Sei Network is a recent Layer-1 blockchain project that has made a name for itself. Sei, backed by strong investors and supporters such as Coinbase, Multicoin Capital, Stepn, and Delphi Capital, has recently announced a $120 million ecosystem fund in the past few months, making it one of the leading blockchains today. Moreover, Sei Network (SEI) has also been chosen as the 36th project for Binance Launchpool. So, what exactly is SEI coin? What makes it special? Is it a potential investment? Let’s dive into the details in the following article.

What is SEI coin, and should you invest?

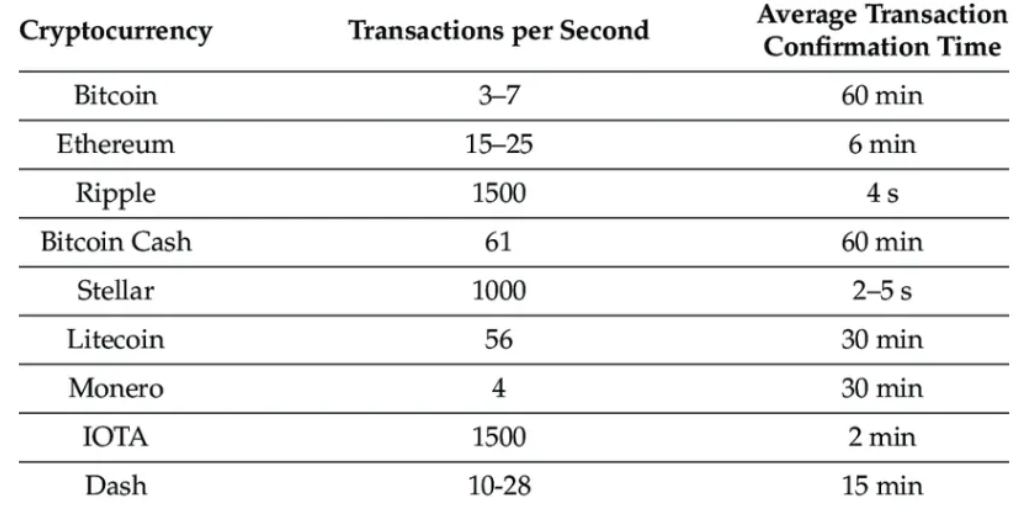

Up to the current time, most tokens have been processed using the Automated Market Maker (AMM) method due to scalability limitations in blockchain. However, as networks focus on scalability solutions like Solana and technologies like zk-rollup on Ethereum emerge, order book-based trading protocols like Serum and dYdX have started to launch.

All current decentralized order book protocols use different methods. Solana’s Serum is a decentralized application, not a blockchain network. Various DeFi protocols on Solana can use Serum’s order book to build their trading interfaces. However, Solana is a shared network, so Serum faces disadvantages when competing with other DApps on Solana. For example, if the network gets congested due to popular NFT minting, DeFi protocols using Serum’s order book will be adversely affected.

On the other hand, dYdX is developed using Starkware’s StarkEx tool and currently runs as a zk-rollup on Ethereum. dYdX can be called a synthetic application and it has the advantage of excellent optimization due to a specialized network structure for the order book feature. However, this is also a disadvantage as it has only one feature, which is trading, as dYdX requires network bridging to interact with other services, making it less versatile.

Thirdly, there is the Injective protocol in the Cosmos ecosystem. Injective is an application chain in the Cosmos ecosystem created using the Cosmos SDK and provides on-chain order book functionality. However, because it is built using the Cosmos SDK, the protocol is constrained by the Tendermint consensus algorithm. As a result, while block creation times have been reduced, the drawback is that it still has relatively slow settlement times for order book trading, around 2 seconds.

=> There is a decentralized order book protocol that claims to address the advantages and disadvantages of the three protocols introduced above. That is Sei Network. Sei Network gained attention in August with a $5 million investment from top venture capital funds such as Multicoin Capital, Coinbase Ventures, and Delphi Digital.

What is SEI coin?

SEI coin is the cryptocurrency of SEI Network, an app-chain dedicated to DeFi based on the Cosmos SDK. However, unlike other app-chains primarily focused on a single function, Sei Network also possesses Layer 1 characteristics, as it can support various DApps.

Sei Network is built on the Cosmos SDK and utilizes the Limit Order Book (CLOB). It operates as an infrastructure for decentralized finance within the Cosmos ecosystem. Since Sei Network is compatible with Inter-Blockchain Communication (IBC), all DApps built on Cosmos can leverage its IBC capabilities.

In addition, SEI coin boasts fast transaction processing speeds, with transaction processing times as low as 600 milliseconds.

Để bạn hiểu rõ hơn SEI coin là gì, cũng như công nghệ đằng sau SEI Network, chúng ta cần làm rõ những vấn đề mà blockchain giải quyết.

- Ethereum’s blockchain is not optimized for decentralized transactions, hindering the network’s development.

- Building an Orderbook-style exchange on a main chain is challenging due to network congestion.

- Current Layer 1 blockchains are too slow and cannot provide the trading experience that centralized exchanges offer.

It is evident that the drawbacks of existing app-chains are their difficulty in introducing different features because these blockchains are optimized for specific functions. Conversely, the drawbacks of Layer 1 blockchains are their difficulty in creating the most optimized operating environment for a specific DApp, despite their ability to support various DApps.

=> Sei Network (SEI) serves as an intermediary between app-chains and Layer 1. Because it is created using the Cosmos SDK, it can optimize the blockchain for DeFi functionality and, at the same time, provide an environment where multiple different DeFi services can be deployed, allowing them to easily interact with each other. Furthermore, Sei Network aims to become a high-performance DeFi hub within the Cosmos ecosystem by enabling DApps on top to fully utilize specialized order book features for DeFi trading.

Here are the key differentiators between Sei Network and other blockchain networks:

- CosmWasm & IBC

- Công cụ khớp lệnh tự nhiên

- Optimisitc Block Production

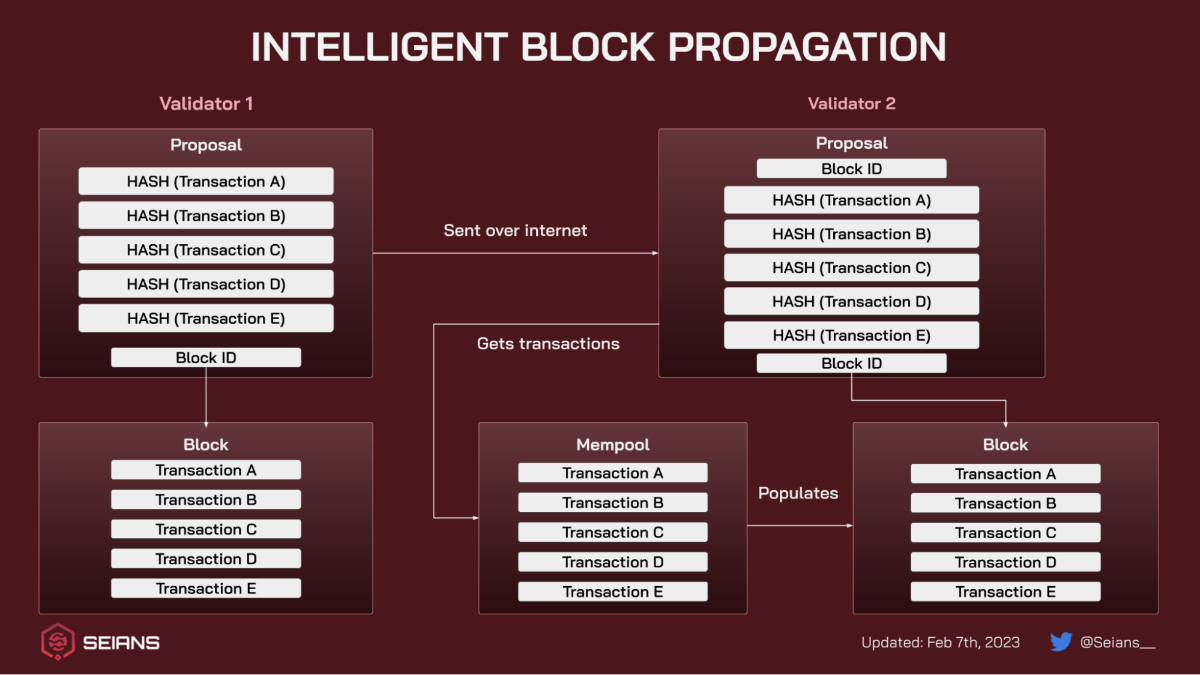

- Intelligent block propagation

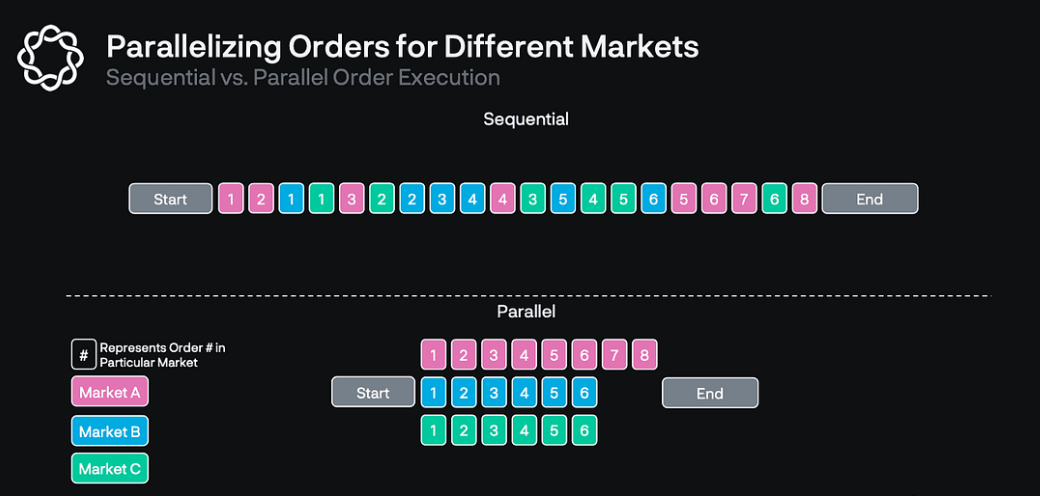

- Parallel Order Execution

- Frontrunning Prevention

- Oracle Pricing

- Order Bundling

Thanks to the features mentioned above, Sei Network can achieve high throughput and low latency. To delve deeper into SEI Network’s technology, let’s explore it further in the section below.

What sets Sei Network’s technology apart?

- CosmWasm & IBC: Because Sei Network is a Cosmos SDK-based blockchain, it can use the CosmWasm module, a virtual machine, and IBC, a communication protocol from the Cosmos ecosystem. Thanks to the CosmWasm module, many DApps built on smart contracts can be deployed on the Sei Network since they operate within the same execution environment.

- Intelligent Block Propagation: This is a consensus mechanism designed to increase transaction speed by processing multiple blocks simultaneously. However, processing multiple blocks at once requires significant resources and can lead to unsynchronized blocks and network delays.

- Công cụ khớp lệnh tự nhiên: Unlike the order book feature in the Solana network, which is supported by Serum DEX, Sei’s order book is provided directly by the blockchain. As a result, various DeFi platforms on the Sei network share a common order book, providing a significant liquidity advantage.

- Sản xuất khối Optimisitc: Sei Network can reduce block creation time to 600 milliseconds through optimistic block production, a modified Tendermint consensus process that significantly improves throughput and latency.

- Frontrunning Prevention: Sei executes each trade one by one (as it would happen on Ethereum or Solana). Sei can aggregate all orders together at the end of the block and execute all market orders at the same price to prevent frontrunning.

- Parallel Order Execution: This means matching orders in parallel. Recently, new blockchains like Solana, Aptos, Sui, and Fuel have demonstrated the trend of introducing many parallel transaction processing processes to improve transaction throughput, and Sei Network is no exception.

- Oracle Pricing: As a blockchain dedicated to DeFi, Sei features an Oracle module for price reference. The Oracle module supports pricing asset exchange rates for use by other modules and contracts.

- Order Bundling: To reduce gas costs for market makers and professional traders, Sei Network allows multiple markets to be updated with a single transaction.

Development of the Sei Network Ecosystem

Although it is a relatively new blockchain, the Sei Network ecosystem has expanded into various fields. With over 100 active projects on Sei, this is quite impressive considering that Sei Network is still in its early stages of development.

- Tham khảo Sei Ecosytem: TẠI ĐÂY

Some notable projects within the Sei Network ecosystem:

- Vortex: A decentralized derivatives exchange based on the Sei Network order book, which can leverage the deep liquidity of the network’s own order book. It offers leverage trading of up to 10x and plans to support perpetual futures trading of over 35 different assets due to the network’s IBC compatibility.

- Axelar: An application chain that acts as a bridge in the Cosmos ecosystem. The Axelar Network will play a significant role in utilizing the cross-chain capabilities of the Sei Network as its verification process supports connecting tokens and messaging with other networks through transaction verification.

- Pyth: An Oracle solution that collaborates with major partners like Amber and Wintermute.

- Synthr: Synthr is a cross-chain synthetic protocol that supports Ethereum, Aptos, Sui, and Sei networks.

- KYVE: KYVE is a decentralized data protocol that helps store, access, query, count, and sort large amounts of data generated by the Sei Network.

- White Whale: A protocol that addresses liquidity fragmentation issues among application chains within the Cosmos ecosystem.

- Kado: Kado is a Web3 payment infrastructure company that provides on-ramp functionality for converting fiat currency into cryptocurrencies or off-ramp functionality for converting cryptocurrencies into fiat currency.

- ….

Information about SEI tokenomics

SEI is the native token of the Sei Network, and SEI token holders can use it to pay transaction fees on the Sei Network, participate in governance, or stake it to secure the network and earn rewards.

- Token name: Sei Token

- Ticker: SEI

- Blockchain: Sei Network

- Contract: Updating…

- Token type: Quản trị, tiện ích

- Total Supply: 10,000,000,000 SEI

- Circulating Supply: 1,800,000,000 SEI

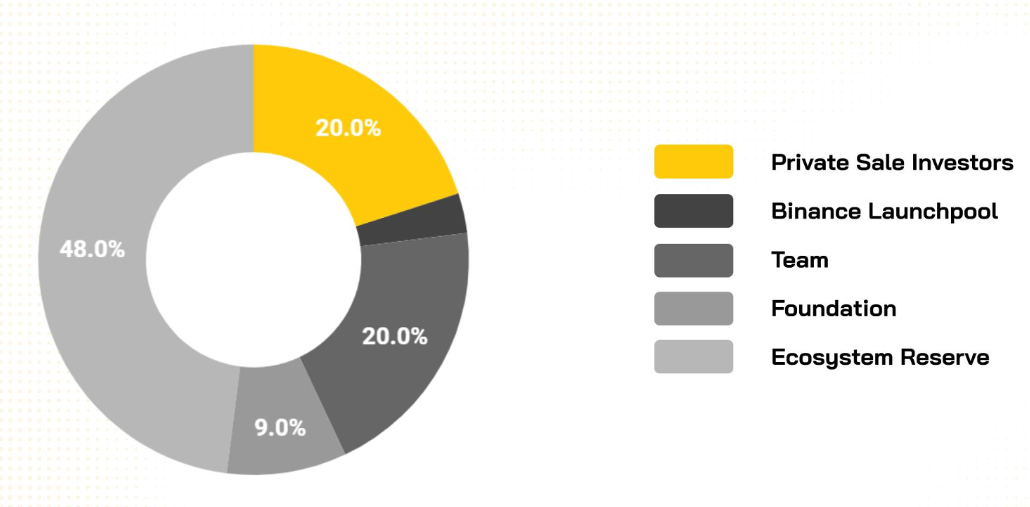

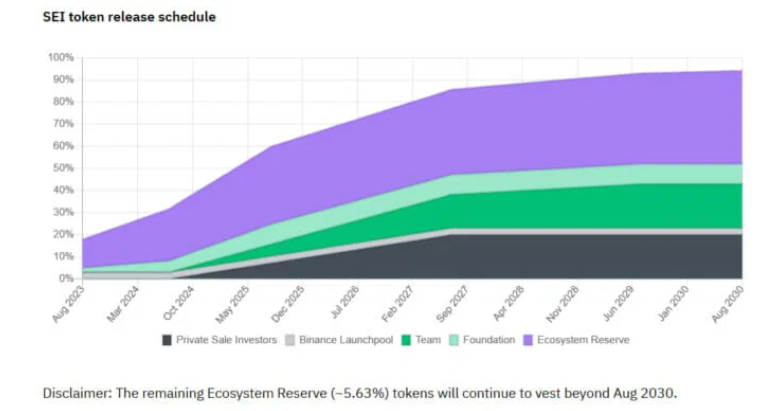

SEI Token allocation:

- Private Sale Investors: 20%

- Binance Launchpool: 3%

- Team: 20%

- Foundation: 9%

- Ecosystem Reserve: 48%

Token Release Schedule:

Team, Investors SEI Network (SEI)

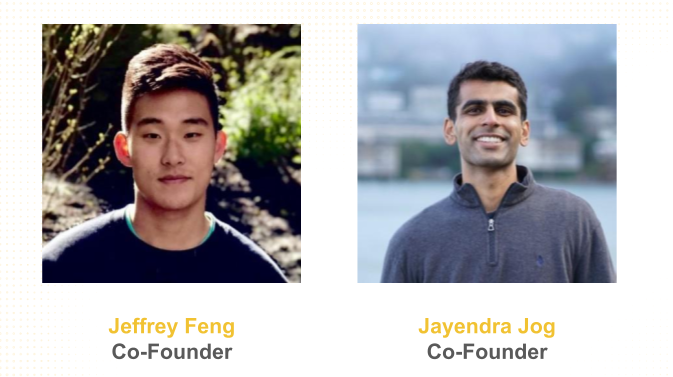

The team behind SEI Network (SEI) includes:

- Jayendra Jog: Co-Founder of Sei Labs, who previously worked as an engineer at Robinhood for 3 years.

- Jeffrey Feng: Co-Founder of Sei Labs, graduated with honors from the University of California, Berkeley, and has several years of experience working at Coatue Management and Goldman Sachs.

Regarding investors, Sei Network has completed two fundraising rounds with a total amount raised of $35 million:

- August 31, 2022: Successfully raised $5 million in the Seed round, led by Multicoin Capital.

- April 11, 2023: Raised $30 million in the Strategic round with a valuation of up to $800 million, led by Jump Capital.

Sei Network (SEI coin) – Does It Have Potential?

Have you learned about what is SEI coin and what Sei Network represents? It’s evident that Sei Network has introduced CosmWasm and IBC to maximize the potential of the Cosmos ecosystem. It is an L1 blockchain specifically designed for order book functionality, customized for DeFi applications, with integrated matching engine, front-running prevention, and the fastest finality of any chain (400-600 milliseconds).

Some advantages of SEI coin:

- Building a dedicated DeFi environment on the Cosmos SDK.

- Cross-chain integration with deep liquidity (IBC and Solana to Nitro L2).

- Plug-and-play into the Sei matching engine and access pooled liquidity from other apps. This is evident through the number of leading DeFi apps built on it (UDX, Alpha Ventures, Cypher, Vortex, Sushi Swap, etc.).

However, there are also some concerns about Sei Network.

- Firstly, there’s a concern about the network’s centralization. Because it boasts a very short block time and scalability, the hardware requirements for validators will be quite high.

- The biggest competitor is Injective. Injective has already developed and has excellent achievements, which could pose a high barrier to entry into the IBC ecosystem, despite SEI’s technological advancements.

- The cryptocurrency exchange dYdX has also recently launched the public testnet of its “v4” version. Overall, the competition for SEI will be fierce, and becoming a major DeFi hub is an ambitious challenge.

Nevertheless, SEI coin remains a highly anticipated L1 blockchain for DEXs, market makers, and TradFi. With the integrated Central Limit Order Book (CLOB) module, decentralized applications can be built on top of it, and other Cosmos-based blockchains can utilize Sei’s CLOB as a shared liquidity center and market maker for any asset. Sei will serve as infrastructure and liquidity hub for the next generation of DeFi products within the Cosmos ecosystem.

Its parallel transactions make it the fastest blockchain currently available, with a completion time of 600 milliseconds. With this, SEI can sustain 18 thousand orders per second, making it ideal for spot, derivatives, and even options trading.

If SEI succeeds in implementing the online order book design, it will earn the title of a leader in this field. While the CLOB capability might surpass AMM to dominate the DeFi market, if Sei successfully implements CLOB on the blockchain, it will become a pioneer in attracting more users to the DeFi arena. In conclusion, time will tell whether Sei Network can achieve its goals of becoming a DeFi hub within the Cosmos ecosystem.

For more detailed information, you can visit:

- https://www.sei.io/

- https://docs.seinetwork.io/introduction/overview

- https://twitter.com/SeiNetwork

- https://blog.seinetwork.io/

Thank you for reading this article. Hopefully, through this article, you have gained a more comprehensive understanding of what SEI coin is and the notable features of this blockchain network. What is your assessment of Sei Network? Please feel free to share your thoughts with us.