USDT is known as the stablecoin with the largest market capitalization and trading volume currently. However, if you are a new investor, you might notice that USDT does not increase in value like other coins but hovers around 1 USD. Why is that, what is USDT? What role does it play, and how to trade and invest with USDT will be answered by us right here.

What is USDT? Why is it only valued at 1 USD?

What is Tether?

Tether (Tether Limited) is a platform that allows fiat currencies to be used on blockchains, through the issuance of Tether coins/tokens equivalent in value.

Originally, Tether tokens were created to develop on the Bitcoin network. The main goal was to make fiat currencies more compatible with cryptocurrency assets and enable 24/7 transactions. However, Tether later expanded to several other blockchains.

Tether tokens (symbol: ₮) are cryptocurrencies whose value is backed 100% by fiat currencies at a 1:1 ratio issued by the Tether company. One Tether token (₮) is valued equal to one unit of the fiat currency backing it.

Tether has issued 5 tokens backed by different fiat currencies:

- Tether USD (USD₮), backed by the US Dollar (USD), commonly known as USDT

- Tether Gold (AUX₮), backed by gold prices

- Tether Euro (EUR₮), backed by the Euro (EUR)

- Tether MXN (MXN₮), backed by the Mexican Peso (MXN)

- Tether Yuan (CNH₮), backed by the Chinese Renminbi (CNH)

What is USDT?

USDT is a fiat-backed stablecoin pegged to the USD at a 1:1 ratio, issued by Tether in 2014. USDT was created to increase market liquidity and reduce risk from price volatility of other cryptocurrencies. Over 8 years of development, USDT is now the stablecoin with the largest market cap of about 68 billion USD.

Read the article What is a Stablecoin to understand more about the nature of this virtual coin.

As Tether (USDT) is a Stablecoin pegged 1 – 1 with the USD, its price always hovers around 1$.

Initially launched in July 2014 as Realcoin, it was renamed USDT in November of the same year.

What is the role of USDT?

Tether (USDT) was created with the following roles:

-

USDT was created to bridge fiat currencies (the money we use for daily purchases) and cryptocurrencies, making crypto transactions transparent, stable, and minimizing investment transaction costs.

-

Maintain stability in cryptocurrency pricing instead of the unpredictable ups and downs like other virtual currencies such as Bitcoin or Ethereum.

-

USDT is often used to buy and trade other types of cryptocurrencies. It is backed by fiat currency.

-

Crypto transactions using USDT for payment are much faster than using fiat currencies. It’s like using Thai Baht for expenses when traveling in Thailand instead of using VND or Renminbi.

-

Eliminate unnecessary conversion costs between fiat and cryptocurrencies.

Why is Tether’s USDT controversial?

Tether’s USDT has been controversial among investors for being alleged as fabricated and lacking enough cash to peg to the USD. Specifically:

- In November 2017, Tether’s website announced that “30,950,010 USDT was stolen from Tether Treasury and transferred to an anonymous Bitcoin address”. This incident raised many controversies around Tether, especially regarding the transparency of its Reserve funds.

- On August 25, 2019, New York’s Attorney General Letitia James sued Tether, BitFinex, and their parent company iFinex for violating New York’s laws. The reason cited was Bitfinex’s deposit of 850 million USD with Crypto Capital to avoid banking-related activities or, in other words, money laundering. When Bitfinex requested a withdrawal, the organization didn’t return the funds, causing Bitfinex to freeze user accounts. BitFinex then borrowed about 850 million USD from Tether’s Reserve to cover its deficits and return assets to users.

- In February 2021, Tether and Bitfinex had to pay a fine of 18.5 million USD. They were also ordered to cease trading with residents or institutions of New York State. In October 2021, Tether was fined 41 million USD by the Commodity Futures Trading Commission (CFTC) for the statement “Tether is 100% backed by USD”. Bitfinex was concurrently fined 1.5 million USD.

- According to CFTC’s investigation, based on data from 2016 to 2018, Tether only had about 27.6% reserve for USDT instead of the initially claimed 100%. In March 2019, Tether had to redeclare that Tether tokens are not 100% backed by USD but by reserve funds, including traditional market assets and cash-equivalent assets, as well as receivables from lending activities.

Overall, controversies around Tether (USDT) are numerous, but to date, Tether is still predominantly used in cryptocurrency transactions. Currently, most Bitcoin and cryptocurrency market transactions are made with Tether, and USDT is the stablecoin with the largest market capitalization at this time.

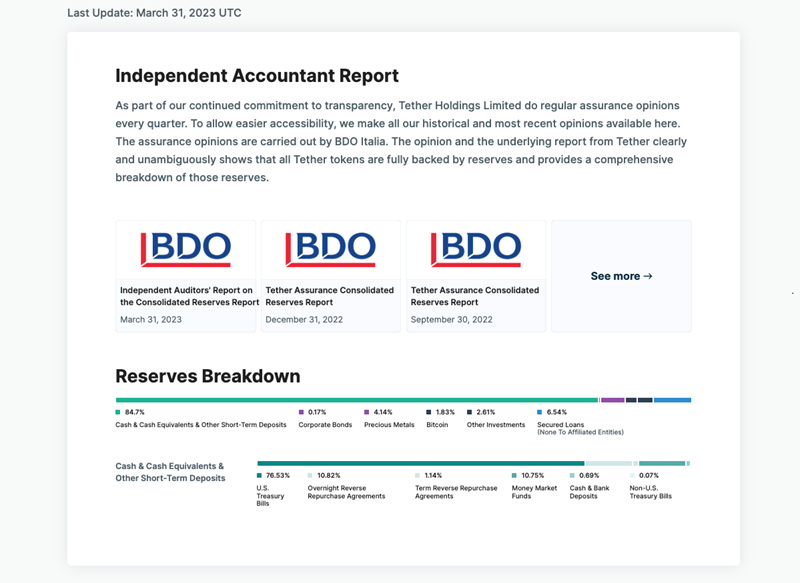

Tether’s Reserve Asset Ratio

When learning about what USDT is, the most important thing is to understand the reserve situation of the company creating it. Tether’s website publishes financial reports on the assets they hold. The latest report was conducted on March 31, 2023, and users can refer here.

How does Tether USD (USDT) operate?

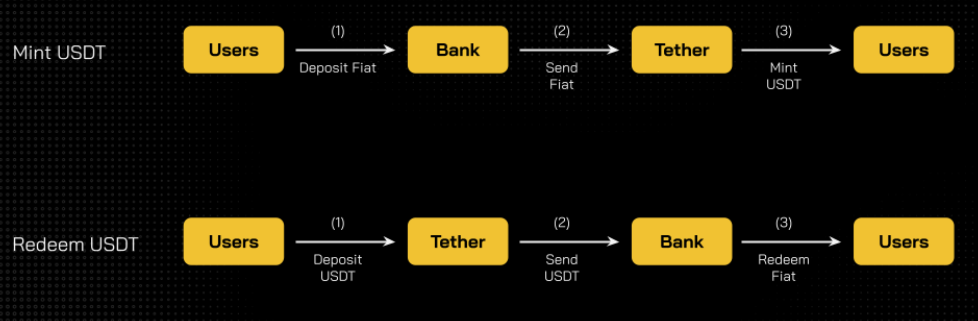

Investors use real USD to buy USDT from Tether, and this money is transferred to Tether’s Reserve.

Tether then creates an equivalent amount of USDT tokens and transfers them back to the investor’s account.

Investors use these USDT to buy other types of cryptocurrencies like Bitcoin, Ethereum, XRP…

When investors want to withdraw money from Tether, they sell their USDT back to Tether, and Tether transfers fiat money back to their account. The USDT collected by Tether is then burned to maintain the 1:1 ratio between USDT and USD.

Should you invest in Tether USD (USDT)?

What is USDT and should you invest? This is a question of interest to many people. Therefore, dautux.vn will answer for you to understand more about the advantages and disadvantages of investing in Tether USDT:

According to Invest286.com, if you want to get rich from cryptocurrency investment, USDT is not a smart choice due to the disadvantages mentioned above. You can use USDT for trading other cryptocurrencies instead of investing in it.

Frequently Asked Questions About Tether (USDT)

Currently, Tether is linked to many platforms like Omni, Ethereum, Tron, EOS, Liquid, Algorand, SLP, Solana, so there are types of Tether like USDT – Omni, USDT – ERC20 (ERC20 is Ethereum’s standard), USDT – TRC20 (TRC20 is Tron’s standard), etc. Presently, USDT is available on about 60 blockchains, while USDC is on 58 and BUSD on 33. This reinforces USDT’s position compared to other stablecoins in the cross-chain trend

To date, no one has a definitive answer to this question, but the currency is still operational and chosen by many investors for cryptocurrency transactions.

– USDT is currently the largest and oldest stablecoin in terms of market capitalization.

– The operational model of USDT is quite simple: users deposit fiat money into Tether to mint USDT. Redeem by doing the opposite.

– Despite leading the stablecoin race, USDT still has weaknesses regarding the transparency of reserves for USDT and its relationship with Bitfinex.