The blockchain space has continuously made its mark recently with the emergence of many new names boasting advanced technology. SUI blockchain (SUI coin) is one of them. Notably, SUI has now officially been listed on several major exchanges, and it has also been selected as the 33rd project by Binance LaunchPool. But what is SUI coin? Why has it become so famous and highly regarded? What makes it special compared to other blockchains? And is the potential of SUI worthy of becoming a long-term investment

Contents

What is SUI coin, and should you invest in it 2025?

What is SUI coin?

SUI coin, or SUI Blockchain, is a decentralized platform that allows developers to build and run decentralized applications (DApps) that can operate securely, efficiently, with high speed, scalability, and low latency. According to the project, this platform can achieve speeds of up to several hundred thousand TPS (transactions per second)..

The scaling approach of Sui is not similar to Solana or Internet Computer (which scale vertically) but somewhat resembles the approach of Ethereum 2.0 (scaling horizontally). Sui’s goal is to expand the ecosystem of Web3, providing an infrastructure with appropriate incentives for developers to quickly build and launch applications.

Sui traces its roots back to Facebook’s Diem project. It was developed by Mysten Labs, a startup established by ex-Meta team members. After Diem’s cancellation, a section of the team pivoted to develop Sui in its current form. Simultaneously, another offshoot of Diem led to the creation of Aptos, making Aptos (APT) often perceived as a key competitor to Sui.

What makes SUI blockchain technology special?

You might already have an understanding of what is SUI coin. But what specifically makes the SUI blockchain stand out compared to other blockchains? We won’t go too deep into the technology or programming language, but we’ll try to clarify the most salient points.

Just imagine, your experience with blockchain is like getting on a train — everyone has to wait for others to get on before the train can start moving.

But on the “Sui train,” you can board through multiple carriages, and the train can start as soon as people board.

Sui adopts a “multi-lane” approach to transaction verification, allowing a large number of transactions to be processed simultaneously and immediately.

To achieve this, SUI blockchain possesses two outstanding technologies:

- The MOVE programming language: The first notable feature of Sui is that it runs smart contracts written in Move, a programming language based on Rust created by Meta to support their cryptocurrency Libra (later renamed Diem and ultimately canceled in January 2022). Generally, Move offers more flexibility compared to other smart contract languages like Solidity. In Move, everything is an object, and contracts are separate from the state; it is designed for parallel execution.

- The Narwhal-Tusk consensus algorithm: Narwhal-Tusk is the consensus algorithm in Sui blockchain, separating the data transmission process from the transaction consensus process. Therefore, it resolves the Mempool issue – the consensus in traditional blockchain designs like Ethereum & Bitcoin, making transactions fast and instantaneous.

=> Based on the two improvements above, Sui blockchain allows for horizontal scaling, supporting millions of transactions per second without the need for dedicated nodes in the network. And this is what makes SUI special compared to other blockchains.

In general, the cryptocurrency community is always on the lookout for blockchain projects that can address the biggest challenge of the industry, which is scalability and security. And SUI seems to have done that by providing a platform capable of high scalability with the ability to process transactions quickly. Its unique sharding solution allows parallel processing of transactions, enabling simultaneous handling of a large number of transactions. This means SUI can support a variety of DApps, including those with high transaction volumes without encountering the bottlenecks that challenge other blockchain networks.

Furthermore, the combination of PoW and PoS consensus mechanisms enhances security and reduces the risk of a 51% attack. This is crucial for the DeFi sector, where security is paramount to protect users’ funds and ensure the stability of the platform.

What is the difference between Aptos and Sui coin?

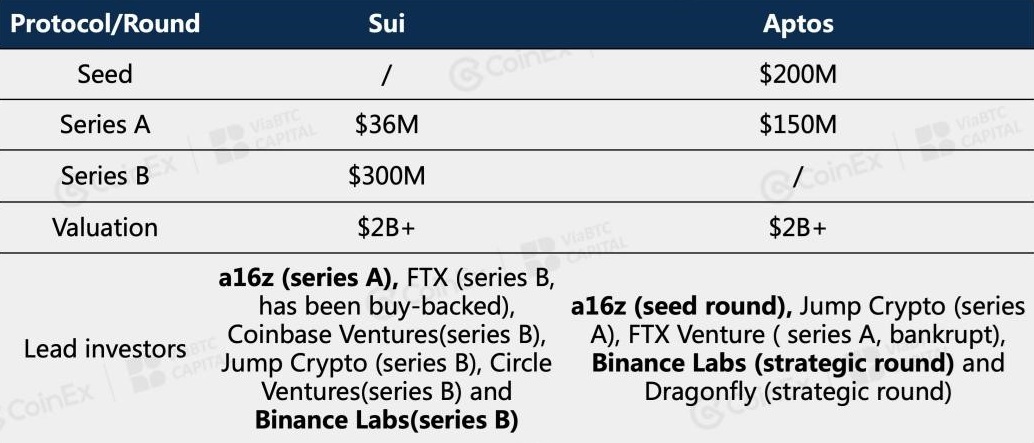

As public blockchains that originated from the Move language, Sui and Aptos have drawn the attention of top investors since their inception. As a result, people often compare these two blockchains. a16z participated in the first funding round for Sui in December 2021 and for Aptos in March 2022. Currently, Aptos has a market capitalization of about 1.9 billion dollars, while Sui’s valuation has exceeded 2 billion dollars following its series B round.

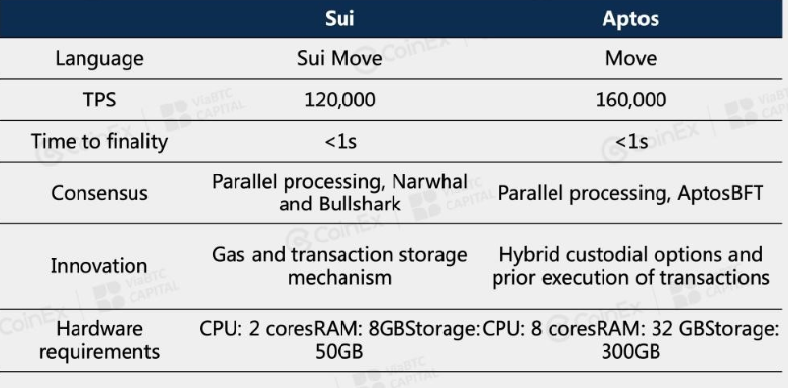

Sui and Aptos both originated from the Diem project and aim to improve TPS, scalability, and security. Both deploy Proof-of-Stake (PoS) consensus and perform parallel transactions. However, their underlying algorithms differ.

Sui and Aptos have many similarities in that both are relatively new Layer-1 blockchains, developed by former Meta employees, and use the Move programming language. But if you look closer at each blockchain, there are quite a few differences.

- Firstly, Sui uses a newer version of the same programming language and is more transparently coded. It allows users to see if an object is owned, shared, immutable, etc., while Aptos does not.

- Secondly, while both run on the same PoS mechanism, Sui uses Narwhal and Bullshark for its consensus algorithms, while Aptos uses a derivative of the HotStuff protocol.

- Lastly, Aptos had a slightly higher throughput during testing stages, reaching 160,000 TPS. However, after the mainnet launch of Aptos in October 2022, its TPS dropped to a low of 4 TPS and is currently running at 6 TPS with 248 validators (as of March 17, 2023). Meanwhile, Sui’s true potential is still to be seen, although its object-centric design—facilitating parallel transactions—promises a high ceiling with theoretically unlimited TPS potential.

Looking at the current ecosystem, the Aptos ecosystem is rapidly developing. From infrastructure services like wallets and oracles to functional applications such as DeFi, NFTs, and games, Aptos is steadily growing a diverse and well-structured ecosystem that continues to expand. In contrast, Sui is developing much more slowly.

Sui, still in its early stages, lacks impressive performance, with only a few simple projects in its ecosystem. It is growing slowly and is overshadowed by Aptos, which has made efforts to build its ecosystem. So, it is clear that Sui is currently falling behind Aptos. In terms of PR, the Sui team is not as active as the Aptos team, which also indicates a focus on stability. The Sui team often strongly promotes the launch of new projects, such as demonstrating the technical capabilities and functionalities of the public chain to the public through Capy NFT, aiming to provide ideas and development possibilities for other applications.

SUI Tokenomics

Sui utilizes a native token called SUI. The maximum supply of SUI tokens is capped at 10 billion (10,000,000,000). SUI tokens serve several primary purposes within the SUI ecosystem, notably:

- SUI plays a critical role in the governance of the Sui blockchain. SUI token holders have the right to participate in on-chain voting.

- SUI is used to pay for gas fees for transactions and other activities on the chain.

- Users can stake SUI tokens to participate in the platform’s Proof of Stake (PoS) mechanism.

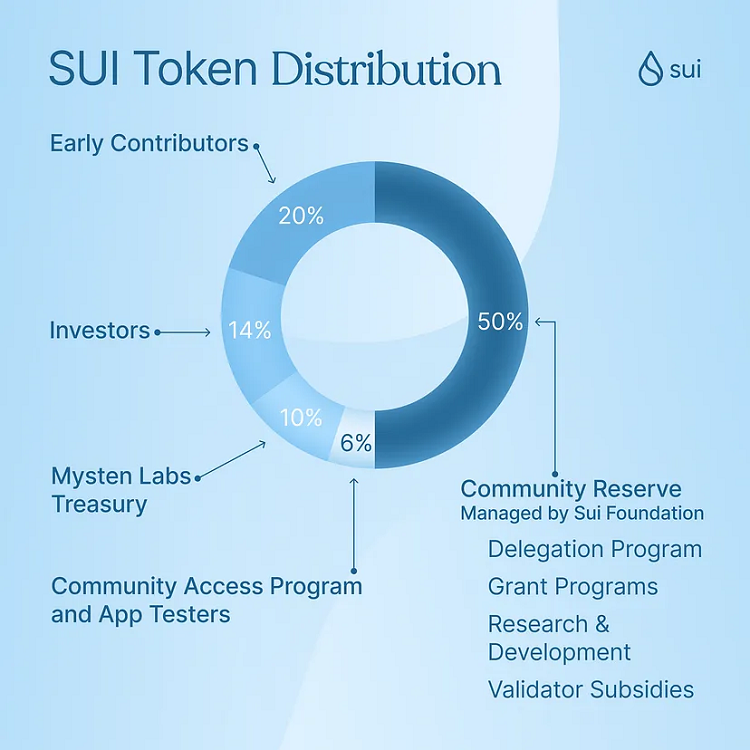

The distribution of SUI tokens is as follows:

- 50% of the tokens are allocated to community reserves (for research, staking, validators, grant programs, etc.)

- 20% to early contributors to the project

- 10% to the project team

- 14% to investors

- 6% for grant programs and for users who participate in early experiences and community outreach programs.

The Team, Investors, and Partners of SUI coin

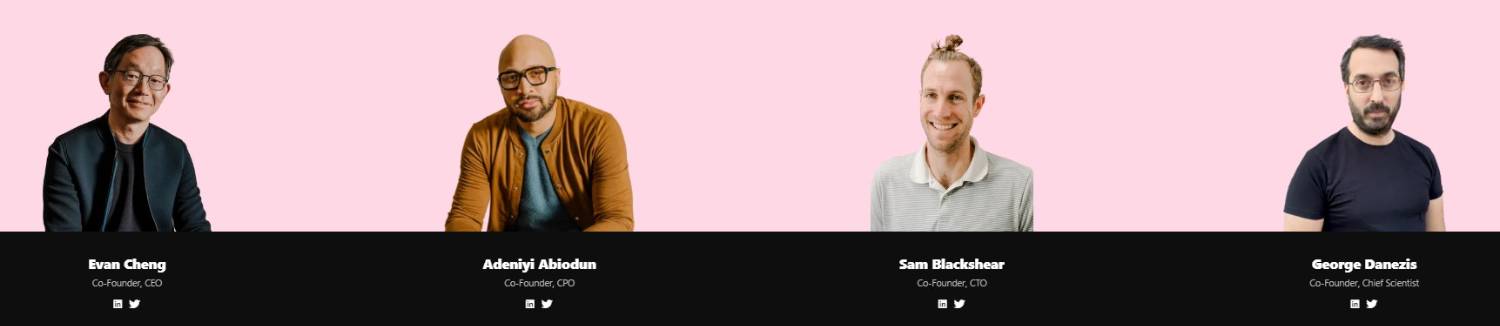

– Team The Sui development team comes from Mysten Labs, and the founding team includes Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, and Kostas Kryptos, all of whom have worked on the Novi and Diem projects at Meta (Facebook). Among them, CEO Evan Cheng was the Director of Technology and Engineering for blockchain development at Meta from 2018 until September this year.

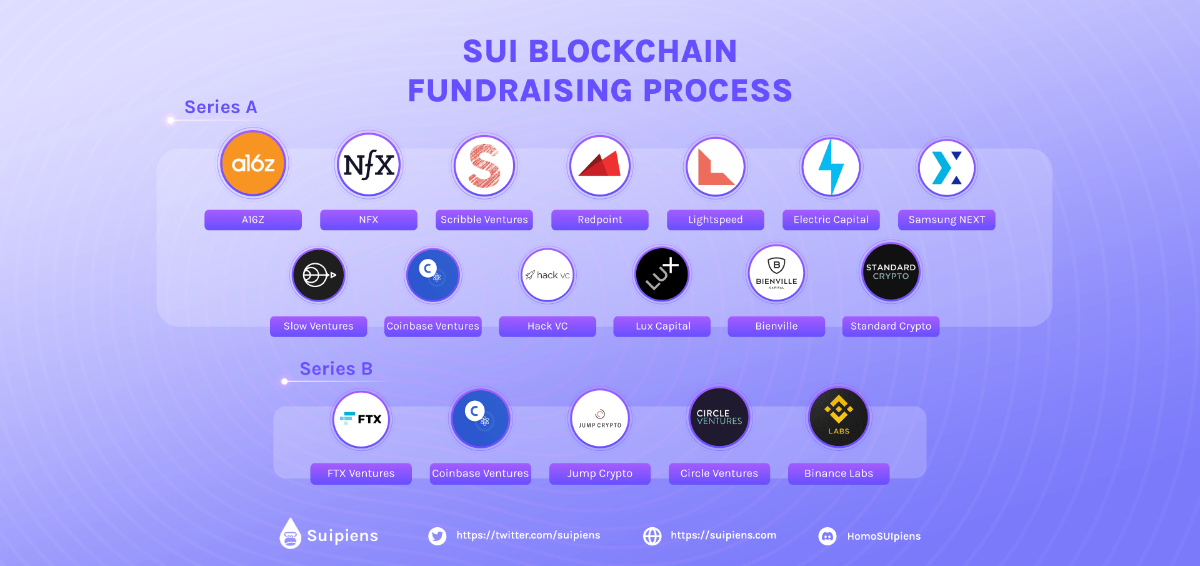

– Investors: SUI has raised over $300 million from multiple VCs, including: a16z, Redpoint, Lightspeed, Coinbase Ventures, Electric Capital, Standard Crypto, NFX, Slow Ventures, Scribble Ventures, Samsung NEXT, Lux Capital, Bienville, Hack VC, Finality Capital.

One of the truly important metrics for a project is the volume of capital raised from major investment funds. Through Series A and B, the Sui Network has raised $336 million from investment funds.

– Series A Round:

- Announcement date: December 6, 2021

- Amount raised: $36 million

- Lead investor: a16z

- Other investors: NFX, Scribble Ventures, Redpoint, Lightspeed Venture Partners, Slow Ventures, Standard Crypto, Electric Capital, Samsung NEXT, Coinbase Ventures

– Series B Round:

- Announcement date: September 8, 2022

- Amount raised: $300 million

- Lead investor: FTX Ventures

- Other investors: a16z, Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, Circle Ventures, Dentsu Ventures, Greenoaks Capital, Lightspeed Venture Partners, Sino Global, O’Leary Ventures

Mysten Labs was valued at a minimum of $2 billion after completing this Series B round. This has led to expectations that Sui Network will be among the top 50 blockchains in terms of market capitalization safely after its launch.

– Community: If you want to get more updates about SUI coin, you can learn more through some of the following information channels:

- Website: https://mystenlabs.com/

- Website: https://sui.io/Twitter: https://twitter.com/SuiNetwork

- Discord: discord.com/invite/mysten

- Medium: https://medium.com/mysten-labs

- Developer Documentation: https://docs.sui.io/

- Github: https://github.com/MystenLabs/sui

- Learning https://docs.sui.io/devnet/learn

- YouTube https://youtube.com/@Sui-Network

- Forums https://forums.sui.io/

- Explorer https://explorer.sui.io/

- Mysten Labs Partners https://mystenlabs.com/partners

- Create Wallet https://docs.sui.io/explore/wallet-browser

Does the SUI coin have potential for investment?

The current cryptocurrency market is very favorable for new and innovative blockchains, and SUI has certainly captured the attention of those interested in this field. Its focus on scalability, security, and developer-friendliness makes it an attractive platform for building DApps that can offer real-world solutions.

In summary, SUI is an ambitious Layer-1 project with a strong team capable of truly transforming blockchain, cryptocurrency, and the entire WEB3 landscape. With its open-source nature, the exclusive MOVE programming language, and an innovative approach to scaling and security, the top-tier funding and capital raised provide strong momentum for its robust future growth, confidently securing a spot in the top 50 blockchains.

Undeniably, the SUI Blockchain has HUGE potential to become a major name in the blockchain industry. Although it is still a relatively new project, there is a high likelihood that SUI will grow sustainably, and its ecosystem will become even more robust in the future. There is much to look forward to with this blockchain.

However, remember that investing in SUI still involves some risks. There are still controversies related to SUI, for instance:

- In its Series B round, SUI received a significant capital investment from FTX Ventures. However, FTX Ventures collapsed, and the absence of FTX Ventures as a powerful ally could restrain SUI’s growth compared to its sibling project – Aptos.

- SUI has caused controversy in the community and alienated some investors with their airdrop plans. Whereas Aptos has been more successful in appeasing investors with its airdrop, Sui has continuously faced criticism and disputes from those who have spent a lot of time contributing to the project. This has led many investors to turn their backs on the project.

So, should you invest in SUI coin? Personally, I rate this as a pretty good long-term investment project. You might consider allocating a reasonable amount of capital if you believe in SUI’s potential for the future. SUI is still relatively new with a small ecosystem, but there is plenty of time and room for growth. Although there is some negativity surrounding SUI and only 5% of the total supply is currently in circulation, SUI will be unlocked gradually over the years, so investors may not face significant sell pressure. Importantly, find the right valuation for SUI from its FDV and total supply to calculate the most optimal SUI price, in line with market trends, and avoid FOMO when prices have risen too high. If SUI and projects within its ecosystem manage to generate good growth, it could become a potential investment for the next bull run.

What about you, do you understand what is SUI coin? What do you think about this blockchain? Do you plan to invest in it? Please share with us. Thank you for reading the article and I wish you successful investing.

Read more: