Blur is a notable project that was listed on several major exchanges such as Huobi, Bybit, OKC, Kucoin, Gate.io, Bitget in early 2023, and most recently Binance also decided to list BLUR coin on November 25, 2023, drawing significant attention to this coin. It is known that this is a project in the NFT-FI or NFT Marketplace sector. But what is Blur coin? What makes it special compared to other NFT Markets? Does the BLUR coin have the potential for long-term investment? Let’s explore in detail in the content of the article below with invest286.com.

Contents

What is BLUR coin, should you invest?

What is Blur coin?

Blur coin is the main currency of the Blur.io platform – a platform that combines NFT Aggregator (a solution that aggregates prices from various NFT platforms) and NFT Marketplace (an integrated NFT trading platform) aiming to optimize the NFT trading experience, as well as providing necessary tools for professional NFT traders within the Ethereum ecosystem.

If you don’t understand what NFT is, read: What is NFT? Understand it thoroughly and completely

To elaborate further, the Blur.io exchange is:

- An NFT Marketplace for both traders and collectors.

- Instead of listing items directly on the platform, Blur aggregates data from various NFT exchanges so users can trade NFTs in one place. This provides convenience for users to choose suitable items.

- Provides tools to support pro NFT traders who need a tool to maximize trading experience and portfolio management.

What are the key features of BLUR coin?

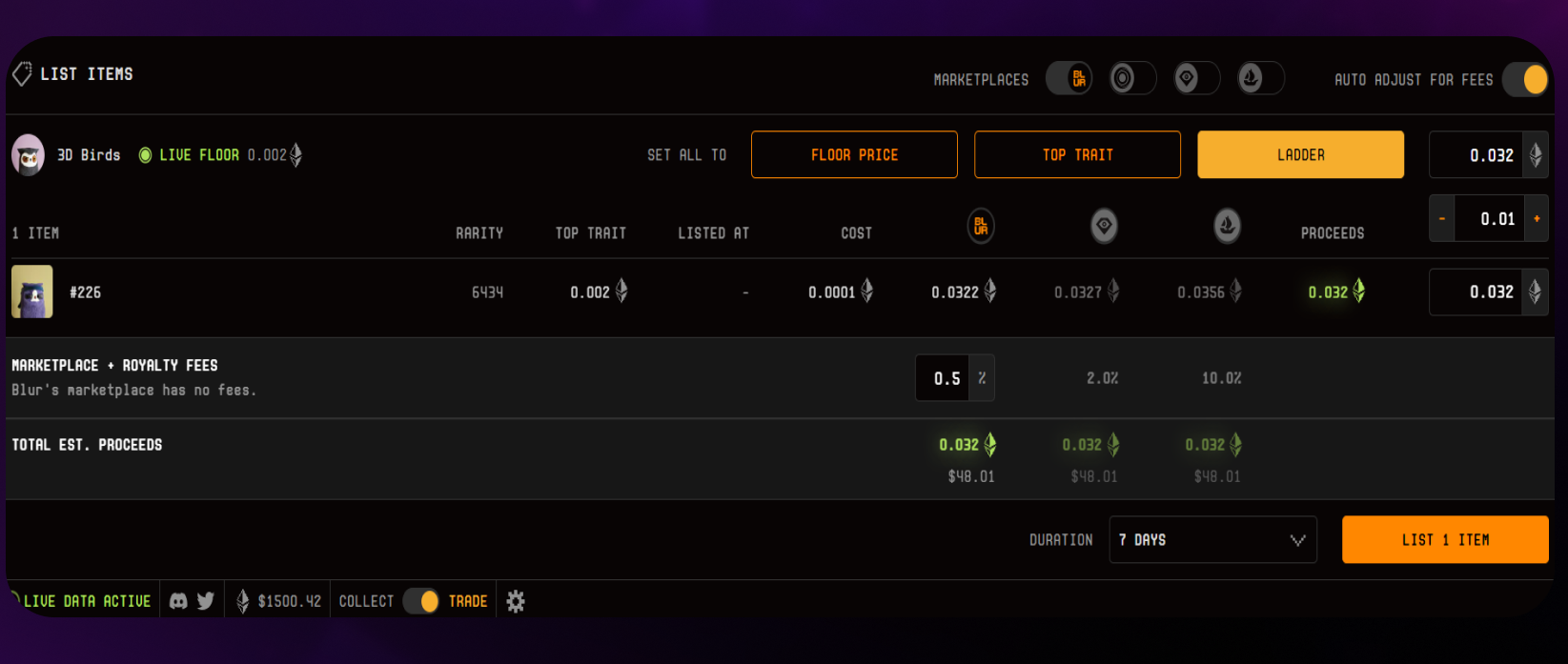

It can be seen that Blur.io is quite different from most current NFT exchanges like OpenSea, Gem, X2Y2,… focusing more on retail and collecting. It integrates not only basic data parameters like recent sale price, time but also clearly displays the rarity of each NFT, ongoing transactions, liquidity depth, current gas fees, etc. Some strengths of Blur.io include:

- Low cost: Blur does not charge any fees like OpenSea 2.5%, X2Y2 0.5%,… Thus, combined with 0% royalty fee, users can enjoy 100% of the revenue when trading on Blur.

- User-friendly interface: Blur.io aggregates information like trading volume, holder,.. with an intuitive, easy-to-view interface, and all information is continuously updated.

- Numerous tools: The project provides links to other NFT Marketplaces, offers an interface for both trader and collector, and supports trading with various charts and tables. Additionally, Blur.io also sets fixed gas fees.

- Extremely fast operation: Compared to other NFT platforms, Blur is 10 times faster in system startup, NFT listing, and pending transactions.

Some other outstanding features:

– Sweep Feature: You can purchase multiple NFTs at floor prices at once to optimize profit. Blur quickly eliminates suspicious or slow NFTs. Note that gas fees for buying a large number of NFTs at once on Blur will be higher than on other NFT Marketplaces. For example, gas fees on Element for buying one or multiple NFTs at a time are the same. However, this feature ensures the highest success rate when buying multiple NFTs and speeds up transactions.

– NFT Aggregator: Blur aggregates NFT listing information from various NFT Marketplaces. NFT traders can interact and trade multiple NFTs from OpenSea, LooksRare,… on the Blur platform. Its main competitor in this segment is Gem. However, Blur surpassed Gem and became the #1 NFT Aggregator after three days of its launch.

– Customizable royalty fee model: Royalty fees are still a controversial topic in the NFT community between the interests of creators and increasing market liquidity. Platforms like OpenSea and X2Y2 have mandatory royalty fees, but Blur, catering more to professional traders, allows users to customize royalty fees, potentially reducing them to zero.

*** Note, even if the royalty fee is set to zero, it doesn’t mean that Blur’s royalty fee is always 0. Below is an illustration showing the average royalty rate of Blur is 0.65%, sometimes even higher than the market average ***

Basic information about BLUR tokenomics

Like many NFT exchanges competing with OpenSea, Blur uses tokens and airdrop strategies to attract NFT users. Since its launch to the present, there have been three airdrops, specifically:

- Airdrop 1: Required participation in NFT trading on Ethereum network platforms within 6 months before Blur’s launch.

- Airdrop 2: Required users to list NFTs on Blur before December 6, 2022.

- Airdrop 3: Users needed to place Bid orders close to the floor price on Blur (deadline February 14, 2023).

Each subsequent airdrop was confirmed by Blur to have a larger token amount than the previous one, motivating users to continue experiencing Blur’s products.

Among them:

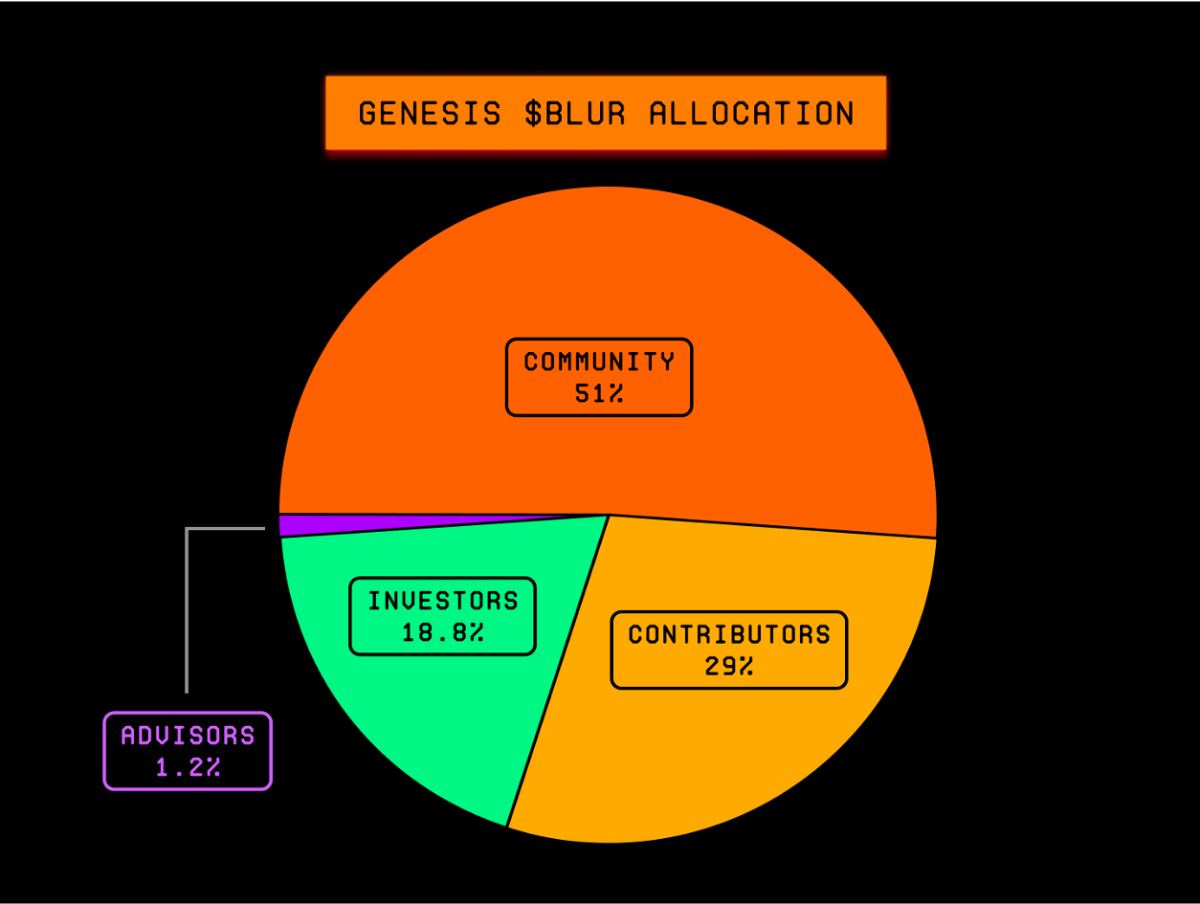

- 51% – 1,530,000,000 BLUR for the community.

- 29% – 867,601,888 BLUR for contributors to the project.

- 18.8% – 565,633,826 BLUR for investors.

- 1.2% – 36,764,286 BLUR for project advisors.

Overall, the tokenomics of BLUR are quite similar to those of UNI (Uniswap), but with a longer lock-up and vesting period. 12% of the total supply of BLUR (360,000,000 BLUR) will be allocated from the community portion of the tokenomics to cover the tokens for the past three airdrops.

=> Overall, the way Blur uses its tokens is quite clever, and coupled with an effective product that has been well received by users, Blur is currently a direct and the only comparable competitor to OpenSea. ***

The Team, Investors, and Partners of BLUR

– The Team: Currently, BLUR has not publicly disclosed the members behind its Marketplace, but it is known that they are a group of people with experience from MIT, Citadel, Five Rings Capital, Twitch, Brex, Square, and Y Combinator.

– Investors: In 2022, Blur successfully raised over $11 million from leading figures and organizations in the NFT field such as Paradigm Fund, 6529, Cozomo Medici, dhof, Bharat Krymo, Zeneca, OSF, MoonOverlord, icebergy, Deeze, Andy8052, Keyboard Monkey. Blur has considerable potential and is positively evaluated by the professional NFT community.

