If you are interested in the field of cryptocurrency, you will surely have heard some news related to projects receiving investments from crypto VCs, which implies that these crypto projects will come with strong price increase potential due to capital advantages. Therefore, in addition to researching various cryptocurrency projects, paying regular attention to VC (Venture Capital) funds can also be very useful in making investment judgments. So, who are these people called VCs? Which VCs have a better reputation? More importantly, what projects are they investing in?

Today, I will help you organize a relatively comprehensive guide on this topic. Through this article, you don’t need to be a professional data researcher, just by using some free and extremely easy on-chain tools, you can easily track these VC investments and have the opportunity to find the next x10, x50 opportunities.

Contents

Guide to Tracking Crypto VCs

What are Crypto VCs?

Simply and understandably, VC stands for Venture Capital, often referred to as venture capital funds. These funds are usually large companies or organizations with abundant capital, regularly looking for new, potential crypto projects to invest in. In addition to investing capital, some VC funds also support project development. Therefore, a blockchain project supported by one or more VC funds is usually a sign that it is a good and potential project.

The Biggest Crypto Venture Capital Funds 2025

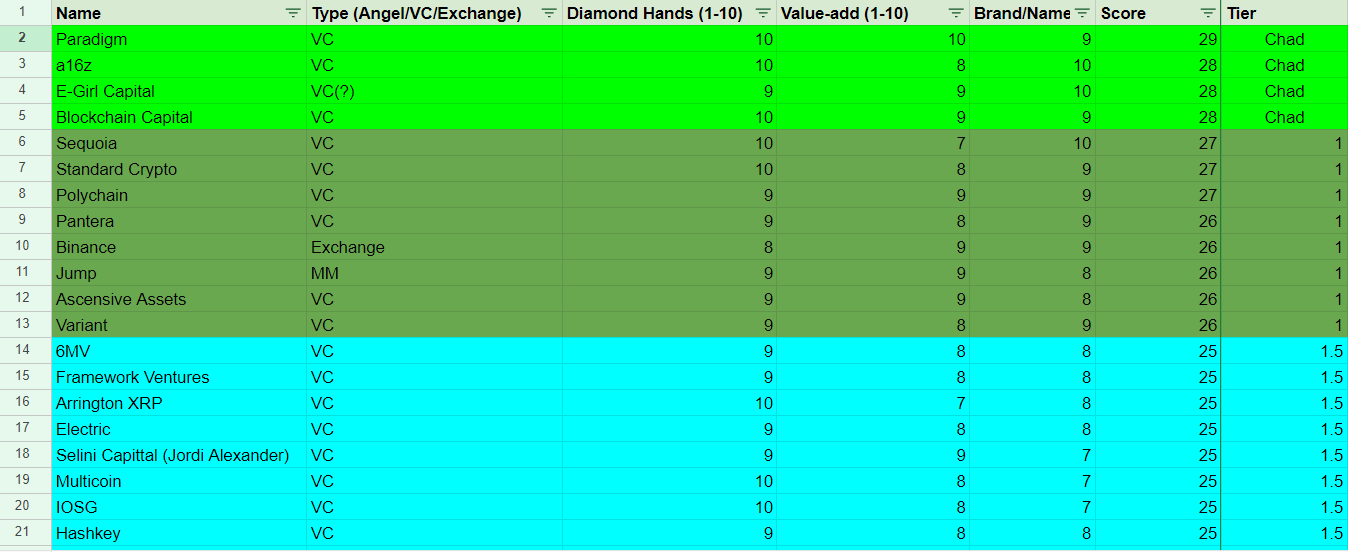

Next, you need to understand the types of VCs and their corresponding levels. I will not go into what this fund is, its characteristics, what projects it is holding/supporting in the content of this article. I will only mention the most prominent, popular, and influential names in the cryptocurrency market.

The image below is the leading crypto VCs. Many of you may know or have heard of these names.

Remember these names, at least the top 10 most prominent ones. When you have this list of VCs, you can track and research the investments of specific funds more deeply.

Here is a list of over 100 current crypto VCs, fully ranked, which you can save for gradual reference:

https://docs.google.com/spreadsheets/d/1saqKNeo9pSl-m_Xa9jVpFyPfg8faCXn6lZ3TEtTKz5Y/edit#gid=0

Tools to Track and Discover Crypto VCs

Now, I will introduce some of my commonly used on-chain tools to help you better explore and track these VC funds.

CryptoRank

- Access: https://cryptorank.io/funds

By accessing the “Fund” tab of CryptoRank, you can easily access detailed data about each VC fund, including their investment history.

