If you are looking into cryptocurrency projects, you will often come across terms like Multi-chain and Cross-Chain. In this article, we will delve into understanding what Multi-chain is, the differences between Multi-chain and Cross-Chain, and introduce you to the most potential Multi-chain projects currently.

Contents [Hide]

- 1 What is Multi-chain? Best Multi-chain Projects 2025

What is Multi-chain? Best Multi-chain Projects 2025

In the past few years, we have witnessed many significant changes in the vast field of blockchain. Previously, there were only a few popular blockchains like Bitcoin, Ethereum, or Cardano, but now things have changed. A series of new blockchains have been launched, and it is expected to create a business value of over 176 billion USD by 2025, and possibly reach 3.1 trillion USD by 2030.

Blockchain is no longer confined to small communities, but more and more governments, businesses, and individuals are gradually taking interest in it. The increasing number of people interested in and using blockchain networks is good, but it also faces many limitations, such as:

- The number of users increases, exceeding the technology’s capacity, leading to network congestion and high transaction fees.

- The nature of blockchains operating independently, lacking connectivity, makes it difficult for two people using two different blockchains to transact with each other.

⇒ To make blockchain more popular and practical in life, it needs to change to overcome these two limitations. That’s why technologies like: multi-chain, side-chain, and cross-chain are important. In this article, we will learn more about what multi-chain is?

- You might be interested in: What is Cross-chain?

What is Multi-chain?

Multi-chain is a term meaning “multiple chains, multiple platforms”. That is, if a project is labeled multi-chain, it means that it is being deployed on several different blockchains (at least 2). For example, a project can be deployed simultaneously on blockchains like Ethereum, Binance Smart Chain, Solana, Polkadot, Avalanche, or others.

*** Note, it is necessary to distinguish the term Multi-chain from Multichain (MULTI), as Multichain (MULTI) is not a term but the name of a coin infrastructure for chain content interaction

What is the difference between Cross-chain and Multi-chain?

If you are learning about what Multi-chain is, you might wonder as it is often mentioned together or compared with Cross-chain. Let me briefly explain the concept of Cross-chain to you. Specifically,

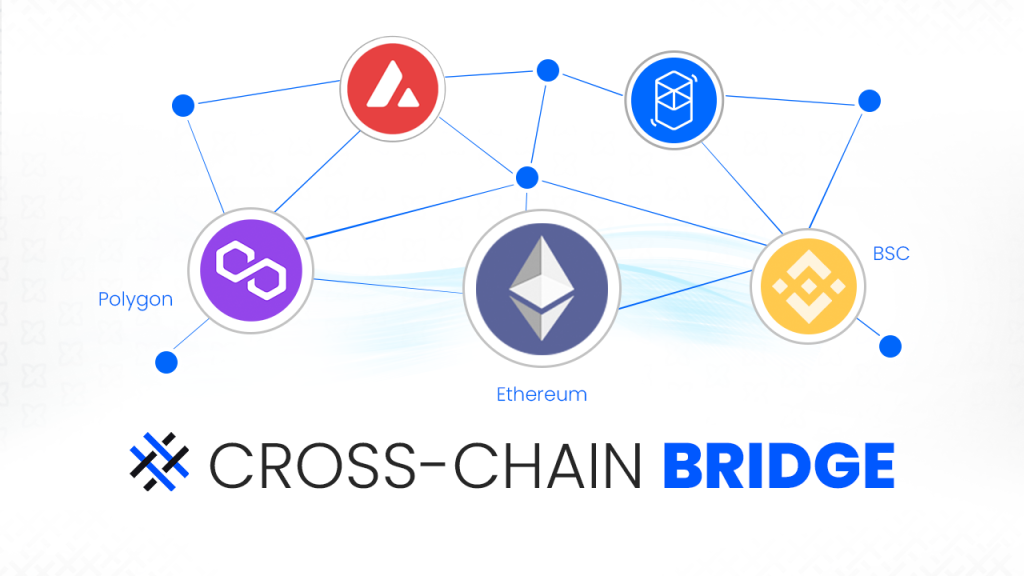

Cross-chain means “cross-chain”, a solution that allows users to transfer assets from one blockchain to another to optimize the combination between chains. It helps you connect and transfer assets across many different blockchain platforms.

- Multi-chain refers to a project operating on several different chains. When project A implements Multichain, it means that in addition to its original chain (e.g., Ethereum), project “A” can also be independently deployed on other chains like BSC or Polkadot.

- However, to transfer assets between these independent chains, you will need a Cross-chain tool. It is a tool that helps people transfer assets between the Ethereum chain and other chains on the market.

To avoid confusion between Multi-chain and Cross-chain, remember that:

- Multi-chain: similar to a multinational company with many offices in different countries.

- Cross-chain: similar to a company that transports goods from one country to another.

The Importance of Multi-chain

In the current context, for example, in the field of AMM DEX, each platform has its prominent names, like Uniswap on Ethereum, PancakeSwap on Binance Smart Chain, Quickswap on Polygon.

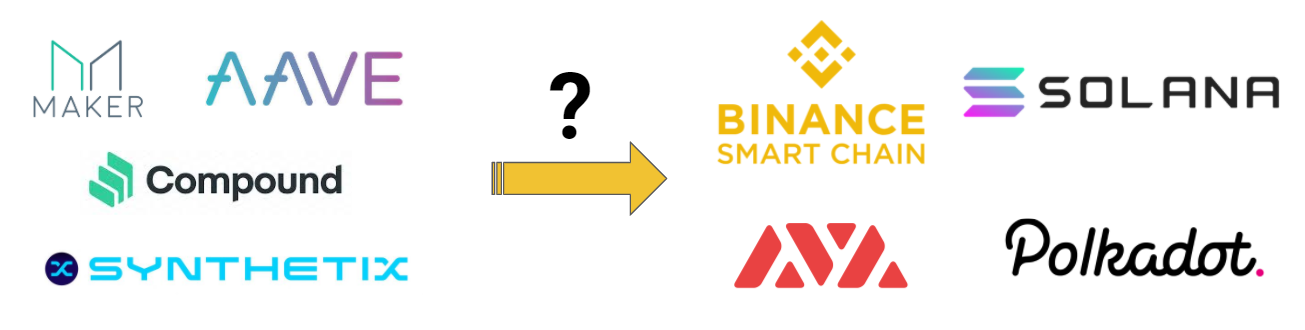

However, each project operates very independently and has not yet reached a large number of users from other ecosystems. But what if the projects implement Multi-chain?

When implementing the Multi-chain mechanism in projects, not only users but also the project will benefit from the following advantages:

For users:

- Easily use products and services on different blockchain networks, no longer confined to using services in a single ecosystem. Users will also have more diverse choices, being able to access services that their familiar ecosystem has not yet implemented.

For projects:

- By applying the multi-chain model, the project will reach more customers in different ecosystems, expanding the scope of the project.

- Launching a multi-chain project will overcome network congestion and slow speed on the main chain where the project was built; leveraging the speed and low cost of other chains to provide a better experience for users.

- Minimize risks: in case a blockchain encounters problems, the project itself will not be much affected because it is deployed across multiple ecosystems.

However, implementing multi-chain also faces many challenges, as this is not an easy task and cannot be completed overnight. Each blockchain has its characteristics, structure, programming language, and supporting toolkit. Therefore, when wanting to deploy on a new blockchain, projects will need to study to deploy on new chains as each chain has its peculiarities. This means that we cannot realize it in just a day or two. In addition, the security issue of Multi-chain is still controversial as many Multi-chain projects are not yet secure, safe, or fast enough to meet the decentralized needs of the entire industry.

Some of the Most Potential Multi-chain Projects

You have learned what Multi-chain is, so are you curious about the projects currently implementing Multi-chain? In recent years, many projects have emerged and claimed the ability to connect multiple specific chains into a global network, empowering individual users and breaking the Internet monopoly. Let’s explore the most prominent Multi-chain projects currently.

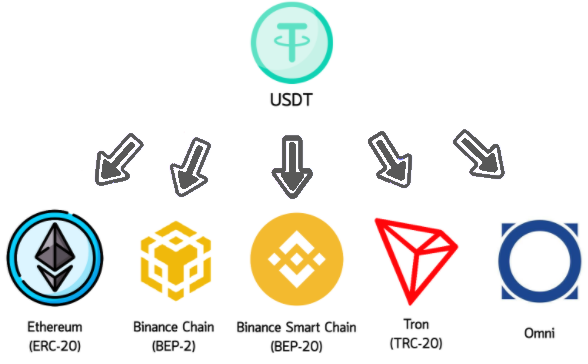

Tether (USDT)

Tether (USDT) is the most prominent stablecoin and accounts for up to 80% of the stablecoin market share. By implementing multi-chain very early, Tether has been widely trusted, accepted, and used by most investors. Currently, USDT is present on more than 20 different ecosystems such as Ethereum, Binance Smart Chain, Solana, Algorand, Fantom, Polygon…

Polkadot (DOT)

Polkadot is a platform that connects multiple blockchains, creating an expandable multi-chain network. It uses a segmented model with a structure consisting of Relay Chain, parachain, parathread, and bridges. Each structure provides different functionalities for the Polkadot network with its own coin/token and governance system. The Relay Chain ensures flexible connections and consensus among the parachains and parathreads in the Polkadot network, as well as maintaining the security and consensus protocol of the system.

Currently, Polkadot has 13 parachains with notable names like Moonbeam, Acala, Astar Network…

Cosmos (ATOM)

Cosmos is a cryptocurrency project focused on creating a network of various blockchains that can interact with each other. Its main chain, Cosmos Hub, acts as a central ledger for compatible blockchains known as Zones. It allows developers to design their cryptocurrencies, set custom block validations, and other features.

Cosmos is one of the first multi-chain cryptocurrencies and remains a popular choice to this day. Many multi-chain networks have since integrated with high-traffic blockchains like Ethereum and directly compete with Cosmos. However, Cosmos aims to expand current trends including decentralized finance (DeFi), cross-chain staking, and non-fungible tokens (NFTs) – positioning itself to become increasingly popular in the future.

THORChain (RUN)

THORChain is a DeFi project initially launched on the Cosmos network; however, it transitioned to its mainnet in April 2021. THORChain is a cross-chain liquidity protocol designed to power multi-currency exchanges on various blockchains.

Currently, cryptocurrency investors and traders often exchange assets on multiple blockchain platforms. However, most blockchains are isolated and cannot directly share information, resources, or tokens. THORchain provides users with a decentralized system that supports token exchanges across different blockchain networks without intermediaries.

Chainlink (LINK)

Chainlink is a multi-chain ecosystem designed to connect blockchains with the real world. Essentially, blockchains have no efficient way to access external data – connecting off-chain data with on-chain data using smart contracts is challenging.

Chainlink connects blockchains to the real world through decentralized oracles, which can provide external data to smart contracts on Ethereum. Oracles are software that translates external data into a language that smart contracts can understand (and vice versa). Chainlink can connect internal systems, APIs, or other types of external data sources. LINK is an ERC-20 token used to pay for oracle services on the network.

SushiSwap (SUSHI)

SushiSwap is a decentralized cryptocurrency exchange platform initially built on Ethereum to compete with Uniswap. SushiSwap is also one of the most prominent multi-chain projects in the AMM DEX segment, supporting up to 14 different chains such as Ethereum, Polygon, Moonbeam, Avalanche…

So why did SushiSwap choose to develop Multi-chain for its platform? The AMM Dex segment on Ethereum is currently saturated with significant competition from Uniswap and 0x Protocol. Therefore, to expand its potential and attract new users, SushiSwap had to deploy on other chains – places where there are not many prominent AMM Dex projects.

Aave (AAVE)

Aave is a prominent DeFi protocol at present. It deployed its lending platform on Polygon in March. In August 2021, CEO Stani Kulechov announced plans to expand this platform on the Solana ecosystem. Additionally, the expansion plans include deploying through Neon Labs’ EVM-compatible solution, Avalanche, and Optimistic Rollup solutions like Arbitrum, Optimism. Therefore, Aave is also a Multi-chain project worth paying attention to.

1inch (1INCH)

The 1inch exchange is a decentralized exchange (DEX), but instead of operating as a typical DEX, it acts as an aggregator, dividing orders among several other DEXs to find the best possible rates.

Initially, 1inch was deployed from Ethereum, but later it expanded to the BSC and Polygon ecosystems in 2021, making it a multi-chain project.

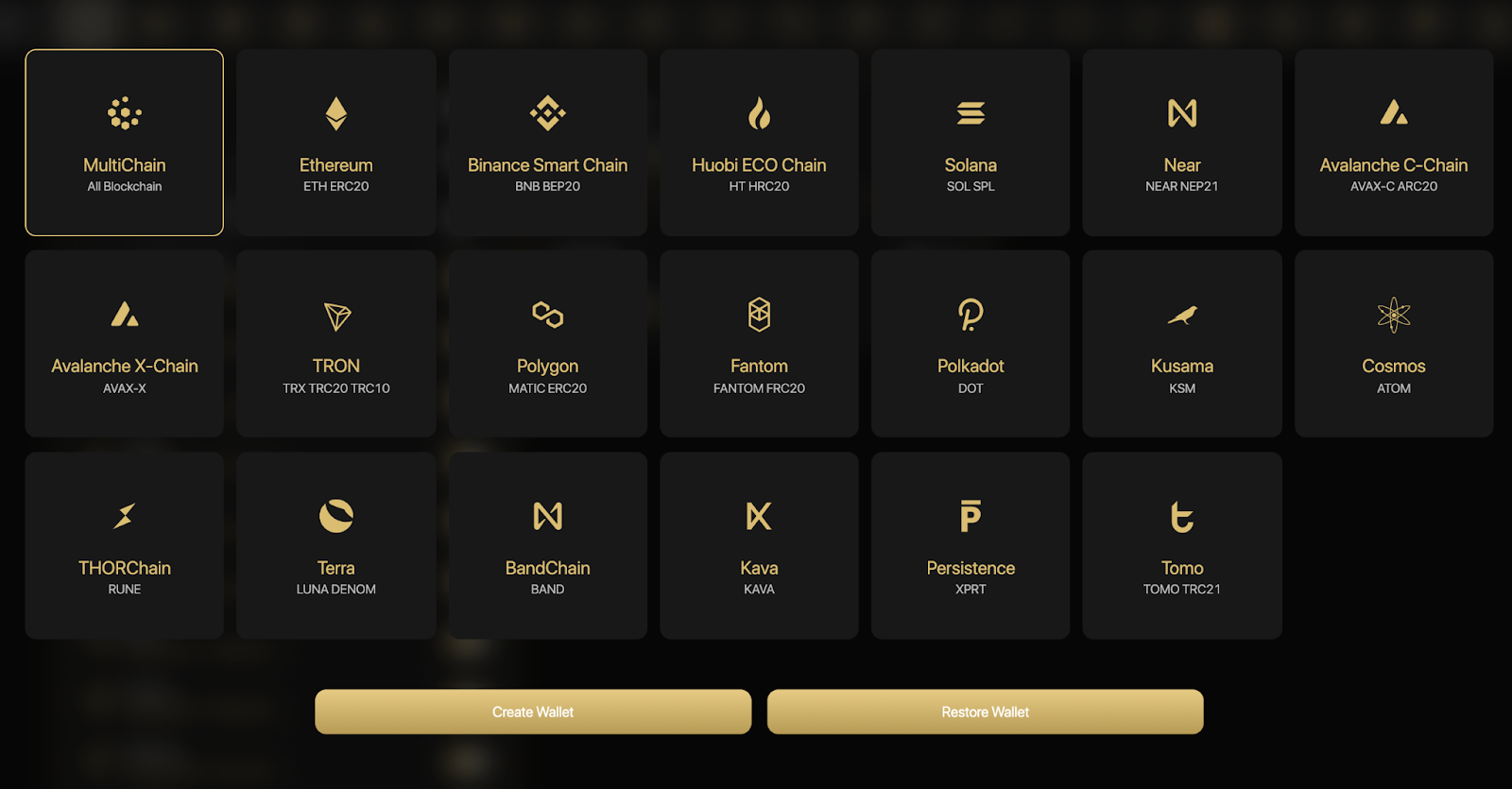

Coin98 (C98)

Coin98 is one of the standout projects currently doing well in both Multi-chain and Cross-chain domains. Starting as an all-in-one DeFi platform, Coin98 aims to build a Multi-chain ecosystem that allows users to connect and use various DeFi, GameFi, Metaverse services through Coin98’s products…

Multichain (MULTI)

Multichain (formerly AnySwap) is a multi-chain routing project that supports various ecosystems, allowing users to transfer assets between blockchains and mine liquidity.

Currently, Multichain supports 28 chains and acts as a bridge for about 1,295 asset types between the supported blockchains, including Ethereum, BSC, Avalanche, Moonriver, etc. The platform has over 300,000 users with a TVL of $6.71 billion.

Which is the best Multi-chain coin?

Apart from Aava, 1inch, or Sushiswap offering something useful and distinct, let’s compare different Multi-chain platforms. In my personal opinion:

Polkadot is a leading project in the Multi-chain field, and its blockchain remains very useful to this day. Unlike its biggest competitor Cosmos, Polkadot provides unified security across the entire network. All of Polkadot’s parachains are supported by the same composite security as the Polkadot Relay Chain, while blockchains connected to the Cosmos Hub do not have unified security.

Compared to THORChain, Polkadot offers a more comprehensive and efficient solution for on-chain interoperability. Unlike THORChain, Polkadot does not require cross-chain liquidity pools on both sides of the interacting blockchains.

On the other hand, Chainlink is a more challenging comparison. Since Chainlink is an oracle network, comparing Polkadot to Chainlink is like comparing apples to oranges. Chainlink connects real-world data to blockchain, thus providing better off-chain interoperability. However, Polkadot is more efficient in connecting different blockchains, thereby providing better on-chain interoperability.

Polkadot has the largest market capitalization among its competitors, standing out with overwhelming support from both institutions, retail investors, and developers. Although Polkadot also has its limitations, as an investor, you have the responsibility to conduct thorough research before investing in cryptocurrencies.

The future of multi-chain in 2025

Currently, there are hundreds of blockchains operating with different technological infrastructures, token standards, rules, and governance models. The lack of interoperability between these blockchain platforms also makes capital distribution in the market uneven, concentrated, and inefficient, hindering innovation and development of the entire market.

While Ethereum was once considered the leading platform, and everyone wanted their assets/projects to operate on this blockchain, cross-chain solutions are also partly reducing Ethereum’s dominance. Before 2021, Ethereum’s TVL almost entirely dominated the DeFi market share. But as BNB Chain and other platforms were built and developed, Ethereum’s TVL now only accounts for 60% to 70% of the entire market. This is a sign that the future of multi-chain projects is very close.

I assess that multi-chain has great potential for further development, as it brings many benefits to users and may become the “blockchain trend” in the coming years. It is an indispensable piece as blockchain becomes increasingly popular. Therefore, investing in coins of multi-chain projects is quite a correct decision.

I assess that multi-chain has great potential for further development, as it brings many benefits to users and may become the “blockchain trend” in the coming years. It is an essential piece as blockchain becomes more popular. Therefore, investing in coins of multi-chain projects is quite a correct decision.

Sooner or later, the use of multi-chain solutions will be increasingly widespread, opening a future where barriers between blockchains are eliminated, and users can freely explore the world of cryptocurrency. You should pay attention to projects in hot sectors like AMM DEX or Lending that have not yet implemented multi-chain solutions. These could be good investment opportunities as the capability and trend of adopting multi-chain solutions are increasing in the future, so if one of them implements multi-chain, it could be a driving force to increase the value of your coins.

Here are some tips to predict which projects will implement multi-chain:

-

Always monitor the social media activities of large potential ecosystems like Binance Smart Chain, Polkadot, Avalanche… Before deploying on a new ecosystem, developers will build cross-chain bridges for users to transfer assets between chains, or the development team will announce partnerships before officially deploying.

-

Monitor DeFi projects across various ecosystems, and you will see that some emerging ecosystems have not yet invested in components like AMM DEX or Lending. Projects that have been perfected in their original ecosystem often want to expand and deploy on other chains to attract more users.

The above information sheds light on what multi-chain is. It can be seen that multi-chain is the trend of the future, and there is still a long way to go for its development. I hope that through this article, you have gained useful information and knowledge about multi-chain, allowing you to more accurately assess the usefulness and potential of the project you are interested in. If you have any questions, please leave a comment below for me to answer. Thank you for reading this article, and I wish you successful investments.