The 31st project on Binance Launchpool to reboot the market, the HashFlow project. Hashflow is a decentralized exchange designed for interoperability, no slippage, and transactions protected by MEV. The number of DeFi traders has recently increased and many decentralized exchanges (DEX) are emerging in the market. So, what makes HFT stand out compared to other DEXs? Let’s find out what HFT coin is and its outstanding features in the article below.

Contents

What is HFT coin, and does it have potential?

What is HFT coin?

HFT coin is the main currency of Hashflow – a decentralized exchange (DEX) supported by a Request for Quotation (RFQ) pricing model, with many advantages such as allowing cross-chain interoperability, low transaction fees, high liquidity, and no slippage.

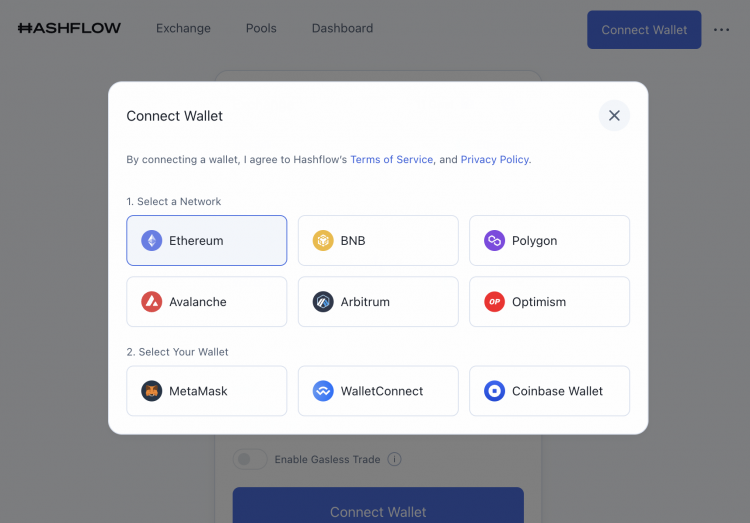

You can use Hashflow just like you use any other decentralized exchanges, such as Uniswap, Pancakeswap… Hashflow does not require you to create any account, and also does not charge any commission on transactions. All you need to do is connect your wallet (like Metamask) and then you can buy, sell, exchange different coins.

Currently, Hashflow supports public chains like Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, and Optimism.

What makes HashFlow – HFT coin special?

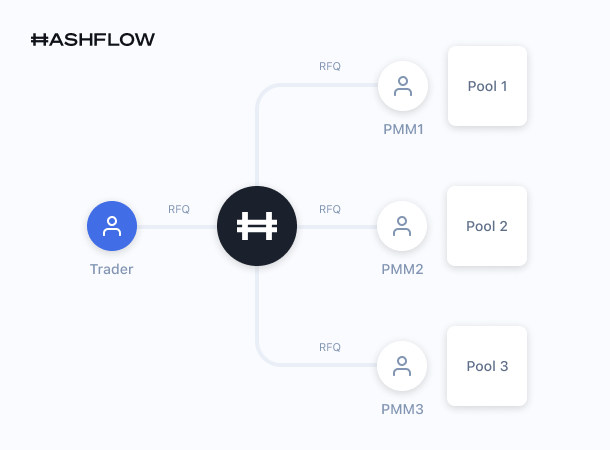

Unlike Automated Market Makers (AMM), Hashflow operates more like a traditional order placement method. Pricing is done off-chain and transactions are executed on-chain. To start trading, users first need to connect their wallet to Hashflow, enter the amount they want to trade, and then view the quote. After the user accepts, the order is sent, verified, and added to the Hashflow network. Market makers on the other end will handle issuing quotes. After the market maker signs it, the deal is completed without slippage.

Hashflow provides a completely native cross-chain swap function without using bridges or synthetic assets, allowing seamless transactions on one or more blockchains with guaranteed execution prices. Hashflow’s RFQ model allows Market Makers to price any type of asset and is no longer limited to stablecoins or blue-chip assets. This means Hashflow can seamlessly transact products (like options, ETFs…) that were previously unfeasible in DeFi.

But the benefits of HashFlow (HFT) can be mentioned:

-

MEV (Miner Extractable Value) Solution – Cryptographic Resistance for front-running activities in Hashflow, limiting security attacks.

-

No commission fees, additional transactions, and gas fees up to 50% lower compared to other popular AMMs.

-

For Market Makers: Market Makers can efficiently price assets. They can use Hashflow’s increasingly complex pricing algorithms that take into account off-chain data collection. This data includes historical asset values, volatility, and other real-world information.

-

For investors: Off-chain pricing provides tighter quotes, giving traders a better price. Also, there is no slippage, meaning all Hashflow quotes are executed at the displayed price. They also have MEV resistance. Cryptographic signatures make front-running impossible, ensuring traders can keep what they earn.

Since its launch in 8/2021, Hashflow has achieved the following figures:

- Over $10 billion in total trading volume

- Over 150,000 unique wallets trading on the platform

- Average daily trading volume is $25-30 million

- Average of 1,800 DAU (daily active users)

- Over $1 billion in total trading volume on Polygon and Avalanche within six months

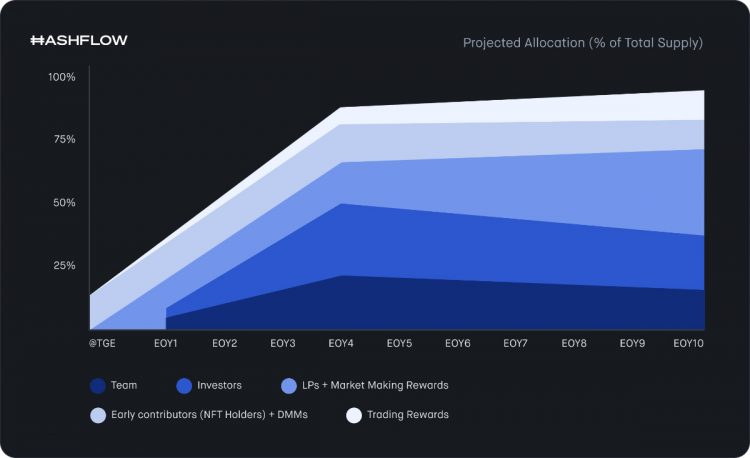

Tokenomics of Hashflow (HFT)

HFT is the governance token of the Hashflow platform. It follows the ERC-20 token standard on the Ethereum mainnet. They have a total supply of 1,000,000,000 (One billion Tokens).

- Token Name: Hashflow

- Ticker: HFT

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: Updating…

- Token Type: Utility, Governance

- Total Supply: 1,000,000,000

- Circulating Supply: 558,869,275

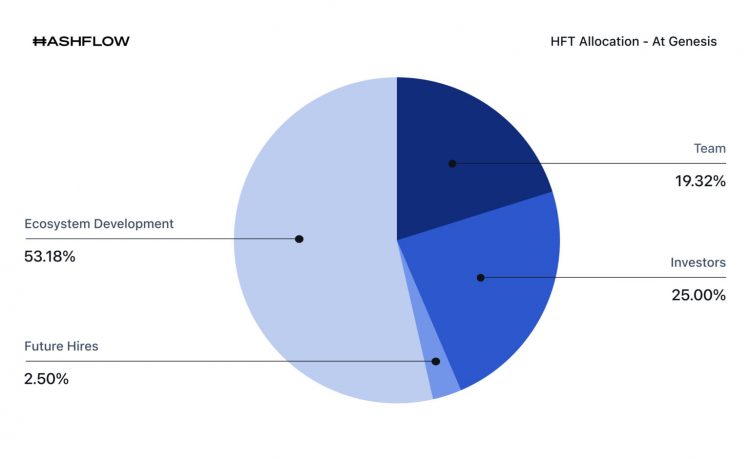

Ecosystem Development: 53.18% – Ecosystem development. Among them:

18.54%to Ecosystem Partners13.08%to Community Rewards (NFTs + Rake the Rewards + Exchange Distribution)9.54%for Future Community Rewards7.50%to Designated Market Maker Loans2.52%to Vendors and Early Service Providers1.00%to the Community Treasury1.00%for Hashverse Rewards

Future Hires: 2.5% – Future hires.

Early Investors: 25% – For early investors

Core Team: 19.32% – For the core team of the project.

HFT owners will be able to unlock features in the Hashflow ecosystem, such as:

- Governance: Governance of Hashflow will follow a vote-escrowed (ve) token model where voting rights are determined based on the number of HFT staked as well as the duration HFT is locked. Staking will grant users the right to vote and manage the future of the protocol. This includes decisions related to protocol fees, marketing, and code development.

- In-DAO Health & Rewards: Hashverse is the first narrative-driven DAO governance and control platform. Share codes will be used to determine user health indicators in Hashverse. Users must continuously adjust the amount and term of their staked tokens to maintain their health in Hashverse. The protocol will continue to reward the most active community members, and their presence in Hashverse will play a significant role in exchanging these rewards.

Team and investors of Hashflow (HFT)

Currently, Hashflow has not disclosed its project members, possibly to protect the personal information of the members.

Regarding investor information, Hashflow has raised up to 3.2 million USD from various large funds and investors. This fundraising round was led by Dragonfly Capital, Electric Capital, Galaxy Digital, Unanimous Capital, Balaji Srinivasan, Kain Warwick, Ryan Sean Adams, among other major investment funds…

Hashflow also enjoys high popularity in the market and its social media platforms are active. As of November 14, its Twitter has 197.8 thousand real-time followers, while its Discord has 121.2 thousand users and 9.5 thousand online figures. You can join Hashflow’s social channels below:

- Twitter: https://twitter.com/hashflow

- Linktree: https://linktr.ee/hashflow

- Website: https://www.hashflow.com/

- Discord: https://discord.com/invite/hashflow

- Telegram https://t.me/hashflownetwork

- Documentation: https://docs.hashflow.com/hashflow/

Does the HFT coin have investment potential?

What is HFT coin, and should you invest in it? Overall, Hashflow is a relatively new DeFi project aiming to change the current operating DEX market. It has several advantages, such as:

- Protecting user interests, reducing gas fees, and not charging commissions.

- Creating cross-chain bridges to facilitate trading assets across different blockchains easily, without needing a third party.

- Extremely low price slippage, and potential to find a trade at the best price thanks to MEV.

- Being a project backed by Binance Launchpool, and currently listed on Binance and other major exchanges, hence, it has high liquidity. Other exchanges that have listed HFT coin include: Huobi, Kraken, Bitrue, MEXC World, Coinbase, BitMart, and Gate.io

- After the FTX exchange collapse, users will tend to turn to DEXs more, and Hashflow as well as HFT coin will benefit from this.

However, there are also some risks when investing in HFT coin:

- Hashflow’s market makers can price assets off-chain, so they might send quotes that benefit themselves for their own trading. If you choose a Pool for Farming into a common fund run by unprofitable or insolvent market makers, these LPs may not be able to withdraw their assets.

- DEXs have developed rapidly over the past two years and have become an important component of DeFi. Therefore, there are numerous new projects in the market trying to improve the AMM mechanism. This indicates fierce competition in the area chosen by Hashflow.

So, should you buy HFT coin?

In my personal opinion, HFT is currently benefiting significantly as the 31st project of Binance Launchpool. Additionally, trust in centralized exchanges (CEXs) is gradually waning, so decentralized exchange (DEX) coins like HFT are likely to benefit. Therefore, you may consider investing a small amount of capital in HFT coin.

Looking at the longer-term perspective, HFT is still quite new, with its Total Value Locked (TVL) not being very high, and it is still lagging behind many other well-known DEXs in the market. The best approach is to observe over time, to see what HashFlow will achieve, whether it will stay on track or increase its user base. The race is long, so it’s important to stay updated on information about Hashflow (HFT).

Related post:

- What is THETA coin? Is THETA a good investment?

- What is BAND coin? Is Ban Protocol a good investment?

The above is information about Hashflows – What is HFT coin? It can be seen that this is a relatively new DEX coin with much potential for growth. However, investing in any coin requires a specific investment strategy, finding the right buying points, and avoiding FOMO when the price has risen too high. I wish you wisdom and success with HFT coin.