Then, if interested in any VC, you just need to click on that VC fund, and it will show you the details of their cryptocurrency investments, and the projects they are investing in for development. Personally, I find this to be one of the simplest, easiest tools for you to tracking crypto VCs.

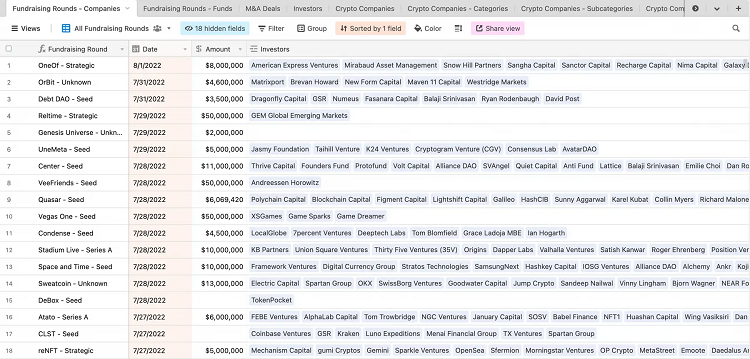

Messari Fundraising Data

- Access: https://messari.io/fundraising-data

Messari’s Fundraising Data is a regularly updated sheet to capture the latest known information about the investments of cryptocurrency VC funds. From this form, we can capture the actions of the fund you have chosen by tracking their investments in real time.

This tool requires a fee if you want to use it. I recommend if you are someone who wants to delve into and research cryptocurrencies, then you should experience Messari, as after all, this is one of the most useful and famous platforms providing data and analytical reports about cryptocurrencies today.

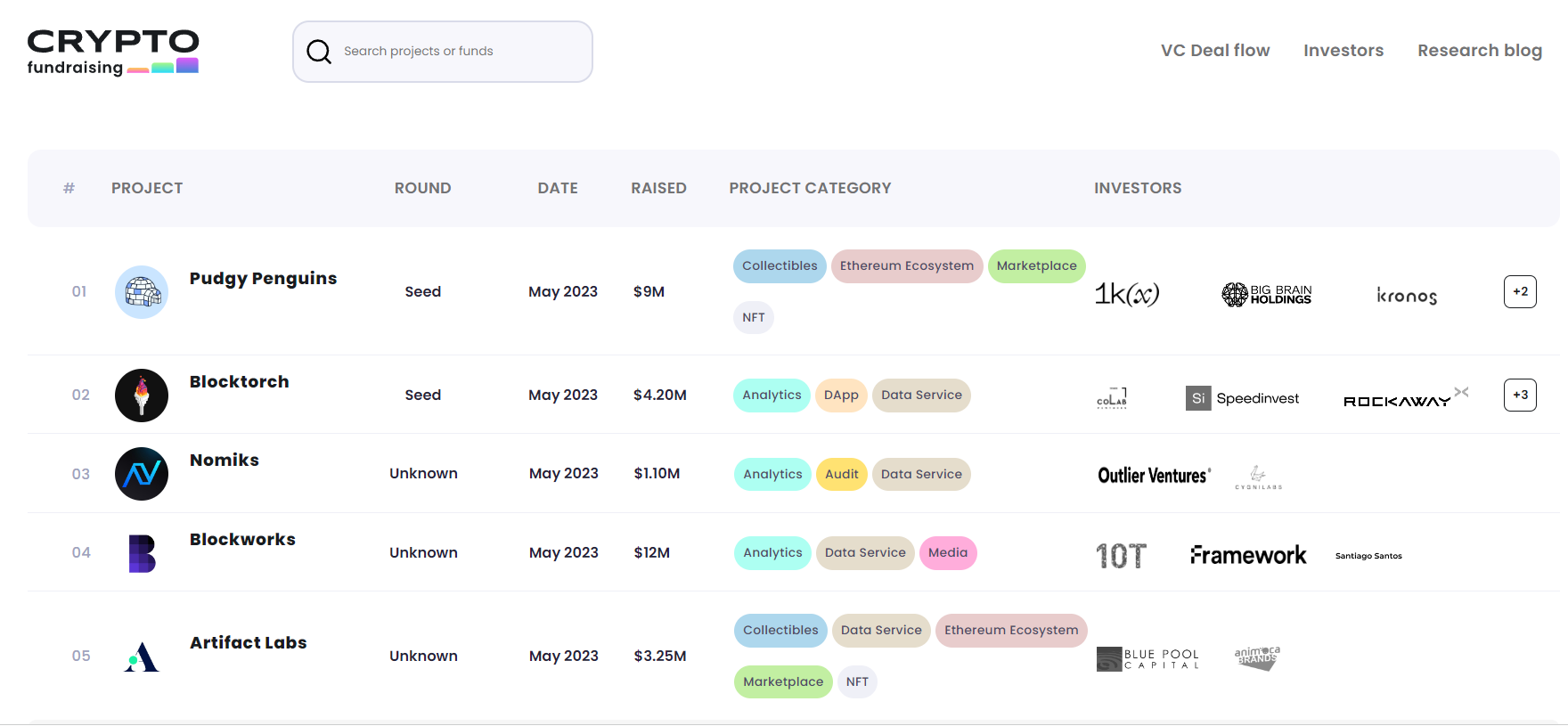

Crypto Fundraising

- Access: https://crypto-fundraising.info/

This is a platform where you can view most of the information about the project. Through Crypto Fundraising, we can find detailed information about each funding round of specific projects, related news, and other information. You just need to enter the name of the project you’re interested in, then click “Search” to get corresponding detailed information.

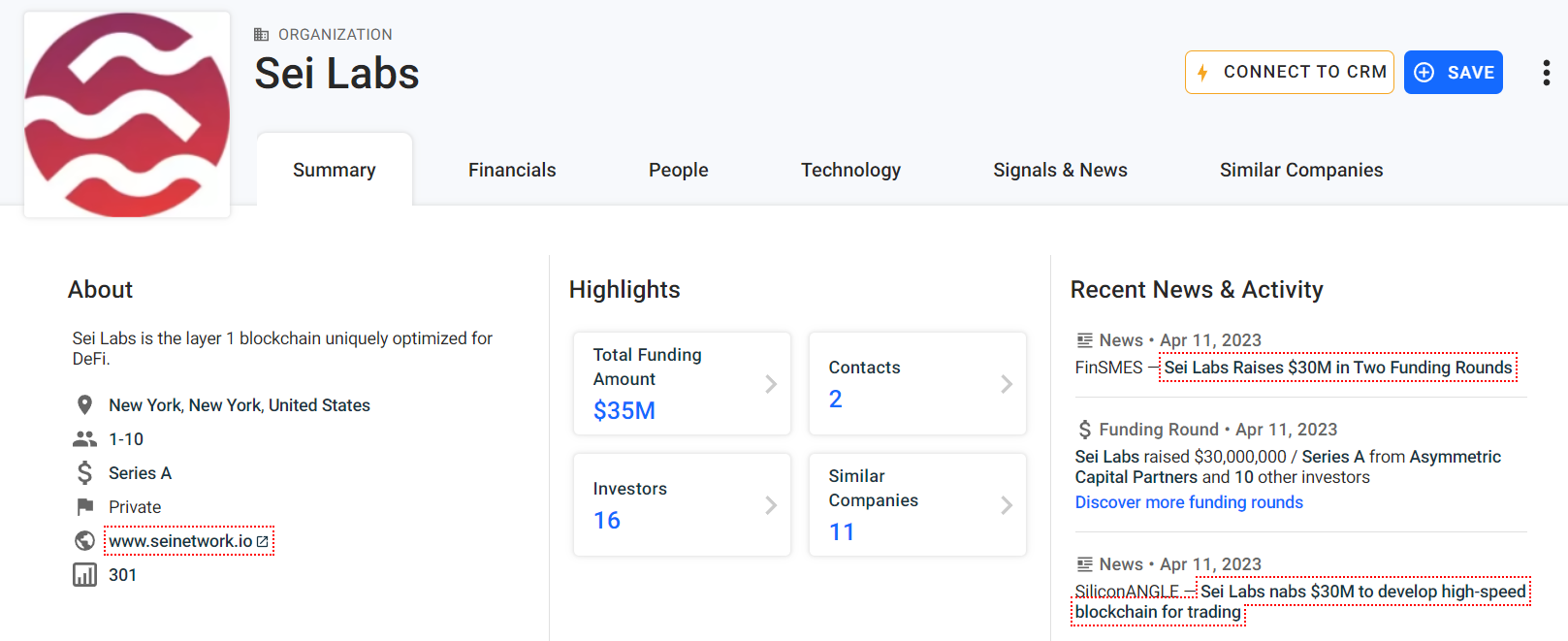

Crunchbase

- Access: www.crunchbase.com

For any researcher in the field of digital currency, Crunchbase is a relatively comprehensive database query platform. Through Crunchbase, you can learn about the financial situation of specific projects, the origin of the company, as well as corresponding employee information of the project, etc., and it also displays the total amount of money from all fundraising rounds. From there, it can help you track the latest investments of VCs and market trends.

