“What is ICO?” is a question that resonates strongly in the dynamic world of cryptocurrency and blockchain technology. Standing for Initial Coin Offering, ICO have emerged as a groundbreaking way for startups and projects to raise funds. This innovative fundraising mechanism allows investors to become part of potentially game-changing projects from their infancy. In this article, we unravel the complexities of Initial Coin Offering, examining what they are, how they function, and their significance in the rapidly evolving landscape of digital currencies. We aim to provide a clear and comprehensive understanding of Initial Coin Offering, demystifying their workings for both seasoned investors and curious newcomers alike.

Contents

- 1 What is ICO?

- 1.1 What is the concept/definition of ICO?

- 1.2 How does an ICO work?

- 1.3 What are the advantages of ICO coins?

- 1.4 What are the disadvantages/risks of ICOs?

- 1.5 Where to Find Projects Preparing for ICO?

- 1.6 Important Considerations Before Participating in an ICO

- 1.7 The Most Successful ICO Projects

- 1.8 Comparing ICO, IDO, and IEO

What is ICO?

What is the concept/definition of ICO?

ICO, short for Initial Coin Offering in English, is understood as the initial coin offering, a fundraising campaign of new startup blockchain projects whose tokens are not yet listed. This fundraising will help the project acquire additional funds for development, while early investors can benefit from buying tokens at the initial price and potentially gaining high returns when the project successfully launches on the market.

The first ICO was organized by Mastercoin in 2013, and the idea of ICO originated from IPO. While IPO is the stock market’s capital-raising activity requiring thorough vetting and legal recognition, ICO in coin does not require any vetting.

The success of an ICO depends on the project’s marketing and is not regulated by law, any blockchain project can organize an Initial Coin Offering.

How does an ICO work?

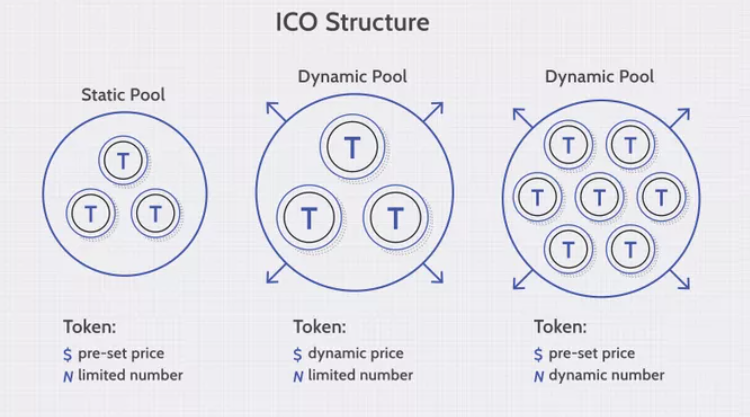

When a cryptocurrency project wants to raise money through an Initial Coin Offering, the first step for the organizers is to determine how they will structure it. ICOs can be structured in several different ways, including:

- Static Supply and Static Price: A company may set a specific funding target or limit, meaning each token sold in the ICO has a predetermined price, and the total token supply is fixed.

- Static Supply and Dynamic Price: An Initial Coin Offering can have a static token supply and a dynamic funding target — this means the amount raised in the ICO determines the overall price per token.

- Dynamic Supply and Static Price: Some ICOs have a dynamic token supply but static price, meaning the amount raised will determine the supply.

These three different types of ICOs are illustrated below:

Another consideration is that you often need to own another type of cryptocurrency to invest in ICOs. Because new tokens issued in an ICO are usually only purchasable using a well-established cryptocurrency such as Bitcoin or Ethereum, ICO investors need to have 2 cryptocurrency wallets:

- A cryptocurrency wallet to store another cryptocurrency like Bitcoin or Ethereum

- An additional cryptocurrency wallet to hold the token or currency being sold for the Initial Coin Offering.

What are the advantages of ICO coins?

There are several advantages/benefits of ICOs that you should know:

♥ Any cryptocurrency project can conduct an initial coin offering (ICO) without waiting for approval

♥ Anyone can participate in ICOs whether they are in Vietnam, China, the US, the UK…

♥ Potential for high returns as many cryptocurrency projects have had extremely successful ICOs like Ethereum, The DAO, Bancor, Filecoin…

♥ No intermediaries, projects are developed and reach actual users immediately

♥ Early participants will have additional privileges on the platform

What are the disadvantages/risks of ICOs?

♦ Risk of being used for fraudulent purposes, as any project can conduct an ICO; if investors do not research carefully, they might lose their entire investment.

♦ The time from purchasing ICO tokens until they are listed on an exchange is uncertain; it could be a few months, several years, or they may never be listed.

♦ The success rate of ICO projects is currently lower than the rate of unsuccessful ones.

♦ Projects that want to raise significant funds need to advertise extensively among thousands of developing cryptocurrency projects. This might require a substantial investment to help the project reach investors worldwide.

♦ Investors need to thoroughly research, and for newcomers, there are many technical terms that they may not fully understand.

♦ ICOs are banned in China and some other countries, are unregulated, unsupported by law, and therefore carry risks solely borne by the investor.

Where to Find Projects Preparing for ICO?

If you want to find information about projects that are conducting ICO, you can visit forums or websites such as:

- ICO drop: https://icodrops.com/

- Foundico Blog: https://foundico.com/icos/

- ICO bench: https://icobench.com/

- ICO watch list: https://icowatchlist.com/

Important Considerations Before Participating in an ICO

-

The first and most important thing you need to focus on is reading the project’s whitepaper. If the whitepaper is too basic, you need to consider carefully. Additionally, the whitepaper must contain important information like goals, technology to be used, problems to be solved, etc. In general, a detailed but concise whitepaper is good.

-

Read the terms and conditions of participating in the ICO carefully. Many investors, without reading the terms of participation carefully and just following others’ advice, have invested in fraudulent ICO projects. Many cryptocurrency projects state in their terms that they refuse all responsibility related to investors’ tokens, and by agreeing, you are essentially falling into their trap.

-

Information about the project development team needs to be transparent and public. A cryptocurrency project created by well-known and experienced individuals in the industry will be preferred over a project where the core developers are anonymous.

-

Check if the ICO funds are stored in an escrow wallet. This type of wallet requires multiple access keys, providing useful protection against fraud.

-

If you believe in the potential of a new project, you should only invest a small amount of capital because the risk involved in ICOs can lead to the loss of all of this investment.

-

Participating in an ICO is quite similar to gambling, and currently, the rate of winning is lower than losing.

The Most Successful ICO Projects

Although ICOs have many drawbacks, it cannot be denied that some projects have been extremely successful in their ICOs, such as:

Ethereum – The Most Successful ICO Project of All Time

Do you know what the ICO price of Ethereum was? The Ethereum ICO event took place in 2014 with the starting price of 1 ETH at just 0.311 USD, while the current price of 1 ETH is $ 3,318.64 USD.

That ICO round for Ethereum raised 16 million USD and this capital-raising activity took place over 42 days.

IOTA – ICO Project Organized in 2015

If Ethereum brought unimaginable profits, another project that also yielded high returns is IOTA. According to statistics, IOTA was ICO’d in 2015, the Initial Coin Offering price was about 0.00059 USD and that ICO round only raised 590,000 USD. However, the current price of IOTA has increased tens of thousands of percent, at USD.

Cardano (ADA) – ICO Project with Profits of Tens of Thousands Percent

Cardano (ADA) is an ICO project that brought tremendous profits, up to tens of thousands of percent for investors, with the starting price at just 0.0024 USD in 2016. The current price of ADA coin is $ 0.919269 USD.

NEO – ICO Project with Impressive Profits

NEO is also a successful ICO project with an ICO price of NEO coin at just 0.2 USD and fundraising amounting to about 5 million USD. The current price of NEO coin is $ 13.72 USD.

DigixDAO – 2016 ICO Project with over 10,000% Profits

DigixDAO is another successful ICO project, bringing extremely high profits, over 10,000%, with the starting price of DigixDAO at just 3.235 USD, but the current price has risen to USD.

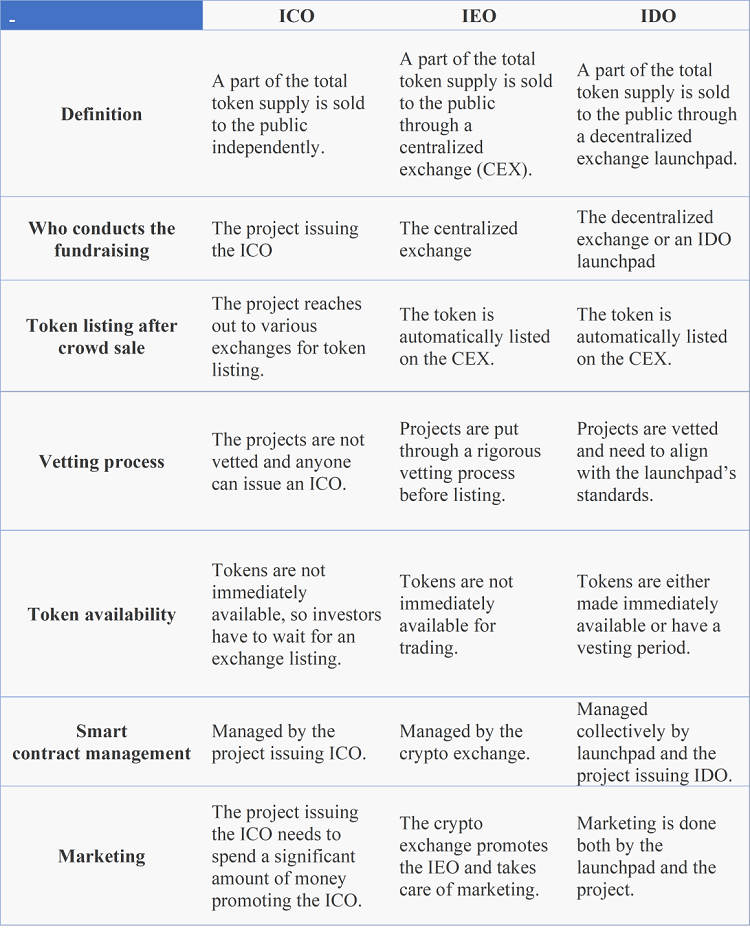

Comparing ICO, IDO, and IEO

Related post:

Through this, we hope you now understand what ICO is, whether you should participate in ICOs, and what the pros and cons of Initial Coin Offering are. We hope this information is helpful to you, and if you have any questions, feel free to leave a comment for an answer within 24 hours. We wish you accurate investment choices and success.