We have previously introduced readers to standout crypto narratives, and much of the information in those has a high degree of accuracy, as almost all the areas introduced in the article such as Layer-2, NFTfi, SocialFi, AI, LSD… have all become popular in the market, with some trends even triggering a very positive growth wave. Currently, are there any trends forming that we need to pay attention to? A prominent name right now is: CLMM – Concentrated Liquidity Market Maker

Contents

What is Concentrated Liquidity?

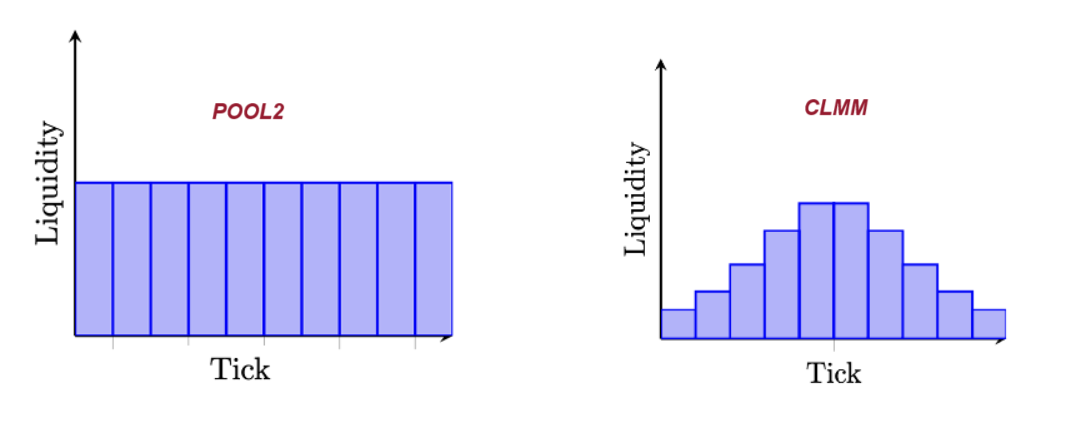

CLMM – Concentrated Liquidity Market Maker: A market maker for concentrated liquidity, originally introduced by Uniswap V3. Unlike the usual Pool2 liquidity (50-50 LP), which spreads liquidity from zero to positive infinity, CLMM concentrates liquidity within a fixed price range.

Benefits of CLMM:

- CLMM focuses on a specific price range, so liquidity providers receive more fees if there are swap transactions in that range.

- Traders also suffer less from slippage when swapping.

- CLMM helps optimize the use of capital.

- No inflationary tokens, all rewards are paid in x-y LP tokens (Realyield).

- Limits temporary loss depending on the liquidity pair ratio provided by the user.

- Deep liquidity will help deploy more products like Perpetual, Option Trading, etc.

However, CLMM still has some limitations:

- Need to monitor and manage liquidity.

- More complex calculations are required.

- Still does not completely mitigate temporary loss.

Why is CLMM Gaining Attention?

The reason why Concentrated Liquidity – CLMM is likely to become the focus of attention in the coming time is:

- Many investors have made significant profits from the $ARB airdrop event by Arbitrum by pairing liquidity on Uniswap V3 and Trader Joe at the time of the airdrop.

- TVL of JOE on Arbitrum skyrocketed after 23/03/2023 (the day ARB was officially listed). JOE’s token also achieved a profit of ~260% in the past March, further attracting attention to this field.

- Although Uniswap V3 is leading in this field, Uniswap V3’s license will expire on 01/04, and they will open source their algorithm after 2 years of development, potentially leading to a Fork Season for the DeFi market.

- Many AMMs are gradually shifting to the concentrated liquidity mechanism (CLMM) instead of traditional Pool2 to solve liquidity optimization issues they face.

Best potential CLMM crypto coins 2025

The safest choice is Uniswap (UNI). This coin is probably familiar to many, known as one of the most prominent DEXs currently. However, investing in Uniswap may not yield significant profits (as its market cap is already very high).

Below are some projects you might consider adding to your watchlist:

Trader Joe (JOE)

Trader Joe implemented CLMM since last year but did not receive much attention as the project was only operational in Avalanche. However, earlier this year, Trader Joe made a wise move by choosing Arbitrum as the next stop to welcome capital inflows from the market. A stroke of luck when the LB model proved capital-efficient after the recent Arbitrum airdrop event.

After some time using Trader Joe’s Liquidity Book, it’s evident that their liquidity creation is much more flexible than Uniswap, but can be difficult for those new to the DeFi market.

They will soon launch an Auto-Pool model (automating liquidity for users), a concentrated liquidity model combined with Order-book and Fee sharing for JOE token holders.

Liquidity Book is novel protocol, offering a hybrid AMM <> CLOB style experience.

LB was built from the ground-up and truly empowers Liquidity Providers and Traders alike by offering a very different experience from all existing concentrated liquidity AMMs.

Learn why ???????????? pic.twitter.com/oo6B0jDuCc

— Trader Joe (@TraderJoe_xyz) March 28, 2023

Steakhut Finance

Steakhut Finance is a liquidity management platform for TraderJoe’s Liquidity Book. This project will automatically manage and control the price range, compounding interest into the initial capital of liquidity providers.

Introducing: SteakHut Liquidity ????+????????

Automate and optimize your concentrated liquidity on the @traderjoe_xyz Liquidity Book!

Welcome to the Liquidity Layer of #Avalanche, now ????????????????! ???? pic.twitter.com/UYEGq4kNve

— SteakHut (@steakhut_fi) January 6, 2023

Gamma Strategies (GAMMA)

Gamma Strategies is a liquidity management platform initially built for Uniswap V3 users. Instead of having to calculate the price range, the fees to be received, temporary loss, etc., Gamma helps users manage, adjust, and reinvest in the capital they put in.

Gamma has also grown stronger by supporting liquidity management for DEXs transitioning from traditional Pool2 to CLMM like Thena Finance, Quickswap, Zyberswap.

Unipilot

Similar to Gamma Strategies, Unipilot is also an automated liquidity management platform built on Uniswap V3.

Are you an $ETH maxi looking to earn #yield?

Our cbETH/ETH vault has a 7D average APR of 9%, with all returns coming from earned LP fees!

Find it at https://t.co/XgEHVbJCCa pic.twitter.com/8p8uIJQeoc

— A51 Finance ???????? (@A51_Fi) January 6, 2023

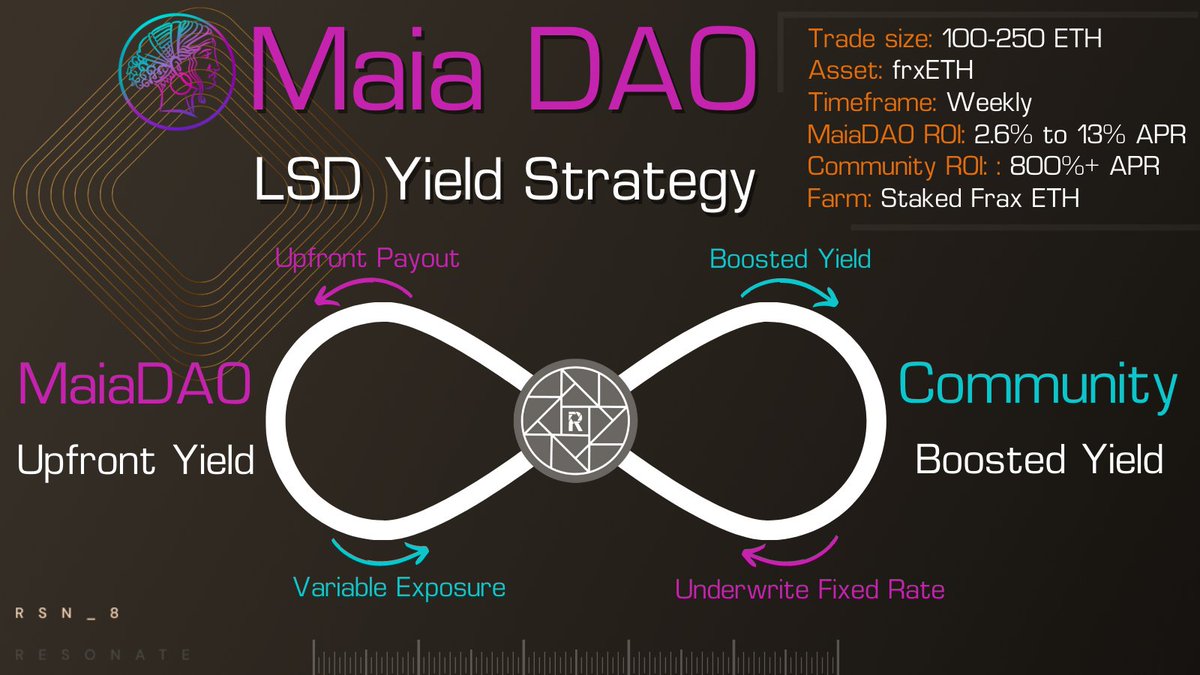

MaiaDAO

MaiaDAO is a project that has built an ecosystem on Layer 2 Metis, and recently announced a new whitepaper with improved products as follows:

- Hermes V2: ve(3,3) model built on Uniswap V3

- Talos: Platform supporting automated liquidity for Uniswap V3

- Ulysses: Multichain liquidity creation protocol using Omnichain technology

- MaiaDAO: The mother protocol of the ecosystem, also acting as a Convex-type for Hermes Protocol.

Bunni Protocol

Bunni is a protocol that builds the Curve Wars model on the liquidity of Uniswap. In addition to being a Yield Boosting, Bunni also automates liquidity management and accumulates rewards for providers. Bunni Protocol can be described as a combination of Uniswap, Balancer, and Curve Finance.

Arrakis Finance

This is a platform similar to Gamma Strategies and Unipilot. However, Arrakis has raised $4M from UniswapLabsVC, Accel, 0xPolygon, robotventures, and alphanonce.

Currently, Arrakis does not have a token, but you can follow and provide liquidity on this platform for a chance to receive an airdrop.

✨We are thrilled to announce that we have raised $4 million from a group of great investors!

This allows us to continue improving capital efficiency of decentralized exchange liquidity by building trustless market making infrastructure and strategies!https://t.co/KclcCqAKas

— ✨Arrakis Finance (@ArrakisFinance) December 19, 2022

Gamma Swap

In contrast to the above protocols, Gamma Swap is built on the Straddle strategy to counteract the risk of temporary loss for liquidity providers and opens up the potential for a “No Impermanent Loss Liquidity Wars”.

In general, if holding governance tokens that share revenue from the project is called real-yield, then providing liquidity and receiving swap fees from users is also a form of real work, real profit. Therefore, CLMM could be a model that may develop sustainably in the future with its usefulness, optimization, and absence of inflation.