Tokenomics has become a popular term in recent years. Projects with well-designed tokenomics are more likely to succeed in the long term, as their teams have effectively encouraged investors to buy and hold their tokens for an extended period. Conversely, projects with poor tokenomics are bound to fail, as people quickly sell off their tokens at the first sign of trouble. So, what exactly is tokenomics? How do you properly read and analyze tokenomics? Let’s explore these details in the content below.

Contents

Understanding What is Tokenomics

What is Tokenomics?

Tokenomics is a term formed by combining two words: Token (Cryptocurrency) and Economics. Therefore, Tokenomics refers to the economy of cryptocurrency (or the economy of the coin you are considering).

Tokenomics represents the economic model of Crypto assets in the Blockchain world. More specifically, for each project, the development team designs the number of tokens to suit their operational mechanisms. After designing, how the tokens are allocated, the unlocking schedule, whether there is a token burning policy or not, all these aspects are related to tokenomics.

For a coin project to function well, besides owning good technology, it must design its tokenomics reasonably. Tokenomics is usually designed in the early stages of a project and plays an important role in the project’s operation. Projects with less experience may face significant developmental impacts due to poorly designed tokenomics.

The Importance of Tokenomics

To understand the concept of tokenomics more clearly, let’s delve deeper into its importance. Typically, if you invest in a coin project, it will involve the following participants:

- Team and advisors

- Initial sponsors

- Major investors (whales, investment funds)

- Exchanges

- Market Makers (important players in controlling and regulating market prices)

- Small investors, like us

So, who are the masters in this game? They are the market makers, developers, and large investment funds. And we – the small investors – are essentially participating in the game set by these initial players.

What we buy is the token and place our trust in it. But these tokens are built by skilled developers, builders, and market makers. In the short term, the crypto market is a Zero-sum game, where everyone wants to make money. So who will lose? Tokenomics explains the operation of this process. If you look at a project where tokens are sold early to sponsors, or are heavily held by whales, you might just be their “prey.”

Moreover, if a coin project does not control the number of tokens distributed in the market well, it will suffer significant inflation over time. Would you want to buy a coin that doubles or triples in quantity after some time? Certainly not, as it would lead to an unstoppable decline in value.

Therefore, understanding what tokenomics is and how projects operate the tokenomics of their coins is extremely important in making investment decisions.

Guide to Reading and Analyzing Tokenomics

This section is quite lengthy, but it is very necessary for everyone, so please do not miss it. Typically, when examining the tokenomics of a project, you should pay attention to the following information:

Token Supply

If you look up information on CoinMarketCap or Coingecko, you will see three concepts related to the supply of the coin, including:

Total Supply is the total supply or the total amount of Coin/Token in circulation and locked, minus the amount of Coin/Token that has been burned. Total supply is divided into two types:

- Fixed total supply: the maximum initial supply is predetermined and does not change. Many coins have a fixed total supply. For example, the initial total supply of Bitcoin is 21 million BTC, and of Uniswap is 1 billion UNI…

- Unlimited total supply: can increase or decrease during the project’s operation. It may increase due to mining (e.g., ETH depends on the performance of the Ethereum network) or decrease due to coin burning (e.g., BNB initially had a total supply of about 200 million BNB but later only 100 million BNB due to burning).

- Continuously changing total supply according to the Issue-Burn mechanism. Most are found in Stablecoins like USDT, USDC, DAI…

Circulating Supply: is the supply currently circulating in the market (i.e., how many coins have been unlocked and can be traded, not burned).

Max Supply: This is a concept added by Coingecko and CoinMarketCap but is often confused with Total Supply. In reality, it determines the maximum number of tokens that will exist, including those to be mined or available in the future.

*** We find the most important are Total Supply and Circulating Supply. Try comparing these two supplies and answer the following questions ***

– What is the maximum total supply?

– How much is the circulating supply, and what percentage does it represent of the maximum supply?

– How will the unlocked tokens be released, and what is the schedule?

The essence you need to understand is that a coin will increase in value if its quantity in the market gradually decreases. Conversely, if its quantity increases rapidly, it will quickly lose value (also known as inflation).

Setting aside issues of utility and technology, from the perspective of supply, you must always understand the circulating supply (Circulating Supply) and how the total supply (Total Supply) will change over time. Prioritize projects with a high Circulating Supply/Total Supply ratio, have a coin burning mechanism, or have a moderate and reasonable coin release schedule.

Market Cap & Fully Diluted Valuation

Market Cap: is the market capitalization of the project with the number of tokens circulating in the market at that time. From the Circulating Supply, we can calculate the Market Cap.

- Market Cap = Circulating Supply * Token Price

Fully Diluted Valuation (FDV): is the market capitalization of the project but calculated with the total number of tokens both circulating and yet to be unlocked. From the Total Supply, we can calculate the FDV.

- FDV = Total Supply * Token Price

Why does market capitalization affect growth potential more than price? For example, a project with token A has a Market Cap of $10,000,000:

- If the project issues 10,000,000 A tokens ⇒ Each A token = $1.

- If the project issues 10,000,000,000 A tokens ⇒ Each A token = $0.001.

The number of tokens issued can vary from tens of thousands to several billion, but market capitalization is the crucial factor affecting a token’s growth potential.

Therefore, many think simplistically that buying low-priced coins makes them more likely to increase in value. For example, Shiba Inu’s current price is 0.00001169 USDT, but importantly, its initial total supply was 1 quadrillion SHIB. Meanwhile, YFI costs 8940 USDT, which may seem expensive, but do you know its total supply is only 36,666 YFI?

Hence, when considering what tokenomics is and its potential, look at the market capitalization. A coin with potential for significant long-term price increases must also meet the requirement of not having too large a market cap. If the market cap is already high, the chance to double or triple its value is much harder compared to smaller cap coins. Moreover, if your coin project is about to release many new coins, its price will certainly decrease significantly, as this will push the market cap very high.

Token Governance

Currently, there are over 14,000 different coins in the market. However, not every token is entirely decentralized like Bitcoin; some tokens/coins are still governed centrally. I will categorize them into three basic types:

- Decentralized Tokens are those whose governance is entirely decided by the community and not subject to any organization’s control. Examples: Bitcoin, Ethereum,…

- Centralized Tokens are those whose governance is decided by a leading organization, which can influence the project’s nature that the token represents. These are often full-backed stablecoins like Tether, TrueUSD; or exchange tokens like Huobi, FTX, or projects with a centralized governance model like Ripple,…

- From Centralized to Decentralized: There are also coins/tokens initially governed centrally, then gradually decentralized to the community.

Example: Binance Coin was initially fully managed by Binance. But after launching Binance Smart Chain and the “Validator Spotlight” program, Binance has been progressively decentralizing the BSC network and BNB token for user control. This is a significant plus point.

=> When evaluating tokenomics from a governance perspective, I advise choosing coins with the highest possible level of decentralization. Only then can investors protect their interests the most. Avoid project owners who build operating mechanisms to benefit themselves the most and then abandon the project.

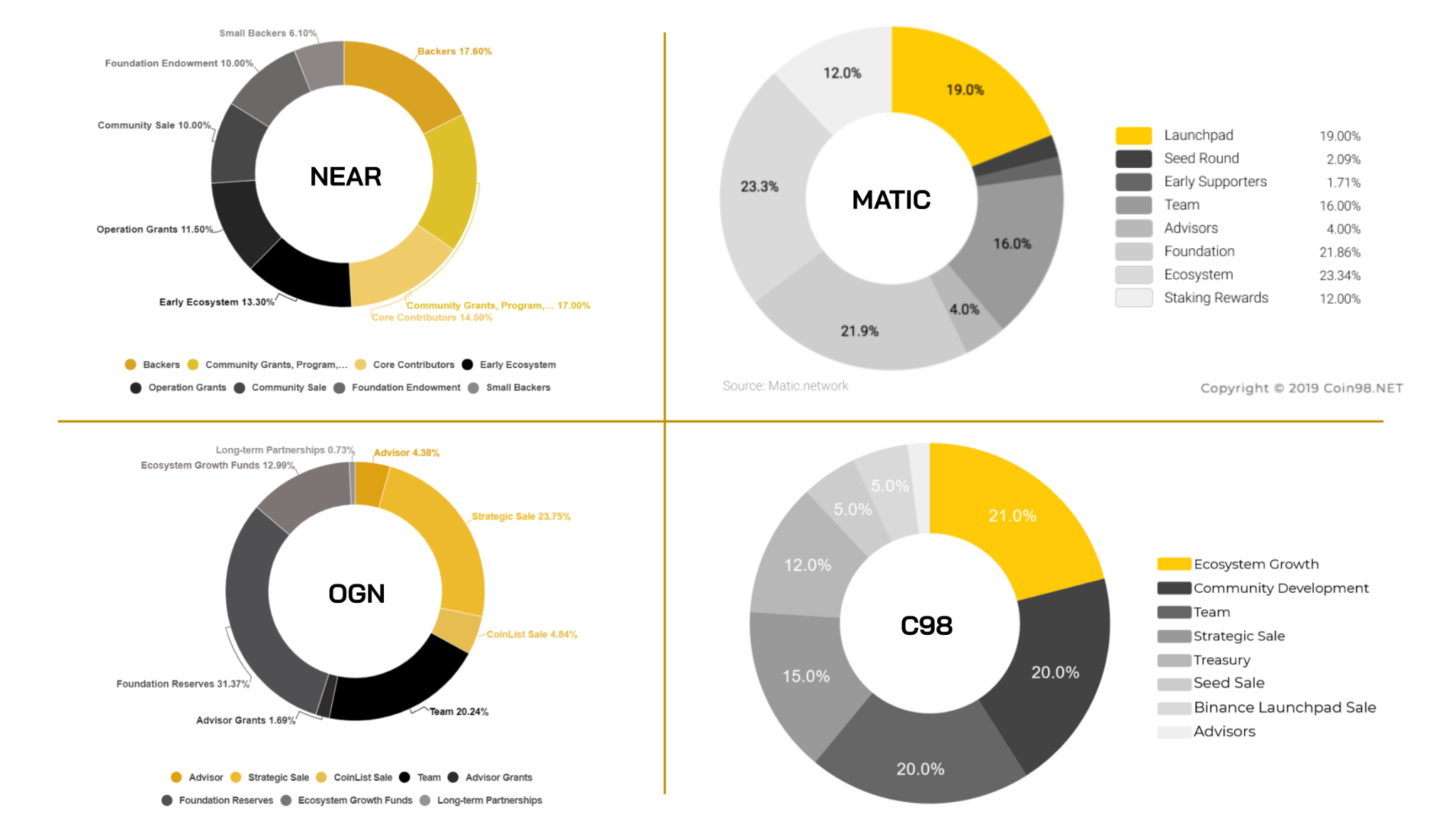

Token Allocation

Token Allocation will help you know if the token distribution among the Stakeholder groups is reasonable and their impact on the overall project.

- Team : This part is for the project development team. It includes tokens for members contributing value to the project like founders, developers, marketers, advisors, etc. The ideal figure is usually about 20% of the total supply.

– If this ratio is too low, the project team will lack motivation to develop the project in the long term.

If this ratio is too high, the community will lack motivation to hold the project’s tokens, as they are being overly influenced by one entity. This can lead to issues such as centralization of power and high manipulation risks.

- Foundation Reserve: The reserve is the project’s provision for developing products or features in the future. This token allocation does not have a specific amount and typically represents about 20-40% of the total supply.

- Liquidity Mining: This portion of tokens is minted as rewards for users who provide liquidity to DeFi protocols.

- Seed/Private/Public sale: These are tokens allocated for fundraising rounds to develop the product. Projects typically have three sales rounds: Seed sale, Private sale, and Public sale (details in the Token Sale section).

- Airdrop/Retroactive: To attract initial users, projects often airdrop a small portion of their token allocation. This typically represents about 1-2% of the total supply.

- Other Allocation: Depending on the project, there may be a part of the Allocation for specific cases, such as Marketing, Strategic Partnerships, etc. These usually have a small proportion and may be included in the Foundation Reserve.

Observing various coin projects through different stages, I’ve noticed some differences:

-

2017 – 2018: Public Sale represented over 50%, Insider held less. Examples: ADA, ETH, XTZ, ATOM,…

-

From 2019 onwards: Public Sale represented 20 – 30%, Insider held the largest share. Examples: NEAR, AVAX, SOL,…

Here, Public Sale refers to tokens sold to the community, while Insider includes the development team, investment funds, etc.

Simply put, in the past, tokens of projects were not widely used in ecosystems, and they needed capital for development. Currently, the market has seen the emergence of large investment funds, and tokens are more utilized within platforms. Therefore, Insiders and Foundations will hold a large portion of the tokens in the market.

Token Release

Token Release is the distribution plan of a project’s tokens into the circulating market. Similar to Token Allocation, Token Release significantly impacts the token’s price and the community’s motivation to hold. Currently, there are two types of token allocation in the market:

Token Allocation According to a Predetermined Schedule

Each project has a different token release schedule, but they can be categorized into the following time frames:

Under 1 year: Projects releasing 100% of tokens within a year indicate that the team does not commit long-term to the product they are building and cannot create much value for the platform and its token.

3 – 5 years: This is the ideal timeframe to release 100% of tokens, as the crypto market changes rapidly. Therefore, 3 – 5 years is an optimal number to motivate the team’s development and the community’s token holding.