Immediately after launching its token, The Block reported that the Blur exchange is completing its next funding round with a valuation of over a billion dollars, with the fundraising expected to be between $15 – $30 million. In addition, besides major investors, Blur also has Wintermute, a leading market maker in the industry.

– Competitors: include other NFT exchanges, with prominent names like OpenSea, Pine Protocol, Fracton Protocol, X2Y2, Cripco…, and specifically, its competitor in the NFT Aggregator segment is Gem.xyz.

Some on-chain data of BLUR

As a new project, Blur launched three airdrop campaigns to boost platform user numbers and successfully created a significant FOMO effect. Shortly after launch, Blur attracted enthusiastic participation from the community, with daily user numbers consistently ranking second, about a quarter of that of OpenSea.

However, it was not until the highly anticipated Art Gobblers NFT was released that Blur’s true potential was revealed. Thanks to Blur’s real-time data feed on sales and NFT listings, those wishing to trade Art Gobblers drops flocked to the platform in large numbers. According to Blur’s official Twitter account, the platform surpassed Gem to become the highest volume NFT Aggregator just three days after its release.

In the early days following its launch, the most surprising fact was that Blur’s daily trading volume surpassed OpenSea and took the top spot. This can be explained by the fact that the high volume was mainly from investors engaging in Wash Trading – users initiating sales transactions and then buying for themselves to inflate the trading volume and increase their chances of receiving an airdrop. Although the Blur team stated they would filter Wash Traders from the airdrop list, the actual trading volume of Blur is undeniably large.

Does BLUR coin have investment potential?

With a $14 million investment and within a few months of launch, the Blur NFT Marketplace has demonstrated its appeal by quickly rising to rank number 1 in daily NFT trading volume. As of now, Blur is the first NFT Marketplace project that can surpass OpenSea in terms of NFT trading volume. Transactions on both OpenSea and Blur are considered quite “clean,” with wash trades accounting for a very small proportion.

Overall, Blur is an NFT trading platform suitable for professional NFT traders, with many advantages over its competitors. However, from another perspective, Blur still has many drawbacks, for example:

- First: Information about the Blur team is currently anonymous. In fact, anonymity is not uncommon in the cryptocurrency space – many major developers also choose to remain anonymous. However, anonymity does bring a small risk, as if there are any issues with Blur, it will be difficult to find someone to explain and take responsibility.

- Second: BLUR is operating quite well, and it is on its way to becoming a valuable and long-lasting part of the Web3 infrastructure. Although the quality of what Blur offers is not a matter for debate, whether it can be widely adopted is another story. The issue is that the target audience of the platform is mainly professional traders – a relatively small group, so Blur may have difficulty reaching out to many newcomers to its platform.

- Third: Blur scores points for its continually increasing user base and at times even surpassing OpenSea in trading volume. However, a large part of this may be due to the airdrop campaign (as it rewarded tokens to those who traded on the platform). A question arises, after they have received their airdrop rewards, will they continue to stay and use Blur? Can Blur maintain its user base?

- Fourth: Blur’s transaction fees are much cheaper compared to other platforms. In the short term, this is effective, as it will help attract users to the platform in its early stages. But in the long term, it will affect the platform’s revenue – is Blur really sustainable with low revenue? This could limit the medium and long-term growth of the platform if it does not find a way to resolve this issue.

Should you invest in BLUR coin?

Despite the current crypto winter, the BLUR team is still working actively to provide a very useful NFT trading platform for everyone. From a technical standpoint, it has outperformed other markets and NFT aggregators, and its use in the minting process of Art Gobblers is proof of this fact. Although it has many drawbacks, I think with what the BLUR team has done and is doing, they will surely find ways to improve the platform to make it more appropriate and sustainable in the future.

Let time evaluate whether the user data and trading volume of Blur are positive or not? Can it create a more sustainable revenue model than currently? Or will a new and superior competitor emerge to challenge Blur? And will the overall NFT market explode in the coming time, or still face liquidity issues? All of these will have a significant impact on the future of BLUR coin. No one can predict the future, but if you believe in the long-term potential of Blur, you might consider investing a small amount in BLUR.

Wish you wisdom and successful investment.