DeFi coins are increasingly gaining attention from investors, and dYdX coin is a well-known name in this field. But specifically, what is dYdX coin, how does it work, and what sets it apart from other coins? Let’s explore the details in the article below.

Contents

What Is dYdX Coin? Should You Invest?

What Is dYdX Coin?

dYdX coin is the native cryptocurrency of a decentralized trading platform that allows users to trade various derivative products, including Spot (immediate settlement), Margin (leveraged), and Perpetuals (non-expiring contracts). The ultimate goal of dYdX coin is to bring common trading tools found in traditional markets into the blockchain environment.

While at first glance it may seem like any other lending and borrowing protocol on Ethereum, dYdX is actually aiming to take DeFi a step further. Despite the existence of lending protocols on Ethereum for a while, such as Compound (COMP), the Ethereum ecosystem still lacks advanced derivative trading tools and protocols in general. This is precisely why dYdX coin has emerged.

In simpler terms, if you’ve ever traded futures, gone long or short on centralized exchanges, dYdX is similar but operates on the blockchain.

The Significance of dYdX Coin

In practice, when trading on centralized exchanges (CEX) like Binance or Huobi, users enjoy benefits such as high liquidity, fast transaction speeds, and low slippage.

However, the downside of relying too heavily on these CEXs is the issues related to security (personal information, bank account details, etc.) and even concerns about exchanges manipulating order books to “liquidate longs” or “liquidate shorts.”

That’s why dYdX was created, to provide traders with peace of mind regarding market price transparency while also offering better protection for users’ cryptocurrency assets.

How Does dYdX Coin Work?

According to the official website of dYdX, the dYdX exchange has established itself as a formidable player in the cryptocurrency world. The platform proudly boasts approximately 70,000 traders, $11 billion in profits, and TVL (Total Value Locked) that continues to grow over time.

Particularly, according to statistics from Defipulse.com, dYdX is currently ranked 1st among cryptocurrency platforms providing derivative products based on TVL (while it was ranked 4th at this time one year ago).

The dYdX exchange is divided into two main layers to provide DeFi products with different features:

Margin & Spot Trading on Ethereum Layer 1: This is a trading platform running on the Ethereum blockchain’s smart contracts, allowing trading without any intermediaries.

Perpetual Trading (Non-expiring): This is a Layer 2 solution provided by Starkware.

Its specific features and products include:

-

Margin & Spot trading with leverage of up to 5x supporting three pairs: ETH-DAI, ETH-USDC, and DAI-USDC.

-

Perpetual trading with leverage of up to 10x supporting three pairs: BTC-USD, ETH-USD, LINK-USD.

-

Borrowing with wait times and no minimum borrowing amount, supporting tokens ETH, DAI, and USDC.

-

Lending with a minimum collateralization ratio of 125%, supporting tokens DAI, ETH, and USDC, collateral assets must be above 115% to avoid liquidation.

In addition, dYdX also supports portfolio management for traders to control their trades, offers volume-based fee discounts, and introduces Trading Rewards. Furthermore, they provide a valuable source of data and price predictions for users.

dYdX utilizes MakerDAO and Chainlink oracles to provide price data through smart contracts running on the Ethereum blockchain.

Team & Investor of dYdX Coin

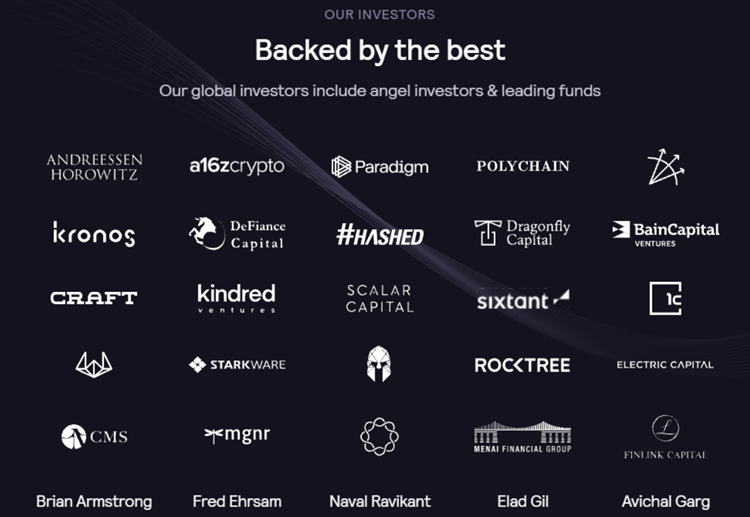

dYdX was founded in 2017, and since then, it has built a strong reputation for itself, garnering long-term support from reputable organizations and companies in the cryptocurrency space. Additionally, it has assembled an experienced blockchain team to develop the platform.

The team at dYdX adheres to exceptionally high benchmarks, and justifiably so. Their goal is to establish a cutting-edge, professional trading platform where users have genuine ownership of their assets and, ultimately, the platform. Additionally, dYdX is dedicated to equipping traders with sophisticated tools akin to those in the current financial ecosystem, aiming to democratize access to decentralized trading, margin trading, and perpetual contracts globally.

The team at dYdX includes:

- Antonio Juliano – Founder

- David Gogel – Head of Growth

- Paul Erlanger – Business Operations and Growth

- Lucas W – Software Engineer

- Corey Miller – Growth and Investment

- Marc Boiron – General Counsel

In terms of marketing, the DYDX Network team is doing an excellent job. Data shows that DYDX’s Twitter account has grown by 74% in terms of followers over the past few months, a significant number. Additionally, the number of DYDX Reddit subscribers has also increased by 105%.

What Is dYdX Token, and How Many dYdX Tokens?

The DYDX token is the governance token of the dYdX platform. It is used for mining rewards, participation in governance, and can also be used for fee discounts if you engage in trading on the dYdX exchange.

There is a total of 1,000,000,000 DYDX tokens in circulation, and they will be distributed gradually over 5 years at the following rates:

- The dYdX community will receive 50% of the tokens.

- 27.73% will be allocated to previous active investors.

- The official dYdX team, including founders, advisors, employees, and others, will receive 15.27%.

- The remaining 7% will be reserved for future consulting experts and team members.

Information about the dYdX token:

- Token Name: dYdX

- Blockchain: Ethereum.

- Token Standard: ERC-20.

- Contract: 0x92d6c1e31e14520e676a687f0a93788b716beff5

- Token Type: Governance.

- Total Supply: 1,000,000,000 DYDX.

- Circulating Supply: 765,781,167 token.

Should You Invest in dYdX Coin?

You’ve learned about what is dYdX coin, and you might be wondering whether it’s a good investment or not, right?

Let’s go through the advantages, disadvantages, and potential when investing in dYdX coin.

Advantages of dYdX coin:

- Leading decentralized derivatives trading protocol.

- Low fees with no gas costs (direct trading on the dYdX platform).

- Strong security and privacy thanks to Starkware Layer 2 technology, ensuring safety through Zero-Knowledge Rollups.

- dYdX offers transparent, secure trading and addresses some of the issues with current DEX and CEX platforms.

- The DeFi and DEX trend is growing, and dYdX stands to benefit from this.

- dYdX has a talented and dedicated founding team and a supportive community.

- dYdX has received funding from several well-known organizations.

Nhược điểm của dYdX coin là gì?

- Faces stiff competition in the DeFi and DEX sectors from projects like Curve Finance, SushiSwap, Aave, Compound, etc.

- In the derivatives sector, it competes with Nexus Mutual, Synthetix, Ribbon Finance, among others.

- Currently, users still prefer trading derivatives on centralized exchanges (CEX), so it may take time for dYdX to realize its full potential.

- Limited range of supported currency pairs, and it does not support USDT.

- dYdX coin’s price is highly volatile and heavily influenced by market fluctuations.

- dYdX is not operational in the United States due to regulatory restrictions on derivatives products.

dYdX coin có tiềm năng không?

Over time, DeFi has experienced exponential growth, with numerous DeFi applications emerging. Therefore, the growing interest in decentralized finance cannot be denied, and it is expected to attract even more users in the future.

=> dYdX is a prominent name in providing decentralized derivatives trading services. It’s safe to say that, as DeFi becomes more prevalent, the value of dYdX will be recognized, and its potential is substantial.

The fact that an exchange like dYdX can address the weaknesses of both DEX and CEX platforms and leverage the advantages of both demonstrates its importance.

=> In my personal evaluation, dYdX coin has significant potential for long-term investment. However, remember that the cryptocurrency market carries risks, so you should only invest with funds you can afford to lose.

♠ dYdX is a DEX platform that supports derivatives trading.

♠ dYdX coin operates on the Ethereum blockchain.

♠ dYdX has received investment from many major organizations.

♠ dYdX currently leads in providing decentralized derivatives products on the blockchain.

♠ dYdX has significant growth potential due to the increasing adoption of DeFi and DEX platforms.

♠ dYdX faces substantial competition in its sector.

♠ dYdX is suitable for long-term investment.

♠ Currently, the price of dYdX coin is $ 0.573541, ranked 145 in the market by market capitalization.

These are the key points about what dYdX coin is, its potential, and whether it’s a good investment. I hope this article has provided you with important information about this coin, helping you make informed investment decisions. Good luck!