Litecoin is often referred to as the “little brother of Bitcoin.” It shares many properties with Bitcoin and is one of the oldest cryptocurrencies in the market. These facts alone have made Litecoin (LTC) an object of interest and choice for many. But what is LTC coin? What is Litecoin, how does it operate, and does Litecoin have great potential? Let’s delve into the details in this article.

Contents

- 1 What is Litecoin? What is LTC coin?

- 2 How was Litecoin created?

- 3 Litecoin: What Sets It Apart from Bitcoin?

- 4 How many Litecoins are there to mine?

- 5 What are the advantages of Litecoin?

- 6 What are the current challenges of LTC coin?

- 7 Litecoin (LTC coin) has a lot to develop

- 8 Should you invest in Litecoin (LTC)?

- 9 Where to buy and how to store Litecoin (LTC)?

What is Litecoin? What is LTC coin?

How was Litecoin created?

Litecoin was created by Charlie Lee, a graduate of the Massachusetts Institute of Technology. Lee, a former Google engineer, was initially very interested in Bitcoin. After some time engaging with cryptocurrency exchanges, Lee dedicated most of his time to developing Litecoin.

What is Litecoin and why was it created? In an announcement about Litecoin published in October 2011 on the Bitcointalk forum, Lee stated that he wanted to “create a silver version of Bitcoin,” inheriting and improving the best features of Bitcoin and other Altcoins active at that time.

To create LTC, he forked Bitcoin. Essentially, Lee modified the DNA of Bitcoin and then added his new innovations to make people start mining and believing that it had a future.

-

Firstly, Lee based Litecoin on Bitcoin and transformed it into Litecoin by increasing the supply and decreasing the block generation time to create a faster and cheaper currency.

-

Secondly, Lee changed Bitcoin’s mining algorithm to a new system named scrypt (a derivative function). Litecoin was the third cryptocurrency to use scrypt. The first coin was a long-dead cryptocurrency called Tenebrix, and the second was Fairbrix, also created by Lee but had many shortcomings.

At that time, many cryptocurrency enthusiasts wanted Bitcoin alternatives with the highest fairness, without fear of the development team hoarding too much supply, leading to potential price manipulation. When Litecoin was launched, it addressed these concerns, and was well-received, causing its price to rise quickly.

However, Litecoin also caused controversy when, on December 2017, founder Charlie Lee sold all of his holdings at the peak price of $350. Lee’s action faced much criticism from the community. But Lee explained that it was the peak of LTC, and it was unlikely to collapse down to $20.

Nonetheless, after a period of “collapse,” Litecoin once again surpassed its all-time high in August 2021. This demonstrated that, once again, Litecoin could be a “resurrecting” investment in an uptrend.

