Sometimes when you read the news, you often come across headlines like “FED Maintains Hawkish Policy” or observe some countries implementing dovish monetary policies. So, what is hawkish and dovish?

? What are the objectives of these monetary policies? How do they affect the Forex market? Let’s explore the answers in the following article.

Contents

What is Hawkish Monetary Policy?

What is Hawkish?

Hawkish, also known as “hawkish policy,” means that the central bank is implementing a monetary policy by tightening it through increasing interest rates.

When implementing Hawkish policies, interbank lending rates, mortgage rates, and fixed deposit rates are increased.

Hawkish monetary policies will NOT encourage:

- Consumers to spend more on goods and services.

- Companies to borrow money from banks to expand their businesses.

The reason for implementing Hawkish policies is to slow down an overheated economy.

Hawkish policies may create difficulties for those seeking employment because job opportunities are less likely to increase rapidly. However, Hawkish policies benefit individuals with fixed incomes since their purchasing power remains stable, unlike in an inflationary environment.

How does Hawkish Impact the Market?

When a country implements Hawkish monetary policies, it means that interest rates will be higher. This will lead to:

- Investors transferring their funds from other countries to the country implementing Hawkish policies to earn higher interest rates.

- As a result, the demand for the currency of this country will increase, and the currency of this country will appreciate.

Additionally, Hawkish monetary policies can be further classified into:

- Hawkish – Expected Hawkishness: When Hawkish policies are anticipated, similar to what was forecasted, you will notice less volatility in the charts of currency pairs related to this currency.

- Hawkish – Surprise Hawkishness: When the central bank unexpectedly raises interest rates higher than expected. In this case, you will see significant volatility in the charts of currency pairs related to this currency.

Therefore, when assessing whether a country is implementing Hawkish policies, it is essential to compare it with the “expected” interest rate. Since prices often move ahead of news, if the interest rate matches expectations, the market will experience less volatility (sometimes positive volatility).

Utilizing Hawkish News in Forex Trading

The central bank’s monetary policy on interest rates is a key driver of the Forex market.

Here’s what you would do, for example:

– Suppose the Federal Reserve of the United States is Hawkish.

⇒ The US Dollar (USD) will strengthen.

– If the central bank of Japan is Dovish, the Japanese Yen (JPY) will be relatively weaker compared to the USD.

So, what does this mean? USD/JPY may rise – because you need more JPY to exchange for 1 unit of USD.

This trend may continue for several months before central banks announce their next monetary policy decisions.

Here are some trading strategies:

- Trade breakout – BUY when the price breaks above the previous high.

- Trade pullback – BUY when the price rebounds from the MA 50 line.

For trade management, monitor your stop-loss orders using one of the following methods:

- Moving average.

- Previous resistance level turned into support.

This way, you can ride the trend for all the movements Hawkish news brings about.

What is Dovish Monetary Policy?

What is Dovish?

Dovish, also known as accommodative monetary policy, means that the central bank has eased its monetary policy by reducing interest rates.

This subsequently leads to a decrease in interbank lending rates, mortgage rates, and fixed deposit rates.

Dovish monetary policies will encourage:

- Consumers to spend money on goods and services.

- Companies to borrow money from banks to expand their production and operations.

The reason? To stimulate a healthy economic recovery.

One primary effect of Dovish policies is a more developed economy, more employment opportunities, and lower unemployment rates. However, an expanding economy also tends to lead to higher prices and wages. This can create an inflationary spiral, especially if prices rise faster than wages. Inflation also has a significant impact on those living on fixed incomes.

Dovish monetary policies are in complete contrast to Hawkish policies.

How does Dovish Affect the Market?

Dovish monetary policies mean that interest rates will be lower.

- Therefore, investors will shift their funds from countries implementing Dovish policies to other countries to earn higher interest rates.

- When a country adopts a Dovish stance, the demand for its currency decreases, leading to the depreciation of the currency.

Additionally, Dovish monetary policies can be further classified into:

- Expected Dovish Policy: If a Dovish policy is anticipated, you will not see significant sudden chart movements when the news is announced.

- Unexpected Dovish Policy: In this case, you will observe a strong chart movement when unexpected Dovish news is released.

If an unexpected Dovish policy occurs, you may see sudden spikes in your chart to account for the release of unexpected Dovish news.

Utilizing Dovish News in Forex Trading

Here’s what you would do:

You will look for another currency unit belonging to a country with a Hawkish monetary policy.

For example:

– Suppose the central bank of China is Dovish.

– The Chinese Yuan (CNH) will be weaker.

– If the Federal Reserve of the United States is Hawkish, then the US Dollar (USD) will be relatively stronger than CNH.

So, what does this mean: USD/CNH is likely to rise – because you need more CNH to exchange for 1 unit of USD.

At this point, you can look for buying opportunities in the USD/CNH pair. This trend may continue for several months before central banks announce their next major policy decisions.

Similarly, you can also apply breakout or pullback signals to trade (similar to what I explained in the Hawkish section).

IN SUMMARY:

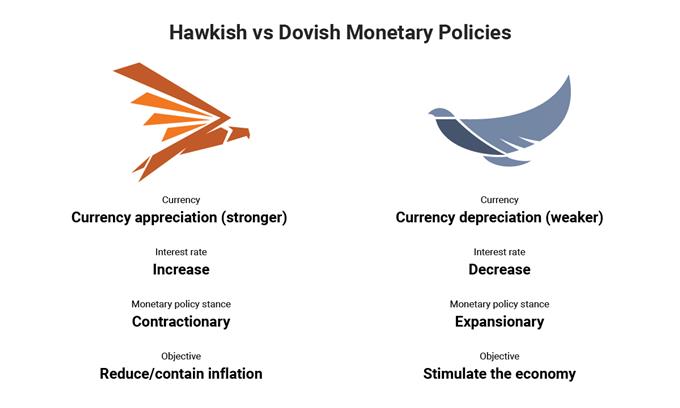

Policymakers implementing Hawkish (hawk) policies tend to focus on controlling inflation as a primary goal of monetary policy. In contrast, Dovish policies are more concerned with promoting economic growth and job creation.

Both Hawkish and Dovish policies use interest rates to achieve their policy goals. Hawks typically seek to raise interest rates to restrain inflation, while doves want interest rates to fall, encouraging consumers to buy goods and services and businesses to invest in hiring and expanding production.

As a Forex trader, being aware of whether a country’s monetary policy is Hawkish or Dovish is crucial. It’s especially important to compare it with policy forecasts to anticipate and cope with unexpected market developments.

Wishing you smart and successful trading.