In the following article on NFT investment experience, I will guide in detail about how to invest in NFTs for beginners. I hope that through these shares, you will know how to find and research promising NFT projects with high growth potential.

But before you start, please note the following:

-

At present, NFT is not a very attractive investment, often lacking liquidity. It is much more difficult than investing in cryptocurrencies.

-

The content in this article is only for sharing/educational purposes. It is not a recommendation for you to invest in NFTs. And the NFT projects mentioned here are just examples, not investment advice.

If you’re ready, let’s explore the NFT investment experience together.

Contents

NFT Investment Experience from A – Z

What is NFT?

NFT stands for non-fungible token. It is a digital certificate of ownership of an asset such as collectibles, artwork… stored on a blockchain.

The unique feature of NFT is that it provides you something called OWNERSHIP. For example, you own an NFT of a certain painting. Anyone can download it, copy it – but only you own the ORIGINAL.

Like a musician, they can keep the copyright of a song, or sell that ownership to someone. Anyone can sing, listen, but the only owner is the one holding the COPYRIGHT.

But not only paintings, there are many types of assets/ownership encoded as NFTs, including:

- Art NFTs: Especially digital art, the most popular form of NFTs at present, such as BAYC and AZUKI.

- Collectibles: For example, baseball cards and CryptoPunks.

- Game NFTs: Players own characters and equipment in the game.

- Sports Moment NFTs: Short video clips of memorable sports moments presented as NFTs.

- Music NFTs: Allow musicians to interact directly with their fans and encode their work.

- NFT Domains: Using NFTs to represent domains, URLs, payment addresses, etc.

- Fashion NFTs: Fashion brands like LV and Gucci release their own NFTs.

- Financial NFTs: The combination of NFTs and DeFi.

- Asset-Backed NFTs: Such as real estate, gold, antiques, etc.

Requirements for NFT Investment – Things to Know

If you are not familiar with cryptocurrencies, you should not invest in NFTs right away. First, you need to understand what you are investing your money in. And to do that, you must start with the basics.

Requirement 1: Basic Knowledge of Cryptocurrency

- Learn about blockchain technology. What it is and how it works. This includes understanding wallets, addresses, private and public keys, how transactions work, etc.

- Gain experience in buying, holding, and selling cryptocurrency. You should only invest in NFTs when you have gone through a period of trading/investing in cryptocurrency.

Requirement 2: Cryptocurrency (NFT) Investment Psychology

I know that perhaps when you read this article, you are thinking of investing in NFTs to make money. But to make money with assets, “psychology” is extremely important, equal to the knowledge requirement above. That’s why before going to the practical research part of this guide, I want to share some tips on the psychology you need to make money with NFTs.

NFT investment experience, here’s what you need to know:

-

Most NFT Projects Will Fail: NFTs are in a very early stage, similar to cryptocurrency ICOs in 2017. Most ICOs failed in the sense that they lost over 95% of their initial value or simply disappeared. A similar scenario applies to most NFT projects. That’s why you need to set realistic profit targets. Sell as soon as you make a profit, don’t be “diamond hands” – meaning, don’t hold for too long.

-

Invest Only What You Are Willing to Lose: This is one of the oldest and most genuine investment rules. NFTs are a risky investment. Limit your risk by investing only a portion of your available funds, representing a very small percentage of your capital.

-

The Best Time to Buy NFTs is Before They Get Hyped: Focus on researching the project and make a wise selection. When the hype and PR start, sell and take profits.

-

Don’t FOMO When Prices Keep Rising: Don’t worry if you miss out on joining an NFT project. There are many new NFT projects every day offering new opportunities.

-

For Famous & Established NFT Projects, Don’t Try to Buy at High Prices: Be patient and wait for a correction before buying.

-

Never Stop Learning: To become a successful NFT investor, you need to understand why you make a profit or why you lose with a project. Therefore, constantly learn and stay updated.

-

Take a Break When Feeling Overwhelmed: Stress leads to poor decision-making. It harms you. So, when things get too much, take a step back. As I said, with cryptocurrencies and NFTs, there are new opportunities every day. Don’t rush; occasionally missing some investment opportunities is perfectly normal. It’s okay.

Where to Find Potential NFT Projects?

In the next step of the NFT investment experience guide, let’s focus on the process of researching NFTs. However, you need to know where NFTs are traded, and which platforms/tools will help you stay updated with NFT information.

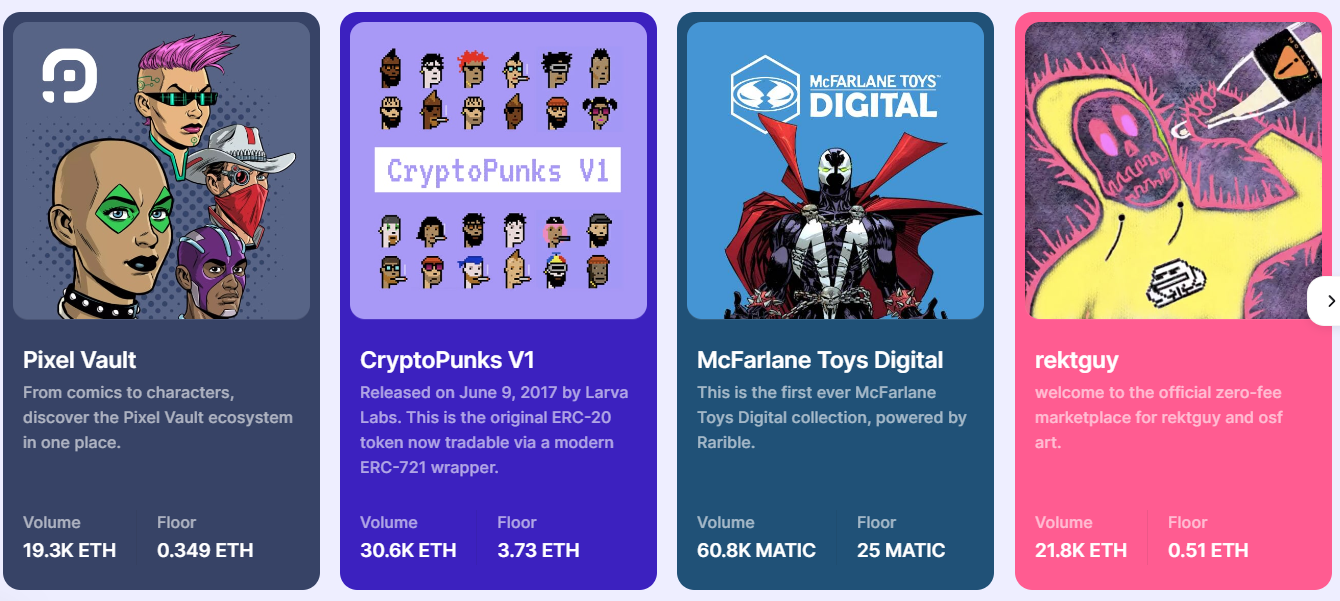

NFT Marketplaces

- https://opensea.io/ (the largest and most widely known)

- https://www.binance.com/en/nft/home (most user-friendly for many investors)

- https://rarible.com/

Additionally, there are many other NFT marketplaces to choose from. You can read more in the article to find the most suitable marketplace: Top 10 NFT marketplace reputable, low fees, most used

Check These Websites for New NFT Projects

- https://nftgo.io/discover/nft-drops

- https://rarity.tools/upcoming/

- https://www.cryptoscores.io/calendar/calendar

- https://mintyscore.com/home

These sources will provide you with good ideas and an overview of what types of NFTs are currently available.

How to Research NFT Projects Before Investing

Next, let’s look at different steps to research the basic principles of an NFT project. The good thing about NFTs is that anyone can create and sell them. But that doesn’t necessarily mean they’ll be good. That’s why it’s important for you, if you want to become a successful investor, to know how to analyze.

So, when researching a project, make sure you know/understand the following information:

Criterion 1: The NFT Creators

The people behind an NFT project are one of the most important factors you need to research. Because only when the team understands the community well and has the right skills and knowledge can they realize their plan.

Look for answers to the following questions:

- Do the creators have a good track record? Are they newcomers, or have they had previous (successful) NFT projects?

- What can you find out about their background? Do they have experience with cryptocurrencies? A lot also depends on the nature of the NFT project you’re researching. For example, for an art NFT, you want the creator to combine artistic skills with deep understanding of the cryptocurrency field.

To learn about the creators, you should check different places such as the project’s website, social media channels, press releases about the project, etc.

Criterion 2: The Roadmap of the NFT Collection

The roadmap is an essential piece of information showing what has happened so far and what an NFT project wants to achieve in the future.

Focus on the following:

- What developments and other things does the project still have in its plan? What is the growth potential?

- When will these points be implemented?

- Are the stated goals and timelines realistic?

- How many goals or milestones have been achieved? This is an indicator of how fast the project is progressing.

Criterion 3: The Marketing Approach of the NFT Collection

Marketing is essential for any type of NFT project. No promotion = fewer people seeing or knowing about the project = not many people will buy NFTs = no growth in value.

An example of this is the failure in GamiFi cryptocurrency projects. If no one plays the game, the NFTs will have no value.

Answer these questions to assess the marketing activities of the creators.

- What marketing channels does the team use? How many followers do they have? Is there significant user engagement?

- Do they have strong partners/brands to promote their NFTs?

- How do they promote their NFTs? Is it professional? Do they address community feedback and expectations?

These three criteria include some of the most crucial steps in researching NFT projects. However, NFTs are also a type of cryptocurrency asset, so you should also research other criteria: community, investors, competitors, blockchain activity, transaction fees, etc.

How to Evaluate the Potential Value of NFTs

To make money from NFTs, you need to understand why one NFT project is more likely to increase in value than another. In the following section, I will show you some key aspects that play a significant role in determining the value of each NFT project.

Utility of NFTs

Utility refers to what you can use the NFT for. A lot here depends on the type of NFT you own. Here are some examples:

- Art: Many factors like the artist’s reputation and art style play a crucial role here. One common point for art NFTs is that the value of each NFT is individual, and they are very subjectively priced.

- Gaming: Some NFTs are used as items in games. For example, a sword with +5 attack attributes will naturally outshine one with only +2. Importantly, it has to be an item in popular games.

- Finance: Some projects offer NFT owners certain privileges like lower transaction fees.

- Music: NFTs grant ownership rights to a song.

- Sports: Some sports NFTs grant collectors special privileges, such as access to VIP areas on match days.

Creativity and Uniqueness of NFTs

Successful NFT projects have always involved a creative element, whether in their design or functionality. What unique features does the NFT you are interested in possess that sets it apart from others?

- Crypto Punks: Pioneering project leading the way for PFP NFTs with simple, unique designs.

- Bored Ape Yacht Club (BAYC): Adds more utility to NFTs through real-world item airdrops, expanding the collection through NFT airdrops (MAYC), etc.

- Azuki: High-quality anime imagery.

- World of Women (WoW NFT): Exclusive art pieces specially created for and by women.

- MonkeDAO: A collection decided by the community (DAO NFT).

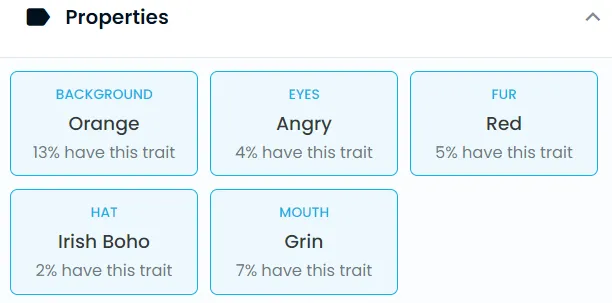

Rarity of NFTs

In NFT investment experience, rarity is the most crucial factor determining the value of NFT projects and individual NFTs. Rarity is influenced by various aspects.

- Supply – How many types of NFTs are there or will be minted? The total supply of an NFT collection indicates the number of NFTs in one collection. The total supply of NFTs also affects the collection’s value. Collections with a larger total supply generally have lower value per NFT, while those with a smaller supply often have higher floor prices due to the rarity of the NFTs.

Popular NFT projects on Ethereum typically have a total supply of around 10,000 NFTs due to the strong NFT market in this ecosystem. On Solana, projects often have a smaller total supply. This number can be found on the project’s homepage or on marketplaces like Opensea.

Below are some tools you can use to check the rarity of specific NFTs:

- https://rarity.tools/

- https://raritysniper.com/

- https://rarityranks.io/

These websites allow you to search for NFT projects and will provide you with various statistics showing the rarity of each NFT.

- https://opensea.io/

With OpenSea, the property section of each individual NFT will list how many NFTs in the collection share the same attributes.

The Hype Factor

OK, this is a bit challenging. In this case, the hype factor refers to the community’s enthusiasm and excitement about an NFT project. It’s a phenomenon that you can often see in the cryptocurrency space, and it usually doesn’t last long.

How can you ‘measure’ the hype?

You can’t. But if you see many people passionately talking about an NFT project on platforms like Reddit, Twitter, etc., then it’s probably being hyped. It’s best not to focus too much on this factor alone. However, if an NFT project comes with a lot of hype, it’s a good sign – either the project backers know how to market it well or it genuinely resonates with the audience.

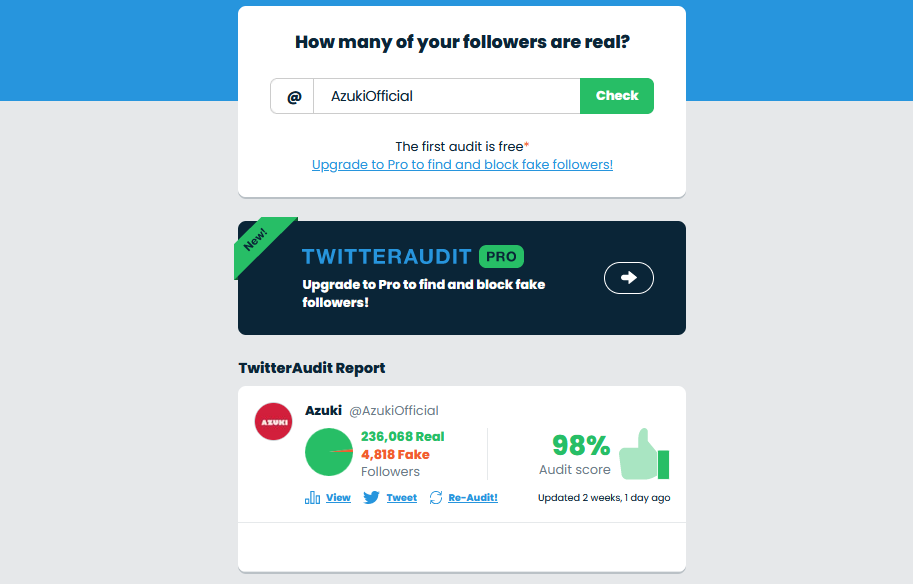

But be aware, many projects use airdrops to gain followers, or even buy bots to increase follower count. This is a negative point. A tip for you is to use this tool to check whether the followers are bots or not. Additionally, pay attention to the ratio of likes/retweets to the number of followers to see if the community is genuinely interested in the project.

Backed by Major Organizations and Celebrities

In 2022, companies and celebrities from outside the cryptocurrency world are increasingly joining the NFT bandwagon. From Italian fashion company Gucci to English Premier League clubs, and various other companies are undertaking NFT projects.

Big names mean big money. For NFTs, the support or distribution of famous brands, people, and companies will be an important value-creating factor in the future. Due to their popularity and marketing power, they will generate significant interest in their NFTs. Investors who keep an eye on NFTs backed by these groups will undoubtedly have an advantage.

Example: The high price of BAYC isn’t random. Many celebrities have publicly confirmed their ownership of this unique NFT collection, including names like rapper Eminem, basketball superstar Steph Curry, football star Neymar, and even the sports brand Adidas…

Analyzing NFT Trading Metrics

Finally, check the most important trading parameters to understand the market for an NFT project and individual NFTs.

NFT Floor Price

The floor price is the lowest price of an NFT within a project. Your goal is to buy a rare NFT at a price close to the floor. Or if that’s difficult, find a project that balances value and accessibility. Projects with a high floor price have certainly established their value, but they are less accessible for traders with smaller capitals.

Here is a website where you can check the floor price: https://nftpricefloor.com/. Also, many NFT exchanges provide clear floor price information for each NFT.

The floor price can be seen as a gauge to assess community reception for a project. If a project is sought after and demand increases, the floor price will rise. The simplest NFT investment strategy is to buy the cheapest NFT in a collection, which you can sell later when the collection becomes more popular, and the floor price rises.

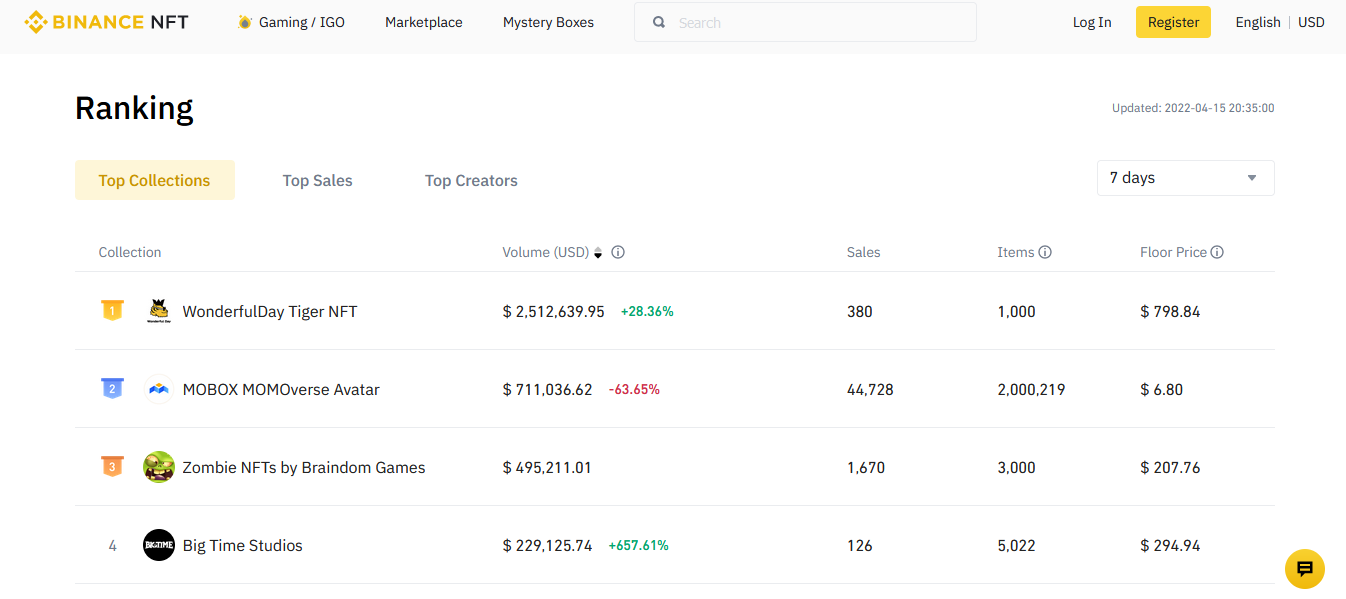

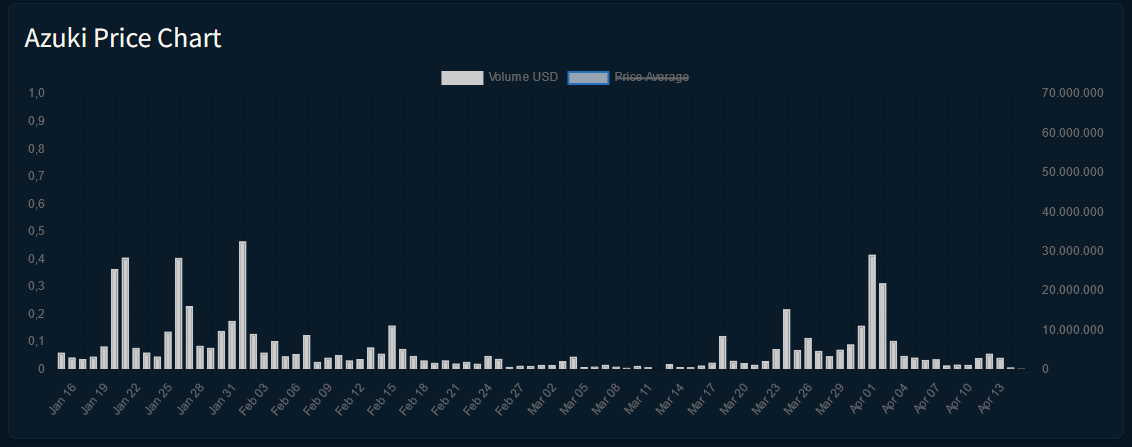

Trading Volume

This will show you the demand for an NFT. By looking at the total trading volume or daily trading volume, you can easily assess whether a collection is in demand. Projects with high liquidity make it easier to enter and exit NFT positions.

In NFT investment experience, trading volume can be used in conjunction with the floor price to gauge interest in a collection. If the trading volume spikes, many NFT holders sell, and the floor price drops, this could indicate an upcoming panic sell.

Conversely, projects that maintain stable floor prices and trading volumes even during bear markets are very likely to rise when the market stabilizes again.

Number of Holders Relative to the Number of NFTs

What we’re looking for is a small number of NFTs and a large number of holders. A large number of NFTs per owner could indicate low demand, and when selling pressure occurs, the floor price could drop. OpenSea provides a simple overview, where you can view the total items and owners of an NFT project.

To analyze various trading metrics, you can use two analysis tools:

- https://dune.xyz/home – Offers various features, where you can find different metrics such as the overall floor price of a project, top owners, etc. Users can also create their own dashboards following the provided guidelines.

- https://nftgo.io/ — This platform provides all kinds of different market data. An important feature is the whale tracking page: https://nftgo.io/whale-tracking/trade

Additionally, pay attention to the allocation ratio. Look for holders who own a large percentage of the total supply, are they whales, long-term holders, or the project team itself? Observing the actions of these holders will provide you with valuable information. Tools that can help you do this include Nansen.io, explorers like Etherscan, Bscscan, etc.

IN SUMMARY

In NFT investment experience, here are the key points to remember:

- Requires basic knowledge of cryptocurrency, blockchain, and understanding what NFTs are.

- Find and choose a suitable NFT exchange.

- Know the websites/tools that help you look up data related to NFTs.

- Research the NFT creators, team, community, and media presence of the NFT collection.

- Understand what type of NFT you are considering, its utility, and whether it’s supported by celebrities or major organizations.

- Research what type of NFT you are planning to buy, its utilities, and whether it’s backed by celebrities or major organizations.

- Consider metrics like ceiling price, floor price, total supply, and the number of holders to estimate an appropriate price level.

- NFT investment requires a significant initial sum of money, so a lot of dedication and extensive research is necessary.

- NFT investment is not suitable for holding onto profits for too long. Sell when you have a profit.

- NFTs are not an easy investment, but can be exciting if you are genuinely interested in this field.

You might be interested in:

These are some of our NFT investment experiences. We hope that through this sharing, you have found useful content. Evaluating, researching, and investing in an NFT project is not simple. But if you are determined and spend time learning, you will surely find great investment opportunities with NFTs. We wish you early success as an investor.