Radian Capital (RDNT) is a new and innovative platform challenging the limits of what’s possible in the DeFi sector. It is known as the first multi-chain lending protocol. Notably, the RDNT token has garnered attention as Binance selected Radiant Capital (RDNT) as the 32nd project on Binance Launchpool. So, what is RDNT coin? What is Radiant Capital? Is it a potential investment? Let’s delve into the details in the article below.

Contents

- 1 What is RDNT coin, and should you invest?

What is RDNT coin, and should you invest?

What is Radiant Capital – RDNT coin?

Radiant Capital is a Lending Protocol operating on the Arbitrum layer 2 chain. Radiant aims to become the first omnichain money market, allowing users to lend and borrow assets across any chain. Meanwhile, RDNT is the utility token for mining and liquidity management.

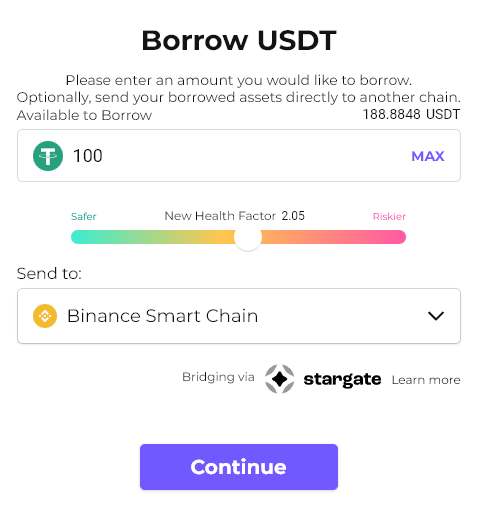

Radiant has built cross-chain interaction capabilities based on Layer Zero, using the Stargate router. With this solution, users can collateralize assets on one chain and borrow on another without any difficulties.

Other key information:

- Radiant Capital is a lending platform developed on Arbitrum and is currently one of the most prominent projects in this ecosystem.

- Radiant Capital was established in July 2022 and is fully self-funded, with no venture capital investment.

- Since its inception, the Radiant Captial team has been receptive to user feedback to improve the platform. Consequently, Radiant v2 has been developed to offer the best possible multi-chain platform, with significant enhancements to its features and capabilities.

The main goal of Radiant Capital is to unify fragmented liquidity, create faster and easier lending and borrowing processes, and provide customers with a safe means to earn competitive rates on their assets. The founders of Radiant Capital have worked diligently to make it the most advantageous alternative solution in the cryptocurrency industry today.

How does Radiant Capital (RDNT) work?

To better understand what RDNT coin is and its unique aspects, let’s dive into the current DeFi market.

A common scenario:

- When a borrower seeks a loan from a lender in the decentralized finance (DeFi) ecosystem, the lender chooses which blockchain network to use.

- Once the lender decides on a specific blockchain network, the borrower must provide collateral on that network.

For example: If the lender chooses the Ethereum network, the borrower must provide Ethereum-based assets as collateral. However, sometimes the borrower may want to use different blockchains to send and withdraw their assets. Being fixed to one blockchain limits choices. If a borrower wants to send wrapped Bitcoin (wBTC) on Arbitrum but withdraw Ethereum (ETH) on the main Ethereum network, they cannot do so directly.

Instead, they must engage in complex transactions to achieve the desired outcome, which can be cumbersome.

=> Radiant Capital has approached this concept by consolidating liquidity across different blockchains. Specifically, lenders provide liquidity to the Radiant platform, and borrowers also borrow directly from here. Borrowers can use their assets as collateral to withdraw money without having to sell or close their positions.

Radiant is built on Arbitrum, which they believe is the most secure and decentralized chain; additionally, Arbitrum’s low gas fees make transactions easier.

Meanwhile, Radiant’s cross-chain interaction function is executed on Layer Zero. The Layer Zero blockchain network will manage the network’s consensus mechanism, the process by which nodes reach consensus on the network’s state. It also handles the verification and processing of transactions as well as maintaining the network’s integrity and security.

Notably, Radiant will inherit cross-chain interaction capabilities by being built on LayerZero through Stargate’s interface, allowing lenders to withdraw their funds on any chain they desire.

Main Features of Radiant Capital

Borrowing

Radiant Capital enhances user utility through a collateralized asset borrowing mechanism. Specifically,

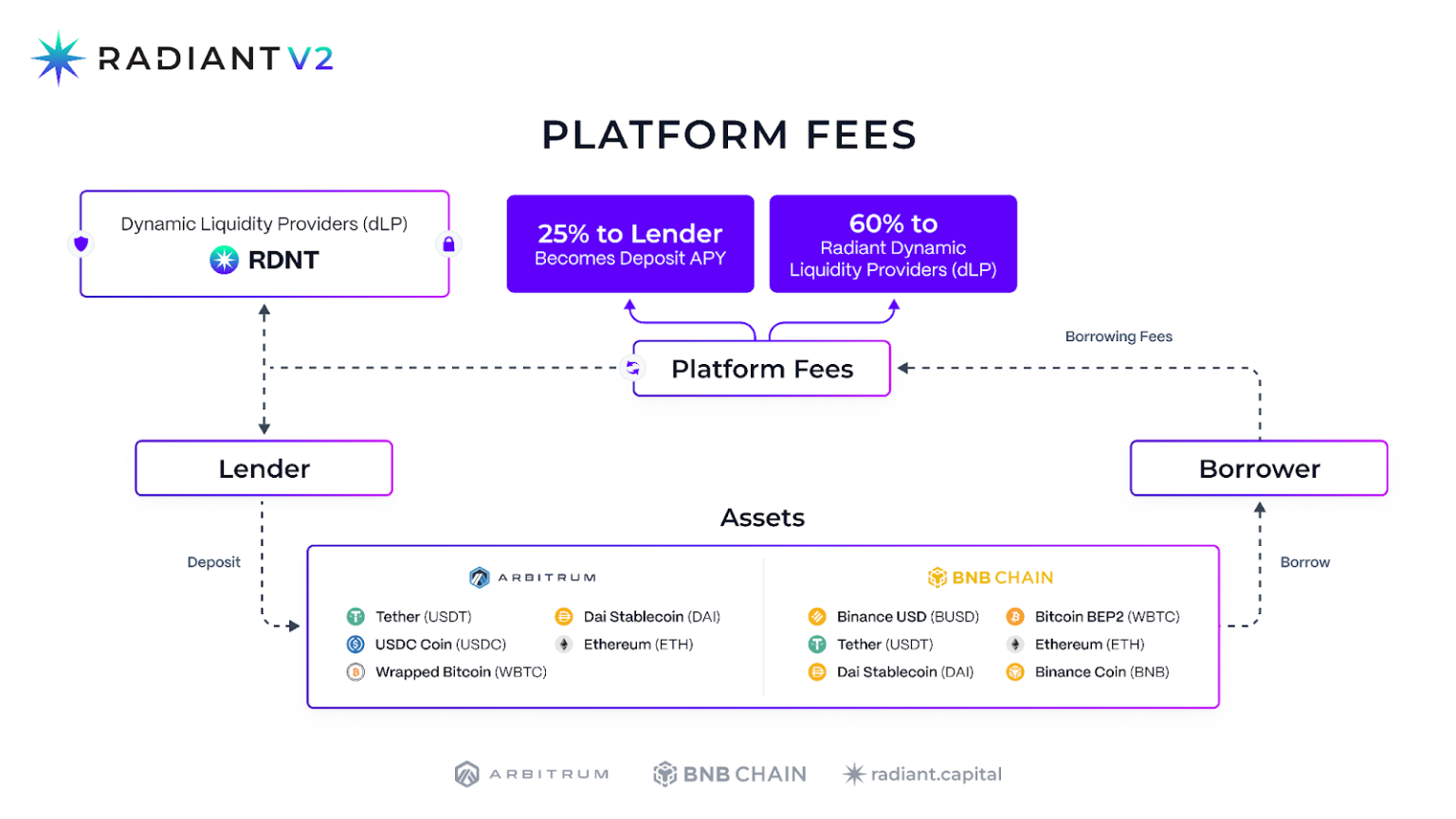

- Lenders (lenders) collateralize their assets on the platform to receive interest and RDNT Token rewards from the protocol.

- Borrowers (borrowers) collateralize assets and receive rToken (a token representing the collateralized asset) and then borrow the desired coin, while also paying interest on the loan. Currently, borrowers are still rewarded with RDNT tokens when borrowing.

However, all RDNT Token rewards from lending, borrowing, or providing liquidity must go through a 28-day vesting period. If users want to withdraw rewards earlier, they must incur a 50% penalty, and this amount will be redistributed to other RDNT lockers.

Lending

Radiant Capital supports users in providing liquidity to the platform. This liquidity supports the platform’s lending function. Those contributing liquidity can receive RDNT token rewards.

Lenders will have two options with the RDNT received from Radiant:

- Vest until completion: Allows RDNT to be gradually paid out, and users receive the entire amount of the reward token.

- Exit early: Receive RDNT tokens immediately by incurring a 50% penalty.

Looping Feature

Radiant Capital offers a 1-Click Loop feature that allows users to increase the value of their collateral by automating the cycle of depositing and borrowing multiple times.

Loop is a form of interaction and provides utility for the platform, and users can gain increased value by generating profits on the collateral value with up to 5 times leverage.

Bridge Feature

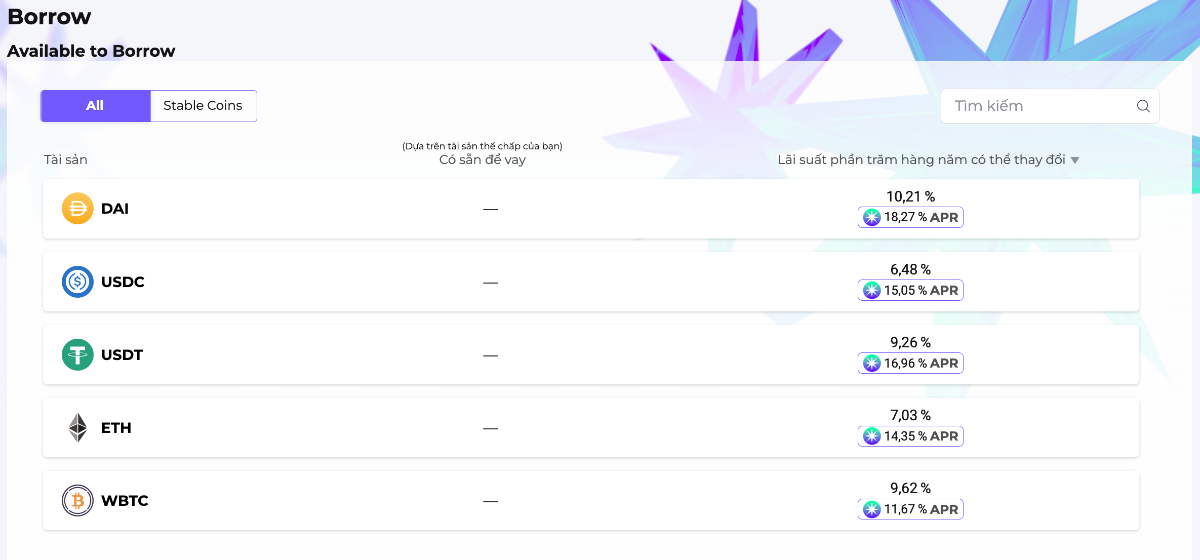

After collateralizing assets, users can directly borrow other assets on multiple chains through the Stargate interface on Radiant. This is currently applicable for USDC and USDT pairs.

The Achievements of Radiant Capital

Although the project has only been operational since July 2022, it has already achieved quite a few notable accomplishments.

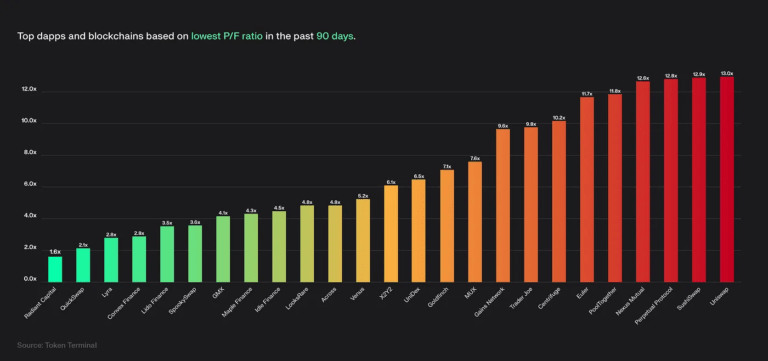

According to TokenTerminal, after a short period of operation, Radiant ranks number 1 in the top DeFi projects based on the “Price to Fees” index. In other words, Radiant has generated significant revenue compared to its market capitalization, and to date, has created nearly 16.3 million USD in protocol fees and over 8 million USD in revenue. This makes Radiant one of the most notable projects in the Real Yield narrative.

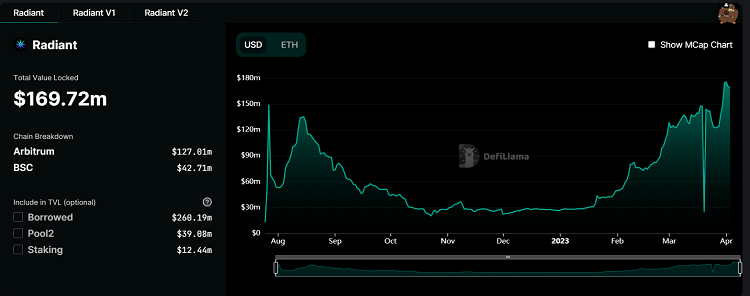

Additionally, Radiant Capital is currently the second highest TVL Lending project in the Arbitrum ecosystem, ranking fourth among the highest TVL projects in the system, contributing significantly to Arbitrum’s nearly 2 billion USD TVL.

Currently, Radiant (RDNT coin) is present on 3 chains: Ethereum, BSC, and Arbitrum.

All fees from interest on loans (paid by borrowers) and penalty fees (for withdrawing rewards before 28 days) are divided into two parts:

- 50% for lenders

- 50% returns to the protocol, this part is allocated to RDNT Vester, Locker and Liquidity Provider for the RDNT-WETH pair of Pool2.

Radiant’s revenue has been growing recently, reaching over 100 thousand USD per week.

The TVL of Radiant Capital project is 136.18 million USD, ranking third in the entire Arbitrum ecosystem. From December 2022 to the present, the TVL of this protocol has shown strong recovery and is nearly reaching its ATH.

The Radiant platform has paid out approximately 6.18 million USD in rewards to RDNT lock users. Users can receive rewards in 6 types of tokens: RDNT, USDC, DAI, USDT, WETH, WBTC.

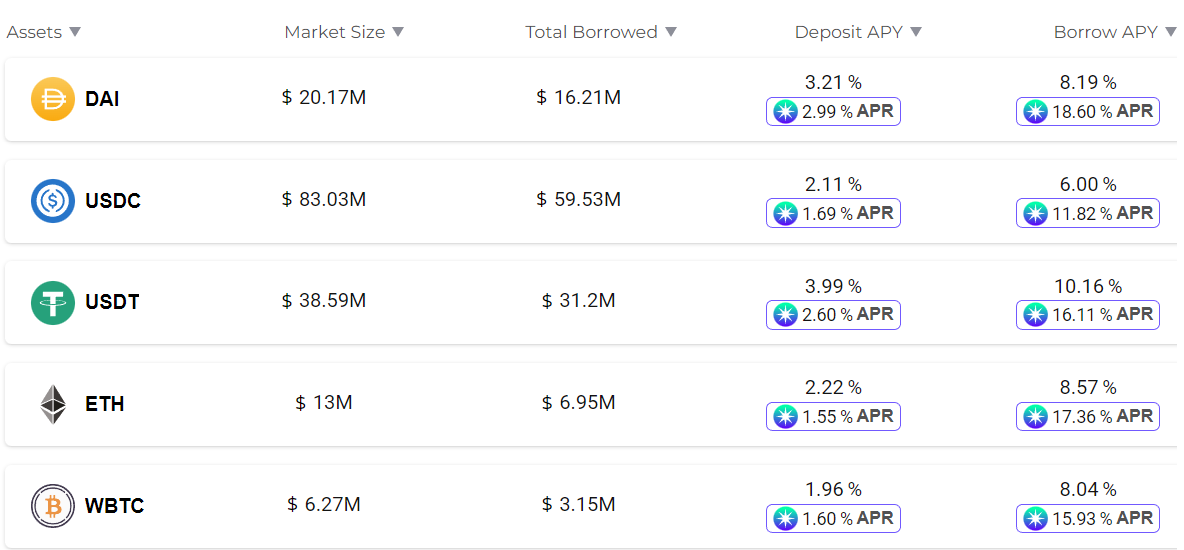

Currently, Radiant Capital lends 5 types of assets including: ETH, WBTC, and stablecoins (DAI, USDC, USDT).

Among these 5 cryptocurrencies, USDC and USDT have the largest market sizes, respectively 83 million USD and 38.59 million USD. Additionally, USDC is the most borrowed asset (59 million USD), compared to just 31.2 million USD from USDT.

*** Note, data is as of the time of writing and will change continuously. For the most accurate updates, you can refer in detail at: https://radiant.capital/ ***

What is the Tokenomics of RDNT?

The native token of Radiant Capital is RDNT. The information about the RDNT token is as follows:

- Token Name: Radiant Capital

- Ticker: RDNT

- Blockchain: Arbitrum

- Token Standard: ERC-20

- Contract: 0x0c4681e6c0235179ec3d4f4fc4df3d14fdd96017

- Token Type: Utility, Governance

- Total Supply: 1.000.000.000 RDNT

- Circulating Supply: 1,208,733,992 RDNT

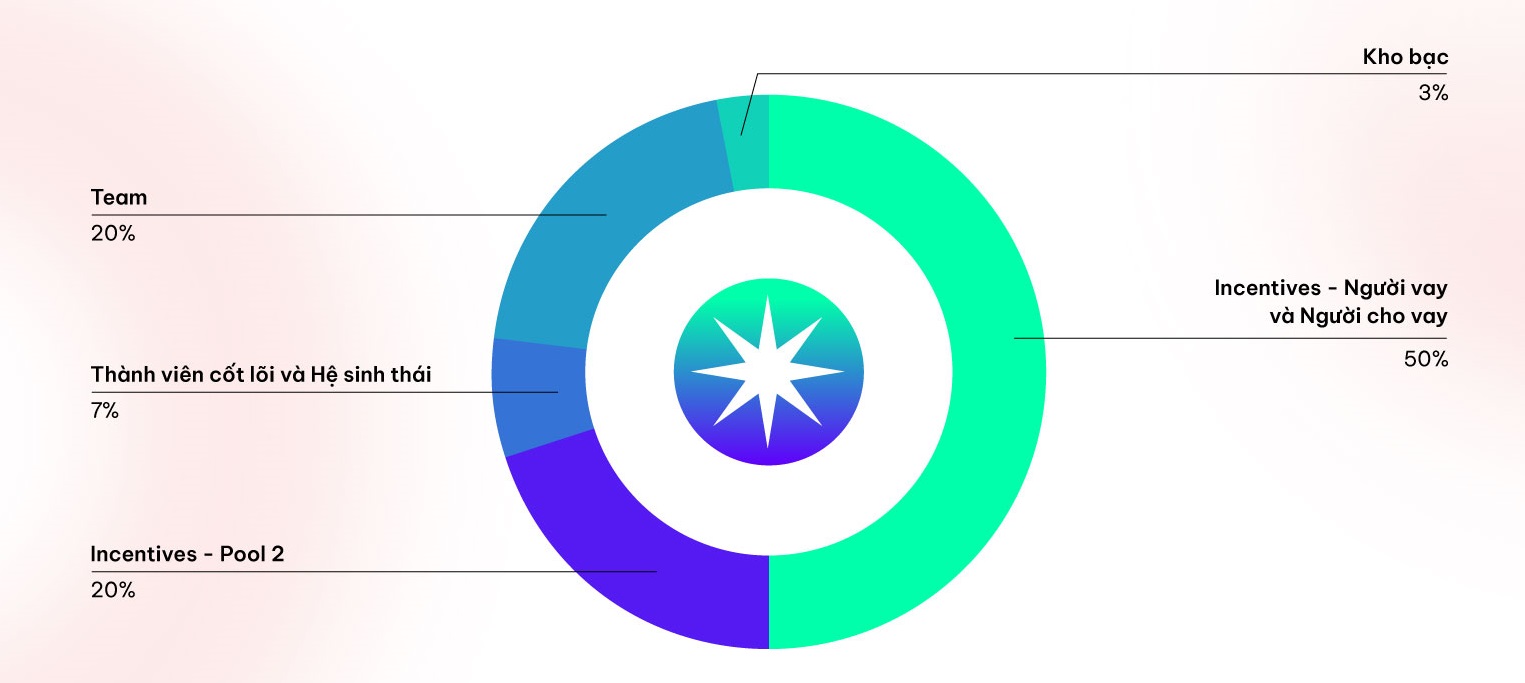

The maximum supply of RDNT is 1 billion tokens. Half of the tokens are distributed as participation rewards for borrowers and liquidity providers. Another 20% is allocated to incentivize Pool 2 liquidity providers. An additional 20% is allocated to the team, with the remainder for advisors and core contributors.

Token release schedule:

- Suppliers and Borrowers: tokens will be paid over a 2-year cycle

- Incentives – Pool 2: tokens will be paid over a 2-year cycle

- Team: linear vesting over 1 year, with a lock-up period of 3 months (10% of this allocation for the team will be locked at the launch phase and will be unlocked after 3 months).

- Core contributors and Advisors: linear vesting over 1 year.

Functions of RDNT token:

- Governance: Users can lock $RDNT to have voting rights in the DAO, participate in governance activities within the protocol.

- Participate in DeFi activities on the platform such as Stake, Vest, and Lock.

- Earnings from platform revenue: Liquidity providers in Pool2 and lenders, borrowers, $RDNT lockers will be rewarded with the $RDNT token, vested over a period of 28 days.

Users have 2 options to receive $RDNT reward tokens:

- Receive rewards upon full vesting: you will receive 100% of the $RDNT token reward.

- Early reward collection: Or you will immediately receive 50% of the unlocked $RDNT reward, the remaining 50% will become a penalty fee for not meeting the 28-day vesting period, this penalty will be shared with those who have locked $RDNT.

The Team, Investors, and Community of Radiant (RDNT)

– Investors: The Radiant development team operates the project entirely with personal funds. Therefore, Radiant Capital does not have a private sale, IDO, or the involvement of any Venture Capitals.

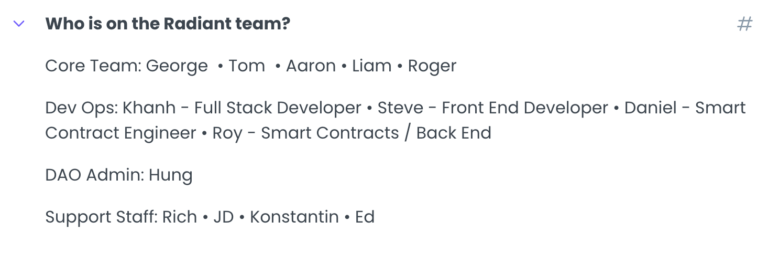

– Core Team:

– Partners: The biggest partner of Radiant is LayerZero, and the team is also working with LayerZero Labs in smart contract auditing, and Radiant has integrated Stargate into its interface to realize the Omnichain mission both are pursuing. Additionally, Radiant Capital has been audited by reputable entities like Peckshield and Solidity Finance.

– Community Channels:

- Telegram: https://t.me/radiantcapitalofficial

- Twitter: https://twitter.com/RDNTCapital

- Medium: https://medium.com/@RadiantCapital

- Discord: https://discord.gg/radiantcapital

- Documentation: https://docs.radiant.capital/radiant/

– Similar Projects:

- Arbitrum: AAVE, dForce

- Other Ecosystems: Compound, Venus, Solend,…

Does Radiant Capital (RDNT coin) have potential?

It’s evident that Radiant Capital is a comprehensive and unique cross-chain DeFi platform, offering its customers many attractive features as well as real profits.

The Radiant Capital team is continuously upgrading its platform to deliver the best possible customer experience. Evidence of this is their adherence to the roadmap they have set out, such as the implementation of several tasks on Radiant v2. It is known that they are also striving to improve the features and functionality of the platform while generating more profits for users.

With their efforts, Radiant Capital is one of the lending platforms with the highest TVL on Arbitrum currently. In the near future, this project will have many conditions to grow as Arbitrum gains attention and the flow of funds continues into the ecosystem.

Although the V1 tokenomics of Radiant was designed to be quite inflationary and lacked long-term price increase incentives, with the launch of V2, the future of Radiant looks very bright. V2 will be an important stepping stone for Radiant to achieve stronger growth in TVL as well as market capitalization in the future.

Overall, Radiant Capital (RDNT coin) is a DeFi project with many advantages and real profits – Consider adding it to your watchlist and possibly invest a small amount in RDNT if you believe in the project.

Through the above sharing, you probably have understood what RDNT coin is, what Radiant Capital is, as well as grasped the basic information about this project. It can be seen that Radiant Capital is positioned to become a major player in the DeFi field, thanks to its dedicated development team, successful audits, and a community-driven strategy. There will certainly be many interesting things to observe as to how Radiant Capital develops in the future and how it shapes the DeFi environment.

We are not responsible for any of your investment decisions. Be wise and make rational decisions. We wish you success and profitable returns.