSD?

As LSD becomes increasingly popular, a smaller sub-sector of DeFi has also emerged to leverage this trend. Combining LSD and DeFi, this LSDFi sector is built on LSD tokens — aiming to increase the utility of these tokens and bring additional profits to LSD token holders.

In summary, LSDfi is a term combining LSD + Finance, referring to DeFi protocols revolving around the use of LSD. LSDfi protocols enhance the liquidity of LSD tokens, improve capital efficiency, and create profit opportunities in the DeFi ecosystem through the integrative abilities of LSD.

Overview of the Current LSDfi Ecosystem

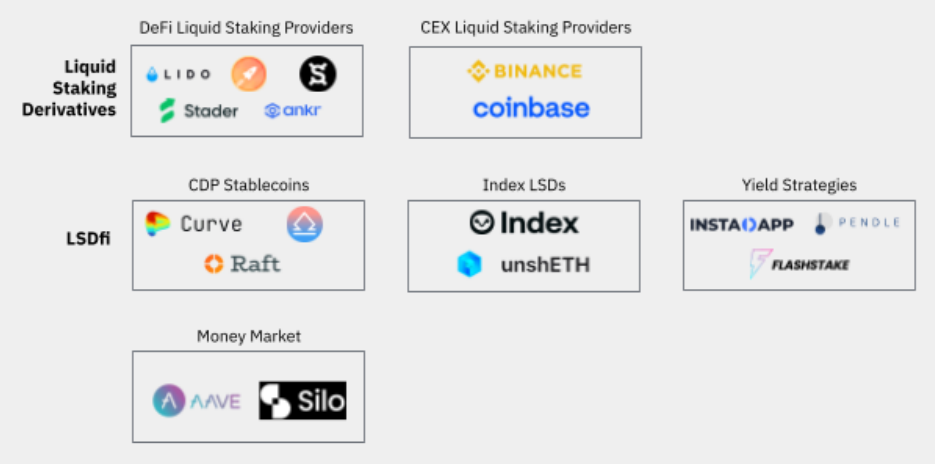

The LSDfi ecosystem combines mature DeFi protocols that have integrated LSD into their diverse product portfolio, along with newer LSD-based projects. For more insight, refer to the Liquid staking and LSDfi map below:

In general, the LSDfi ecosystem could be traditional DeFis like DEX and Lending or more complex protocols. Specifically:

- DeFi liquid staking providers: These are DeFi protocols offering staking services. Users staking their tokens receive LST in return. Examples: Lido Finance, Stader, Ankr…

- CEX providing Liquid Staking: These are CEXs offering staking services. Examples: Binance, Kraken, Coinbase

- CDP Stablecoins: Collateral Debt Position, describing collateralized debt positions. CDP protocols allow users to mint stablecoins by collateralizing LSD tokens. Examples: Curve, Raft, Lybra…

- Index LSD: Users lock tokens to receive LSD tokens of the project. This diversifies risk and helps users holding various LSD components to maximize their returns. Examples: UnshETH, Index Coop…

- Yield Strategy: These protocols enable users to access opportunities and strategies for better profit on their assets. Examples: Pendle Finance, Instadapp, 0xAcid, Parallax Finance, Asymetrix …

- Money Market: These are Lending/Borrowing protocols, allowing the use of LSD tokens as collateral. Examples: Aave, Silo…

Why Will LSDfi Become a Trend in the Future?

Reasons why LSDfi might become a “narrative” in the future include:

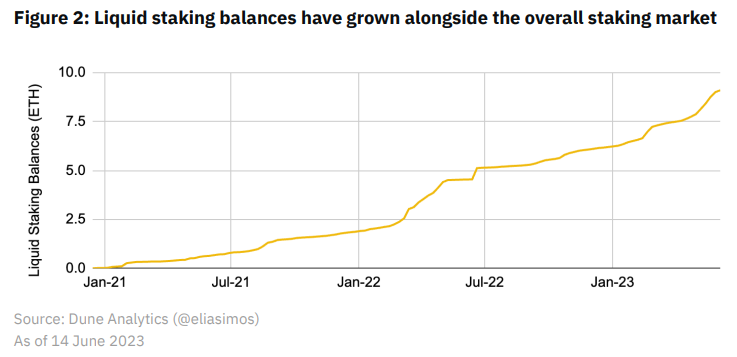

- After Ethereum’s Shapella upgrade, LSD protocols continue to witness exponential growth in TVL and are expected to maintain strong growth in the future. This growth also stimulates the TVL growth of LSDfi protocols.

- The emergence of positive catalysts like Eigen Layer’s Mainnet, a leading re-staking project, which will also be a prominent name in LSDfi, and Binance’s announcement of choosing Maverick as their 34th Launchpool project, a project about Liquid Staking Token (LST).

- The catalyst from Binance cannot be overlooked. The concept of LSDfi isn’t entirely new, but it really gained momentum after being highlighted by Binance Research in their report.

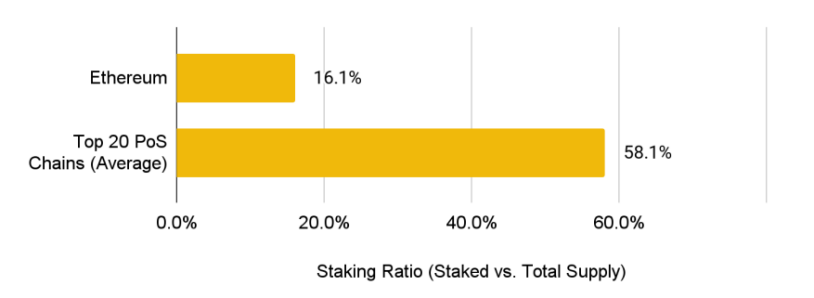

- The current ETH staking rate is very low, only at 16.1%, much lower than the average of leading PoS networks. However, the allowance of withdrawals after Shapella makes staking more attractive, and this gap is gradually narrowing. If the staking rate increases, a significant amount of ETH will be staked, boosting the development of LSD and LSDfi protocols.

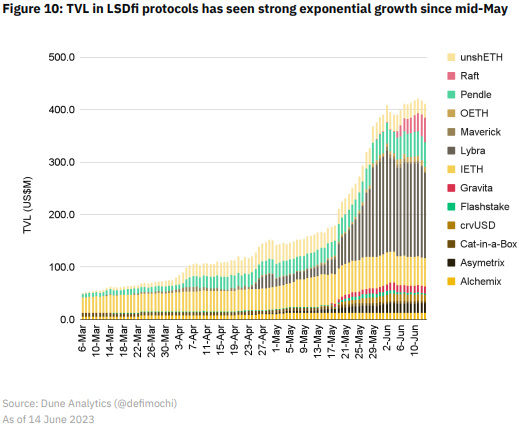

- LSDfi enhances liquidity and capital efficiency of LSD tokens. However, currently, the Total Value Locked (TVL) in LSD-fi protocols is less than 3% of the total LSD market, indicating significant growth potential.

=> LSD is a field that will continue to grow significantly in the future. Meanwhile, the newly launched LSDfi sector still occupies only a small portion with the potential for the entire market. With the expectation from a major organization like Binance Research, it can be said that LSDfi will be one of the sectors attracting investment in the coming time.

Top Most Promising LSDfi Projects 2025

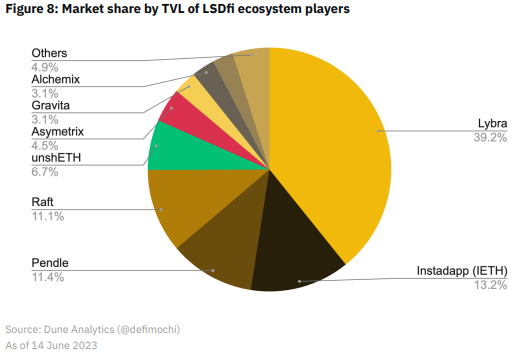

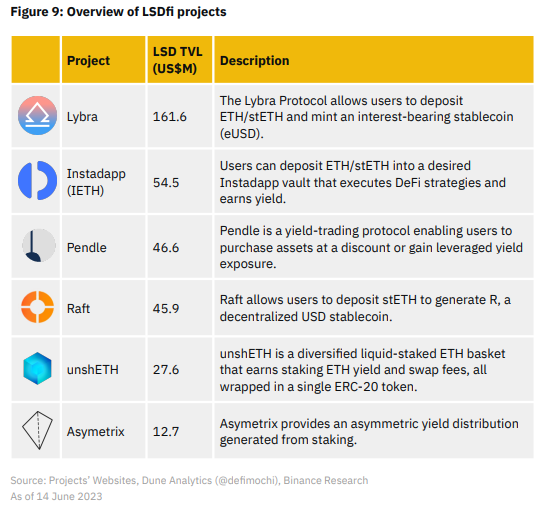

You’ve learned about what LSDfi is. Next, what are the most interesting LSDfi projects? As of the time of writing this article and based on what Binance Research has shared, the current LSDfi landscape is relatively concentrated, with just 5 leading names holding over 81% of TVL. Lybra Leads the Market and its rise to leadership happened swiftly, as the project only mainnetted this past April.

The LSDFi ecosystem encompasses numerous projects, ranging from stablecoin CDP, Index LSD, Yield Strategy… Over time, we may see even more components and new projects launched, enriching the diversity of LSDfi. Presently, there are six standout projects mentioned in Binance’s report, so let’s quickly analyze these six LSDfi projects.

Lybra Finance (LBR)

Lybra has been a pioneer in the LSDfi space and its eUSD is one of the fastest-growing stablecoins in the DeFi space. To date, Lybra still holds over 36% of the total LSD TVL and is making significant changes to its tokenomics V2 model.

LBR v2 will bring several new changes to the tokenomics economic model, such as adding LBR staking, using $LBR to mint eUSD, extending the authorization time, etc. Additionally, Lybra’s current trading price has decreased by 70% from its previous high, and the likelihood of further significant drops is limited, making this project definitely worth attention in the coming period.

Instadapp (INST)

InstaDApp is a decentralized asset management protocol aiming to revolutionize the DeFi space by creating a comprehensive hub for all things DeFi. INST’s success stems from its seamless integration of various applications, allowing users to develop strategies, securely hold cryptocurrencies, and even earn ETH income.

Instadapp’s IETH has experienced explosive growth previously and currently holds 13.38% of the LSDfi market share. With current smart strategies, users can leverage blue-chip applications like AAVE, Morpho, MakerDAO, and Compound to earn higher ETH returns.

Pendle (PENDLE)

Pendle allows users to leverage “prepaid” returns to create custom strategies suited to their risk tolerance and time preferences, essentially enabling them to capitalize on returns generated on their ETH. Recently, Pendle’s TVL surpassed 100 million USD.

Furthermore, another noteworthy point about this project is that they are building a thriving ecosystem around the PENDLE token. For instance, Equilibria and Penpie, two yield aggregators currently built on Pendle, are utilizing the rewards distribution benefits of vePENDLE, increasing the demand for PENDLE.

Raft (Token Not Yet Available)

Raft allows users to mint R, a decentralized stablecoin backed by ETH. Leveraging Lido Staked ETH, Raft aims to become the leading DeFi stablecoin. Raft’s TVL has shown good growth since its launch last month.

Additionally, Raft is reportedly planning to launch the RAFT token to decentralize its ecosystem. In the above figure, we can see that Raft’s TVL has grown quite well, even though it hasn’t yet launched a token. With the future token launch, it could further stimulate R minting and even more growth in Raft’s TVL.

unshETH (USH)

unshETH allows users to stake their ETH among various validators, facilitating decentralized liquid staking and earning higher returns. Currently, this protocol accounts for 6.5% of the LSDfi market share, and USH is also rapidly expanding beyond Ethereum.

Furthermore, to expand the influence of ushEth, a few days ago (June 15), they announced a partnership agreement with CamelotDEX (Arbitrum’s number one DEX). Users can receive four incentives USH + vdUSH + GRAIL + xGRAIL by staking in their Camelot USH-ETH LP to participate in unshETH governance.

Asymetrix (ASX)

Asymetrix allows more people to participate in staking ETH by randomly assigning additional rewards to stakers. Its goal is to encourage everyone to stake their ETH and create opportunities to win substantial rewards.

Essentially, Asymetrix can be seen as an ETH lottery. Users hold their ETH and earn a stable 5% staking reward, along with the chance to win the Pool reward through weekly random draws. In just the past two months, their TVL has increased to 18.2 million dollars, showing considerable appeal.

The above information details LSDfi and highlights the top current LSDfi projects. Overall, the current total value of the LSDfi protocol is negligible compared to the LSD market. However, we have witnessed the explosion of LSD this year and subsequently, the burst of creativity and innovation in LSDfi. Compared to other POS networks, ETH has a much lower collateral rate, so LSD and LSDfi still have plenty of room for future development. Therefore, we can continue to pay attention to some potential LSDfi projects in this field to find a suitable investment opportunity. Wishing you success.