Nowadays, decentralized exchanges (DEX) are gaining more attention from crypto traders. DEXs offer leveraged crypto trades with no deposit, login, password or KYC required. Instead, all you have to do is connect your wallet and trade. You can even trade directly from your wallet.

Previously, DEXs only provided a very limited number of assets with low liquidity, high fees and slow processing times. But that is changing rapidly as many new DEX exchanges are launching with many attractive features and extremely preferential costs. If you are wondering about finding the best DEX to replace centralized exchanges, this list of the top 10 best DEX exchanges for 2025 will help you.

Contents

Top 5 best DEX exchanges for 2025

gTrade

gTrade is the best DEX you should learn about. It is a liquidity efficient and user-friendly decentralized leveraged trading platform on Polygon and Arbitrum, developed by Gains Network.

Its unique design makes gTrade very efficient to trade, allowing for low trading fees (0.02%) and it has a wide variety of leverages and trading pairs. gTrade offers the largest number of trading assets among DEXs. It currently lists 45 cryptocurrency pairs, 17 forex pairs and 27 US stocks. Users can trade using up to 150x leverage for crypto, 1000x for forex and 50x for stocks.

To trade on gTrade, you will need stablecoin DAI in your Metamask wallet on the network you want to trade on (Polygon or Arbitrum). You will need MATIC (on Polygon) or ETH (on Arbitrum), a few USD will be enough.

In addition to its trading platform, gTrade also offers one-sided staking pools of GNS tokens and DAI stablecoins. Staking participants will be paid rewards according to the platform’s trading volume – the higher the volume, the greater the staking reward.

Currently, the total trading volume on gTrade has just reached 40 billion and is constantly increasing.

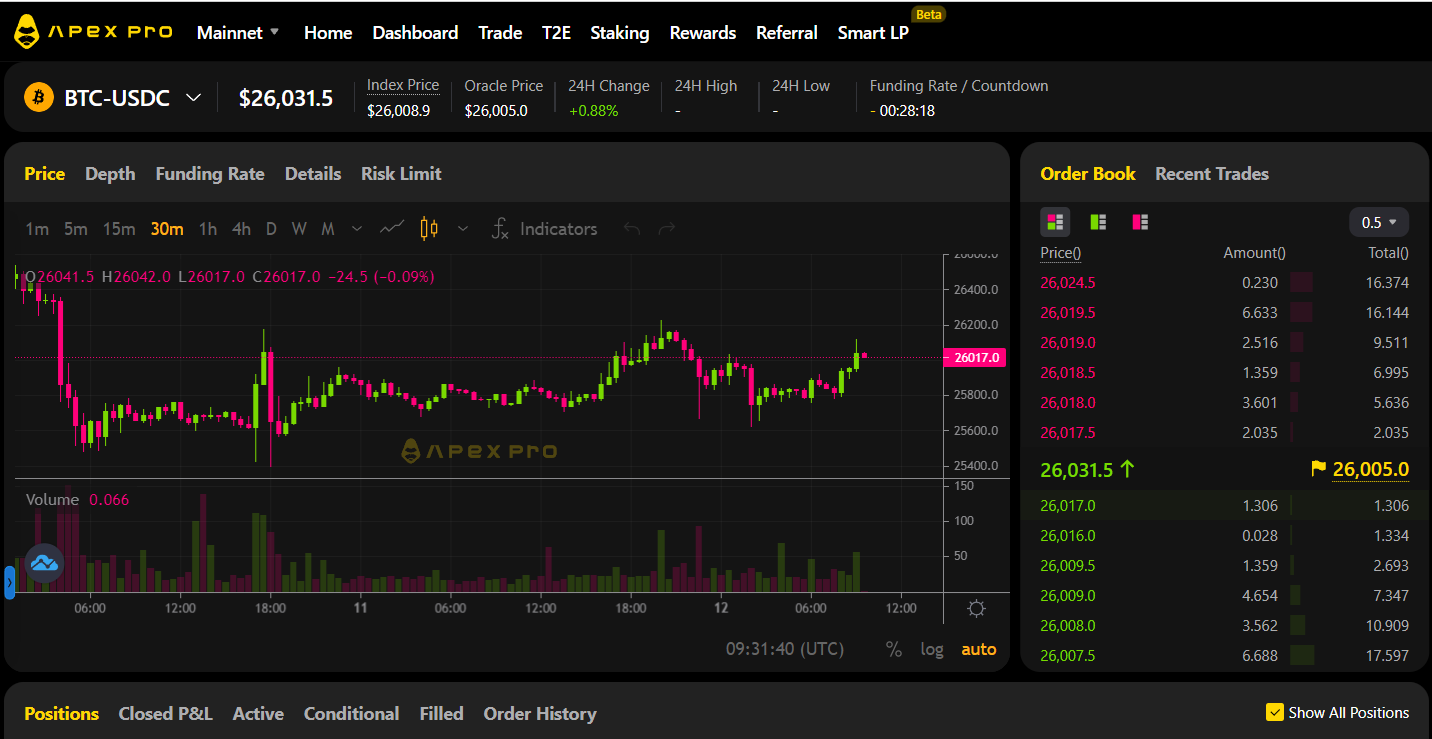

ApeX Pro

ApeX Pro is a non-custodial trading platform that provides cross-margin contracts within a new Social Trading framework. Currently, ApexPro offers 16 cryptocurrency trading pairs across six different networks (Ethereum, Polygon, BNB, Avalanche, Optimism, and Arbitrum). It utilizes StarkWare’s Layer-2 scalability solution to offer low fees, deep liquidity, and maximum security.

When you deposit cryptocurrency into ApeX, you are depositing it into a smart contract wallet. You will retain control over your funds, unlike when you deposit them into a centralized exchange.

Maker fees are set at 0.02%, and Taker fees are set at 0.05%.

Unlike gTrade, Apex doesn’t use oracles but operates as an order book exchange. This means that liquidity is provided by actual market participants, similar to centralized exchanges.

One drawback is that this platform has limitations for U.S. citizens (even though there is no KYC requirement, you have to prove that you are not a U.S. person).

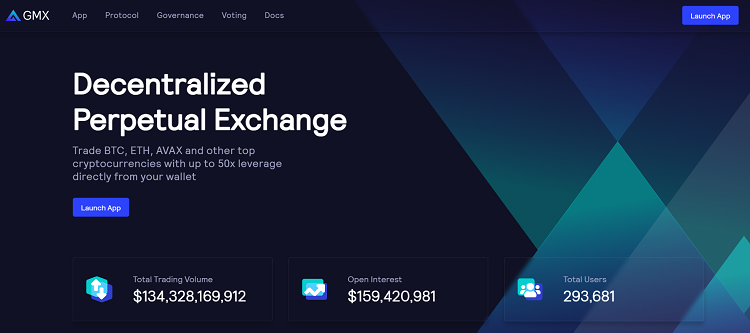

GMX

GMX is a fairly well-known decentralized exchange (DEX) these days. It offers both spot and derivative trading and is notable for its low swap fees and trades that have minimal impact on prices (resulting in very low slippage).

Trading is facilitated by a unique multi-asset pool, and this group earns liquidity provider fees from market-making, swap fees, and leverage trading.

The total trading volume on GMX has surpassed $133 billion. GMX offers leverage trading on Arbitrum and Avalanche with leverage of up to 50x, although it currently provides a very limited number of trading pairs. Similar to gTrade, GMX’s trading is not conducted through an order book but via a shared liquidity mechanism, functioning as a pool of all tradable assets.

The cost to open or close a position is 0.1% of the position size.

Users can also stake the native platform tokens $GMX and $GLP to earn rewards. GMX is a utility and governance token, while GLP is the platform’s liquidity provider token. The GMX team currently provides a 3.46% APR, while the GLP team offers 13% (on Arbitrum).

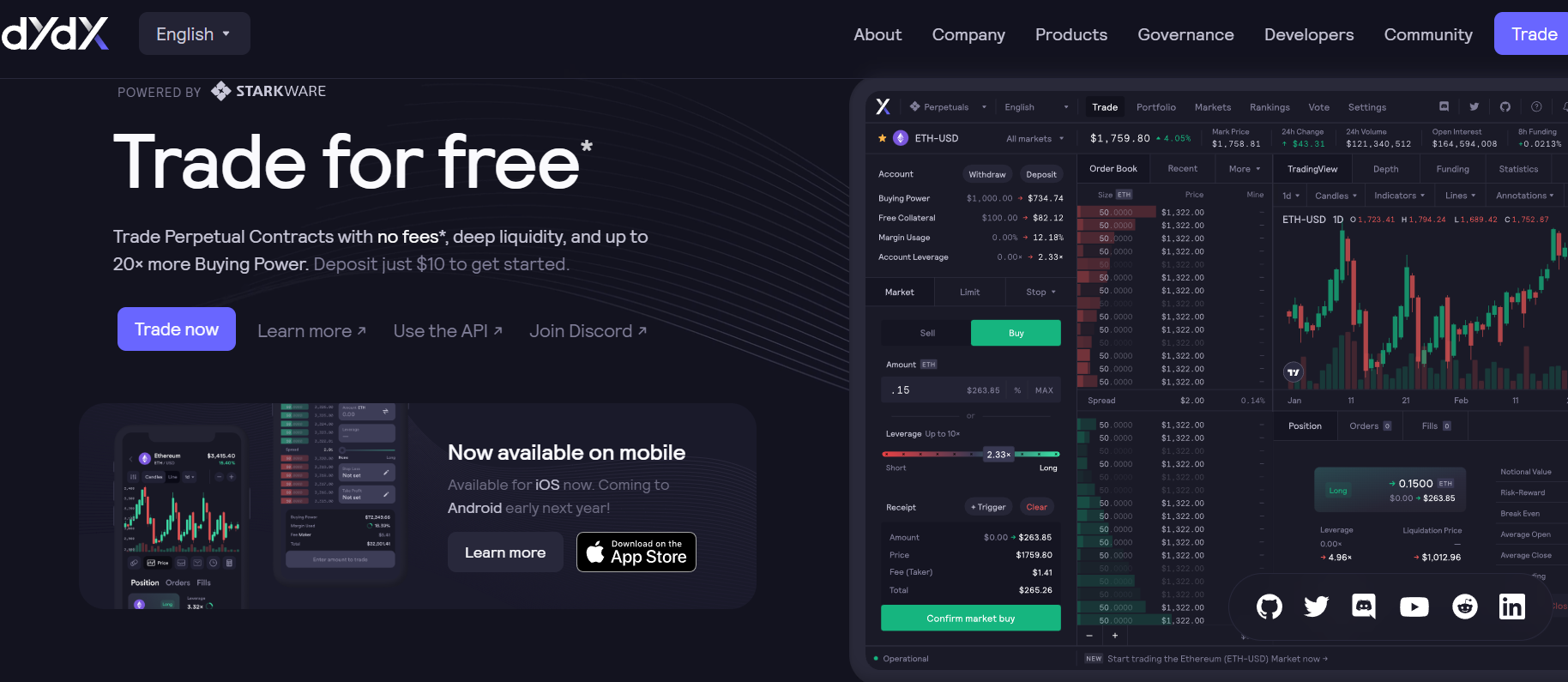

dYdX

dYdX is the largest decentralized exchange (DEX) in terms of trading volume and market share. Similar to Apex, it employs StarkWare’s StarkEx scaling solution to significantly reduce fees and transaction times.

This platform offers approximately 40 cryptocurrency pairs on the Ethereum network with leverage of up to 20x.

dYdX provides free trading with volumes up to $100,000 per month. Additionally, traders can earn rewards in the form of dYdX tokens by trading on the platform.

Similar to Apex, dYdX doesn’t rely on Automated Market Makers (AMM) but uses an order book model. According to the team, they use an order book because it’s a more established trading model, and they believe that order books are more efficient than AMMs.

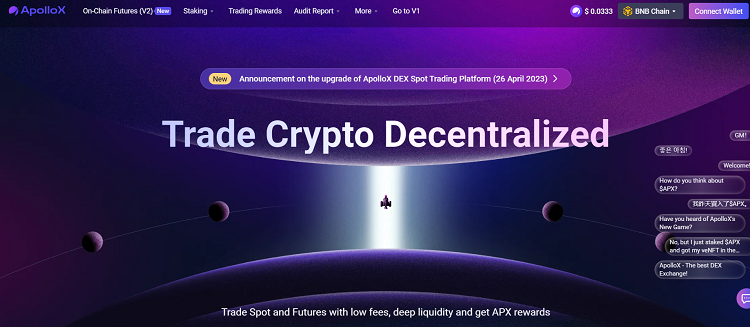

ApolloX

Apollo X Finance is one of the top-performing DEXs currently, supporting derivative trading where users can enjoy a seamless trading experience by connecting to the platform through their non-custodial wallet.

ApolloX provides two versions of its platform. Version 1 offers perpetual contract trading through an order book. On the other hand, the newer Version 2 is entirely on-chain.

On V2, trades are executed against the ALP pool on the BNB Smart Chain, and liquidity for all V2 trading pairs is shared through the pool to maximize capital efficiency.

On its V1 version, ApolloX offers nearly 100 cryptocurrency pairs across four different networks (Ethereum, BNB, Arbitrum, and zkSync) with leverage of up to 200x. V2 provides 26 cryptocurrency pairs with leverage of up to 150x.

The maker fee is 0.02%, and the taker fee is 0.07%.

Users can also provide liquidity and earn rewards by purchasing the platform’s liquidity token, $APL. The APL token can be staked at the current 22% APY rate. Additionally, users can stake the platform’s governance and utility token, APX, in the APX/BNB staking pool with a 20% APY ratio.

Uniswap

Uniswap, established in 2018 on the Ethereum Blockchain, is considered one of the top DeX platforms. It relies on Ethereum, known for its highly secure and unhackable database, to facilitate the swapping of ERC20 tokens. Uniswap employs an innovative trading model referred to as an automated liquidity protocol, enabling traders to also function as liquidity providers.

What sets Uniswap apart is its unique pricing mechanism known as the Constant Product Market Maker Model. With this approach, any token can be added to the decentralized exchange by endowing it with an equivalent value of ETH and ERC20 tokens.

Uniswap’s Highlights:

- A well-known decentralized exchange.

- Operates on the Ethereum Blockchain.

- Supports the trading of various ERC20 tokens.

- Utilizes an innovative trading model known as the automated liquidity protocol.

- Each token is associated with its smart contract and liquidity pool.

- It allows the creation of liquidity pools for newly introduced tokens.

SushiSwap

SushiSwap, built upon Uniswap’s code, is a prominent competitor to its predecessor. Like best DEX Uniswap, SushiSwap is an Ethereum-based decentralized exchange that enables users to trade a wide range of tokens and access various financial services. It also relies on smart contracts and user-provided liquidity.

SushiSwap has had a controversial and eventful history, but it has evolved and improved significantly in the present. While it borrowed many features from Uniswap, it introduced a crucial addition in the form of a governance token known as SUSHI.

SushiSwap’s Highlights:

- Utilizes an Automated Market Maker (AMM) system for trading.

- Relies on smart contracts to facilitate a variety of transactions.

- Allows SushiSwap users to lock up their funds.

- Offers Yield Farming, where users earn a portion of fees generated by traders.

- Provides additional DeFi functionalities.

- The SUSHI token serves as an extra avenue for users to earn rewards and participate in the DEX’s governance decisions.

1inch Exchange

One of the standout characteristics of 1inch is its role as a DEX aggregator. As a DEX aggregator, it selects the most favorable and cost-effective prices from various decentralized exchanges, enabling customers to engage in the most advantageous trading.

Best Dex – 1inch operates as a non-custodial exchange, which necessitates the use of a third-party wallet like Metamask to access its services.

Features of 1inch:

- Functions as a DEX aggregator, optimizing trading prices across multiple decentralized exchanges.

- Offers flexibility by allowing traders to use various wallets.

- Enables users to generate income by providing liquidity to the pool.

- Provides a diverse selection of cryptocurrencies for trading.

- Offers the option to add tokens that may not be available initially, enhancing accessibility.

PancakeSwap

PancakeSwap is a decentralized exchange, akin to Uniswap, but distinctively operating on the Binance Smart Chain rather than Ethereum. Notably, it provides enhanced token monitoring capabilities.

The user interface closely resembles that of Uniswap. Yet, PancakeSwap offers an opportunity for users to earn rewards by bypassing intermediaries when they choose to lock their tokens for a specified duration.

PancakeSwap’s Highlights:

- Built on the Binance Smart Chain blockchain, ensuring fast and cost-effective transactions.

- Provides access to a wide range of popular cryptocurrencies for trading.

- Offers a lottery feature, allowing traders the chance to win substantial prizes.

Bancor

Bancor facilitates Automated Market Maker (AMM) operations and incentivizes users to lock their crypto assets in liquidity pools, granting them rewards as these assets are traded by other users.

Bancor enables effortless conversions of cryptocurrency tokens and also supports several autonomous governance tokens.

Key Features:

- Bancor offers liquidity support to small and micro-cap cryptocurrencies.

- Utilizes a two-token layer system.

- Implements smart contracts to facilitate its operations.

- Price calculations are performed using the Bancor formula, ensuring efficient trading.

Related post:

Summing up, we’ve provided you with a list of the top 10 best DEX – Decentralized Exchanges at the current time. Notably, the first 5 options are best DEXs that support derivative trading. The primary advantage of using DEX platforms is that you retain full control over your assets and can trade directly from your cryptocurrency wallet.

With the tightening regulations on centralized exchanges, this might be the perfect moment for cryptocurrency traders to explore and engage in trading through DEXs.