If you ask me to introduce you to a meme coin that can increase by 100, 1000 times, all I can say is: NO. No one can guarantee how much a coin can increase in value, especially when it comes to memecoins. Don’t believe in the hype that this coin will x10, x100 in the near future. Or if you’re persuaded by someone getting rich quickly by buying a certain quantity of coins, don’t regret it – because how many lucky people are there in this “gambling” game?

PEPE coin has recently attracted a lot of attention from everyone, but if you missed it, you don’t have to regret it. Because in this field, things like this always happen, and it’s nothing new. For experienced investors, have you missed similar opportunities in the past few years? Just continue with your own plans (like investing in BTC, ETH regularly) and don’t let FOMO affect your investment principles.

BUT – There is a way to find “potential” memecoins. Although we have no way of knowing which coin will be the next x100, x1000. However, through some basic methods, we can have a chance to find projects with such potential. But it seems like no one tells you how to find it and how to avoid being deceived in the search process. So, today I will focus on this topic and share some concise tips with you. Let’s see how to find the most potential NEW meme coins.

Contents

Tips Find Potential Meme Coins Early

How to Find Meme Coins Early – Key principles to know

Meme coin season is back, causing money to flow into decentralized exchanges in search of more and more “game-changing” opportunities. Alongside that, new meme projects are continuously being created.

Over the past 1.5 months one person has created 114 meme coin scams.

Each time stolen funds from the scam are sent to the exact same deposit address.

0x739c58807B99Cb274f6FD96B10194202b8EEfB47 pic.twitter.com/uwVAiG9WGG

— ZachXBT (@zachxbt) April 26, 2023

During the PEPE coin craze, “Crypto Detective” ZachXBT discovered wallet addresses creating over 100 memecoins in just 2 months to scam users. Therefore, in a jungle filled with meme coins, finding a “good” project isn’t a simple task.

But if you’re attempting to discover a new, promising meme coin to invest in, below are some essential principles/steps you must adhere to:

1. Understanding Meme Coins: Keep an eye on which meme tokens are performing well. While you shouldn’t take the risk of buying a coin that nobody knows about, consider purchasing it when it begins to attract attention, just before it experiences significant growth. DEXTools is an excellent resource to monitor projects from a price perspective.

2. Monitor Performance: Keep an eye on which meme tokens are performing well. While you shouldn’t take the risk of buying a coin that nobody knows about, consider purchasing it when it begins to attract attention, just before it experiences significant growth. DEXTools is an excellent resource to monitor projects from a price perspective.

3. Community: A strong community is essential for the success of any meme coin. Prioritize meme coins with humorous, interesting, and easily relatable memes. You can track social metrics on LunarCrush or check if a token is being discussed on Twitter, Telegram, Discord, or if it’s trending on platforms like Twitter, Google, DexTools, or CoinGecko.

4. Research Fundamental Principles: Find out who is behind the meme coin, their level of competence, whether they have significant partnerships, what ecosystem they are a part of, and whether their tokenomics are favorable. While these questions may be less critical when researching meme coins, they can still provide an advantage and help mitigate some risks.

5. Decide on “Leader” or “Rotation Game”: Consider investing in a leading project in a specific niche market, such as DOGE for Inu tokens, PEPE for Frog tokens, or ORDI for BRC-20 tokens. Money often flows into the leader first, and then trickles down to smaller coins in that niche. This decision requires careful consideration and rational calculation. If it’s a common trend within a niche, smaller projects may receive funds after the “main” project experiences explosive growth. Nevertheless, this is still a high-risk game.

6. Follow Smart Money: To follow the smart money, check what successful meme coin traders and whales are buying and contemplate mimicking their actions. You can achieve this by examining their wallets, as this information is entirely public on the blockchain. I’ll provide instructions on how to do this below.

Tools to Find New & Promising Meme Coins

Filtering Potential New meme coins via DEXTools

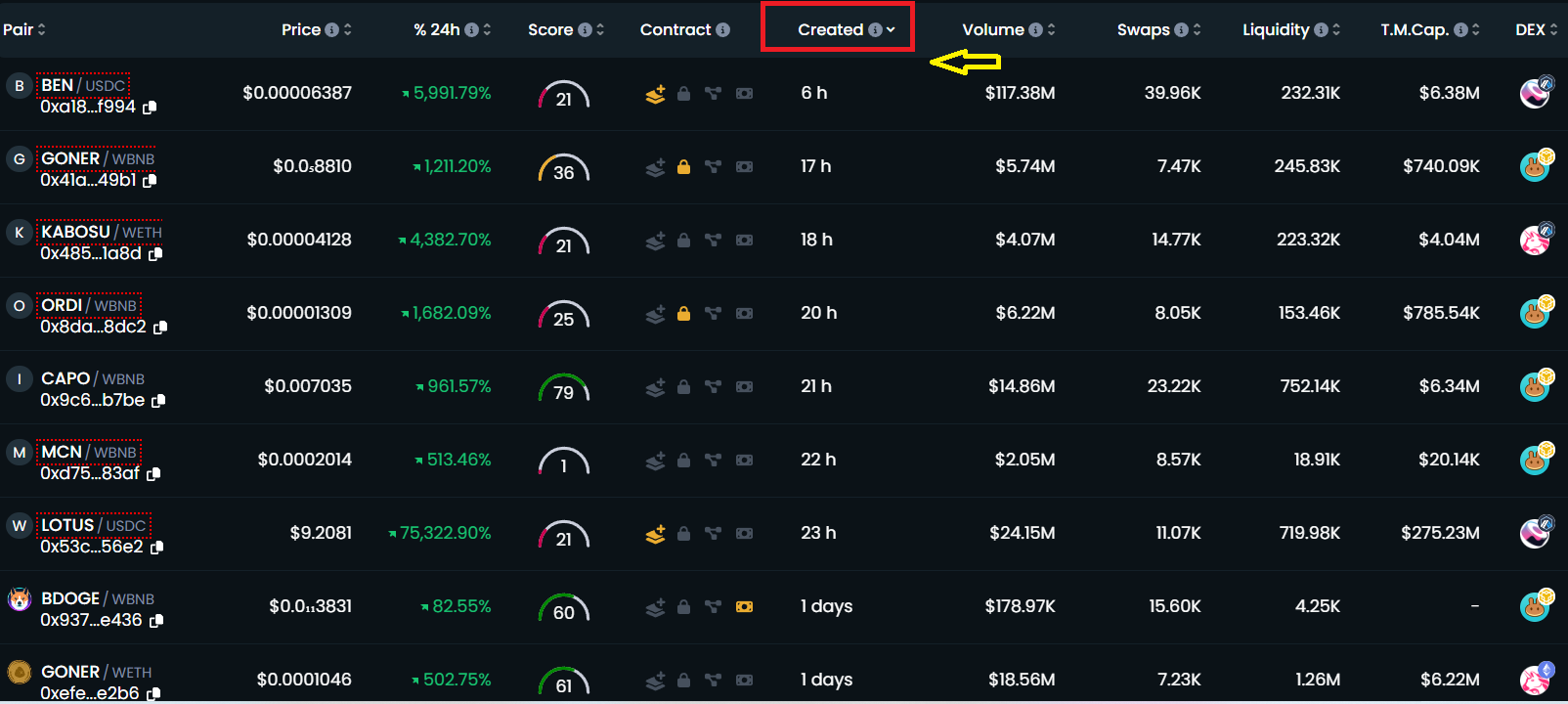

First, we can use two on-chain tools: DEXTools or Dex Screener. I believe these are currently the best platforms for discovering new MEME coins. Here, we’ll use DEXTools as an example.

– Go to: https://www.dextools.io/

– In the project list, filter the “Creat” column. This will show you the most recently created coins.

However, it’s important to note that around 90% of the projects there may be scams. So, what should you look for when selecting a new project? First, look for projects with liquidity. Then, continue your research:

- Holders Count: : If a project has fewer than 100 holders, it’s better to stay away from it, as it may be a scam. A project with a high number of holders is a positive sign for that project because it is less likely to be manipulated. To find this data, you can click on the name of each project, and it will display details for you.

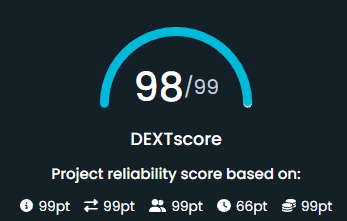

- DEXT Score: The DEXT score is a synthetic calculation based on blockchain data and other external sources to measure people’s trust in a project. This score ranges from 1 to 99, with High (>80), Medium (50-80), Low (10-50), and Least (<10) categories. If a project has a low DEXT score, it also means higher risk. So, choose projects with higher DEXT scores.

Check the Community with Tweetscout

Once you’ve found a project that meets the criteria mentioned above, you can move on to checking their community. If a project doesn’t even have a website or community, it might be a scam.

You can look for projects that meet specific criteria, such as:

- Over 1000 followers on Twitter.

- A well-designed, user-friendly official website.

- An active Telegram/Discord community (without bots).

You can directly see these addresses through DEXTools. Of course, you can also use tools like CoinMarketCap or CoinGecko to search for a project and view its introduction page.

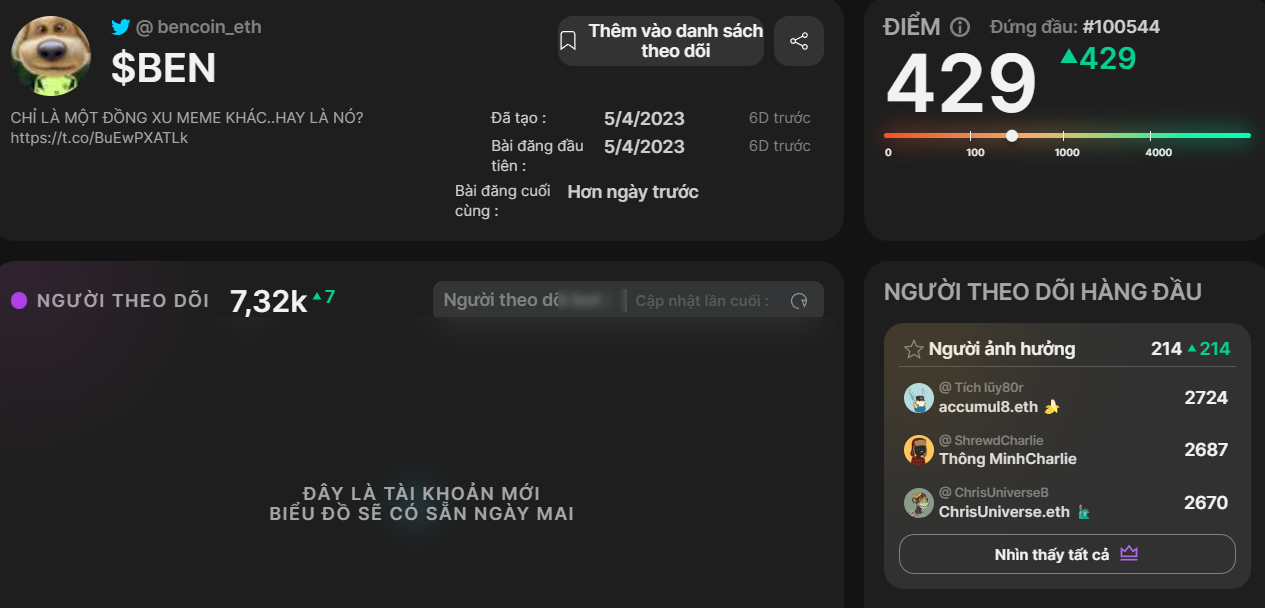

Let me share a tip to find and check potential early memecoins, minimizing risks: I often use Tweetscout.io. This tool gives an overview of a cryptocurrency project’s Twitter account (which is very important as Twitter is almost the most popular social media channel for cryptocurrencies nowadays). Here are the steps:

– Visit Tweetscout.io

– Copy the Twitter link into the search box on the Tweetscout website

– Read the displayed data::

Requirement: The higher the score, the better, at least over 200 for new projects. Refer to data about followers, the first/most recent post date. It’s crucial if many influencers and celebrities also follow this project. Overall, this tool will provide you with comprehensive information.

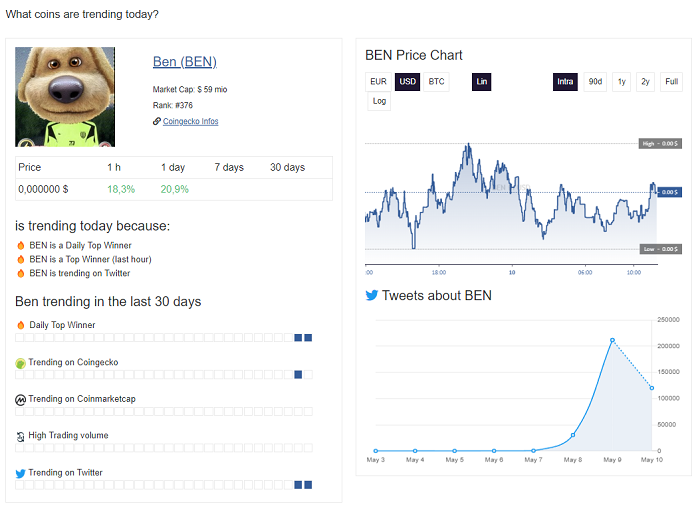

Finding “trending” projects through Blockchaincenter

Although when you discover new potential memecoins at the moment they are being actively discussed in the market, it might be “a bit late.” However, sometimes, it’s not entirely the case. Because a coin can attract attention and continue to rise in price for many days afterwards. You might not be able to buy it early, but joining right when it “JUST GOT HOT” is also lucky.

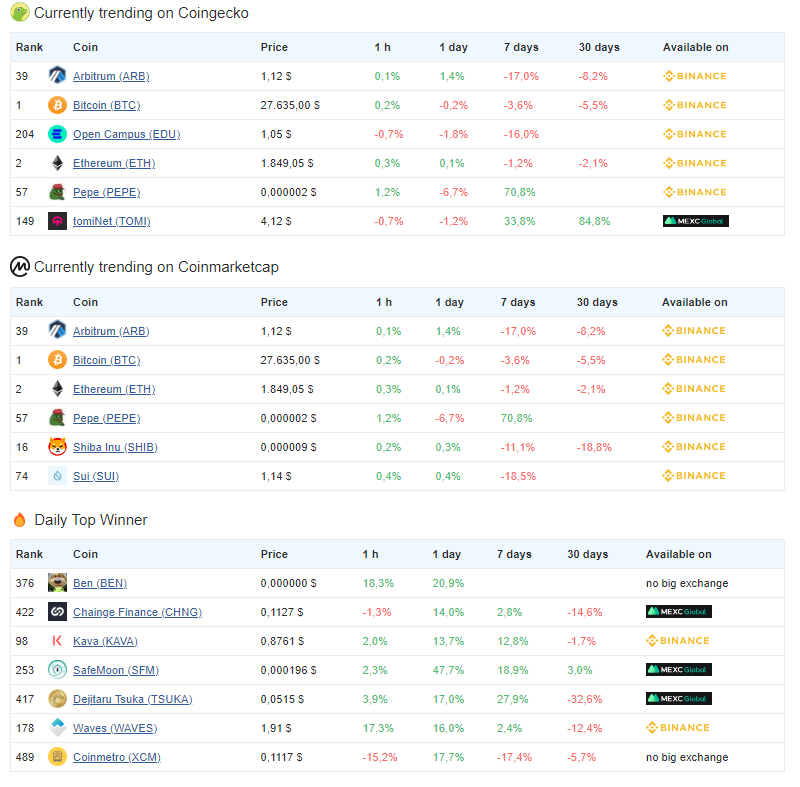

Most cryptocurrency websites like LunarCrush, Coinmarketcap, Coingecko have a trending section for your research. But sometimes – Each platform provides different “trending” data. Luckily, there’s a tool that helps us consolidate this, you just need to visit:

It will provide you with the current HOT trending coin, at different time frames, along with its popularity level on information channels/social networks. Convenient, right?

If you scroll down, you’ll see a summary table like this:

*** Note: Not every trending project should be bought. It’s crucial to combine analysis, reasonable valuation, avoid blind FOMO, and only participate with a small amount of capital ***

You may not know, there’s a “Trending Coin Challenge on Blockchaincenter.net.” A famous investor applied this challenge by buying an equal value of the trending coin each day. Over time, his return was even worse than if he had bought BTC every day. You can refer to the performance statistics at:

- https://cryptodca.io/blockchaincenter-challenge/

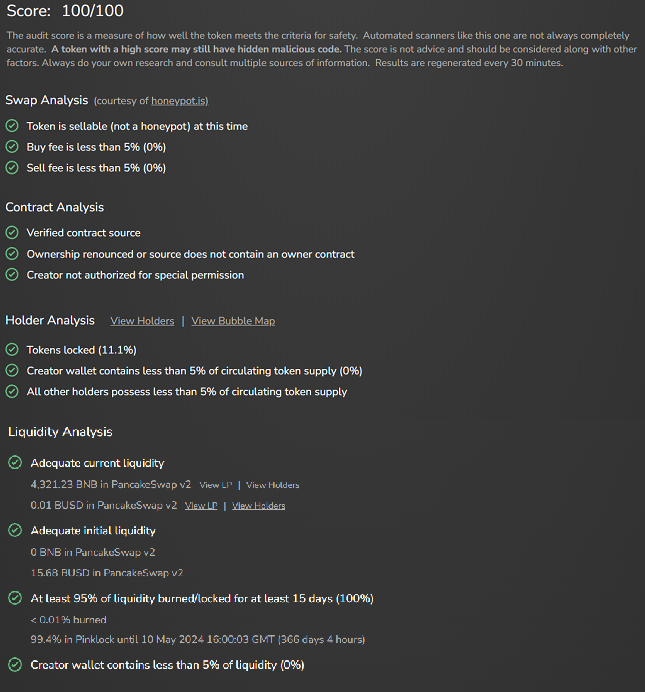

Checking token addresses with Tokensniffer

After finding a potential coin, before you trade, you should check its address. Many tools support this, but I usually choose:

- Token Sniffer: tokensniffer.com

It’s very simple to use, just paste the token address into the search box, and the tool will display a result table like this:

The higher the score, the safer the token address. But there are some notes you should know:

- Honeypot: indicates scam tokens that cannot be sold Buy/Sell taxes: be aware before trading to avoid unexpected losses

- contract owner renounces ownership or does not transfer ownership to another party – to prevent changes in the contract.

- Owners and other participants hold less than 5% of the total supply – to counter price manipulation/scams

- Most liquidity is locked/burned and the owner holds less than 5% of the total liquidity -⇒ low rug pull risk

However, this information cannot entirely eliminate risks. Risks still exist, and there’s no guarantee these projects will rise in price soon. But investing in meme coins is like betting on a lottery, so it’s best to choose the “ticket” that minimizes risks as much as possible.

Following “Whales”, “Smart Money” to Find Potential Meme Coins Early

Another method used by many to find early investment opportunities, which is simpler, involves tracking “whales” (holders of a large number of tokens) or “smart money” wallets (wallets that have previously invested early and successfully in projects).

Step 1. Find “whale” wallets

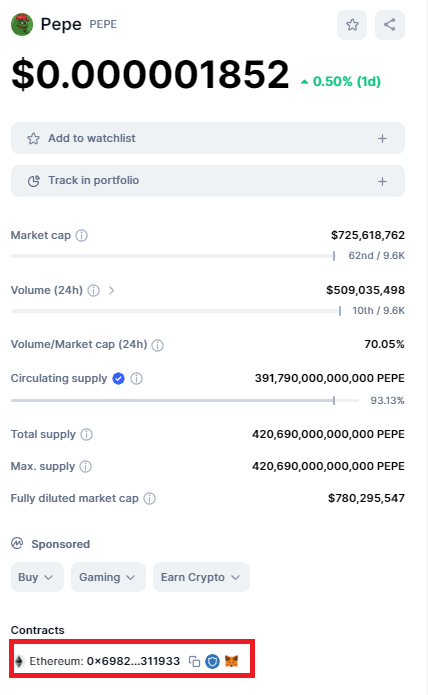

One way to identify early buyers of successful memecoins like PEPE is to visit Etherscan. Just copy the smart contract address of the token and check. This allows you to see the wallet addresses of the first investors in the successful meme coin. These early buyers may continue to be interested in future meme coins, potentially giving you a good chance to consider underpriced coins. Tools like Dune, DexTools, Dexscreener also allow you to filter this information.

For example, if you don’t know where to find the project’s token address, it’s simple. Just visit coingecko or coinmarketcap, and you’ll see the smart contract address clearly displayed. For example, the image below shows the contract address of PEPE token on Coinmarketcap.

Then, copy the smart contract address of the Token into the search bar of Etherscan.io (or any alternative tool that can check wallet addresses).

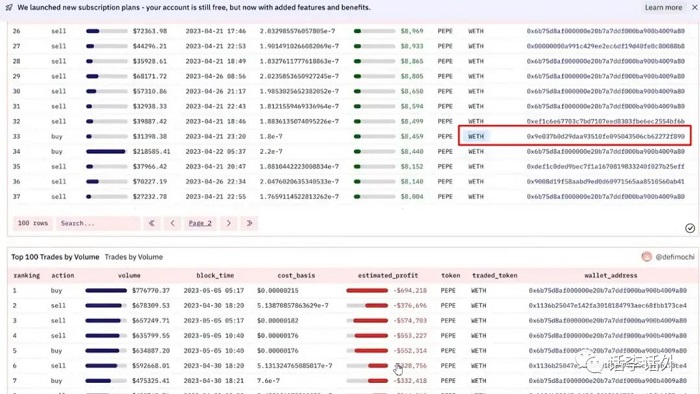

In the example above, I checked using Token Analyzooor. After searching, you can see all the wallet addresses that have traded PEPE during the corresponding period. Many of them are MEV bots or wallets of CEXs. But after some searching, you will discover some potential wallets.

Step 2. Find “smart money” wallets

Once you have identified the top buyers or early buyers of a coin, you can look for “smart money.” These are usually investors with a significant amount of cryptocurrency assets and have been successful in past investments. You can also use this tool to see which meme coins they are investing in, to follow and invest alongside them.

If you don’t know where to find information about “smart money,” I suggest following the Twitter channel @lookonchain. They always provide activities of whale wallets and “smart money” wallets very quickly and accurately. Whenever there is information, you can save these wallet addresses for reference.

1/ How did I turn $1,000 into $30,000 with smart money?

I found a SmartMoney in $MATIC in June that is very good at buying lows and selling highs.

I added this address to my watch list. pic.twitter.com/cCPrHabHy4

— Lookonchain (@lookonchain) August 2, 2022

Step 3. Follow Wallets on DeBank

To see what “whale” and “smart money” wallets are buying, you can follow their wallets on DeBank. This tool allows you to view transactions and investments of certain wallets, seeing what they are buying/selling, and which projects they are holding.

- Visit: https://debank.com/

- Paste the wallet address into the search box. Then, you’ll see a summary of the assets this wallet is holding, along with their transactions.

Note, use their buying transactions as a basis for further research, and don’t blindly follow them – there’s no guarantee that the investment will rise in value or be profitable. It’s essential to combine this with other factors, considering trends, cash flow, valuation, community… of the new project, to determine whether it’s a good investment or not.

Most Effective Meme Coin Investment Method

Assuming you’ve found and bought a memecoin, it’s crucial to have a plan to ensure you are managing your investments effectively. Here are four key steps you can take to guide your buying and profit-taking decisions:

- Treat it like a casino: Investing in meme coins can be exciting and potentially profitable, but it’s important to approach it with a gambling mindset. Only invest what you can afford to lose and always be prepared for the possibility of losing your entire investment. It’s important to avoid overallocating capital and stick to a budget that you’re comfortable with.

- Only trade meme coins in a separate wallet: Meme coins can be volatile and unpredictable, so separate your investment capital and meme coin funds by using different wallets. This helps you avoid emotional trading decisions and maintain a clear perspective on your overall investment strategy. Be comfortable with the possibility of losing 100% of the money in this separate wallet.

- Use technical analysis (TA) to make informed decisions: While conducting accurate TA on meme coins can be challenging due to limited liquidity and historical data, it can still be a useful tool to develop an action plan. A good approach is to wait for significant price corrections, then trade at resistance/support thresholds…. This can help you avoid buying high and selling low. Additionally, consider using DCA at predefined price levels within your capital limit to minimize volatility. Avoid indiscriminate DCA.

- When profiting, gradually withdraw your capital: If you’ve profited from a meme coin – congratulations. What you need to do is gradually withdraw your initial investment when you have doubled or tripled it. And continue to invest with the profits. As the profit grows, withdraw an additional percentage. However, be aware that this strategy is only appropriate until the peak of the meme coin is formed, and at that time the market may experience severe downturns. To minimize risk at this time, monitor indicators that may signal a market peak. These include reversal of trading volume, price break from the uptrend line, MA…, reduction in holders, and a significant slowdown in holder growth rate. Additionally, large whales beginning to sell and the funding rate shifting from negative to positive are also warning signs. Although there’s no guaranteed way to predict when a peak will occur, using these indicators in combination can help you minimize risk when potential peak signs appear.

SUMMARY:

Although investing in meme coins can be a risky venture, identifying promising projects early can give you an edge, minimizing risk and maximizing rewards. The earlier you buy, the lower the entry cost, and as the coin becomes popular, its price will rise, leading to substantial profits.

One of the most significant advantages of investing in meme coins is the rapid return on investment. Traditional cryptocurrency investments may take months or even years to yield returns, but meme coins can do so in just days or even hours. This quick turnover can provide investors with a reliable source of passive income.

Importantly, have a sensible investment strategy, don’t have high expectations for meme coins, treat it like a lottery, know when to take profits. Understanding your risk tolerance, setting realistic goals, and having a comprehensive strategy will help you protect your investment while enjoying the benefits that meme coins offer.

Above is guide “How to Find Potential Meme Coins Early”. I hope the above shares have given you some experience in “hunting” for the most potential early meme coins, before they become popular and are listed on various exchanges. If you have any questions, feel free to leave a comment for me to answer. Thank you for reading the article, and I wish you successful investing.