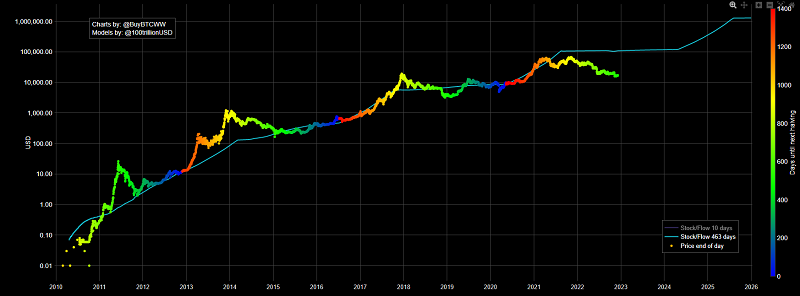

The cryptocurrency space has many price prediction tools. Some are based on historical price fluctuations (also known as technical analysis), others on market dominance, and even some on projected scarcity. Yes, you read that correctly. Scarcity of supply is a reliable method for long-term price prediction. And the Bitcoin stock-to-flow (S2F) model is one of such tools.

With Bitcoin Stock To Flow, Bitcoin is trying to tell a story of limited supply. From this perspective, if something valuable is in short supply, and demand increases or remains constant – it will cause the price to rise. But Bitcoin Stock To Flow is not just a concept, it is also an official indicator with a positive correlation to BTC price. Let’s find out more about the Bitcoin Stock Flow model in the content of the article below.

Contents

Understanding the Bitcoin Stock to Flow Model

What is Bitcoin Stock to Flow?

The Bitcoin Stock to Flow model is a linear regression mathematical model that helps predict the price of Bitcoin, based on the correlation between Bitcoin’s price and its scarcity. The higher the scarcity, the greater the demand, the higher the price and vice versa.

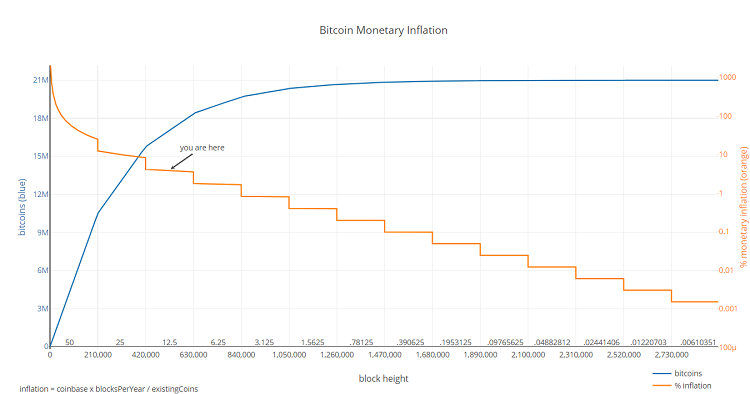

Bitcoin Stock to Flow is based on data related to Bitcoin Halving. Because after each Halving, the block reward (reward for miners) of Bitcoin is halved, increasing the scarcity of this asset. Bitcoin’s annual inflation rate will gradually decrease to 0 after 32 Halvings. From this information, the Bitcoin Stock Flow model predicts that Bitcoin price can steadily increase with a profit of about x10 after every four years.

Who created the Bitcoin Stock-to-flow (S2F) model?

A Twitter account nicknamed Plan B introduced the S2F model in March 2019. He discussed this model in great detail in his extremely popular Medium post: “Modeling Bitcoin’s value with scarcity.”

- Detail: https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25

Here are the price predictions of Bitcoin by the stock-to-flow model:

- Exceeding 100,000 USD by the end of 2021.

- Reaching over 1,000,000 USD by 2025.

How to calculate the Stock to Flow ratio of Bitcoin

The S2F ratio is a measure of scarcity. The higher the S2F ratio, the less new supply enters the market compared to the total supply, and the better the asset retains value in the long term.

The Stock to Flow ratio is calculated by dividing the total reserves by the annual production flow with the formula:

Specifically:

- Stock: The amount of Bitcoin created and in circulation.

- Flow: The amount of Bitcoin created over a specific period.

Additionally, the growth rate of supply can also be used with the formula:

As the maximum supply of Bitcoin is capped at 21 million Bitcoins, and the process of mining new coins takes time and energy, the number of Bitcoins in circulation is limited over a certain time frame.

Is the Bitcoin Stock to Flow model effective?

The Bitcoin Stock to Flow model was once one of the most reliable price prediction models for Bitcoin. But since the cryptocurrency market’s sharp decline on May 19, 2021, also known as “Black Wednesday”, when Ethereum dropped over 46% and Bitcoin over 32% in 12 hours, it has caused the model to deviate significantly.

Although Bitcoin Stock to Flow is a good model for predicting price based on scarcity, it does not consider every aspect of the market. Specifically, it does not account for price volatility, while Bitcoin’s price is often highly volatile. Especially during “black swan” events like LUNA, FTX can cause the market to plummet.

In June 2021, Plan B predicted that Bitcoin could reach a threshold of 450,000 USD by the end of the year. In the worst case, Bitcoin could reach a price of 135,000 USD and surpass 1 million USD by July 2025. But it did not come true. However, at this time, Bitcoin is only being traded at around ~ 17,000 USD, much lower than the predictions made by Plan B’s model.

However, the ability of the Stock to Flow model cannot be denied when it accurately predicted the price of Bitcoin in August 2021 at 47,000 USD and in September 2021 at 43,000 USD.

In June 2022, Vitalik Buterin criticized the stock-to-flow model. Here is what he tweeted:

Stock-to-flow is really not looking good now.

I know it's impolite to gloat and all that, but I think financial models that give people a false sense of certainty and predestination that number-will-go-up are harmful and deserve all the mockery they get. https://t.co/hOzHjVb1oq pic.twitter.com/glMKQDfSbU

— vitalik.eth (@VitalikButerin) June 21, 2022

In summary, the Stock to Flow model in Bitcoin helps to make predictions about Bitcoin’s price based on the amount of Bitcoin created and in circulation and the amount of Bitcoin produced over a specific period. However, the Stock to Flow model does not consider all aspects related to Bitcoin’s price, including macroeconomic market factors and unpredictable elements. The results from this model are only for reference and are not 100% accurate, so you should not rely too heavily on this model.

Read More: