Yield Farming is a term that has been mentioned a lot recently as the decentralized finance (DeFi) sector is booming more than ever. With Yield Farming, investors can earn profits from their coins. However, Yield Farming is not entirely free, and it also comes with certain risks. So what exactly is Yield Farming, where should you do Yield Farming? Is Yield Farming or Staking better? Let’s find out the answers in the content of the article below.

Contents

- 1 Understanding What is Yield Farming?

- 1.1 What is Yield Farming?

- 1.2 How Does Yield Farming Work?

- 1.3 What are the Benefits of Yield Farming?

- 1.4 Comparing Yield Farming vs Staking

- 1.5 Which is Better, Farming or Staking Coins?

- 1.6 How to Participate in Yield Farming?

- 1.7 Top 5 Most Popular Yield Farming Platforms 2025

- 1.8 Yield Farming Experience You Need to Know

- 1.9 Tools and Websites Supporting Yield Farming

Understanding What is Yield Farming?

What is Yield Farming?

Yield, roughly translated, means profit, and Farming means cultivation. Yield Farming, therefore, is profit cultivation. Simply put, Yield Farming is a way to use your cryptocurrency to earn more cryptocurrency.

Investors can earn profits from their cryptocurrency by depositing money into some DeFi protocols. This means you deposit money into a liquidity pool on a DeFi platform. These liquidity pools can be likened to banks, where you deposit your money, and then they lend it to others. You will be paid an interest rate at a certain ratio.

How Does Yield Farming Work?

The concept of Yield Farming has been around since 2020, when Compound – the first DeFi lending protocol was launched. To this day, many DeFi platforms have appeared to support Yield Farming. They operate by allowing users to deposit cryptocurrency, lend it to borrowers at interest through smart contracts, and then pay the profits back to the lender.

The farming process is quite simple; you just need to deposit your money into the platform and receive back the APY (profit) and bonus tokens of that platform.

However, note that you will have to provide a pair of currencies according to the available liquidity group.

For example: Suppose the DEX platform offers a BNB/PXP trading pair.

To be able to easily exchange BNB for PXP or PXP for BNB, a suitable amount of liquidity must be available to facilitate the exchange (i.e., BNB and PXP are available on that DEX platform).

=> This is where “farmers” like you come in. You will deposit both your BNB and PXP into this liquidity pool, with an equal amount of money. For example, $1000 worth of BNB and $1000 worth of PXP.

After depositing this pair of currencies into the liquidity pool, you will receive a percentage of the fees that borrowers have to pay to the platform. And this is how Yield Farming works.

What are the Benefits of Yield Farming?

If in the past, people thought that cryptocurrency was simply something to store value like gold, often stored in cold wallets, then Yield Farming was born and changed this way of thinking. All thanks to DeFi, it makes your cryptocurrency able to create more value. And that is the essence of Yield Farming.

Also thanks to such approaches and operations, Yield Farming has many advantages such as:

- Flexible lending time: The vast majority of liquidity pools in Yield Farming do not have a minimum lock-up time. This means you can add or withdraw money whenever you want.

- Huge profits: Depending on the trading pair you choose, you may be entitled to higher returns than you think, if the demand for borrowing from the liquidity group you Yield Farming is high.

- Additional rewards: When you deposit money into the liquidity pool (LP) of a DeFi protocol as a lender, you will earn additional tokens you have deposited, and also bonus tokens of the platform. For example, if you deposit money on Compound, you will receive COMP tokens, or if you deposit into the SushiSwap pool, you will earn SUSHI.

Currently, there are many DeFi protocols, and many offer various forms of rewards for Yield Farming, and they are often interlinked. When you deposit coin A into a certain platform, you receive coin B, which you can then use to continue “farming for profit.” By taking the time to learn and create an innovative Yield Farming strategy, you can earn a substantial profit.

Comparing Yield Farming vs Staking

If you are learning about Yield Farming, you might find it quite similar to Staking, right?

It is evident that both Yield Farming and Staking are excellent methods for earning additional income from your cryptocurrency.

So, how are they different?

The main difference between Yield Farming and Staking is that Yield Farming requires you to lock a pair of tokens, such as BNB/USDT, whereas Staking only requires you to lock a single type of token.

Additionally, there are a few other differences such as:

-

Staking mainly suits PoS coins like ADA, SOL, EOS… Meanwhile, Yield Farming is more diverse in terms of coin types.

-

The minimum lock-up time for Staking is longer, whereas Yield Farming does not require a lock-up time, allowing you to withdraw your tokens anytime.

-

Staking usually comes with a fixed APY, meaning you always know exactly how much you will receive when the staking period ends. On the other hand, Yield Farming is more volatile, so you never know exactly what profit you will make.

Which is Better, Farming or Staking Coins?

In deciding whether Farming or Staking is better, you need to consider two main issues: profit and risk, which often have an inverse relationship.

Yield Farming VS Staking: PROFIT

Ultimately, the main purpose of locking your cryptocurrency into a protocol is to make money. Therefore, the profit criteria – APY should be a top priority.

However, there is no fixed rule on how much money you can make from either Farming or Staking. It depends on:

-

Type of token: For example, if you lock popular coins like ETH, neither Farming nor Staking will yield high profits. But if you lock lesser-known and less liquid coins, like DEFC/BNB, you will certainly get a very high APY.

-

Lock-up time: APY will be higher if you agree to lock your tokens for a longer period. For example, if you decide to stake your tokens flexibly, then certainly the APY will not be as high as locking them in for 12 months.

Typically, platforms supporting staking/farming display the APY/APR for your reference in advance. The majority of profits from staking will seldom fluctuate compared to that APY. However, Yield Farming can offer you the opportunity to earn more APY, significantly exceeding the levels estimated by the platforms.

=> In summary, in terms of profit, Yield Farming tends to be more advantageous than Staking.

Yield Farming VS Staking: RISK

However, the opportunity to make money often comes with risks, and Yield Farming VS Staking is no exception. Below are the risks they will have to face:

-

Risk of opportunity cost: With Staking, when you lock your coins into a platform, as it requires a minimum lock-up time, you may miss other, more profitable investment opportunities, at which time you cannot withdraw your coins. With Yield Farming, you won’t have this issue.

-

Risk of price volatility: During the time you participate in Staking/Yield farming, the price of the coin may increase more than the profit you get from Staking/Yield farming. Then, when it’s time to withdraw, the coin’s price decreases => This risk is mainly encountered in Staking because it does not allow you to withdraw freely, while Yield Farming is somewhat limited.

-

Platform-related risks: If you are staking on a blockchain platform, it is somewhat safer, as most of them are reputable blockchains. However, if you choose staking/yield farming on a third-party platform, it depends a lot on whether this platform is reputable and decentralized. Therefore, choosing a reputable platform to lock your coins is extremely important. From this perspective, Yield Farming is riskier than Staking (because Yield Farming mainly uses third-party platforms).

-

Smart contract risks: Continuing from platform risks, although many protocols use smart contracts and have a very high level of decentralization. However, if it is not built correctly, it can be easily attacked by hackers. With this risk, Yield Farming and Staking are equally vulnerable.

=> In terms of risk, Staking faces the issue of missing opportunities when unable to withdraw freely, but Yield Farming encounters more risks related to platform and smart contract issues.

You have learned about what Yield Farming is, as well as the differences between it and Staking. However, personally, I believe the choice between Farming or Staking coins depends on each individual’s knowledge of the cryptocurrency market.

Although profit is the top priority and it seems that Yield Farming has an edge, the risks between these two methods are similar. But:

- Yield Farming: is quite complex and requires time to research thoroughly and develop a suitable farming strategy to be safe and effective. It is suitable for experienced investors, ready to accept risks for high profits. Also, Yield Farming is suitable for those who want a flexible method of depositing cryptocurrency, allowing them to withdraw money at any time.

- Staking: Suitable for new investors, holding top PoS platform coins, with long-term hold intentions. Moreover, it is also suitable for those who want to know exactly how much they will earn from locking their coins, as most profit rates are fixed. Although there are flexible staking options, their APY will certainly be very low.

How to Participate in Yield Farming?

There are many ways to participate in Yield Farming, but currently the most popular are on the Ethereum network and the Binance Smart Chain.

The highest-value DeFi platforms are on Ethereum (Aave, Curve, Uniswap, etc.), but BSC has enough large projects including PancakeSwap to compete with the Ethereum network. Platforms based on Ethereum can only use ETH and other tokens built on Ethereum – what we call ERC-20 tokens. In contrast, BSC platforms can use most types of Ethereum tokens, and also tokens running on BSC – known as BEP-20 tokens.

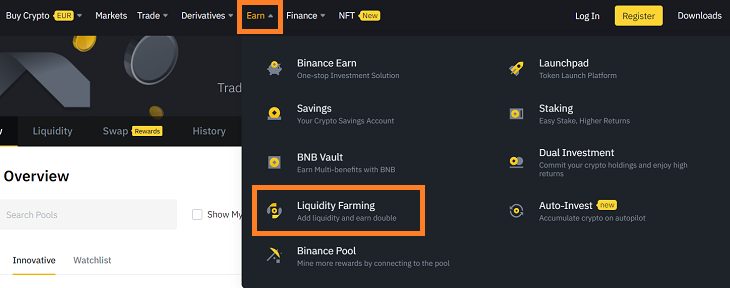

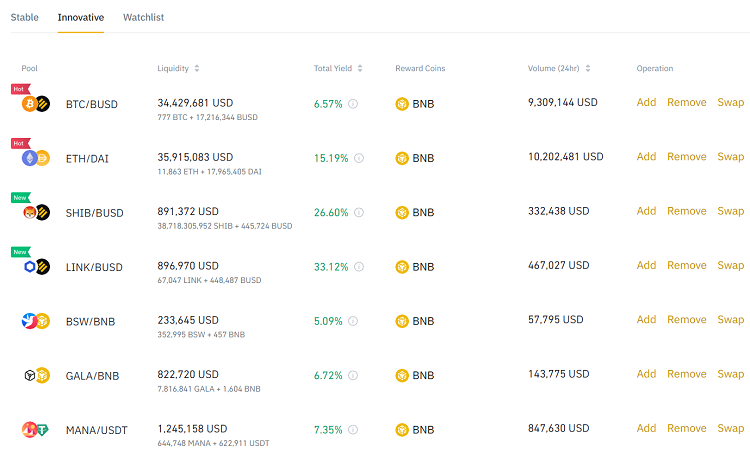

Yield Farming on Binance

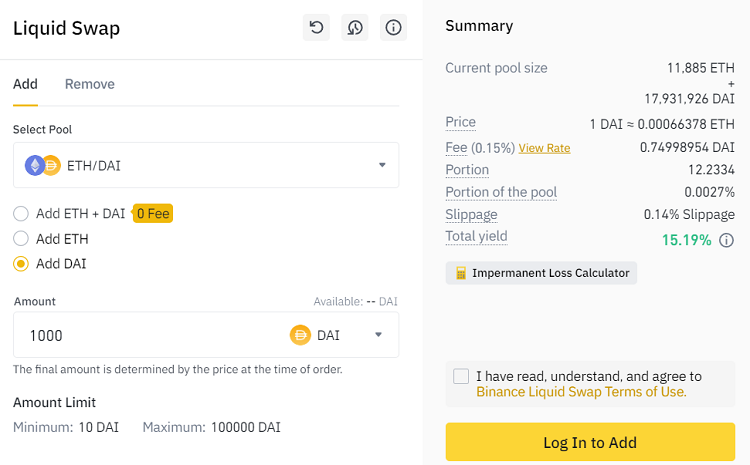

If you are trading on Binance, you can Yield Farm right on this platform. Yield Farming is the “liquidity pool” section on the interface of Binance. (You can find it in the Earn section).

Here, the interface will display various cryptocurrency pairs with the expected profit for you to choose from. If you don’t have both currencies for a liquidity pair, the system will help you convert them so that their value reaches 1:1.

After selecting a suitable liquidity pair, you just need to enter the amount of money you want to Farm. Note that if you already have both pairs of money, there will be no conversion fee, but if you only have one type of money, there will be a fee.

Yield Farming on DEX Platforms

However, if you want to buy Yield-Farming not listed on Binance, you will have to connect your cryptocurrency wallet to a decentralized exchange (DEX). Here I suggest the MetaMask wallet. These are the steps you need to take:

- Step 1: Buy BTC, ETH, USDT, USDC or DAI on exchanges (choose the coins most accepted in DeFi protocols. Also, buy some ETH to pay for gas fees as DeFi protocols on Ethereum will need ETH to pay this fee).

- Step 2: Download MetaMask wallet, install, create an account, and make sure you master the steps of depositing – withdrawing money from MetaMask to exchanges and know how to use this wallet. Note that if you want to use Bitcoin for Yield Farming, buy wBTC on the exchange instead of BTC.

- Step 3: Connect to DEX from the wallet, you can choose one of the DEX platforms I presented below. At this point, you will be asked to connect your wallet. Click on the MetaMask option, then log into your MetaMask.

- Step 4: Choose Yield-Farming and select the liquidity groups you want to join. MetaMask will pop up asking you to confirm two transactions. The first is interaction with the Compound smart contract, the second is to confirm the transaction. Both will incur gas fees paid in ETH, which is why we noted you should buy ETH in step 1.

Top 5 Most Popular Yield Farming Platforms 2025

Having learned about what Yield Farming is, you probably know there are quite a few platforms providing this service. Some platforms are quite easy to use, but some require a bit of knowledge. We have classified them according to difficulty as follows:

- Easy Mode: Compound Finance, Maker DAO, Aave

- Medium Mode: Uniswap, SushiSwap, Synthetix, Curve Finance, Yearn Finance, Badger DAO, Cream Finance, Balancer

- Professional Mode: Alpha Homora, Mirror Protocol, Metastable, Loopring, dYdX

But according to personal assessment, below are the 5 most popular platforms, chosen by many investors for Yield Farming:

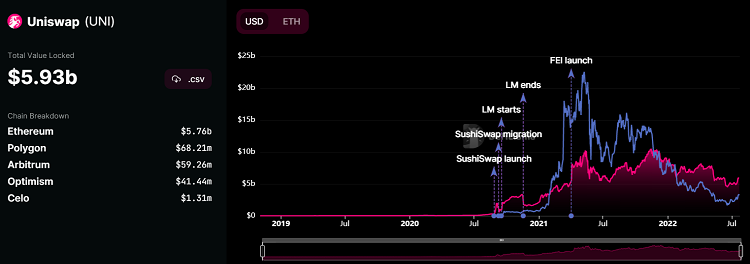

Yield Farming on Uniswap

Uniswap is the most famous decentralized exchange (DEX) today, specializing in providing exchange transactions for thousands of ERC-20 tokens, and you can participate in Yield Farming on Uniswap. Interest rates on Uniswap and all other DEXs vary according to the liquidity pool and market fluctuations. Currently, there are two main versions of the platform, Uniswap V2 and V3.

Yield Farming on Aave

Aave is a prominent name in the DeFi field with its TVL consistently ranking at the top. It is a decentralized platform on Ethereum (and Polygon sidechain) providing low-interest cryptocurrency loans and borrowings. Because many investors have deposited a lot of cryptocurrency into Aave to earn interest, its borrowing APR is one of the best in the market. Different stablecoin loans (such as DAI, USDC, and USDT) vary from 3% APR to 7% at the time of writing.

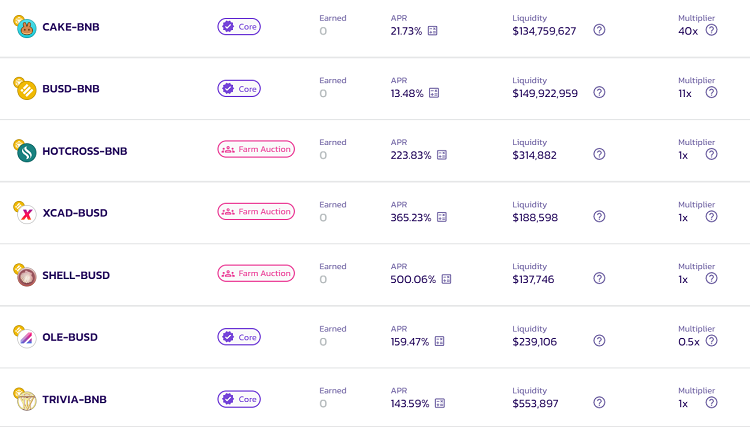

Yield Farming on PancakeSwap

PancakeSwap, like Uniswap, is a decentralized exchange (DEX). It operates similarly to Uniswap but is on the Binance Smart Chain (BSC) instead of Ethereum and has additional features focused on gamification. Although it runs on BSC, many Ethereum-based tokens can still be Yield Farmed on its platform.

Yield Farming on Curve Finance

Curve Finance is a major DEX, consistently in the top 5 in terms of TVL value. This platform also uses locked funds more efficiently than any other DeFi platform with its unique market-making algorithm. This benefits users who perform Yield Farming on Curve. Notably, Curve has a long list of stablecoin groups pegged to fiat currencies (mainly USD) with APRs better than many other DEXs.

Yield Farming on Yearn Finance

Yearn Finance (YFI) offers a unique aggregator and yield farming tool to always provide users with the highest possible profit. Additionally, Yearn is tightly integrated with Curve Finance, with over 30 Curve pools integrated into Yearn, where investors can deposit one of five different cryptocurrencies (ETH, WBTC, DAI, USDT, or USDC) into a smart contract that deposits into the corresponding pool on Curve to earn interest.

Yield Farming Experience You Need to Know

Considerations Before Starting Yield Farming

To participate in Yield Farming with the aim of maximizing profits and minimizing risks, you need a correct strategy, and keep in mind the following points.

First: Only Yield Farm when both coins move in the same direction.

- Both increase in price: When the coin price increases, the value of the rewards received also increases.

- Both decrease in price: When both tokens decrease in price together, you can continue to farm to receive rewards.

Do not Farm when two coins move in opposite directions. Because when coin A increases and coin B decreases, the opposite directions will have significant impacts on the value of the rewards you can receive in the farming pools, while also carrying a high risk of slippage.

Second: Prioritize Farming stablecoin pairs if you fear risk

You can farm stablecoin pairs with potentially lower rewards, but these pairs are safer and not affected by market fluctuations.

Third: Do not withdraw liquidity if the coin price has not recovered

For long-term coin pairs, when their price drops below the level you bought them at, you should continue farming and wait for the token price to recover so as not to incur losses while still receiving rewards.

Third: Limit Yield Farming during strong market fluctuations

During strong market fluctuations, large price disparities can occur, and the coins used for farming will also be affected. You need to carefully consider when deciding to Yield Farm at these times.

When to Start Yield Farming Coins?

Step 1: Find liquidity pools with high Rewards.

Step 2: Choose assets with low volatility (over a period).

Step 3: Join quickly, before TVL increases ⇒ High Rewards.

Step 4: Once you receive Reward tokens, you can convert 50% to Stablecoin.

Step 5: The remaining 50% can be optimized based on TVL.

When Should You Pause Yield Farming Coins?

There are 2 cases you need to consider if you want to decide to temporarily pause Yield Farming:

- When the TVL (Total Value Locked) of the liquidity pool increases rapidly ⇒ Rewards decrease.

- When TVL no longer increases and starts to decrease: Early farmers with a large amount of assets begin to “take profit” to preserve capital, so those who join farming later will no longer earn as much profit.

Tools and Websites Supporting Yield Farming

If you want to become a professional investor in Yield Farming, just operating on platforms is not enough; you need to continuously learn and update information about the platform you are participating in for Yield Farming.

There are many websites/tools for support, you can refer to:

- DeFiPulse.com: It’s like CoinMarketCap for DeFi. All market capitalization data, TVL, and related rankings you need to research can be easily found on DeFi Pulse.

- Zapper.fi: A convenient DeFi aggregator that helps keep track of all your investments, farms, and profits. Use Zapper to find updated information on APY profits on different platforms.

- Instadapp.io: A DeFi manager that helps you manage liquidity on protocols like Uniswap and Aave. Particularly, it features a Smart Account that helps you automatically optimize your profits.

- Debank.com: An all-encompassing DeFi platform with an investment portfolio manager, token swaps, DeFi market, a list of DeFi projects, and a DeFi TVL ranking page.

This is all the information about what Yield Farming is as well as advice on the most efficient Yield Farming experience. I hope this article is helpful and can support you in the process of Yield Farming coins. If you have any questions or encounter any issues, please leave a comment below for my response. Wishing you successful investments.