Using it is very simple, you just need to type the name of the project you want to search into the Crunchbase search box, and they will display the details for you.

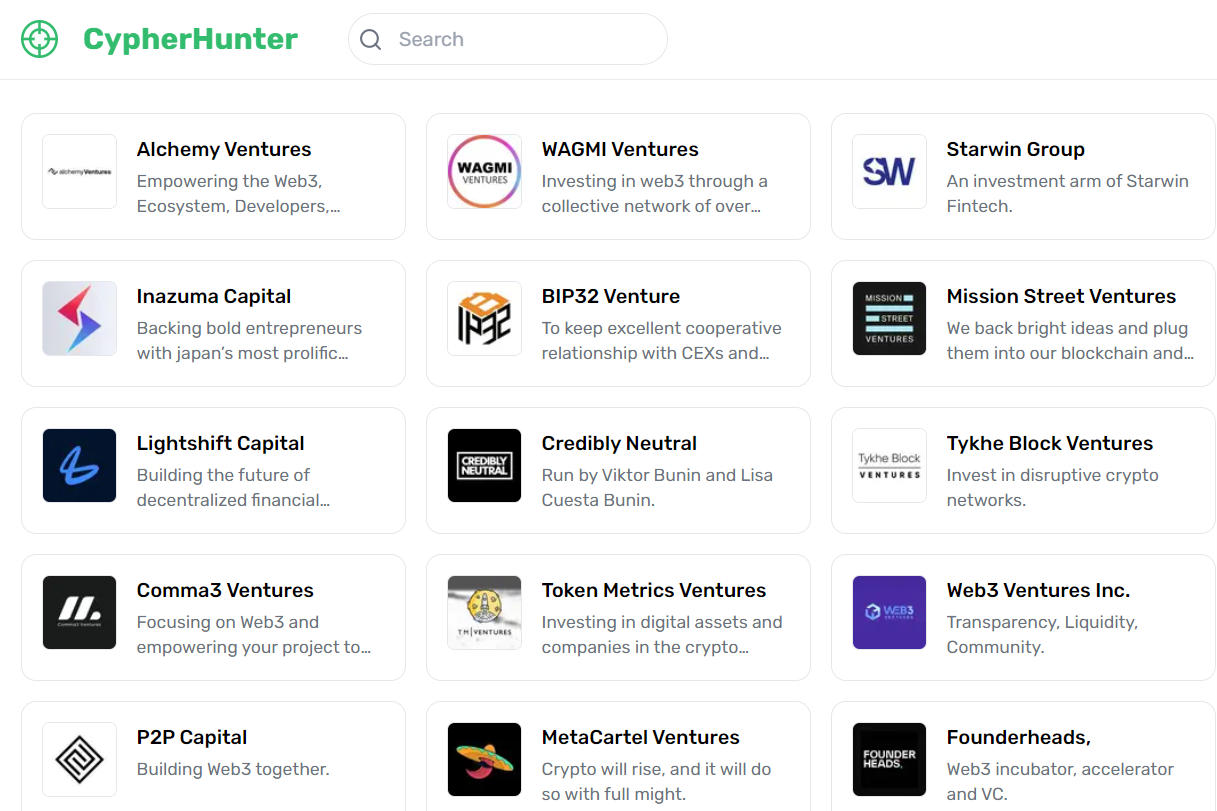

Cypher Hunter

- Access: https://www.cypherhunter.com/en/t/crypto-vc/

If you need to find investment information for smaller projects, that can be more difficult. But since I discovered the Cypher Hunter platform, I have essentially solved this problem because Cypher Hunter’s reports can help us easily get some information about those smaller projects. This platform, similar to those mentioned above, contains a lot of information about smaller investments.

TwitterScore

- Access: https://twitterscore.io/

TwitterScore is one of the best free tools to determine the Twitter of a project, it categorizes and ranks various projects, and can also display whether major VC funds are following and considering selecting it or not. This tool is useful when a project is very new and has no investment information at all, because once a new project is being searched by funds, it has a high chance of success.

For example, in the image above, when I search for information about Len Protocol, it will display in detail the Twitter score of the project, especially including a list of KOLs, famous analysis platforms, and leading investment VC funds following this project. Isn’t it useful?

Read more:

This is all our sharing on how to tracking crypto VCs to find investment opportunities. In general, you just need to remember about 5 – 10 prominent VC names in the market, and use some useful tools I shared to track their actions. Personally, I find CryptoRank, Crunchbase, and TwitterScore to be simple, easy to use, and useful. I hope today’s sharing can be useful for everyone.