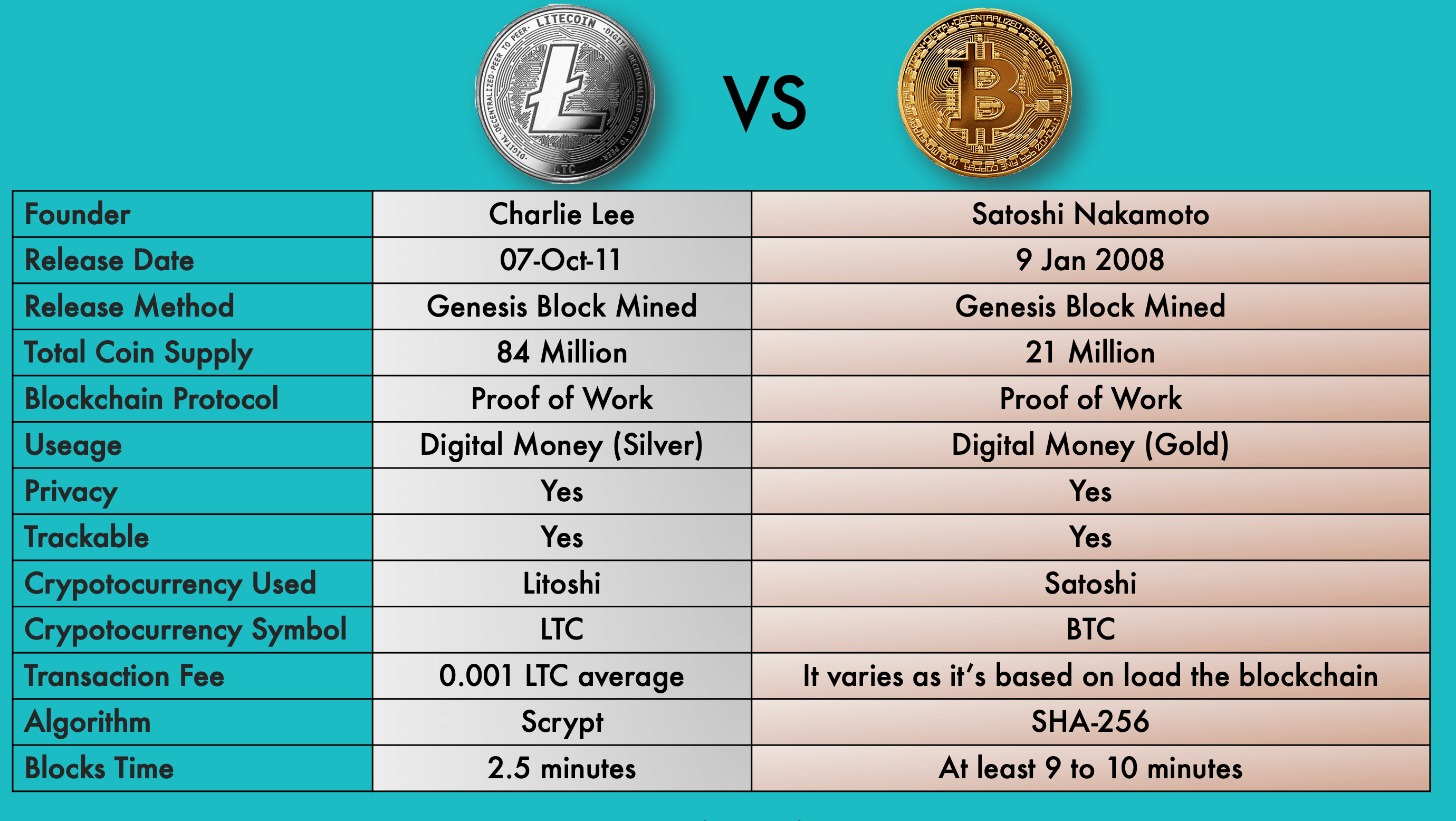

Litecoin: What Sets It Apart from Bitcoin?

Although Litecoin was launched with the goal of being the “silver to Bitcoin’s gold,” it is, like BTC, a peer-to-peer (P2P) cryptocurrency based on blockchain technology. However, it was designed to address some of the shortcomings identified in Bitcoin.

Like many other early cryptocurrencies, Litecoin employs a proof of work (PoW) consensus mechanism. In PoW, powerful computers known as miners compete to add transaction records to a block. In the Bitcoin network, a block is added to the blockchain every ten minutes. Once a block is added, the next one must wait about 10 minutes before being added to the blockchain.

Litecoin – while similar to Bitcoin in most aspects of its core technology – boasts a block generation time of just 2.5 minutes. This makes Litecoin four times faster than Bitcoin. Litecoin uses Scrypt as its PoW mining algorithm, which is less energy-intensive than Bitcoin’s SHA-256 algorithm. Litecoin also utilizes an open-source full node software called Litecoin Core to validate transactions and blocks on the Litecoin network.

Overall, the most notable differences are:

- Reducing payment time and increasing the total supply compared to Bitcoin.

- Employing a different mining algorithm than Bitcoin, namely Scrypt.

While Bitcoin uses the SHA-256 algorithm, Litecoin employs the Scrypt algorithm. So, what makes Scrypt superior that Litecoin has chosen to use it?

When Bitcoin was first created, people mined it using home computers. Over time, many began to manufacture high-capacity machines, specifically designed for Bitcoin mining. Miners using these specially manufactured machines started to compete with home Bitcoin miners and began to “professionalize” the business of cryptocurrency mining.

=> This did not sit well with many, as they felt that cryptocurrency mining should be accessible to everyone, not just professional miners with sophisticated equipment.

=> Moreover, there was increasing concern about how much energy Bitcoin mining would require if it were to become a global currency.

Scrypt was designed to address both of these issues. Litecoin allows you to easily mine cryptocurrency at home because Scrypt is much more energy-efficient than Bitcoin mining.

How many Litecoins are there to mine?

Similar to Bitcoin, Litecoin can be mined and also has a maximum coin limit. The maximum supply of Litecoin is 84 million.

As of now, there are a total of 75,695,758 Litecoins in circulation on the market. The remaining amount is still being mined and is expected to be fully mined by the year 2142.

What is Litecoin? Like Bitcoin, the Litecoin blockchain also has periodic Halving events. The Litecoin Halving is planned to occur after every 840,000 blocks – which takes about 4 years – until the maximum supply of 84 million Litecoins is reached. When new blocks are added to the network, miners receive Litecoins as a reward. After every 840,000 blocks, the reward received by miners is halved.

When Litecoin was first launched, the mining reward was 50 LTC. However, now the reward has been reduced to 6.25 Litecoin per block.

What are the advantages of Litecoin?

Have you understood what is Litecoin? Now, let’s recap its prominent advantages.

Low transaction costs and fast processing speed

I’ve explained the strength of Litecoin earlier. Charlie Lee realized that the main issue with Bitcoin was the slow transaction processing, often leading to congestion. Therefore, Charlie Lee discarded the SHA-256 Proof of Work algorithm used by Bitcoin, and instead, he used the SCRYPT consensus algorithm.

The main benefit of SCRYPT is that more users can confirm transactions using basic technology devices. Standard Central Processing Units (CPUs) and Graphics Processing Units (GPUs) in personal computers can be used to mine Litecoin.

- Litecoin can handle 56 transactions per second.

- Bitcoin can handle 4.6 transactions per second.

- Ethereum can handle 10 – 15 transactions per second.

Besides speed, the transaction cost of Litecoin is also very low, averaging about $0.039296. The average transaction fee of Bitcoin is $23.94, while that of Ethereum is $8.934.

=> Lower costs make Litecoin an excellent option for transactions and transfers, suitable for those who have switched to using cryptocurrency as a safe money transfer system.

Litecoin has impressive daily trading volume

One of the largest market and consumer tracking tools – Statista, conducted a study on the number of daily transactions with cryptocurrency. The results:

- Litecoin was listed among the most traded, including Bitcoin, Monero, Ethereum Classic, Ripple, Chainlink, Ethereum, Bitcoin Cash, Dogecoin, and Stellar.

=> This indicates that LTC has gained the trust of many investors. Having many investors trust and currently trading at such low valuations, LTC could become an attractive investment in the future.

Litecoin has a finite supply

At the time of writing, LTC has a total supply of 35,988,173,820, of which a maximum of 84 million LTC will be reached.

In the near future, all LTC will be mined. This will lead to a scarcity of LTC. When LTC becomes harder to buy, perhaps many LTC holders will sell it at a higher price, and buyers will do everything to own this currency.

=> This scarcity will make LTC a safe haven from depreciation and inflation and could help it become a store of value for long-term investors, especially in economically turbulent times.

Litecoin has many important partnerships

Over many years of operation, Litecoin has gained many very important partners, most notably:

- Miami Dolphins: An American football team, announced Litecoin as the official cryptocurrency in 2019. Through this partnership, Litecoin (LTC coin) has promoted its image with stadium advertisements, as well as becoming a payment option for the team’s online content.

- PayPal: At the end of March 2021, PayPal announced the launch of a cryptocurrency payment service. Among the cryptocurrencies, Litecoin was mentioned by PayPal as a payment option that could help users pay for products from over 29 million sellers on PayPal and reach over 377 million people. Especially, Litecoin can be bought and sold on PayPal.

- Skrill: In 2018, Skrill announced that wallet owners could instantly buy and sell cryptocurrencies. Litecoin is one of the cryptocurrencies listed on Skrill’s website. Skrill has more than 40 million users in 30 countries.

=> Transactions on these platforms have played an invaluable role in the daily trading volume of Litecoin. As more people become open to using cryptocurrency, the high trading volume will positively affect the price of Litecoin, making it increasingly valued.

What are the current challenges of LTC coin?

What is Litecoin? Indeed, Litecoin has brought significant profits to investors, but it is not a perfect cryptocurrency. Like all digital assets, its price is affected by global news and the volatility of the cryptocurrency market in general.

Let’s consider some reasons to decide whether or not to buy Litecoin:

Infinite competition from other cryptocurrencies

In addition to facing competition from Bitcoin, Litecoin also competes with other altcoins:

-

Bitcoin currently has two functions, it acts as a transaction currency, and it is also a store of value.

-

Ethereum, Tron, Cardano can also be currencies or stores of value, but they also offer additional applications, dApps, smart contracts…

-

Meanwhile, Litecoin will be grouped with Bitcoin Cash and Dash, mainly used as a store of value and accepted by a few places for payment of goods and services.

However, in the race with the aforementioned cryptocurrencies, Litecoin is not outstanding. Bitcoin Cash has a faster processing speed, up to 116 transactions per second. Meanwhile, Dash also achieves a speed of 56 transactions per second, just like Litecoin. Additionally, they all offer relatively similar fee structures. The average transaction fee for LTC is $0.039296, for Dash is $0.005754, and for Bitcoin Cash is $0.006004.

=> The functionality, utility, speed, and transaction fees of LTC compared to its competitors are equivalent, but the price of LTC is much higher. This is a disadvantage because investors will tend to look for coins that are currently better valued.

Big question marks surrounding the leadership of Litecoin

Charlie Lee sold his stake for Litecoin in 12/2017. He argued that his action was due to a conflict of interest. At that time, this raised questions about the legality and authenticity of the cryptocurrency if its creator decided to abandon it.

Although his actions have not done much harm to the value of Litecoin up to this point, it raises questions about the future of Litecoin as well as Litecoin’s projects.

=> The cryptocurrency market is growing and with it, new technologies and projects are launched continuously. If a project like Litecoin is not cared for, invested in, and improved by its founder, then surely it will gradually be eliminated.

The current advantages of Litecoin are no longer relevant

Litecoin’s initial advantages from 2011 have become increasingly obsolete over time, and the benefits once offered by scrypt have diminished.

Advanced mining tools have been developed, rendering scrypt’s memory-intensive design more of a hindrance to Litecoin’s mining industrialization. Consequently, mining Litecoin profitably at home, as was once feasible, is no longer a practical option.

Moreover, Litecoin’s other selling point – faster transaction processing – is no longer remarkable in the current cryptocurrency landscape. Numerous other cryptocurrencies have emerged, surpassing Litecoin in both performance and the range of utilities they offer.

Litecoin (LTC coin) has a lot to develop

What is Litecoin? Although Litecoin is one of the earliest cryptocurrencies, there have been some developments around the Litecoin project over the years, keeping it “standing strong” in the market, even in the face of the continuous appearance of newer cryptocurrencies advertised to have improved consensus mechanisms. Most of the development drive for Litecoin (LTC) is focused on turning it into a globally accepted payment method. To facilitate this, various improvements have been made.

-

SegWit & The Lightning Network: Segregated Witness (SegWit) is a technology originally designed and proposed for Bitcoin, but it did not receive support from the Bitcoin community. However, Litecoin has adopted the SegWit technology and deployed it. SegWit has paved the way for new features to be added to Litecoin, one of the most prominent being the Lightning Network.

-

Lightning Network: enables scalability and rapid confirmation of transactions. Before the development of the Lightning Network, PoW cryptocurrencies always needed a certain amount of time – a few minutes to a few hours – to confirm a transaction. This was a significant disadvantage and slowed down the mass adoption of cryptocurrencies as a means of payment. However, the number of transactions per second on the Litecoin network increased with the integration of the Lightning Network, which has helped it to also confirm transactions instantly. For example, a customer could instantly pay for coffee at Starbucks, with instant transaction confirmation.

-

Litecoin Card: The Litecoin Card has been released to allow the use of Litecoin as a payment method anywhere that accepts traditional bank cards. The Litecoin Card is issued by Visa and is accepted globally wherever Visa cards are accepted. Users holding Litecoin in a compatible cryptocurrency wallet or account can sign up for the Litecoin Visa card.

-

OminiLite: Lastly, the recent addition of the OmniLite layer is notable. This protocol allows for the management of cryptocurrency assets on the Litecoin network and facilitates capital raising from the community based on the blockchain. OmniLite can be used to create new cryptocurrencies and even issue NFTs.

Update on today’s Litecoin (LTC) price:

Litecoin (LTC)

Should you invest in Litecoin (LTC)?

Are you considering buying Litecoin? Perhaps after reading the aforementioned pros and cons, you have found your own direction. Before deciding to purchase LTC, consider the following:

- Does Litecoin have enough potential to maintain its position among the top coins in the cryptocurrency market?

- Is the Litecoin platform, with its greatest advantage being fast transaction processing and mining via cryptography, appropriate at this stage?

- Is becoming the “silver version of Bitcoin’s gold” enough to serve as “insurance” for Litecoin in the long term?

- Are the things it aims for and its developments strong enough for LTC coin to surge?

Over the past year, the halving event did not significantly affect the price of LTC. LTC price movements follow the general trend of the market (mainly dependent on BTC fluctuations).

However:

- Despite volatility, Litecoin has maintained a stable price for many years. It cannot be denied that Litecoin is one of the ways to transfer monetary value cheaply and quickly to anywhere in the world.

- Litecoin, dubbed the “little brother of Bitcoin,” has longevity and a hard-to-replace position in the cryptocurrency market.

Although Litecoin seems good from a technological perspective and the price charts show positive signals, there are various reasons why cryptocurrency investors are not overly attracted to this currency. Initially formed as a faster version of Bitcoin, Litecoin may now be considered outdated with Bitcoin introducing its own Lightning Network version.

Another “issue” with Litecoin is its use of PoW, a mechanism currently considered to be energy-consuming and environmentally polluting. This has led some regulators to even consider banning PoW.

But despite all of this, Litecoin (LTC) remains one of the largest and most traded cryptocurrencies on the market. Its fast and cheap network, along with the ability to make payments anywhere Visa is accepted, has helped it maintain a strong position in today’s competitive cryptocurrency market.

If Litecoin truly is the digital silver, then there is no reason it cannot coexist with gold, as the two metals have done before. Therefore, Litecoin is still one of the coins you can consider investing in during each uptrend.

=> But, due to the risks associated with Litecoin, it would be wise to diversify your risk. You can hold LTC and other cryptocurrencies along with low-risk assets such as bonds, commodities, and stocks. This will help you balance any losses you may incur in the future.

Where to buy and how to store Litecoin (LTC)?

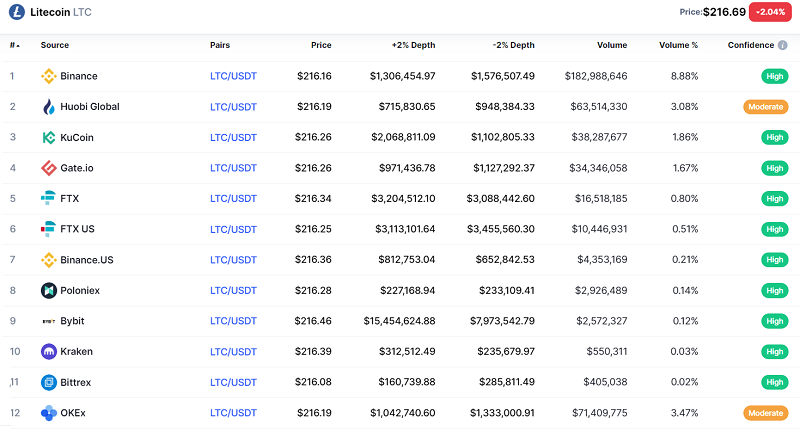

As a very popular and long-standing coin, you can buy Litecoin at almost any cryptocurrency exchange, such as Huobi Global, Binance, Coinbase Pro, OKEx, and Kraken…

For details on exchanges where you can buy LTC, you can refer to:

- https://coinmarketcap.com/currencies/litecoin/markets/

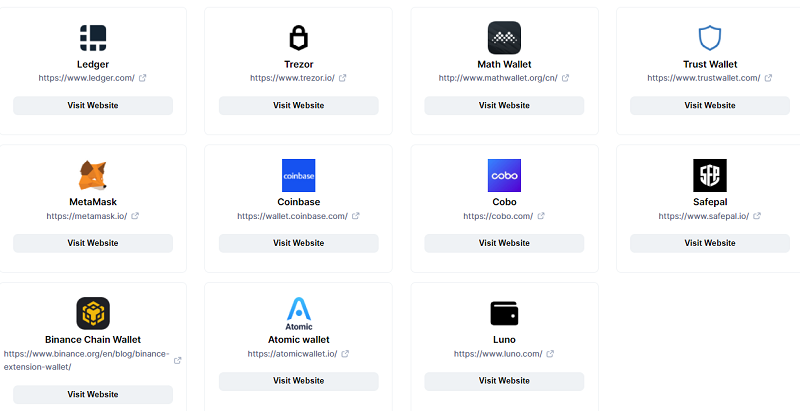

Regarding Litecoin storage wallets, since Litecoin has been around almost as long as Bitcoin, most cryptocurrency wallets you can find support Litecoin.

– Litecoin (LTC) is a long-standing cryptocurrency. For those who have been in the cryptocurrency market for a few years, they will probably remember the unwritten rule of holding Bitcoin, Ethereum, and Litecoin in the crypto community.

– Although Litecoin is currently somewhat behind its competitors, and its advantages are no longer relevant, in the minds of many, LTC remains one of the important coins and is worth adding to an investment portfolio.

– It’s hard to say whether investing in Litecoin is advisable or not. However, with Litecoin’s current situation, LTC will be a quite risky investment. Therefore, only invest moderately, preferably not exceeding 5% of your total capital..

– At the current time, Litecoin (LTC) is priced at $ 83.78, ranking 23 in the cryptocurrency market by capitalization.

Hopefully, with the information shared above, you have somewhat understood what is Litecoin and whether you should invest in LTC coin or not. If you have any questions, leave a comment below to discuss with us. We wish you to choose a suitable and potentially profitable investment portfolio.

Readmore: