Ethereum network users no longer have to worry about network congestion or high transaction fees, thanks to the advent of Layer 2 solutions. Among these, Roll-up solutions, particularly Optimistic Rollup with the Optimism project, are attracting numerous users and currently boast one of the top Total Value Locked (TVL). But what exactly is Optimism? What is OP coin? Does this project have potential? Let’s dive into the details in the article below.

Contents

What is Optimism (OP Coin)?

What is OP Coin?

The slow transaction speeds and high gas fees have been hindering Ethereum compared to other blockchains. Consequently, several projects have emerged to help Ethereum overcome these challenges, with Optimism being one of the best options currently available.

Projects like Optimism are referred to as Layer – 2 (created to address Ethereum’s limitations). To understand more, you can read the article:

So, what is Optimism, what is OP coin and what makes this project stand out?

What’s Unique About Optimism – OP Coin?

In summary, Optimism (OP) makes transactions on Ethereum cheaper and faster. It operates by moving transactions off this blockchain onto another. Additionally, it provides Ethereum developers the opportunity to use all available Ethereum tools without needing to make any changes.

Optimism is designed with three main components:

-

Ethereum mainnet: Also known as Layer-1 or the main network of Ethereum.

-

Optimistic Rollup: The core of Optimism’s scalability. Optimistic Rollup aggregates individual transactions at a time and bundles them into a single transaction for processing on the Layer-2 sidechain. This reduces the volume of transactions Ethereum has to handle, improving gas fees and transaction speed.

-

Optimistic Virtual Machine (OVM): An Ethereum-compatible virtual machine, enabling projects to operate as if on L1 Ethereum. This environment runs Ethereum’s smart contracts, making OVM essentially an EVM with much better scalability, capable of processing a large number of smart contracts at a specific time.

Thanks to this structure, some of Optimism’s notable advantages include:

- Transaction experience: With rapid processing speeds, gas fees are reduced by 88 times compared to current Ethereum gas fees.

- Easy scalability and dApp development: dApps running on Ethereum or EVM-compatible dApps can easily run on Optimism.

- Security: Layer 2 inherits the stringent security level of Layer 1 Ethereum.

- Decentralization: All transactions are posted on Layer 1 Ethereum, inheriting Ethereum’s robust security assurances.

Optimism is an “Optimistic Rollup,” essentially a blockchain reliant on the security of another “parent” blockchain. Specifically, Optimistic Rollups use the consensus mechanism (like PoW or PoS) of the parent chain instead of providing their own. In Optimism’s case, this parent blockchain is Ethereum.

Throughout its operation, Optimism (OP) has achieved impressive milestones, including:

- Total wallet addresses: 329,000

- Average daily transactions: 111,550

- Gas fee for sending ETH: $0.38

- Gas fee for DEX swaps: $0.68

- Gas fee for NFT sales: $0.75

- Currently, there are 108 projects operating on Optimism

- Total TVL across the ecosystem is $640 million. Ranked 3rd in TVL among Layer 2 platforms on Ethereum.

What is the OP Token?

OP is the native token of the Optimism platform. Currently, there’s limited information about the uses of the OP token, but according to Optimism’s announcement, OP token is primarily used in governance roles like:

-

Voting for protocol updates.

-

Voting for the distribution of incentives from a portion of the Governance Fund.

-

Funding projects on Optimism.

-

Participating in project governance with OP Citizens.

Some information about the OP token:

- Token Name: Optimism (OP) Token

- Ticker: OP

- Blockchain: Optimism

- Token Standard: ERC-20

- Contract: 0x4200000000000000000000000000000000000042

- Token Type: Governance

- Total Supply:1,351,719,035…

- Initial Supply: 4,294,967,296 OP

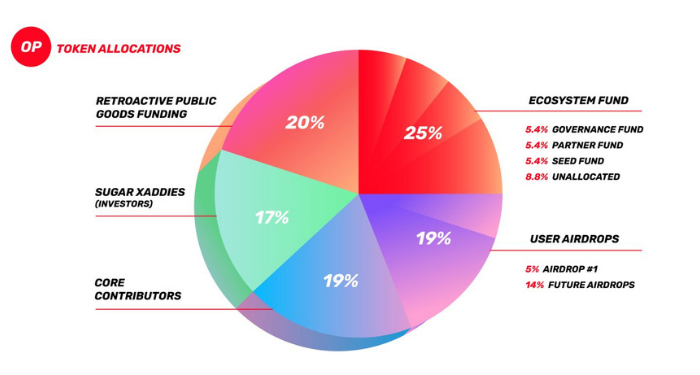

There are initially a total of 4.294.967.296 OP tokens. The total supply of OP tokens will increase at a rate of 2% per year. The distribution of OP tokens will be as follows:

- Ecosystem Fund: 25%

- Retroactive Public Goods Funding (RetroPGF): 20%

- User Airdrops: 19%

- Core Contributors: 19%

- Sugar Xaddies: 17%

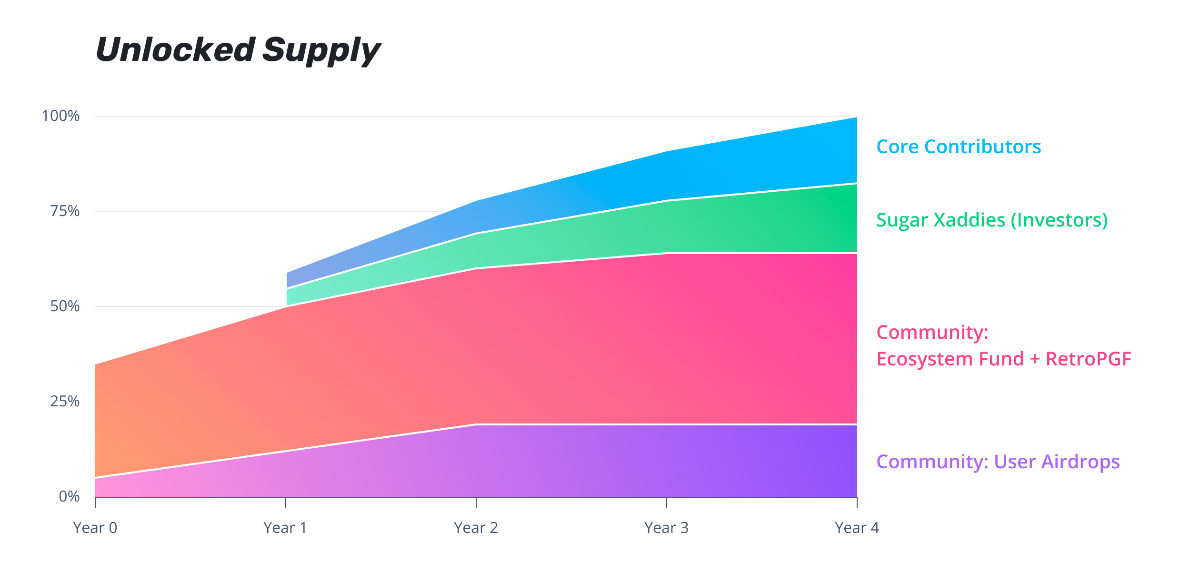

64% of the total supply above will be managed and allocated to the community by the Optimism Foundation. Of this, 30% will be allocated in the first year. The rate for subsequent years will be determined by votes from OP holders. You can refer to the OP token distribution schedule below:

The Team, Investors, and Partners of Optimism (OP)

Next, let’s delve into information about the team, investors, and partners of Optimism to see if it has garnered interest from major organizations and projects.

Project Team

The project has established the Optimism Foundation to manage the Optimism Collective, conduct experiments, drive the ecosystem, and ultimately disband to fully hand over governance to the community.

The Optimism Foundation is led by the two founders of Optimism, Jinglan Wang and Ben Jones, joined by Eva Beylin (Director of the Graph Foundation), Abbey Titcomb (Head of Community at Radicle), and Brian Avello from the Maker Foundation.

Additionally, Optimism PBC has been renamed to OP Labs PBC, with Liam Horne, previously the Head of Engineering at Optimism PBC, assuming the role of CEO at OP Labs PBC.

Investors

Recently, Optimism successfully raised $150 million in a Series B round led by a16z and Paradigm, in addition to earlier fundraising rounds:

- January 15, 2020, Seed Round ($3.5 million): Paradigm, IDEO Colab Ventures

- February 24, 2021, Series A ($25 million): Andreessen Horowitz, Paradigm, IDEO Colab Ventures

- March 17, 2022, Series B ($150 million): Paradigm, Andreessen Horowitz. Current valuation at $1.65 billion.

Optimism Ecosystem

Over time, thanks to its useful functions, Optimism (OP coin) has attracted numerous partners to its ecosystem, spanning Defi, NFT, Wallet, Tool, DAO, and more.

For more details on the Optimism ecosystem, visit: https://www.optimism.io/apps/all

Competitors

Optimism’s biggest competitors are other Layer 2 coins in general, with Polygon and Arbitrum being particularly noteworthy. Their differences include:

-

Arbitrum uses Arbitrum Virtual Machine (AVM), whereas Optimism uses Ethereum Virtual Machine (EVM). Arbitrum mainly seeks to improve the functionality of Ethereum smart contracts. Optimism does something similar but focuses more on reducing transaction costs.

-

Polygon provides tools for developers to build scalable decentralized financial applications. It is a multi-chain platform that combines the best aspects of Ethereum and other blockchains. It operates a bit differently from Optimism. However, as of now, Polygon (MATIC) is quite popular, consistently ranking among the top coins, while Optimism has not received as much attention.

Community

You can stay updated on the Optimism project through their community channels:

- Website: https://www.optimism.io/

- Twitter: https://twitter.com/optimismPBC

- Medium: https://medium.com/@optimismpbc

- Discord: https://discord.com/invite/jrnFEvq

- Blog: https://optimismpbc.medium.com/

What is the Development Roadmap of Optimism – OP Coin?

Another plus for OP coin is its well-structured roadmap and the team’s active involvement in steering the project according to the set path. Their detailed roadmap is published on their website:

- June 2019: Introduction of Optimistic Rollup technology

- October 2019: Launch of Optimistic Rollup PoC mechanism

- September 2020: Launch of EVM Compatible Testnet

- January 2021: Launch of Alpha Mainnet version

- August 2021: Launch of EVM Equivalent Mainnet version

- December 2021: Official Mainnet launch

- 2022: Launch of next-generation Fault Proof algorithm

- 2023: Rollup fragmentation, launch of Incentivized Verification and Decentralized Sequencer features

- 2024: Adjustment of Fault Proofs on Layer 1

Should You Invest in Optimism (OP)?

So, should you invest in OP coin? Does the project have potential? Let’s summarize its advantages and disadvantages for a clearer perspective.

Advantages of OP Coin

- Optimism (OP) is a Layer 2 solution that enables faster, cheaper transactions for Ethereum applications.

- Optimism’s gas fees are 88 times cheaper than Ethereum’s.

- The Optimism ecosystem is growing robustly, with active wallets and increasing TVL.

- Optimism (OP) is listed on several major exchanges, including a recent listing on Binance, which will likely increase its visibility.

- Ethereum has the highest number of active dApps, making the potential user base for Optimism quite large.

- The Optimism (OP) team is dedicated, with a clear roadmap and consistent progress.

Disadvantages of OP Coin

- Compared to other Layer 2 projects, Optimism (OP) is useful but has not received as much attention.

- Optimism faces many competitors in the Layer 2 space.

- The price of OP coin is volatile, currently more speculative in nature.

- The tokenomics of OP coin are not fully clear, and it appears to be subject to annual inflation.

- With Ethereum 2.0 on the horizon, which will improve transaction cost and speed, Optimism and other Layer 2 coins may be impacted.

So, should you invest in Optimism (OP)?

Personally, I find Optimism (OP) to be an extremely useful project for many developers. It was created to enhance Ethereum’s scalability. Given Ethereum’s lead in active smart contracts, Optimism’s future looks promising, with potential for long-term growth.However, Optimism (OP) currently faces several challenges, including competition in the Layer 2 space. The future remains uncertain, but for now, more time is needed for a detailed evaluation of OP coin.Still, if you believe in Optimism and Layer 2 coins in general, you might consider a small investment in OP coin. Remember to only invest an amount you are prepared to lose.

That’s all we have on Optimism (OP). We hope this article has given you a clear understanding of what OP coin is, its unique features, and whether you should consider investing in it. Think wisely, and we wish you successful investing.