Over 10 years: Except for Bitcoin, projects with a token release schedule up to 10 years will struggle to motivate holders as they face token inflation for up to 10 years, and there’s no guarantee that the team will operate effectively during this time.

=> Thus, the number of tokens released must be designed to balance the following two factors:

- The interests of token holders when holding the platform’s token.

- The value of the number of tokens released daily (inflation).

- If the number of tokens is released too quickly compared to the project’s operational efficiency, the token price will tend to decrease as users lack the motivation to hold.

Token Allocation Based on Usage

To address the issue of inflation occurring too quickly compared to the initial plan, some projects have chosen to release tokens based on specific criteria rather than a predetermined schedule. This mechanism is quite effective as it can help stabilize the token’s price if applied sensibly.

For example, MakerDAO doesn’t have a specific token release schedule. Depending on the actual usage on the platform, the number of MKR tokens will be allocated appropriately ⇒ MKR tokens are released only in activities like Lending or Borrowing.

Token Sale

Token sale can be seen as a way to raise capital by selling shares, similar to traditional companies in the conventional market. However, in the crypto market, shares are replaced by tokens.

While traditional companies may have about five funding rounds, crypto projects typically have three token sale rounds to raise capital. The average valuation for companies in traditional markets can vary depending on industry, region, and size. However, by Series C, strong companies can value themselves at over 100 million dollars.

- Traditional Company: Pre-seed, Seed, Series A, Series B, Series C.

- Crypto Project: Seed Sale, Private Sale, Public Sale.

In the crypto market, the average valuation is lower since it is a relatively new market with a smaller market cap compared to the stock markets of some major countries.

The process of coin/token sales from Seed to Public sale.

- Seed sale: the first token sale round of a project. In this round, most projects have not yet completed their product. The investors in Seed Sales are mostly venture capital funds, accepting high risks for potentially significant rewards if the project succeeds.

- Private sale: While Seed sales are mainly for venture capital funds, Private sales involve more prominent and reputable investment funds.

- Public sale: the token sale round for the community. Projects may launch tokens as ICOs like in 2017, or through third parties as IEOs or IDOs.

- Fair token distribution: Many projects do not sell through any format but distribute tokens through activities like Airdrops, Testnets, Staking, Liquidity Providing, etc. These activities help the project become more “equal” to the interested community and reach more users.

Some notable Fairlaunch Projects include Sushiswap (SUSHI), Uniswap (UNI), Yearn Finance (YFI),… They did not sell tokens in any format to raise funds but distributed tokens to actual platform users.

If there is a significant price difference between each sale round, earlier investors have to endure longer lock periods. Conversely, investors buying at higher prices get their tokens unlocked sooner. However, I believe a good project should not have too large a price difference between Private/Seed sale and Public sale to avoid pump-and-dump scenarios with new investors.

Token Use Case

Many decent projects have tokens that are not very attractive. Why? Perhaps because their tokens don’t have many uses (other than for speculation).

Therefore, the token’s Use Case, which is the purpose of the token, is the most important factor in tokenomics, helping investors evaluate a token’s market value based on the benefits it offers to holders.

Typically, tokens have the following functions:

- Staking: Most projects support Staking for their native tokens. This creates an incentive for users to hold tokens due to additional token distribution as interest. Without a Staking mechanism, token holders would face inflation as new tokens are minted into circulation daily. Additionally, Staking reduces the number of tokens in circulation, reducing selling pressure and facilitating price growth. For networks using Proof-of-Stake, increased staking also makes the network more decentralized and secure.

Example: Cardano (ADA) grew from $0.2 to $2 (a 1,000% increase) since early 2021. Theoretically, the capital inflow into Cardano should have been 10 times higher for such growth. However, in reality, the capital inflow was much lower. Cardano’s strong growth is due to 75% of circulating ADA being staked, reducing selling pressure and motivating ADA’s growth.

- Liquidity Mining (Farming): For DeFi tokens that have become popular recently. Users can use them to provide liquidity to DeFi protocols and receive the project’s native token as a reward.

- Network Fees (Transaction fee): To execute a transaction, users need to pay a fee to the network, specifically to Validators to confirm their transactions. Each blockchain network has its native token used to pay network fees (typically blockchain platform projects).

Example: Ethereum uses ETH, Binance Smart Chain uses BNB, Solana uses SOL, Polygon uses MATIC…

- Governance: Token holders can propose and vote on changes to the platform they participate in. Proposals can relate to transaction fees, token unlocking speed, or any other blockchain-related changes.

- Other Benefits (Launchpad, etc.): This is one of the important factors that keep tokens circulating and create a strong incentive for users to hold tokens. Launchpad projects usually require users to stake tokens to participate in sales, or for benefits like participation in NFT raffle programs, etc.

Tokenomics of Top Coins Today

You’ve learned what tokenomics is and how to read and analyze the information in tokenomics. Now, let’s briefly explore a few of the top coins today to see how their tokenomics work and why they are favored by many investors.

Tokenomics of Bitcoin (BTC)

BTC has a relatively stable tokenomics system where the total supply will be created over 140 years. There will be 21,000,000 BTC created, with the rate halving (Bitcoin Halving) every 4 years or longer. Currently, over 19,000,000 BTC exist, meaning only about 2,000,000 BTC will be issued in the next 120 years.

Token Allocation Based on Demand

To address the issue of rapid inflation compared to the initial plan, some projects have opted to release tokens based on specific criteria instead of a fixed timeline. This approach can help stabilize the token’s price if applied appropriately.

For example, MakerDAO does not have a specific token release schedule. The number of MKR tokens allocated depends on the actual demand on the platform ⇒ MKR tokens are released for activities like Lending or Borrowing.

Token Sale

Token sales are similar to capital raising through share offerings in traditional companies. In the crypto market, shares are replaced by tokens.

While traditional companies may have around five funding rounds, crypto projects typically have three token sale rounds. The valuation of companies in traditional markets varies across industries, regions, and scales. However, by Series C, well-established companies can value themselves over 100 million dollars.

- Traditional Company: Pre-seed, Seed, Series A, Series B, Series C.

- Crypto Project: Seed Sale, Private Sale, Public Sale.

For the crypto market, the average valuation is lower as it is a relatively new market with a smaller market cap compared to major country stock markets.

The process of coin/token sales from Seed to Public sale includes:

- Seed sale: the first token sale round of a project. Most projects at this stage are yet to have a finished product. Investors in Seed Sales are mostly venture capital, willing to take high risks for potential high rewards.

- Private sale: While Seed sale targets venture capital funds, Private sales involve larger and more renowned investment funds.

- Public sale: the token sale round for the community. Projects may launch tokens as ICOs in 2017, or through third-party platforms as IEOs or IDOs.

- Fair token distribution: Many projects don’t sell through any format but distribute tokens through activities like Airdrops, Testnets, Staking, Liquidity Providing, etc. These methods help the project become more “equal” for the interested community and reach more users.

Some notable Fairlaunch Projects include Sushiswap (SUSHI), Uniswap (UNI), Yearn Finance (YFI), etc. They did not sell tokens in any format to raise funds but distributed tokens to actual platform users.

If the price difference between each sale round is high, early investors endure longer lock periods. Conversely, later investors buying at higher prices get their tokens unlocked sooner. However, I believe a good project should not have a large price difference between Private/Seed sale and Public sale to avoid pump-and-dump scenarios for new investors.

Token Use Case

Many decent projects have tokens that are not very attractive, possibly due to limited use cases (beyond speculation).

Thus, a token’s Use Case, which is the purpose of the token, is the most important aspect of tokenomics. It helps investors evaluate a token’s market value based on the benefits it offers to holders.

Typically, tokens have functions such as:

- Staking: Most projects support staking for their native tokens, providing token distribution as interest and motivating users to hold. Staking reduces the tokens in circulation, reducing selling pressure and facilitating price growth. For Proof-of-Stake networks, more staked tokens also make the network more decentralized and secure.

Example: Cardano (ADA)’s growth from $0.2 to $2 (a 1,000% increase) since early 2021 was partly due to 75% of circulating ADA being staked, reducing selling pressure and driving growth.

- Liquidity Mining (Farming): For DeFi tokens, users can use them to provide liquidity to DeFi protocols, in return receiving the project’s native token.

- Network Fees (Transaction fee): Users need to pay a fee to Validators to process their transactions, typically using the blockchain’s native token.

Example: Ethereum uses ETH, Binance Smart Chain uses BNB, Solana uses SOL, Polygon uses MATIC…

- Governance: Token holders can propose and vote on changes to the platform they participate in.

- Other Benefits (Launchpad, etc.): Tokens can offer additional benefits like participating in Launchpad sales or NFT raffle programs.

In summary, tokenomics is an essential concept in evaluating a cryptocurrency project’s operational model, including token issuance, distribution, and use. It significantly impacts your investment, and understanding it is vital for making informed decisions. However, it’s also crucial to research other factors such as macro information, project team details, coin performance, and future applications to get a comprehensive and accurate overview.