Arbitrum is one of the most prominent Layer-2 projects recently, particularly since the platform airdropped to users and was listed on major exchanges in March 2023. Following what Optimism (Arbitrum’s competitor) has achieved, it’s no surprise that many people have high expectations for Arbitrum (ARB). So what is Arbitrum? What is ARB coin? And does Arbitrum (ARB) merit long-term investment? Let’s explore these details in the content of the article below.

What is Arbitrum (ARB coin) – Is it worth investing 2024?

- Arbitrum is a Layer 2 scaling solution for Ethereum, utilizing Optimistic Rollup technology.

- Compared to its competitor, Optimism, Arbitrum offers better security, safety, and faster speeds. Currently,

- Arbitrum (ARB) ranks fourth in terms of Total Value Locked (TVL) across the market and leads in TVL within the Layer-2 sector.

- Arbitrum has a strong team, backing from major investors, and a robust community.

- Overall, Arbitrum represents a solid and promising project for potential long-term investment.

What is Arbitrum (ARB coin)?

To understand what is Arbitrum, What is ARB coin, you must first comprehend Layer-2 solutions. Ethereum is currently the largest smart contract platform, but it faces limitations in some areas; hence, Layer-2 solutions have emerged to overcome these weaknesses. And Arbitrum is one such project.

Arbitrum is an Ethereum Layer 2 scaling solution that uses Arbitrum Rollup technology—an advancement from Optimistic Rollup—to address transaction processing issues (cost, speed) on the Layer-1 chain.

The development team behind Arbitrum is Offchain Labs, and they have recently expanded their capabilities by acquiring the Ethereum POS development team. This action demonstrates the significant potential of this ecosystem. Currently, the primary products being built are Arbitrum One and Arbitrum Nova, which focus on different areas:

- Arbitrum One concentrates on DeFi and related tools.

- Arbitrum Nova is focused on the social and NFT sectors.

Arbitrum plans to provide three scaling solutions: Rollups (OPU), Channels, and Sidechains.

- State Channels: Require users to submit a snapshot of Ethereum’s state into a Multi-sign Contract. This state would contain critical data such as address balances. Such a system allows for off-chain transactions to be executed for free with instant finality and high privacy.

- Sidechains: These are independent blockchains with their own consensus rules where Ethereum transactions can be transferred under supervision to ease the burden on the main Ethereum network..

- Rollups: A type of Layer 2 scaling solution that enables rolling up transactions on a sidechain into a single consolidated block and recording it on the Ethereum blockchain. This allows transaction data on layer 2 to be available on layer 1 whenever necessary to verify the transition of states.

What is the unique point of Arbitrum – ARB coin?

Leveraging superior technology, Arbitrum reaps numerous benefits that make it a popular choice for developers. Some of these benefits include:

-

Fully Compatible with Ethereum’s Virtual Machine (EVM): The experience is similar to working with smart contracts on L1, with compatibility with ETH tools. Additionally, Arbitrum can execute EVM code directly, often without the need for recompiling smart contracts.

-

Lower Withdrawal Time: The time required to withdraw funds on Arbitrum is lower than other Rollup solutions (around 1 day on Arbitrum compared to 1-2 weeks on Optimism). The project is exploring solutions like Connext to further reduce withdrawal times.

-

Faster Transaction Processing: Currently, the Ethereum network operates at around 15 to 20 transactions per second (TPS), a relatively low number. The Arbitrum network presents a stack of viable technology to significantly enhance Ethereum’s performance. Analyses suggest that it could conveniently handle about 40,000 TPS.

-

Lower Transaction Fees. A significant number of validators need to confirm the validity of a transaction before it can be executed on Ethereum. This leads to a large backlog in the mempool, with only a small portion being processed per block. Therefore, some traders often add extra fees on top of their regular gas fees, increasing the cost of Ethereum transactions. Arbitrum offers a cheaper alternative. According to Nansen, a Web3 data analytics firm, the average daily fee on Arbitrum is $0.2, compared to $6.5 for Ethereum.

Among the Layer 2 scaling solutions for Ethereum, there are quite a few standout options, but at the current time, Polygon is the most prominent name, and Polygon has also leveraged this extremely well. Furthermore, among the Optimistic Roll-up scaling solutions, Arbitrum and Optimism are seen as the two leading solutions in terms of market share and user base.

To give you a more comprehensive view of what Arbitrum – ARB coin is and its notable features, below is a comparison table of the three most prominent Layer-2 projects:

It can be observed that Arbitrum is not the only Layer-2 blockchain using Optimistic Rollups to enhance scalability on the Ethereum network. It has a main competitor, which is Optimism. Both utilize Optimistic Rollups to accelerate transaction processes on Ethereum. However, there are some fundamental differences between the two, as follows.

- To address the issue of incorrect transactions, Arbitrum uses multi-round fraud proofs which are executed off-chain. On the other hand, Optimism employs single-round fraud proofs. Arbitrum’s multi-round fraud proof system is stronger, more cost-effective, and efficient than Optimism’s single-round fraud proof system.

- Although both Arbitrum and Optimism are compatible with the EVM (Ethereum Virtual Machine), when it comes to building dApps on their ecosystem, Arbitrum has the Arbitrum Virtual Machine (AVM), while Optimism uses the EVM. This is why Arbitrum supports programming languages compiled by the EVM, such as Solidity, Flint, LLLL, Vyper, Yul, and others, whereas Optimism only supports Solidity.

Information about the Arbitrum ecosystem

According to statistical data from ArbiProject, there are currently over 328 different projects on Arbitrum, the majority of which are DeFi projects. It is evident that Arbitrum is considered the most promising successor to Ethereum at the current time.

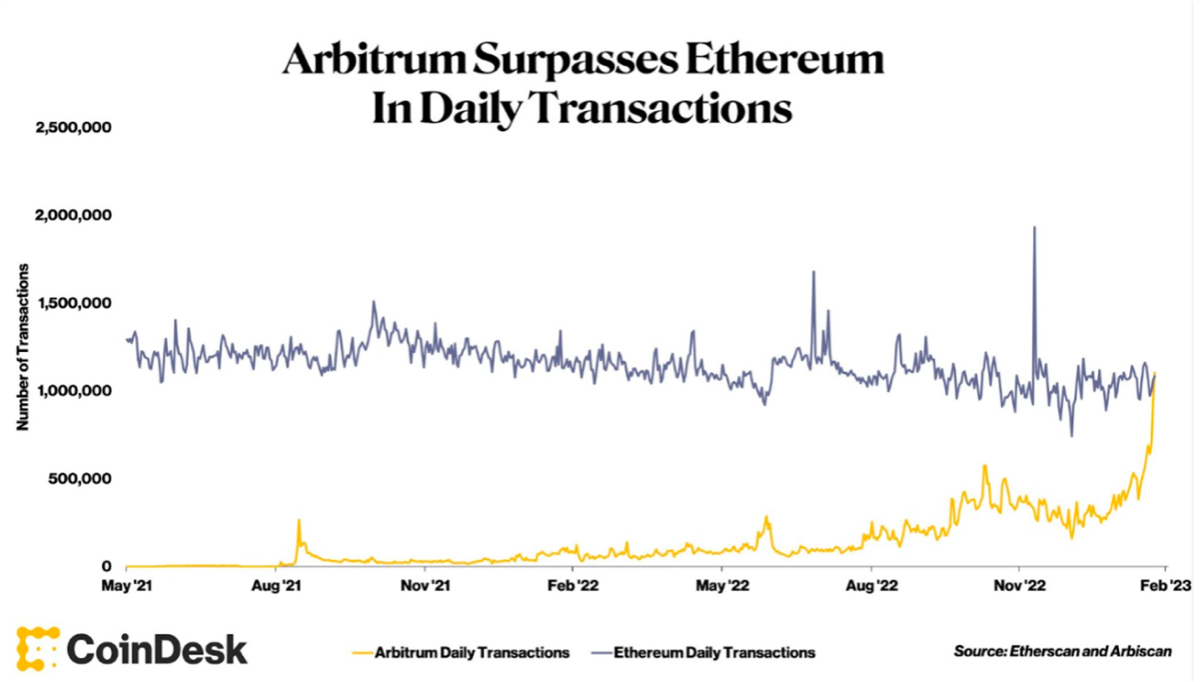

Users are increasingly moving towards using Layer 2 solutions, and recently Arbitrum has surpassed Ethereum itself in terms of the number of daily transactions for the first time. Arbitrum Bridges also consistently maintain the second position among Ethereum Bridges with the highest TVL (Total Value Locked). It is clear that Arbitrum is receiving significant interest from the community and is regarded as the current cradle of DeFi.

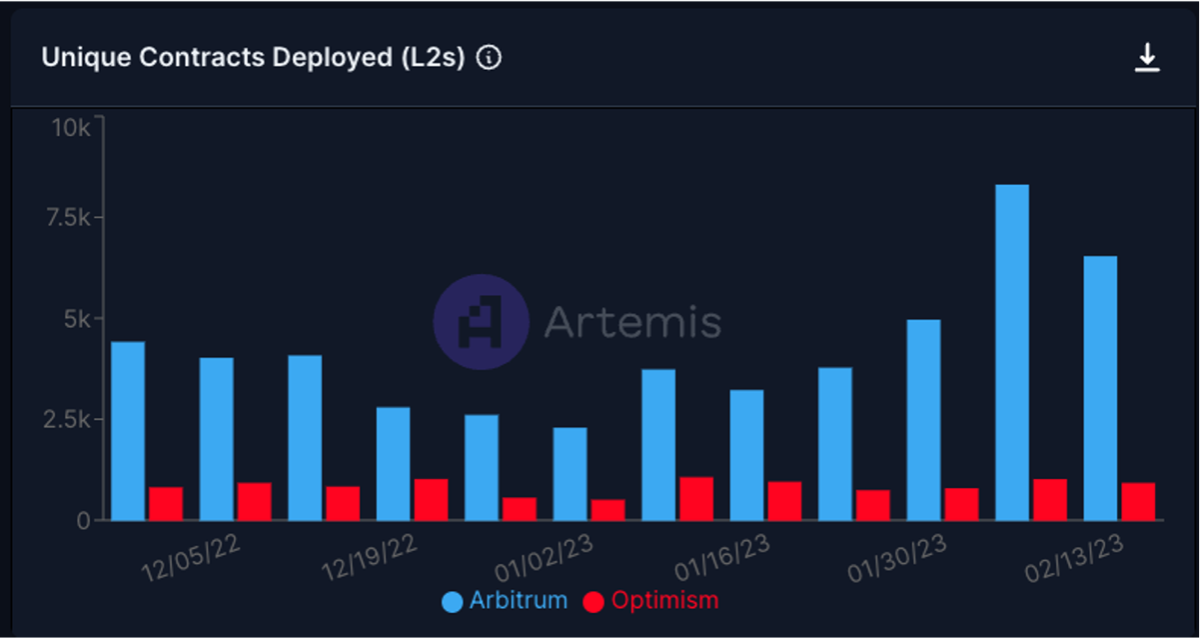

The indicators regarding the number of smart contracts deployed on Arbitrum also demonstrate that Arbitrum is an energetic developer community, with many dapps and new tokens being launched continuously.

Compared to its direct competitor, Optimism, the activity of Arbitrum developers as well as users is still quite dominant.

The growth of Arbitrum, particularly in the DeFi sector, is also reflected in the TVL (Total Value Locked) of its projects. Arbitrum is one of the few projects that have seen a resurgence in TVL growth since mid-2022 and is currently holding the fourth position in the entire market.

GMX is the leading project, accounting for 28.51% of the total TVL in the ecosystem, which is less than the projects in the higher-ranked chains such as PancakeSwap (50.52%), JustLend (67.71%), etc. The rest of the projects have a fairly even distribution of TVL, indicating that there is competitive and relatively heated development among them.

Taking a look at some prominent projects deployed on Arbitrum (ARB coin):

– Wallet: The Arbitrum ecosystem hosts a variety of projects. In addition to common wallets like MetaMask and Trust Wallet, this Layer 2 network also supports additional wallets such as Rainbow, Coinbase Wallet, Coin98, and others.

– Decentralized Exchanges (DEXs): The majority of decentralized exchanges on Arbitrum are large Multichain DEXs in the market such as UniSwap, SushiSwap, Curve, KyberSwap, and others…

– Derivatives Exchanges:: Arbitrum is a haven for decentralized derivatives trading projects where speed and accuracy are paramount. Evidence of this is the prevalence of exchanges like GMX, CAP, MCDEX, and MYCELIUM within the cryptocurrency community recently.

– RealYield: Not only focusing on derivative projects, RealYield also emerges in projects designed to optimize liquidity for the entire ecosystem. Typical examples include PlutusDAO, UMAMI, Yearn Finance, and others.

– NFT Market: Currently, NFT marketplaces that support the Arbitrum network include OpenSea, Tofunft, Babylons, Trove, and others.

=> In summary, the ecosystem on Arbitrum is quite comprehensive in all aspects, with all pieces of the DeFi sector featuring notable projects. TVL on Arbitrum is distributed among various projects from DEXs, Lending, Perpetual DEXs, to Yield Farming. Among these, Perpetual DEXs are undoubtedly the most developed and user-attracting sector for Arbitrum.

Tokenomics Arbitrum (ARB)

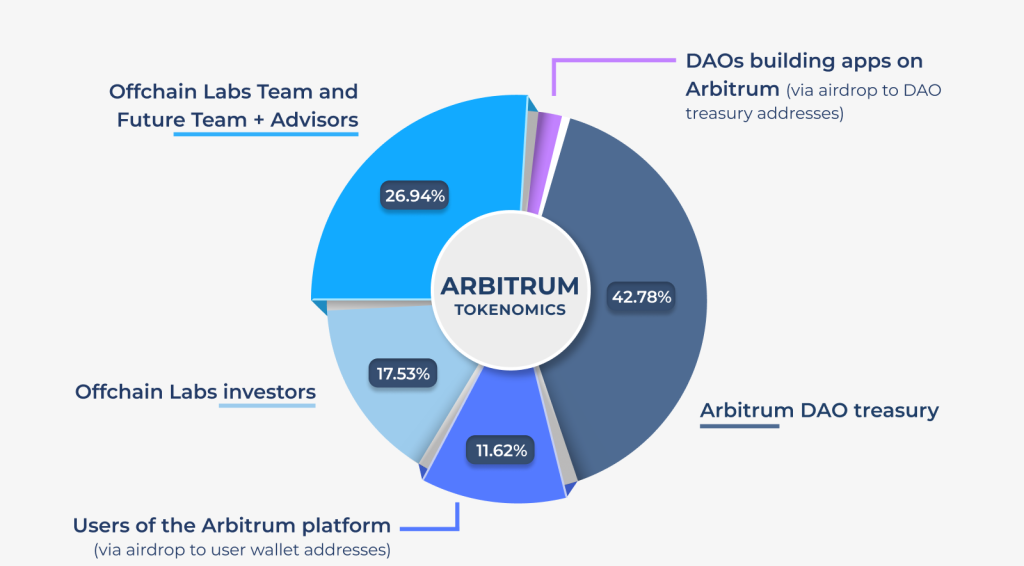

Arbitrum’s token is named ARB. The maximum total supply of ARB will be limited to 10 billion ARB. Arbitrum uses ETH as the fee payment unit, and its native token will be used for governance and community grant support (similar to Optimism). The ARB token will be allocated as follows:

- 42.78% – 4.278 billion: Arbitrum DAO treasury

- 26.94% – 2.694 billion: Offchain Labs development team + Advisors

- 17.53% – 1.753 billion: Investors of Offchain Labs

- 11.62% – 1.162 billion: Users of Arbitrum (airdropped to users via personal wallets)

- 1.13% – 113 million: DAOs built on Arbitrum (airdropped into DAO treasury wallets)

In a broad view, the token allocation of Arbitrum will not be heavily inclined towards the community of users and project builders like Optimism. Additionally, Arbitrum’s supply is not capped and will continue to expand over time (with a commitment to not exceed 2% per year).

Team, Investors, and Community of Arbitrum (ARB coin)

– Team:

The group behind ARB coin carries an impressive pedigree. Based in New York, the team members have experience ranging from the former Deputy CTO of the USA at the White House and Senior Advisor to the President (Ed Felten) to the co-author of a leading textbook on cryptocurrency – ‘Bitcoin and Cryptocurrency Technologies’ (Steve Goldfeder). In addition, many other employees are also cryptocurrency enthusiasts with the requisite experience

- Steven Goldfeder is the Co-founder and CEO of Offchain Labs, the group behind Arbitrum. He received his PhD from Princeton University, where he focused on cryptography and cryptocurrency. He is a co-author of the major textbook on cryptocurrencies, ‘Bitcoin and Cryptocurrency Technologies’.

- Ed Felten is the Co-founder and Chief Scientist of Arbitrum. He is known as a Professor of Computer Science and Public Affairs at Princeton University and is the founding Director of the Princeton Center for Information Technology Policy.

- Harry Kalodner is the Co-founder and CTO of Arbitrum. He is a PhD candidate at Princeton University, where he works with Professor Arvind Narayanan. His research focuses on cryptocurrency economics, privacy, and incentive compatibility. He has created BlockSci, a tool for cryptocurrency research and a simulator for Bitcoin mining techniques.

– Investors:

Arbitrum (ARB coin) has also proven to be a formidable project, attracting a significant number of major investors. The primary development contractor for Arbitrum, Offchain Labs, has received a total of $123.7 million over three funding rounds from 2019 to 2021.

- Seed round 2019: Pantera Capital, along with other investors, led a fundraising round that amounted to $3.7 million during this phase. Additional participants included Compound VC, Raphael Ouzan of Blocknation, Jake Seid, and anonymous contributors.

- Seed round 2021: the seed round included Series A in April 2021 and Series B in August 2021: Offchain Labs announced a fundraising round of $120 million led by Lightspeed Venture Partners. Other investors in Offchain Labs included billionaire and “Shark Tank” host Mark Cuban, as well as Polychain Capital, Redpoint Ventures, Pantera Capital, Alameda Research, and Ribbit Capital.

– Community: Arbitrum (ARB) stands out as one of the rare projects that has managed to build a large community even before the launch of its token. Currently, their Twitter channel has 884 thousand followers, and the engagement is consistently high—a feat that many long-established projects have yet to achieve.

To stay updated on Arbitrum, you can:

- Check project info at: https://barracuda.io/arbitrum

- Monitor the ecosystem’s growth (TVL) and the current DeFi components on Arbitrum at: https://defillama.com/chain/Arbitrum

- Follow Arbitrum’s official Twitter account at: https://twitter.com/arbitrum

- Follow the core developers: https://twitter.com/OffchainLabs

Arbitrum (ARB Coin) – Is It Worth Investing In?

I have reviewed many cryptocurrency projects, but for Arbitrum, I can assert that this is an extremely good project with significant long-term development potential. It possesses too many advantages:

- Firstly: Total Value Locked (TVL) currently stands at the top among Layer 2 solutions. Although it launched quite late, only since 09/2021, its data has exceeded expectations and surpassed even well-known competitors, such as Polygon.

- Secondly: Arbitrum currently has a superior technological advantage over other projects using the optimistic rollup scaling solution. Arbitrum can currently scale up to 40,000 TPS, which is about 15 to 30 times faster than Ethereum, with fees ranging from $0.3 to $0.5. In comparison, the current rival Optimism only has 2,000 TPS with fees of $0.6 to $0.9 and the main Ethereum chain with fees of $5-$10.

- Thirdly: DeFi 2.0 (real yield) trend is booming, and protocols on Arbitrum like $GMX, $DPX, $GNS, $BTRFLY are leading the way, indicating the potential for capital inflows into the ecosystem as the trend gains traction.

- Fourthly: Arbitrum has a powerful array of backers and supporters, alongside a comprehensively developing ecosystem with a record high number of active users recently. This shows that Arbitrum has the capability to grow even stronger and may even maintain its leading position in Layer-2.

Nevertheless, there are a few minor challenges for Arbitrum. TVL is a reasonable way to measure a blockchain’s DeFi footprint. But to assess whether they are genuinely STRONG, a deeper dive is needed. Although Arbitrum has nearly 150 protocols on its network, a large portion of its DeFi TVL is formed from GMX (GMX). While other chains also have such disparities, the issue is that – GMX (GMX) is one of the most hyped cryptocurrency projects lately, and its main catalyst also comes from being a representative of Arbitrum. Many investors have decided to buy GMX betting on the development of Arbitrum (at that time, Arbitrum had no token). Therefore, GMX poses a systemic risk to Arbitrum. However, the level of risk from GMX should be kept at speculative levels, as GMX is still a DEX with many advantages and attracts a large user base). Moreover, many good projects are being developed on Arbitrum and are growing day by day. We can expect even more in the future for Arbitrum, when GMX is no longer the “sole ruler” of Arbitrum.

Additionally, there is a recent trend toward zkEVM, and many zkEVM projects are gearing up for launch, so this may affect the market share of Optimistic Roll Up projects like Optimism and Arbitrum to some extent. But with two upgrades, BedRock, and Nitro, it’s evident that both platforms could potentially transition to zk-Rollups if necessary. This could be seen as a hedging measure, ensuring they maintain the first-mover advantage by attracting a large amount of capital and projects while still ensuring the ability to transition flexibly in the future.

All things considered, Arbitrum (ARB coin) is a VERY GOOD project for long-term investment. But remember to invest with a plan, to invest for the long term, follow the general market trend, and avoid FOMO when prices are too high.

So, have you understood what is ARB coin? What do you think about Arbitrum (ARB)? Please share your views with us. Thank you for reading, and I wish you successful investing.

Invest286.com