Bitcoin Cash is one of the most popular currencies in the cryptocurrency market and currently ranks 20 by market capitalization. There are many reasons people invest in Bitcoin Cash, but there are also many issues that make Bitcoin Cash one of the most controversial currencies in the cryptocurrency field. So, what is Bitcoin Cash, how is it different from Bitcoin (BTC), and should you invest in Bitcoin Cash? Let’s join invest286.com to find the answers in the content of the article below.

Contents

- 1 What is Bitcoin Cash? Is BCH a good investment?

- 1.1 Bitcoin Cash and the Bitcoin Hard Fork Event

- 1.2 Who Created Bitcoin Cash (BCH)?

- 1.3 How many Bitcoin Cash are there in total?

- 1.4 What is the difference between Bitcoin and Bitcoin Cash?

- 1.5 What are the advantages of Bitcoin Cash (BCH)?

- 1.6 Cons of Bitcoin Cash (BCH)

- 1.7 Should you invest in Bitcoin Cash (BCH)?

What is Bitcoin Cash? Is BCH a good investment?

Although there are various other forks of Bitcoin, including Bitcoin XT, Bitcoin Classic, and Bitcoin Gold, Bitcoin Cash remains the largest Bitcoin fork by market capitalization and is the most recognized.

What is a Hard Fork?

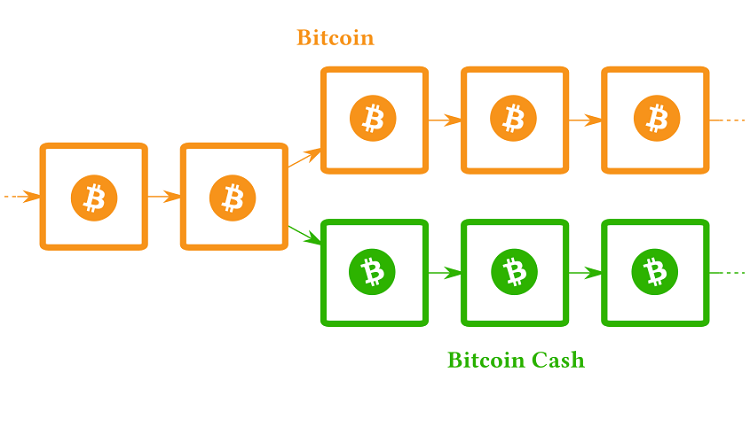

Imagine in the business world, a large company wants to split off a division to build it into a separate enterprise, operating independently from the parent company – that is an illustrative example of a “Hard Fork.”

In the world of cryptocurrency, what they split is the blockchain. If a coin undergoing a “hard fork,” the consequence is that another coin will be born on a newly formed blockchain.

Bitcoin Cash and the Bitcoin Hard Fork Event

Of course, if you understand what Bitcoin Cash is, you probably know that BCH was born from a Bitcoin fork. However, what I want to address here is the reason behind this event.

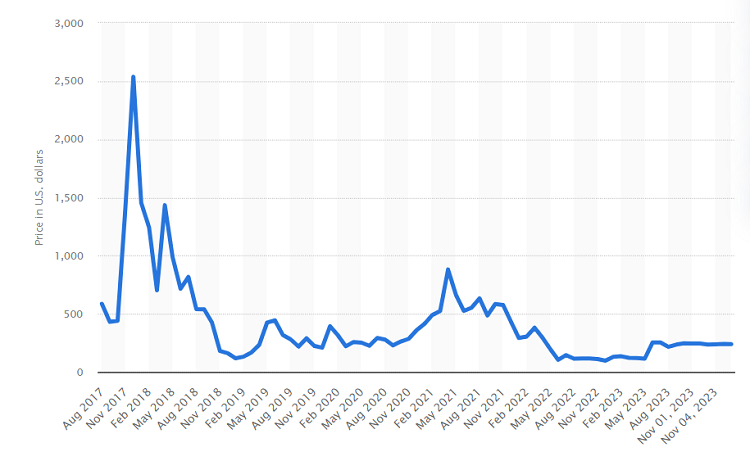

Looking back to the period before Bitcoin Cash was launched in 2017, when money flooded into the cryptocurrency market, Bitcoin reached an all-time high of nearly $20,000. However, the Bitcoin supporter/owner community was bitterly divided into two factions:

Faction 1: Wanted Bitcoin to become a simple store of value, similar to gold.

Faction 2: Wanted Bitcoin to become a common means of transaction, replacing money.

And those who supported Faction 2 were pivotal in the birth of Bitcoin Cash. The Bitcoin Cash developers saw this all-time high and speculated that the current Bitcoin network would not be able to handle the increasing number of transactions in the near future. Therefore, they sought an alternative solution (Bitcoin Cash) that could scale, increase transaction speed, and be cheaper.

Who Created Bitcoin Cash (BCH)?

Amaury Setchet is the main developer who created Bitcoin Cash. Before entering the world of cryptocurrency, Amaury was a member of the Facebook development team. The most interesting thing is that he himself did not come up with the idea of this split. In fact, the idea originated from one of the members of the Bitmain group.

Jian Wu is the co-founder of Bitmain and one of the most prominent supporters of the Bitcoin Cash idea. Some say that it was Jian Wu who told Amaury to start researching BCH.

Furthermore, the success of Bitcoin Cash cannot be mentioned without acknowledging Roger Ver – a person who was very enthusiastic about promoting Bitcoin in the early days, even calling himself “Bitcoin Jesus.” But now he primarily promotes Bitcoin Cash everywhere, and even stated that “he regrets that this hard fork did not happen sooner.” Thanks to his reputation, Roger Ver has made Bitcoin Cash known to many people.

Also, because Bitcoin Cash split off from Bitcoin, anyone who owned Bitcoin at that time received additional Bitcoin Cash.

However, the operation of Bitcoin Cash since August 2017 has caused a lot of controversy. Its supporters do not focus much on developing this currency; instead, they prefer to malign Bitcoin. Therefore, Bitcoin Cash has become a highly controversial currency from its inception to the present.

How many Bitcoin Cash are there in total?

Bitcoin Cash has the same total supply as Bitcoin, which is 21 million BCH. Currently, the circulating supply is 19,792,800 BCH, meaning that over 90% of BCH has been mined.

Bitcoin Cash (BCH) real time price:

What is the difference between Bitcoin and Bitcoin Cash?

Bitcoin Cash closely resembles Bitcoin, to the point where many confuse the two by their logos. Functionally, there are many similarities between Bitcoin and Bitcoin Cash:

- Both use the SHA-256d Proof-of-Work consensus mechanism.

- Both are mineable and undergo a halving event every four years.

- Both have a fixed supply limit of 21 million coins.

However, Bitcoin Cash was designed to address Bitcoin’s scaling issues and improve its speed and efficiency. Thus, there are some differences such as:

Firstly, Bitcoin Cash is faster than Bitcoin:

Bitcoin Cash blocks are designed to be 8 times larger (8 MB) compared to Bitcoin’s (1 MB) and were later increased to 32 MB per block. Because of the larger blocks, Bitcoin Cash can allow its network to handle more transactions per second. Conversely, Bitcoin has 1 MB blocks, aiming to improve security rather than speed. The issue is that Bitcoin can only process about 7 transactions per second, making it inefficient, especially when compared to Visa and other payment methods.

It’s important to note that larger block sizes lead to faster validation, thus facilitating easier payments. Businesses wanting to use cryptocurrency for transactions tend to prefer currencies with high transaction processing speeds. Even a small restaurant can easily manage smaller transactions on Bitcoin Cash – something Bitcoin has struggled with to this day. That’s why some people prefer Bitcoin Cash over the world’s first cryptocurrency – Bitcoin.

Secondly, Bitcoin Cash is cheaper than Bitcoin:

The price of Bitcoin Cash is significantly less compared to Bitcoin (BTC). Currently, one Bitcoin Cash (BCH) trades at $ 499.96, while Bitcoin (BTC) is over $ 95,922.70.

As more businesses start to accept cryptocurrency for payments, they may prefer Bitcoin Cash over Bitcoin. Moreover, the high price of Bitcoin indicates it’s leaning towards being a store of value.

Thirdly, Bitcoin Cash is less secure than Bitcoin:

Bitcoin’s popularity also brings another advantage: security. Since Bitcoin is much larger than Bitcoin Cash, it requires more miners to secure its network. The more miners, the more decentralized Bitcoin is and the less prone to errors. Bitcoin Cash, being less popular compared to Bitcoin, has significantly less computational power and is thus more susceptible to attacks.

Fourthly, Bitcoin Cash is not as widely accepted as Bitcoin:

Although theoretically, Bitcoin Cash might be better as a means of payment, more and more people are using, trading, and owning Bitcoin because it remains the largest cryptocurrency in the world by market capitalization. This means that today, many more vendors accept Bitcoin, even if it’s technically inferior to Bitcoin Cash.

Due to Bitcoin’s overwhelming popularity, Bitcoin Cash may appear to some newcomers as a project copying Bitcoin. It can create confusion for those who don’t understand the differences between Bitcoin and Bitcoin Cash.

Although Roger Ver actively promotes Bitcoin Cash, widespread adoption of BCH still seems quite distant. And we all know that adoption rate is very important for the growth of any cryptocurrency.

It depends on your investment goals and your belief in the currency. Note that Bitcoin Cash has some advantages over Bitcoin. However, Bitcoin leads in market capitalization and has established recognition, and at this time, it is still considered an essential coin to have in one’s portfolio. Whether you decide to buy BCH or BTC, don’t forget that investing in cryptocurrency is a high-risk investment form.

What are the advantages of Bitcoin Cash (BCH)?

What is Bitcoin Cash and is it a promising investment? Since its inception, it’s clear that Bitcoin Cash has shaken up the cryptocurrency community. Many currencies were impacted by the Covid-19 pandemic, but Bitcoin Cash (BCH) has resisted the massive sell-off by investors as HODLers chose to hold onto it instead of selling.

What makes people favor Bitcoin Cash? Here are some reasons and advantages that I think can answer this question.

Bitcoin Cash is faster than Bitcoin and Ethereum

A major issue that makes Bitcoin difficult to achieve mainstream acceptance and adoption is its processing speed. Ethereum is a bit more capable but still quite “weak”. From this perspective, Bitcoin Cash outperforms these two giants.

For comparison, Bitcoin processes 4 to 6 transactions per second, Ethereum (ETH) can handle 10 – 15 transactions per second, while Bitcoin Cash can process 116 transactions per second.

This scalability directly relates to transaction fees.

- The average transaction fee for Bitcoin Cash is $0.009011.

- The average transaction fee for Bitcoin is $50.21.

- The average transaction fee for Ethereum is $22.5.

Among the current famous coins, only Tron (TRX) has a transaction fee of $0, outperforming BCH.

=> Improved transaction speed and costs compared to BTC and ETH will be considered a strength of BCH, making many people want to use it to pay for goods and services more.

Bitcoin Cash is widely accepted

Of course, I don’t compare this criterion with Bitcoin (because it can’t win), but only with other cryptocurrencies. Although a range of blockchain technologies like Cardano (ADA), Polkadot (DOT), Solana (SOL), and Tron (TRX) have significantly improved transaction capabilities, surpassing Bitcoin Cash. But in terms of acceptance level, BCH has an edge.

Bitcoin Cash has successfully partnered with over 4,300 units across a number of industries. Charitable organizations and non-profits such as Save the Children, Heifer International Humanity Road, and Khan Academy all accept Bitcoin Cash as a payment option for donations.

Additionally, Bitcoin Cash is currently used by 73 travel and rental services, 115 marketing and web development services, 185 business services, 655 internet services, 1,385 stores and shopping channels, 147 gambling companies, 807 cryptocurrency services, 74 gaming websites, and 351 offline services.

A few of the most notable examples include:

- At the end of March 2021, PayPal announced that they had added a cryptocurrency payment feature. This has a very positive impact on the market, especially for famous payment coins, including Bitcoin Cash. As a result, Bitcoin Cash has the opportunity to reach more than 377 million PayPal users.

- LIEFERANDO, the largest food delivery service provider in Germany, also allows people to order food from 11,000 restaurants and pay with Bitcoin Cash since 2018.

- Takeaway.com also accepts Bitcoin Cash for online orders at 31,000 restaurants in Europe and in Vietnam.

- BCH is also applied in some online retail stores including hosting services (NameCheap and HostMeNow), pharmacies (Remedy’s Nutrition and Apothecary and Greg’s Botanical).

- Cryptocurrency services (CoinPayments, Coinify, and BitPay), as well as hotel booking websites (Travala.com and Cheapair.com), can also be paid with Bitcoin Cash.

=> This shows the popularity and widespread acceptance of Bitcoin Cash. The more popular BCH is, the more demand for BCH will increase, and this will drive the price of BCH higher.

Bitcoin Cash is undervalued

Since Bitcoin Cash is a branch of Bitcoin, it’s hard to imagine why its trading price is so low. Many analysts and experts have questioned whether Bitcoin Cash is undervalued? BCH is not even worth 10% of the price of BTC. But this low valuation is actually an advantage.

In reality, Bitcoin’s strong development is because it had the advantage of being the first mover. Recently, Bitcoin has been regarded by many as a store of value, or an asset that can replace gold and hedge against inflation.

Meanwhile, in Bitcoin Cash, many users prefer to use BCH as a transaction currency rather than Bitcoin, and the fact that Bitcoin Cash is being undervalued will make more people choose BCH for payments or instead of using BTC.

Especially when all Bitcoin is mined out, people will like to hoard bitcoin (like hoarding gold). At that point, supply and demand could shift to Bitcoin Cash. Since the supply of BCH is limited and soon to be mined out, it will be an opportunity to take Bitcoin Cash to a new all-time high price level.

Cons of Bitcoin Cash (BCH)

What are the weaknesses of Bitcoin Cash? Although Bitcoin Cash has several advantages over Bitcoin and other cryptocurrencies, like any investment, Bitcoin Cash is not perfect. And here are its drawbacks that you need to be aware of: