Chainlink (LINK) is one of the cryptocurrencies that has been highly regarded by users recently, as it possesses a variety of very useful technologies with extremely high application potential. But what is Chainlink, and what is LINK coin? What is special about its technology? Should you invest in Chainlink (LINK)? If you are also planning to invest in this LINK coin, let’s review the detailed information below.

Contents

- 1 What is LINK coin, should you invest in it?

- 1.1 What is Chainlink (LINK)?

- 1.2 What does Chainlink (LINK coin) do?

- 1.3 How Chainlink (LINK) Operates

- 1.4 Main Products of Chainlink (LINK coin)

- 1.5 Chainlink (LINK coin) Team and Partners

- 1.6 LINK tokenomics

- 1.7 Chainlink Economics 2.0

- 1.8 Advantages of Chainlink & LINK Coin

- 1.9 Challenges Chainlink is Facing

- 1.10 Should you invest in LINK Coin?

What is LINK coin, should you invest in it?

What is Chainlink (LINK)?

LINK coin, also known as ChainLink, is a decentralized Oracle network whose task is to act as an intermediary to help smart contracts easily access external data sources securely.

To put it simply, Chainlink’s job is to be a bridge that transmits information and data from the real world outside into the Blockchain platform and vice versa..

It is known that Chainlink was established by the company Smart Contract ChainLink Ltd in 2017 (currently headquartered in the Cayman Islands). Chainlink is an Oracle product providing off-chain data for on-chain smart contracts. To date, Oracle is also their largest and most widely known product.

However, throughout its development process, Chainlink has expanded its scope of activities to become an infrastructure with many products to serve the DeFi and Web3 markets.

What does Chainlink (LINK coin) do?

If you are a long-time participant in the cryptocurrency market, you will certainly know something about Smart Contracts.

Previously, Smart Contracts could not interact with any data outside of Blockchain, which made the development process of smart contracts difficult. However, with the advent of Chainlink, this has been overcome by creating Smart Contracts capable of easily transferring real-world information into Blockchain.

How Chainlink (LINK) Operates

How does Chainlink function? Any external information or data, when ingested into the Blockchain through Chainlink, can trigger the operation of a smart contract. At that point, the Smart Contract will initiate to create output data including: payments, ownership certificates, etc. Currently, Chainlink only supports the creation of Smart Contracts on the Ethereum platform. However, in the future, Chainlink aims to extend its support to all platforms that have Smart Contracts.

To make it easier for you to understand the nature of Chainlink’s operations, consider the following example:

Let’s say there is Company A and Company B, where Company A is the supplier and Company B is the receiver and payer. If A supplies goods to B, both parties will agree to create a Smart Contract.

=> When B receives the goods, they will have to sign a digital signature integrated with an API to notify Company A of the successful receipt. This information goes through the Smart Contract to create a banking payment output for Company B to pay Company A.

Main Products of Chainlink (LINK coin)

In 2017, Chainlink (LINK coin) was launched as an Oracle product providing off-chain data for on-chain smart contracts. To this day, Oracle remains their largest and most widely known product.

However, throughout its development process, Chainlink has expanded its scope to become an infrastructure with multiple products to serve the DeFi and Web3 markets.

Currently, Chainlink has 6 main products:

- Market & Data Feeds: Provides a secure data source for smart contracts in DeFi. The data is aggregated from major sources like Binance, CoinMarketCap, CoinGecko, etc., and delivered to projects such as Aave, Compound, and more.

- Functions: A serverless Web3 development platform that allows you to retrieve any data from any API and run custom computations on Chainlink’s network.

- Automations: Enables Web3 developers to automate smart contract functions. Automations are currently used by projects such as StakeDAO, Pancakeswap, etc.

- VRF: Allows developers to generate random numbers that can be verified on the blockchain, ensuring that outcomes are not interfered with or biased in any way. They are widely used by applications requiring randomness, such as games, lotteries, and betting platforms.

- Proof of Reserve: Enables transparent and timely asset reserve monitoring. It allows users to verify that a particular asset, like a stablecoin, is fully backed by reserves of the underlying asset, such as USD.

- Cross-chain Communication: Provides an open standard for developers to build decentralized services and applications that can send messages, transfer tokens, and initiate actions across multiple networks. This enhances the interoperability and scalability of blockchain applications.

Chainlink (LINK coin) Team and Partners

Chainlink is developed by a strong team, including:

- Sergey Nazarov – CEO of Chainlink: Sergey Nazarov’s early career was at FirstMark Capital. After some time, he justify to join the cryptocurrency revolution in 2011.

- Steve Ellis – CTO: CEO of Chainlink: Sergey Nazarov’s early career was at FirstMark Capital. After some time, he justify to join the cryptocurrency revolution in 2011.

- Dimitri Roche – Software Engineer: Worked at Pivotal Labs and McKinsey. Dimitri Roche has led large engineering teams at Infogroup.

- Mark Oblad – CFO: Mark Oblad’s previous job was at Gunderson Dettmer. He is also known as a talented leader in contract automation. Therefore, he has recognized the development of smart contracts when connected to external Blockchain data.

- Evan Cheng – Technical Advisor: He has worked in many of the world’s leading companies such as being the founder of LLVM running on Apple, and has worked at Google, Nvidia, Intel,… and is currently the Director of Engineering at Facebook.

- Brian Lio – Advisor: The CEO of Smith + Crown. He has a passion for researching Blockchain.

- Hudson Jameson – Technical Advisor: An Ethereum community manager and developer of smart contracts, as well as Ethereum development plans.

Partners: In the crypto market, Chainlink may be the project with the largest number of partners because their domain relates to traditional markets, CeFi, and DeFi markets. Therefore, we can categorize Chainlink’s partners into the following sectors:

- Blockchain: Ethereum, BNB Chain, Solana, Polygon, Avalanche, Arbitrum, Optimism, Fantom, Klaytn, Metis, Moonbeam, Moonriver, HECO, Harmony, Gnosis, etc.

- DeFi: Uniswap, Aave, Compound, Beefy Finance, Coin98, Metamask, Pancakeswap, etc.

- Traditional companies: SWIFT, Google, Oracle, Intel, Microsoft, etc.

The number of Chainlink’s partners has reached into the thousands, creating a vast ecosystem. You can look up which projects are using Chainlink’s technology on their website: https://www.chainlinkecosystem.com/

LINK tokenomics

LINK token Key Metrics

- Ticker: LINK

- Contract: 0x514910771af9ca656af840dff83e8264ecf986ca

- Decimals: 18

- Blockchain: Ethereum

- Token Standard: ERC-677

- Token type: Utility Token

- Total Supply: 1,000,000,000 LINK

- Circulating Supply: 626,849,971 LINK

LINK Token Allocation

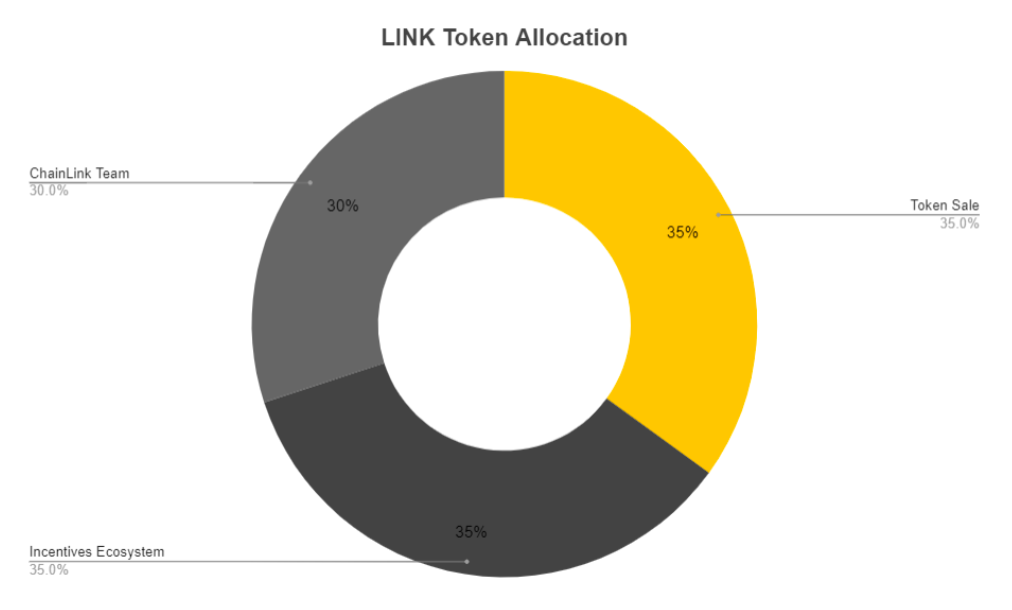

Chainlink Supply Distribution:

- 35% of the total supply of Chainlink will be allocated for sale during the token sale events.

- 35% is designated for Node Operator Incentives.

- 30% is held by the Chainlink team.

LINK Token Use Cases

LINK is the native cryptocurrency of the Chainlink network and has several applications such as:

- Payments: LINK is used as a means of payment for services on the Chainlink network. Data providers also receive LINK as a reward.

- Staking: To provide data to the network, data providers need to stake a certain amount of LINK to ensure they continuously provide accurate data. If they act maliciously, they will be penalized by having a portion of their staked LINK deducted.

- Governance: LINK holders can participate in the governance of the Chainlink network. They can vote on proposals to change network parameters or add new features.

- Collateral & Liquidity Provision: LINK can be used as collateral and to provide liquidity in decentralized finance (DeFi) applications such as Aave and various DEX platforms.

Overall, the LINK token plays a vital role in the Chainlink ecosystem, enabling the network to provide decentralized and reliable oracle services for smart contracts and other blockchain applications.

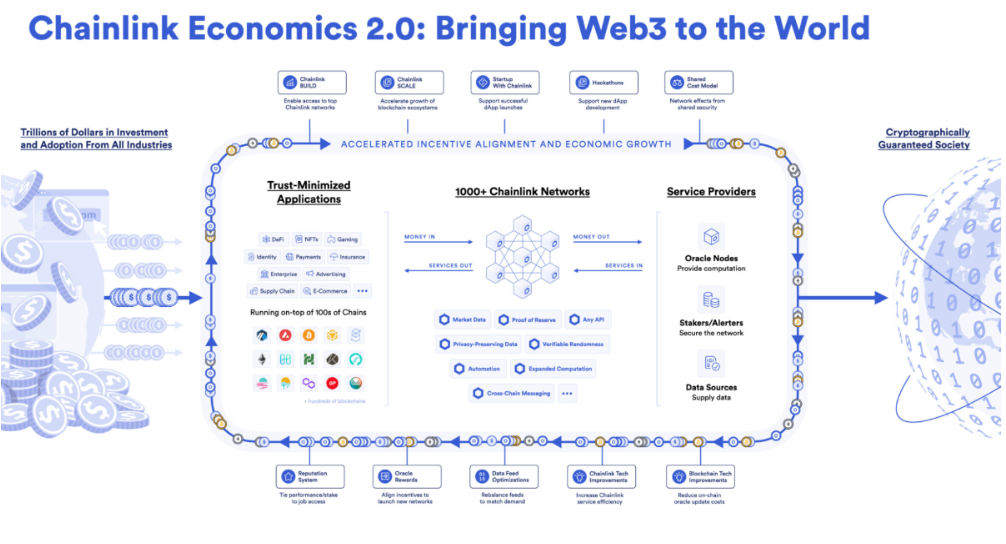

Chainlink Economics 2.0

Since its inception, Chainlink has performed its tasks well in ensuring data value for many significant DeFi projects like Aave, Compound, and blockchains like BNB Chain, Solana, Polygon, etc.

However, Chainlink still has some limitations:

-

Chainlink is seen as a centralized Oracle, which goes against the decentralized vision of DeFi.

-

LINK – the token representing Chainlink does not have much practical utility for holders.

-

The data of Chainlink is still limited as it only includes cryptocurrency-related data.

-

Oracle fees for Chainlink’s data are higher compared to others.

-

The economic model of Chainlink has yet to operate and develop naturally.

-

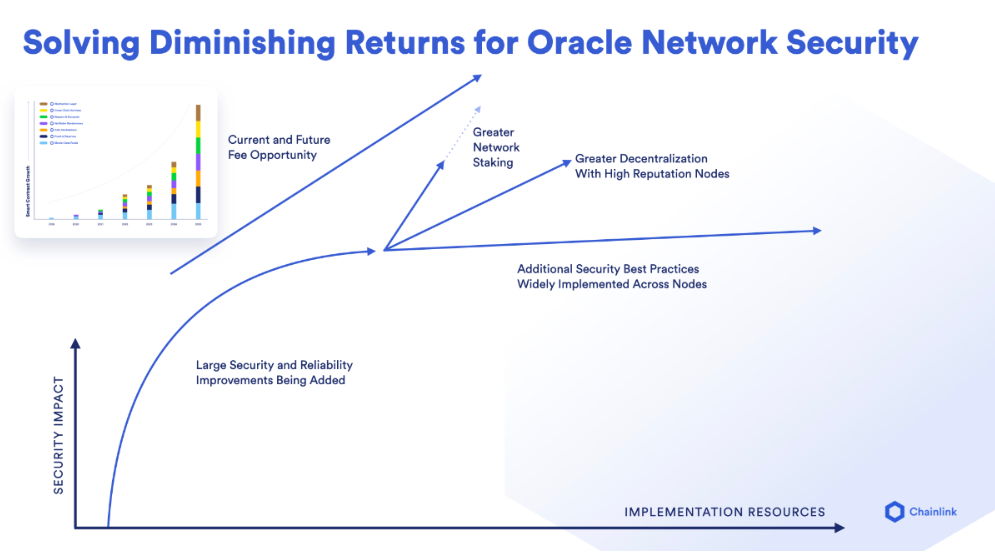

The security of the Oracle network needs further enhancement.

Therefore, Chainlink Economics 2.0 has emerged as a method to solve all the above issues. Running parallel to this strategy will be the Chainlink Staking plan, a significant milestone for Chainlink (LINK coin). Chainlink Economics 2.0 includes three strategies – BUILD, SCALE, and Staking – aiming to bring benefits to LINK holders, Dapps, the ecosystem, and users.

Chainlink Staking

Chainlink Staking is one of the latest initiatives from Chainlink that allows LINK holders to stake their LINK with an APR of about 4.75%. However, rewarding holders is not the only purpose; staking LINK is not for everyone as it is currently limited to 22.5 million LINK.

With this LINK staking strategy, Chainlink can address the following issues:

- Decentralization of the data network as now LINK stakers can provide data, not just Chainlink itself.

- Increase the utility and value for LINK holders (although for average holders, this APR is quite low).

- Enhance the diversity of data because LINK stakers can supply a wide range of data from the real world.

- Improve the security of the network as there are more data providers (this mechanism is similar to blockchain validators, the more participants there are, the more decentralized and secure it is).

- Create a foundation for a self-operating economic model (further explained in the Chainlink BUILD and Chainlink SCALE sections).

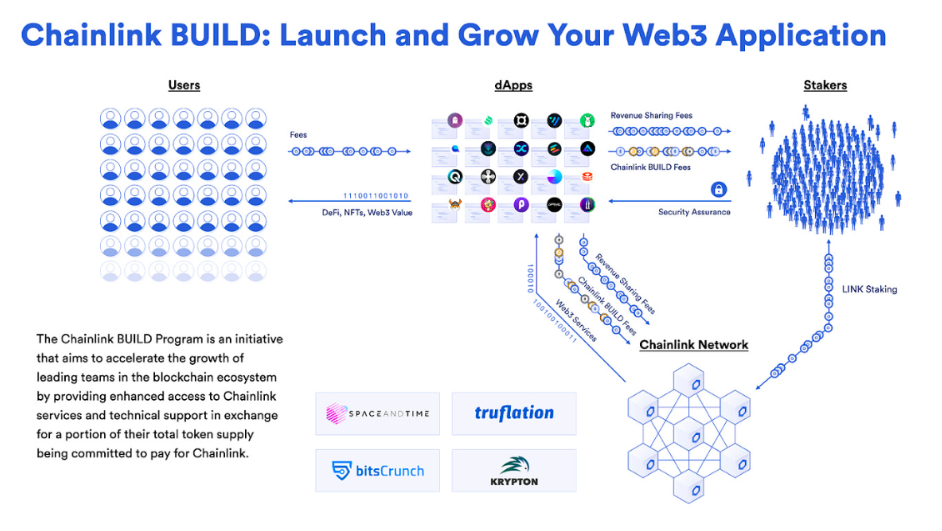

Chainlink BUILD

Chainlink is currently seen as the best Oracle solution in the DeFi market. However, the Oracle fees Chainlink charges are higher than others. This makes it difficult for newly launched DeFi projects without strong financial backing to use Chainlink’s quality data.

Without Chainlink’s data, their market position declines as large capital users only trust projects that use Chainlink data to avoid common Oracle attacks.

To solve this problem, Chainlink has launched the Chainlink BUILD program with the following operating model.

- To diversify the data sources, Chainlink will source this data from LINK stakers. This makes LINK more utilitarian and gives Chainlink access to more exclusive data.

- In exchange, to use Chainlink’s data, projects will need to allocate a portion of their token supply to give back to Chainlink, which will then be distributed to the Stakers.

Therefore, Chainlink BUILD (formerly known as Chainlink Partner Growth Program) will help projects increase security with more reliable and safe data. Projects can also access data sources faster when joining and receiving support from Chainlink.

Currently, the program has three partners:

- Space and Time: A high-speed Web3 data warehouse operating Multichain. Recently, Space and Time raised $20M from M12 Microsoft, Framework, etc.

- Truflation: A center providing inflation data for Chainlink.

- bitsCrunch: Analyzes data to filter out wash (market manipulation) transactions and counterfeit NFT artworks in the NFT market, thereby providing more accurate NFT pricing and creating a transparent market.

Chainlink SCALE

Currently, Chainlink’s Oracle fees are still relatively higher than other Oracle providers for several reasons. For example, Chainlink spends more effort on data verification, and they invest more to buy and diversify data.

However, according to Chainlink’s vision, Oracle fees must be low, lower than other Oracles, and so inexpensive that users pay without really noticing (or minding) them.

Chainlink SCALE operates as follows:

- For Chainlink: Chainlink will continue to use the diverse data sources from LINK stakers to ensure their data network is the highest quality for the blockchain ecosystem. However, unlike the Chainlink BUILD program, they will partner more with blockchain foundations instead of charging fees from projects.

- For blockchain foundations: Chainlink asks the blockchain foundation to provide a dedicated lane on the blockchain so that Chainlink’s data can be easily transferred. This is similar to a shipping fee when we order food. If many people place orders together as one, the shipping cost for each item becomes cheaper. Additionally, Chainlink is partnering with some blockchains like Avalanche, Metis, Moonbeam, Moonriver to have these blockchains sponsor the fees.

- For Dapps in the ecosystem: In return, the projects within the ecosystem will grow strongly if the high-quality Oracle, which was expensive, is now subsidized with much cheaper fees. This benefits both the Dapps and the ecosystem as a whole.

Thus, Chainlink BUILD, Chainlink SCALE, and Chainlink Staking are the three core strategies to help Chainlink achieve the Economics 2.0 model. According to Chainlink’s vision, their Oracle fee must be so affordable that all projects can use it, thereby creating a sustainable fee structure to maintain Chainlink’s economic model.

Advantages of Chainlink & LINK Coin

Recently, LINK Coin has received considerable attention from many investors due to its stable growth and potential for long-term development. Below are the highlights of LINK Coin:

- Chainlink becomes SWIFT’s partner: SWIFT is the world’s leading multi-bank payment system. In 2019, Chainlink announced a collaboration with Chainlink on a new working project, which has attracted widespread interest from investors towards LINK Coin.

- Large community: LINK Coin has garnered widespread interest from the Trader and Holder community. At each growth point, it always creates a breakthrough different from other coins.

- Integrated Staking: It can be said that the Staking project is a factor that contributes to the development of the Chainlink Token, both in terms of value and community in the market. In other words, when Staking was launched, the value of LINK Coin was inflated, and the number of participants in the LINK community also significantly increased

- Trading volume and market capitalization are always improving: At the time you read this article, LINK has a market capitalization of $ 10.59 B, a 24h trading volume of $ 2.02 B, and ranks 19 in the market by capitalization. With such value and trading volume, coupled with the rank that is increasing every day, it can be seen that LINK is being favored by investors and gradually being considered a key coin. Usually, investors prefer to go for top coins with large capitalization, for the sense of security and low risk. Therefore, the positive increase in trading volume, market capitalization, and ranking will further affirm LINK’s position.

- Chainlink has the advantage of being a pioneer: In a decentralized space, Chainlink still has to compete with many other cryptocurrencies. However, the advantage of being a pioneer has allowed Chainlink to integrate and collaborate with a variety of other projects, from infrastructure, gaming projects, data mining, data providers, blockchains, and even large decentralized finance (DeFi) projects. => This indicates that Chainlink is being used more and more widely. With continuously increasing partnerships, its popularity will increase, potentially raising the price of LINK. If done well, LINK could enter the top 5 leading cryptocurrencies in the world.

- Chainlink is constantly being developed and upgraded: Some cryptocurrency projects fail due to a lack of innovation by the developers. Chainlink, on the other hand, is a pioneering service provider compared to its competitors. Having many developers create new smart contracts using Chainlink’s services will help increase the price of LINK. And this originates from the fact that Chainlink is very active in powering its network. Over time, Chainlink has continuously upgraded, and the introduction of tokenomics 2.0 has made Chainlink (LINK coin) increasingly superior.

Challenges Chainlink is Facing

Despite the positives related to Chainlink, LINK is not a perfect cryptocurrency. Like all other coins, it is extremely volatile and sensitive to global economic news.

Additionally, when considering Chainlink itself, there are some disadvantages and challenges to keep in mind before deciding whether to invest in LINK coin or not:

- Competition with other decentralized Oracle networks

Being a pioneer doesn’t mean Chainlink has exclusivity; it is directly competing with Band, Decentralized Oracle Service, Decentralized Information Asset, Tellor, and NEST, all of which have formidable technology not to be underestimated.

However, from another perspective, if we only consider the cryptocurrency space, there are hardly any projects that develop a comprehensive infrastructure ecosystem like Chainlink. Other projects tend to focus on developing just one product – the Oracle. Some notable Oracle projects in the market are Band Protocol, Pyth Network, API3, WINkLink, Berry Data.

=> But this also means that LINK will have to form many more partnerships and innovate more frequently. Because if it doesn’t create any real miracles, its competitors will soon become “Chainlink Killers,” surpassing LINK to be among the top cryptocurrencies in the world.

- Dependence on Bitcoin and the crypto market

The reality is that all cryptocurrencies follow the path of Bitcoin through seasons of rise and fall. Any global economic news that negatively affects Bitcoin could automatically lead to the collapse of the cryptocurrency space. The reason for this is probably because many people have come to equate cryptocurrency with bitcoin.

Therefore, apart from the risks from itself, LINK also faces risks from the general coin market. Although LINK might be rising well and many people tend to FOMO at this time, however, invest only what is appropriate, fitting your risk tolerance.

Should you invest in LINK Coin?

If you’re unsure whether investing in LINK Coin is a good idea, I’d like to offer some personal insights:

It’s evident that Chainlink is on its path to becoming one of the leading cryptocurrencies. There are many valid reasons why LINK could be a stable investment..

LINK’s foundational technology holds the potential to offer enduring stability and viability across the cryptocurrency finance sector. Chainlink, positioned to become a leader in the realm of decentralized oracles in the foreseeable future, is set to benefit from its pioneering status. This advantage positions LINK favorably against competitors, akin to the first-mover edge Ethereum and Bitcoin have maintained in smart contracts and blockchain technology, respectively.

In the future, Chainlink is sure to gain wider acceptance across most cryptocurrency platforms, increasing its popularity and value.

Currently, LINK coin still holds much potential for price increase and many professional forecasters believe that the price of LINK will continue to rise further. Therefore, if you are looking for a cryptocurrency with the potential for stable and secure appreciation to diversify your investment portfolio, LINK could be a smart choice.

In summary:

The article above has provided you with information about what CHAINLINK is, what LINK Coin is, as well as details on the highlights and potential of this platform. Hopefully, this valuable knowledge will help you make a more informed decision about LINK coin and plan your investments more effectively. I wish you success!

Read More: