As one of the decentralized financial platforms that has garnered much attention from the crypto community, NEXO is currently ranked at 81. So, what is NEXO coin, should one consider investing in NEXO, and what are the advantages and disadvantages of NEXO? You can refer to the following analysis for insights.

What is NEXO coin? Is Nexo a good investment 2025?

What is NEXO platform?

Fundamentally, Nexo is a blockchain system that allows users to deposit cryptocurrencies to earn interest or facilitates users’ access to instant crypto-backed loans.

Founded in 2018, it has only recently gained popularity due to the DeFi trend’s explosion in 2021. NEXO positions itself as the “Bank of Cryptocurrency,” striving to replace traditional banking services with cryptocurrencies as the asset of choice.

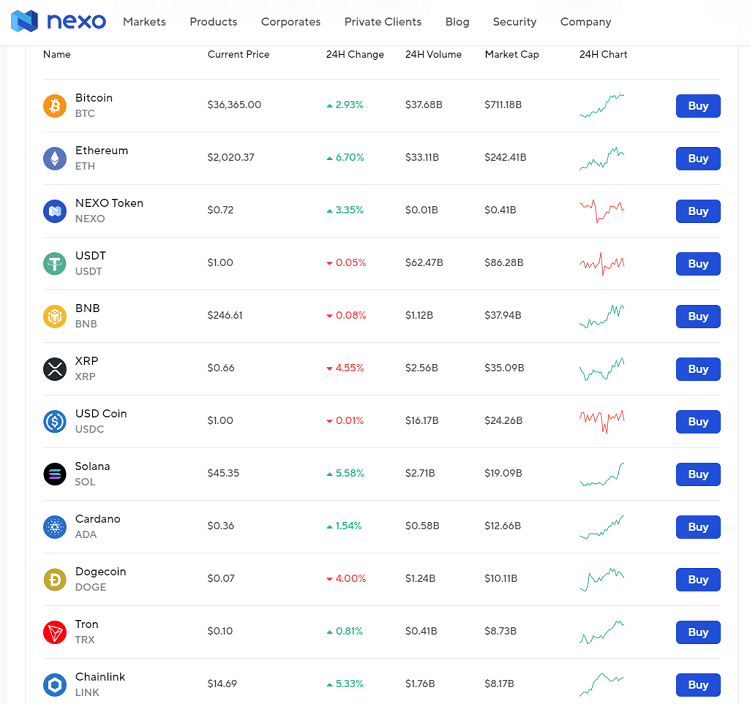

Currently, there are more than 60+ coins you can deposit and earn profits from on NEXO, which include: USDT, TUSD, BTC, AVAX, BNB, TRX, DOGE, USDC, USDX, ETH, FTM, ADA, LTC, XLM, DAI, EURX, NEXO, AXS, SOL, LINK, EOS, USDP, GBPX, DOT, MATIC, XRP, BCH, PAXG….

The specific interest rates for each coin are as follows:

The entire system is designed to ensure liquidity automatically and more flexibly than traditional banks. NEXO enables customers to easily receive fiat currency if they wish, while still retaining ownership of their digital financial assets.The blockchain technology supporting Nexo promotes a transparency that is central to the platform’s integrity. It facilitates smooth processes through Ethereum’s smart contract system and stores all relevant encrypted data for transactions.

What is NEXO coin?

The benefits of holding NEXO tokens are:

- 100% automatic platform. Deposit your assets, withdraw loans, and repay debts autonomously.

- Full control is in your hands. There are no minimum fiat loan repayments. You can repay your loan at any time. It can be repaid in fiat, cryptocurrency, or a combination of both.

- NO fees – interest rates depend on your Loyalty tier. You decide when to pay interest. No hidden charges, no unpleasant surprises.

- High-interest rates: Nexo offers customers up to 12% APR on stablecoins (such as USDT, USDC, TUSD, USDP, DAI) and FiatX savings, as well as up to 37% APR on other cryptocurrencies. Send your passive assets to Nexo and let them work for you without being locked, as NEXO allows you to withdraw them anytime.

- Military-grade security: Nexo partners with the globally renowned custody company BitGo to ensure the safety of all cryptocurrency assets. BitGo is backed by Goldman Sachs and complies with Level 3 Crypto Security Standards and SOC 2 compliance.

- Insured up to USD 375 million: Assets are insured through insurance companies including Lloyd’s of London and Arch and Marsh, and are guaranteed by a group of supervisory partners, among them Ledger Vault and Bitgo.

- Avoid capital gains tax: When you borrow against your cryptocurrency and spend that loan, you do not have to pay any income tax on it.

- Global reach: You can instantly withdraw your loan in over 40 fiat currencies across more than 200 countries. Typically, you will receive the money after one business day. You can also receive loans instantly in stablecoin.

Basic information about NEXO:

+ Ticker: NEXO

+ Blockchain: Ethereum

+ Contract: 0xb62132e35a6c13ee1ee0f84dc5d40bad8d815206

+ Token type: Utility token (ERC-20)

+ Max Supply: 1.000.000.000 NEXO

+ Circulating supply: 1,000,000,000

+ NEXO real time price: $ 1.03

Who is NEXO’s founder?

Nexo was founded by two man, Kosta Kantchev and Antoni Trenchev:

♦ Kosta Kantchev: CEO and co-founder of NEXO, holds a master’s degree in finance from Webster University and has a CAMS certification (Certified Anti-Money Laundering Specialist). He was also a co-founder and a member of the board of directors of Credissimo (an international financial group).

♦ Antoni Trenchev: Co-founder & Managing Partner of NEXO, graduated in law from King’s College London and holds a Master of Laws from Humboldt University of Berlin, is CAMS certified, and was a member of the Bulgarian National Assembly, director, and legal advisor of MDL Ltd.

The main features of Nexo Project

- Earn on Crypto: Nexo allows users to earn interest on their cryptocurrencies and fiat currencies, offering competitive annual percentage yields (APYs). Interest is paid out daily, which compounds, increasing the potential returns for users.

- Instant Crypto Credit Lines: Users can obtain instant fiat currency loans against their cryptocurrency assets, which serve as collateral. This means users can access cash without selling their investments, potentially avoiding tax implications and benefiting from the appreciation of their digital assets.

- High Liquidity: Nexo provides high liquidity to its users, allowing them to withdraw funds or repay loans at any time.

- Security: Nexo prioritizes security with military-grade encryption and a variety of advanced security measures to protect users’ funds. They also use cold storage wallets and have partnerships with leading custodians in the industry.

- Regulatory Compliance: Nexo complies with various global regulations and has a robust anti-money laundering (AML) and Know Your Customer (KYC) policy to ensure the platform’s integrity.

- Insurance: Cryptocurrency holdings on Nexo are insured up to $375 million, a feature that enhances trust and credibility among its users.

- Nexo Token Utilities: The NEXO token grants holders benefits like lower interest rates on loans, higher yields on savings, and free withdrawals. It also offers a dividend distribution model, sharing a portion of the company’s profits with NEXO token holders.

- Buyback Program: Nexo has implemented a token buyback program which can positively influence the liquidity and price of the NEXO token.

- Loyalty Program: Nexo’s loyalty program offers tiered benefits based on the proportion of NEXO tokens in the users’ portfolio.

- Multi-currency Support: Nexo supports a wide range of cryptocurrencies and fiat currencies, allowing users to interact with the platform using their preferred assets.

- Easy to Use: The platform is designed to be user-friendly, suitable for both crypto newcomers and seasoned investors, with an intuitive interface for managing investments, loans, and savings.

Should you invest in NEXO?

To determine whether you should invest in NEXO, let’s analyze the existing pros and cons of this project:

What are the advantages of NEXO coin?

♥ User-friendly and simple enough for anyone to understand, even those new to the cryptocurrency market.

♥ Automated interest calculation and payment. Once your Nexo account is set up and funded, you can sit back and relax – Nexo will automatically calculate your daily earned interest and deposit it directly into your account. Nexo will even send you in-app notifications to let you know when your interest has been paid and how much you have earned. Unlike most other cryptocurrency interest accounts, Nexo distributes the interest you earn daily – so you won’t have to wait a month before you can start benefiting from compound interest.

♥ $375 million insurance: this gives investors more peace of mind when depositing money into NEXO.

♥ $100 million buyback program: this is a way to help NEXO create liquidity for itself and also help increase the value of NEXO coin. The NEXO tokens bought back will be either burned or held back for sale later, depending on the project’s strategy.

♥ A loyalty program to encourage users to stay with NEXO.

♥ The NEXO website is always fully updated with information for those looking to learn more.

What are the disadvantages of NEXO coin?

♦ Must compete with many other similar decentralized financial platforms such as BlockFi, Celsius, CoinLoan, etc., and also has to compete with tens of thousands of different cryptocurrencies currently circulating in the market.

♦ To receive the best rates, users must hold NEXO tokens, so they may choose other platforms to deposit their cryptocurrency savings.

♦ Price is highly volatile, which means there’s a substantial risk involved in investing.

♦ There is a limitation on withdrawals as you have to wait about one day.

♦ Not being listed on Coinbase, which is the second-largest cryptocurrency exchange in the world currently, causes NEXO to lose a significant number of users.

♦ Customer support is often complained about as being slow.

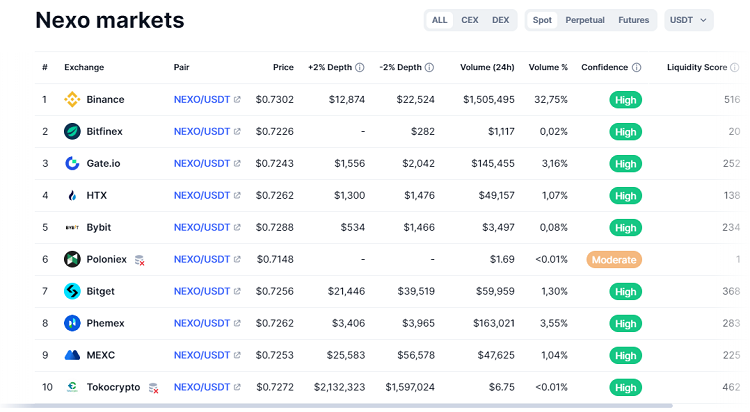

Where to buy NEXO token?

♦ NEXO is a decentralized financial platform, developed to become a “cryptocurrency bank” where users can deposit their cryptocurrencies to earn interest or borrow cryptocurrencies from the platform at competitive rates.

♦ Nexo currently manages assets for over 3 million users across 200 legal jurisdictions with over 40 different fiat currencies.

♦ Over $12 billion is being managed by NEXO with support for more than 60 types of cryptocurrencies.

♦ NEXO is a project positively rated by many people, operating since 2018 and has a clear development strategy.

♦ NEXO is a potential long-term investment, however, it does come with risks, so you may consider investing with a small amount of capital.

Through this, you must have understood what is NEXO coin along with detailed information about this project. Hopefully, with the information provided by invest286.com, you will understand more about this project and make an accurate judgment on whether to invest in NEXO or not. Wishing you the right investment choices and success.